Get the Set Free Tax & Professional Services - Long Beach

Get, Create, Make and Sign set tax amp professional

Editing set tax amp professional online

Uncompromising security for your PDF editing and eSignature needs

How to fill out set tax amp professional

How to fill out set tax amp professional

Who needs set tax amp professional?

A Comprehensive Guide to the Set Tax Amp Professional Form

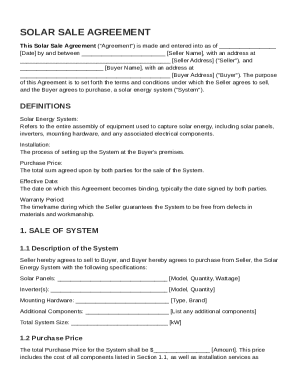

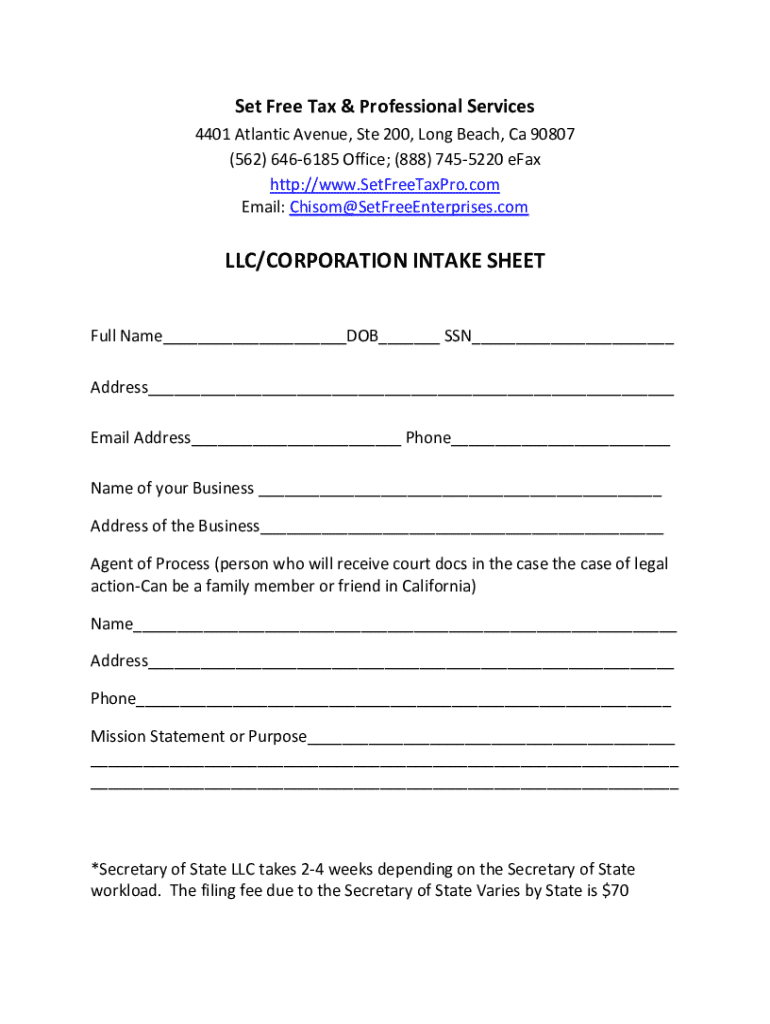

Understanding the Set Tax Amp Professional Form

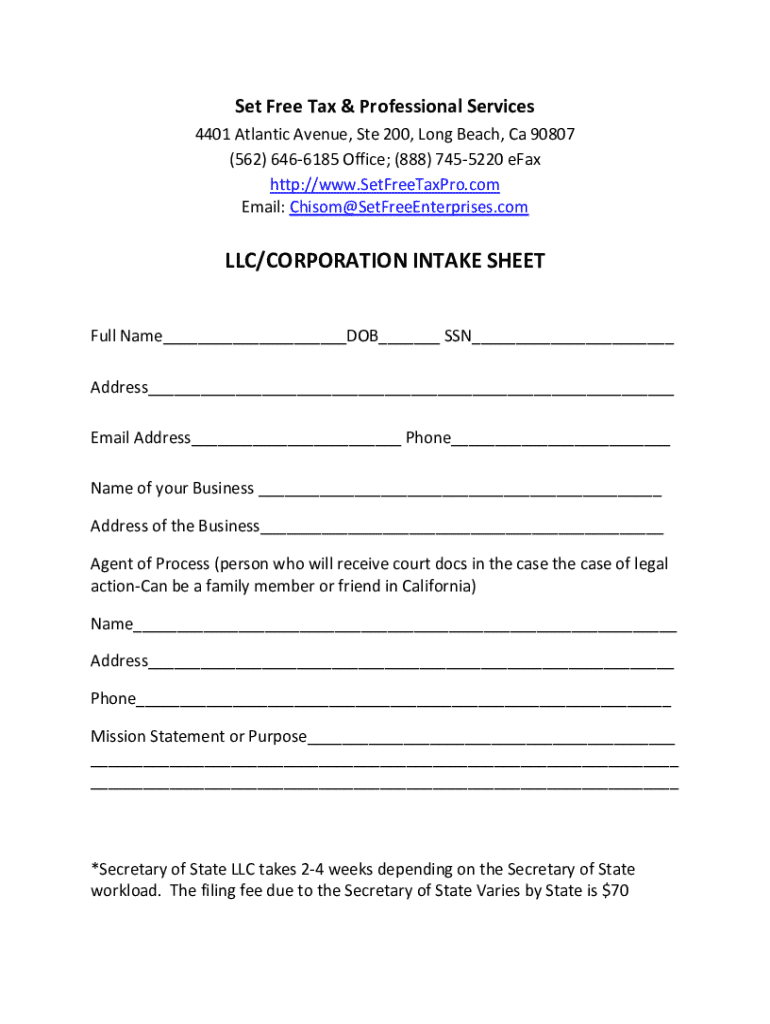

The Set Tax Amp Professional Form is an essential document for individuals and businesses alike, serving a pivotal role in the tax filing process. Its primary purpose is to simplify the reporting of income, deductions, and credits, ensuring that taxpayers comply with tax regulations. Completing this form accurately can greatly influence your potential tax refunds or liabilities, making understanding its structure and requirements critically important.

Individuals who operate a business or hold specified assets like aircraft, boats, or significant personal property fall within the demographic that needs to complete this form. It’s vital for anyone involved in property assessments or holding a business identification number, particularly those in industries heavily impacted by depreciation, such as agriculture and commercial property development.

Key definitions and terms

To effectively navigate the Set Tax Amp Professional Form, understanding key tax-related terminology is essential. Terms like 'market value,' 'assessor,' and 'business property statement' frequently appear, and clarity around these helps prevent costly errors. For instance, 'market value' refers to the price that a property would sell for on the open market, while the 'assessor' is the official responsible for determining property values for taxation.

Professional forms reference the standardized documents required for tax reporting, which not only streamline the process but also ensure compliance with local tax laws. Understanding the implications of these forms, particularly how they affect overall tax liabilities, can help individuals and businesses make informed financial decisions.

Preparing to fill out the Set Tax Amp Professional Form

Before diving into the completion of the Set Tax Amp Professional Form, it is crucial to gather all necessary documentation to ensure a smooth filing process. This involves collecting a variety of documents, including income statements such as W-2s or 1099s, records of any property you own like real estate or boats, and potential deductions like interest on loans or business expenses. Having these documents in hand not only improves accuracy but also streamlines the submission process.

Despite its importance, many individuals make common mistakes when completing these forms. Errors can stem from incorrect income reporting, omitted deductions, or miscalculated tax payments. To avoid these pitfalls, double-checking the information and even utilizing a checklist can assist in ensuring that all data entered is correct and comprehensive.

Step-by-step guide to completing the Set Tax Amp Professional Form

Completing the Set Tax Amp Professional Form can feel daunting, so breaking it down into sections makes the process more manageable. Let’s tackle it step-by-step, focusing on key areas such as Personal Information, Income Details, Deductions and Credits, and Tax Payments and Refunds.

