Get the free Who Can You Claim as a Dependent?Tax Guide

Get, Create, Make and Sign who can you claim

How to edit who can you claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out who can you claim

How to fill out who can you claim

Who needs who can you claim?

Who Can You Claim Form: A Comprehensive Guide

Understanding the claim form landscape

Claim forms play a critical role in numerous financial processes, especially within the realm of taxes. They serve as key documents required to declare dependents, enabling taxpayers to secure various tax benefits and credits. Without a proper understanding of whom you can claim, you may leave money on the table or expose yourself to potential tax audits.

It's essential to identify accurately who can be claimed properly, as this will directly influence your tax filings, credits, and deductions. Moreover, knowing what information is needed to support your claims can streamline your filing process. Utilizing a platform like pdfFiller enhances efficiency, allowing users to manage claim forms digitally and navigate the complexities of tax requirements.

Who can you claim? Exploring dependent eligibility

A dependent is generally defined as someone who relies on you for financial support. The IRS identifies specific categories of dependents, primarily focusing on children and qualifying relatives. Claiming the right dependents can lead to significant financial benefits during tax season.

Understanding the categories of dependents is vital. Immediate family members, such as biological and adopted children, are straightforward cases. In contrast, extended family members like cousins or adult children may require a deeper look into eligibility criteria. Common misconceptions arise when taxpayers assume they can claim anyone living in their household or even friends without meeting IRS requirements.

Criteria for claiming a dependent

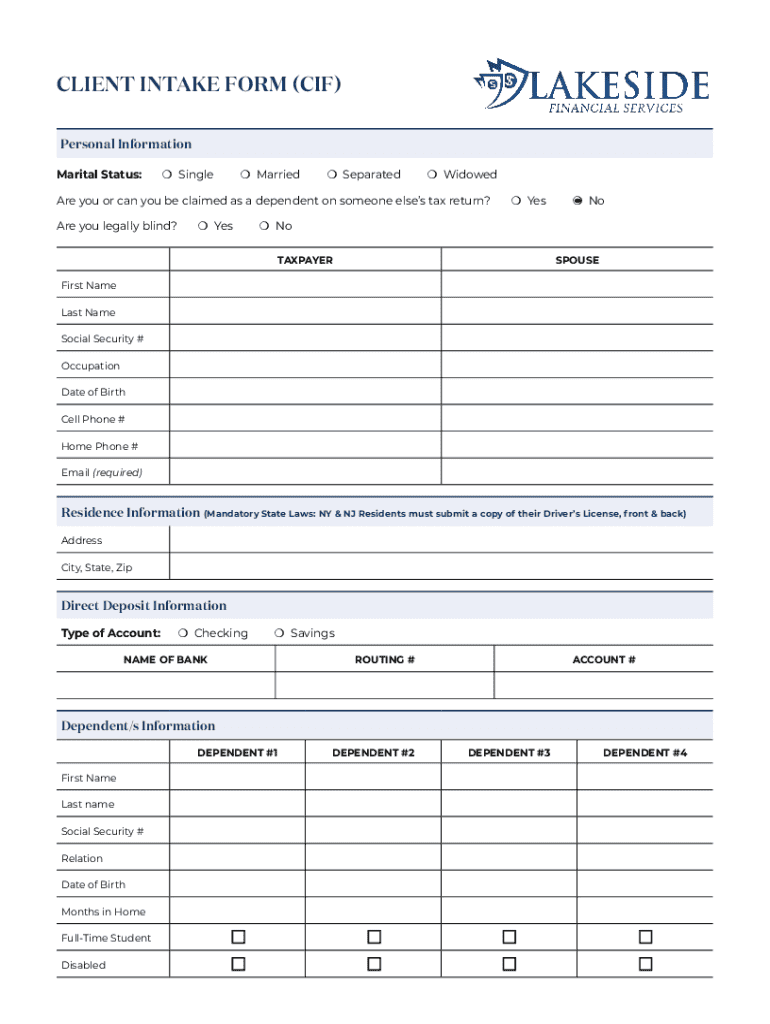

Several basic rules govern the criteria for claiming a dependent, ensuring the integrity of claims made on tax forms. Primarily, the IRS considers factors such as age, relationship, residency, and support. For instance, dependents must typically be under 19 years of age or under 24 if they are a full-time student.