Section-by-section breakdown

1. **Personal Information**: This section typically includes your name, business name, and business identification number. Ensure all information is accurate to avoid delays in processing.

2. **Income Details**: Here, report all income earned. Be thorough and include figures from all relevant sources, such as wages from employment, income from rentals, or sales of personal property.

3. **Deductions and Credits**: Understanding which deductions apply to your situation is crucial. Material expenses related to business, interest payments, or depreciation on equipment can significantly reduce your taxable income.

4. **Tax Payments and Refunds**: Lastly, document any taxes you have already paid and calculate potential refunds. Clear calculations in this section will reflect your tax liability accurately.

Tips for each section

Attention to detail is vital in each section. For Personal Information, consider having someone review the accuracy of your entries. In the Income Details section, double-check the totals against your documentation. For Deductions and Credits, familiarize yourself with what qualifies so that nothing is overlooked. Lastly, ensure thorough calculations in Tax Payments and Refunds to avoid surprises when you receive your tax notice.

Editing and customizing your form

Once you have filled out your Set Tax Amp Professional Form, utilizing tools such as pdfFiller’s editing capabilities will enhance your experience. Editing your form directly in PDF format allows for precise adjustments, ensuring that all changes are reflected immediately.

pdfFiller's interactive features come in handy for users who must collaborate on forms. This ensures that multiple parties can provide input and review changes in real time, proving especially useful when several team members are involved in the tax process.

Adding signatures and initials

The digital signature feature of pdfFiller allows for convenient signing of your documents. eSigning the Set Tax Amp Professional Form can be done in just a few clicks, making it timely and efficient. Additionally, if multiple signatories are required, pdfFiller provides collaborative options so everyone involved can review and sign without needing back-and-forth email chains.

Managing your form after submission

After submitting the Set Tax Amp Professional Form, it's important to track its progress to ensure it has been received and processed. Each jurisdiction may provide different methods for tracking submitted forms, often available online through government tax websites or relevant agencies.

Storing and organizing your documents is another crucial element post-submission. pdfFiller offers cloud storage solutions that allow users to manage their forms effectively, ensuring easy access for future reference or audits.

FAQs about the Set Tax Amp Professional Form

A range of common queries often arises when individuals complete the Set Tax Amp Professional Form. Some may wonder what happens if mistakes occur on their submitted form. In such cases, amendments can be made by following specific protocols detailed by the tax agency. Understanding these processes can help alleviate anxiety surrounding potential errors.

Another frequent question relates to processing timelines. Generally, it’s wise to expect a typical processing time which can vary greatly depending on local regulations, but being informed about usual durations can set realistic expectations.

Contacting support for help

There are times when seeking professional guidance becomes necessary, especially when complexities arise during the tax filing process. For scenarios such as identifying what qualifies as business personal property or understanding specific tax rate implications for your area, expert assistance can be invaluable.

If you require help with navigating pdfFiller’s features, reaching out to their support team is straightforward. Utilize the steps outlined on their website, which detail how to contact the support staff effectively. Ensuring that you are aware of available resources enhances your confidence as you navigate your document needs.

Final tips for successfully using the Set Tax Amp Professional Form

Before submitting your completed form, consider a last-minute checklist. Reviewing all sections ensures you haven’t overlooked any critical details. Check that all required fields are filled, verify calculations, and ensure documents are organized effectively.

Leveraging pdfFiller for your document needs highlights its value propositions, allowing seamless document management. The ability to edit PDFs, sign electronically, and collaborate keeps you organized and reduces the stress commonly associated with tax filing. Embracing this online platform empowers users to handle one of the most vital aspects of their financial responsibilities with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my set tax amp professional directly from Gmail?

Can I create an electronic signature for signing my set tax amp professional in Gmail?

Can I edit set tax amp professional on an iOS device?

What is set tax amp professional?

Who is required to file set tax amp professional?

How to fill out set tax amp professional?

What is the purpose of set tax amp professional?

What information must be reported on set tax amp professional?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.