The residency requirement necessitates that the dependent live with you for more than half the year. Additionally, the support test mandates that you provide more than half of the dependent's financial support to qualify. Moreover, special considerations apply for claiming dependents with disabilities, who may not fit into the typical age and residency restrictions.

Dependents and tax implications

Claiming dependents can have substantial tax implications. For instance, each qualifying dependent may provide access to various tax credits, such as the Child Tax Credit and Earned Income Credit (EIC). These credits can reduce your tax liability significantly, making it crucial to leverage all possibilities when filing taxes.

However, there are specific filing requirements to consider, particularly for dependents themselves. If your dependent has income, they must file a return if they earn above a certain threshold. Special cases, such as divorced parents, also present unique circumstances regarding who can claim a child, sometimes leading to confusion over eligibility.

Detailed insights on specific dependents

When it comes to children, the IRS has clear guidelines. Biological and adopted children can be claimed under standard rules, provided they meet the age and residency requirements. However, claiming stepchildren may present unique challenges, especially if multiple households are involved. It's essential to maintain documentation of the relationship and support provided to ensure compliance.

Additionally, claiming older relatives, such as parents or grandparents, is feasible but requires meeting specific tests concerning their income and dependency status. Non-relatives, such as friends or distant relatives, could potentially be claimed if they meet all necessary criteria established by the IRS, though this is less common.

Navigating complex family situations

Complex family structures can complicate the process of claiming dependents. For parents sharing joint custody, the question of who claims the child on taxes can become contentious. The IRS allows only one parent to claim the child for any given year, often requiring agreement through a signed form. Furthermore, for families with multiple dependents, understanding how to distribute claims can reduce overall tax liabilities.

Changes in family dynamics, such as remarriage or shifts in living arrangements, can also impact eligibility. Maintaining clear communication among family members, alongside appropriate documentation, is essential to navigate these challenges successfully.

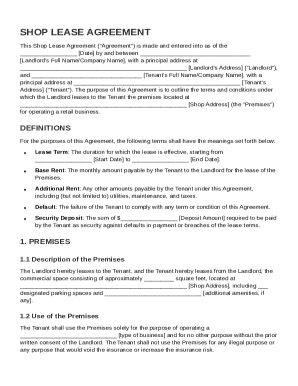

The process of filing a claim form

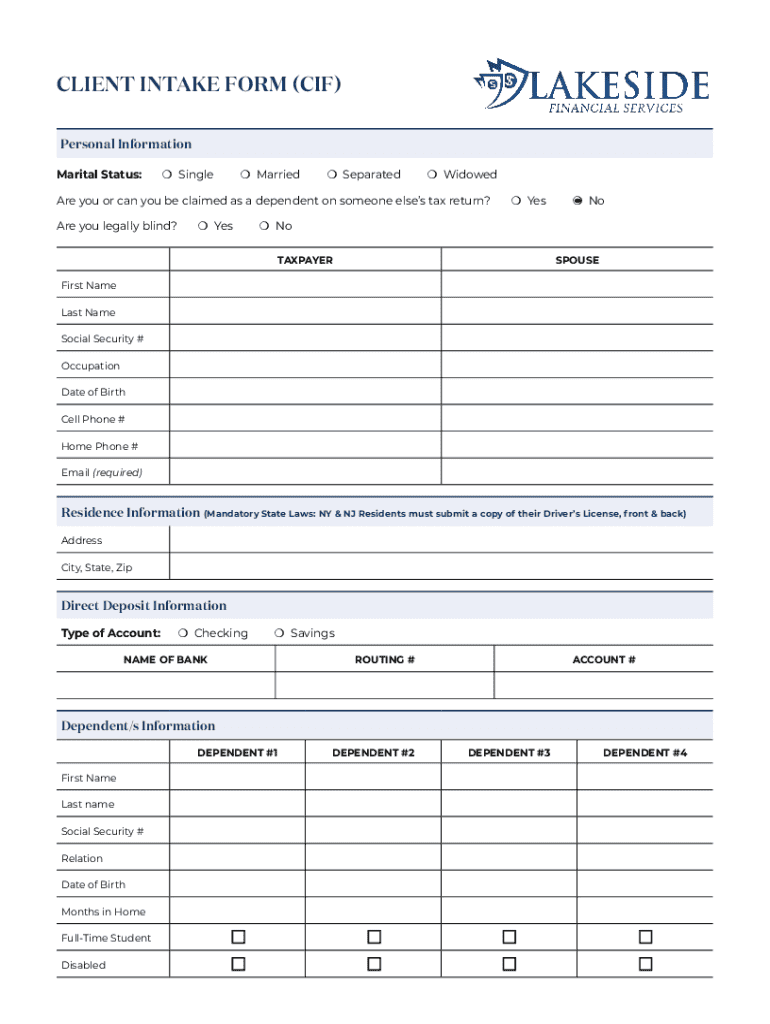

Filing a claim form requires methodical attention to detail to avoid errors that could delay your refunds or trigger audits. Start by obtaining the necessary forms and gathering documentation, such as Social Security numbers and proof of financial support for your dependents. Clearly indicate each dependent you are claiming on your form.

Common mistakes to avoid include incorrect Social Security numbers, claiming ineligible dependents, and failing to attach required documentation. Leveraging pdfFiller can simplify this process, providing tools to edit forms directly, ensuring all fields are completed accurately, and facilitating an efficient submission.

Using interactive tools for claim forms

Modern technology has transformed the way we approach paperwork, especially with solutions like pdfFiller. This platform offers various features that streamline the completion of claim forms. Users can edit documents, fill forms efficiently, and collaborate easily with family members to ensure that all necessary fields are filled correctly.

eSigning capabilities further enhance the process, allowing you to finalize your documents securely and conveniently. With feature-rich options, pdfFiller equips you with the necessary tools to manage your claim forms from any location, making the tax filing process significantly more manageable.

What to do if your claim is disputed

If a claim is challenged, immediate action is recommended. Start by reviewing the reasons provided for the dispute. If necessary, gather key documentation to support your claim, such as financial statements proving your support for the dependent. Having organized records will enhance the credibility of your argument.

Understanding the appeal process is essential. Taxpayers can appeal the decision through the IRS by providing strong documentation of the relationship and support provided. Cooperation with IRS requests is critical in resolving disputes effectively.

Preparing for future claims

Record-keeping is critical for anyone looking to maximize their tax benefits year after year. Organizing financial records related to your dependents ensures that you can substantiate claims efficiently. This preparation also simplifies the filing process as deadlines approach.

Utilizing tools within pdfFiller can further enhance future claims. By maintaining organized and accessible digital files, users can reduce the stress associated with tax season. Digital solutions streamline the process, offering templates and resources that will prepare you for a smooth experience in future filings.

Case studies: Real-life examples of claiming dependents

Examining real-life case studies can shed light on the practical aspects of claiming dependents. Families have experienced financial relief by correctly claiming eligible dependents, leading to increased tax credits and a greater refund. Delayed refunds, however, are often the result of improper claims due to misunderstanding the rules, leading to poor decision-making during tax preparation.

Learning from other families' experiences can provide valuable insights. For instance, a family facing divorce managed to navigate claiming confusion by establishing clear agreements on who would claim the children each year. Expert opinions emphasize the importance of adherence to IRS guidelines and documented agreements, which can drastically reduce claim errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find who can you claim?

Can I create an electronic signature for the who can you claim in Chrome?

Can I create an electronic signature for signing my who can you claim in Gmail?

What is who can you claim?

Who is required to file who can you claim?

How to fill out who can you claim?

What is the purpose of who can you claim?

What information must be reported on who can you claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.