Get the free P45, P60 and P11D forms: workers' guide

Get, Create, Make and Sign p45 p60 and p11d

How to edit p45 p60 and p11d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p45 p60 and p11d

How to fill out p45 p60 and p11d

Who needs p45 p60 and p11d?

Comprehensive Guide to P45, P60, and P11D Forms

Understanding key employment documents

P45, P60, and P11D forms are essential documents used in the UK employment landscape that serve unique purposes for both employers and employees. Understanding them is crucial for efficient payroll management and tax compliance.

Employers are legally required to issue these forms as part of their payroll obligations. Employees must ensure that they receive and retain these for their records and future tax needs.

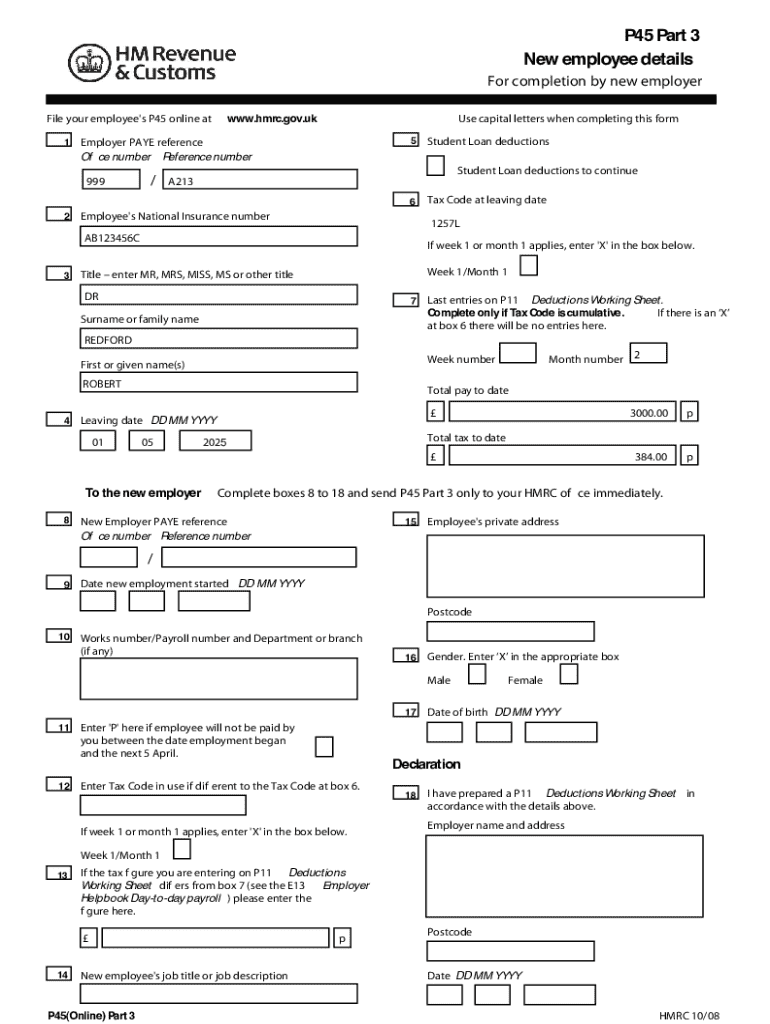

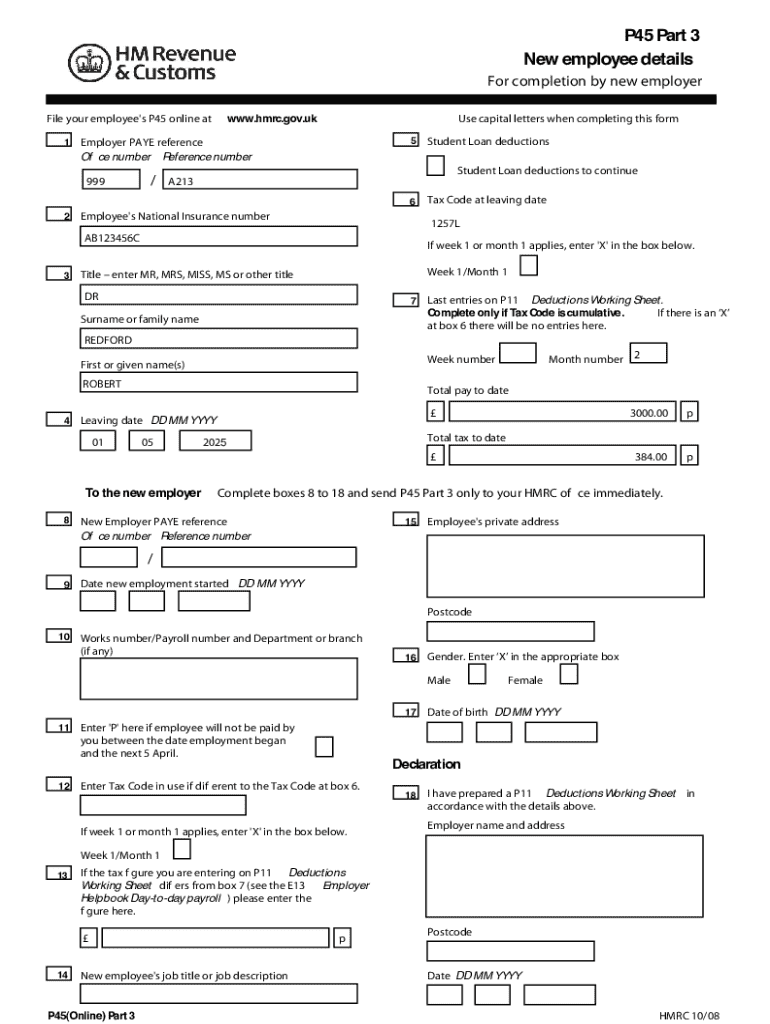

The P45 form: Your departure document

A P45 form is issued when an employee leaves their job. It's provided by the employer and indicates the amount of salary earned and tax paid on that income during the employment. This document is crucial for employees who are moving to a new job, as it ensures that their new employer has the necessary information to calculate tax owed.

Typical scenarios for receiving a P45 include resignation, redundancy, or termination. Key components of a P45 include personal details, the employee’s tax code, and the amounts of tax paid. Each section corresponds to specific tax periods and earnings, providing a comprehensive snapshot of the employee's employment history with that particular employer.

Upon receiving a P45, employees should ensure that all information is accurate. It is vital to keep this document safe as it will be needed for future employment or to claim tax refunds if necessary.

The P60 form: Your year-end summary

The P60 form acts as a year-end summary for employees. Typically issued by employers after the end of the tax year (5th April), it provides an important recap of the employee's annual income and tax that has been deducted at source. Understanding your P60 is essential for personal finance management, as it helps in determining if you paid the right amount of tax throughout the year.

The significant values reported on a P60 include total salary, tax deducted, and National Insurance contributions. If these figures reflect discrepancies or if an employee suspects that they have paid too much tax, it is critical to address this promptly by reaching out to the HMRC.

In the event that you misplace your P60, the first step is to notify your employer, who can provide a duplicate copy. Alternatively, you can access your P60 through the HMRC online services if you have registered.

The P11D form: Expenses and benefits reporting

The P11D form serves as a crucial document for reporting any benefits and expenses that an employer provides to employees. This is mandatory for employers to fill out for employees whose benefits are not included in their payroll systems. The information provided in this form helps in accurately assessing the employee’s tax obligations.

Common items reported on a P11D include company cars, medical insurance, and other perks like accommodation. These benefits may not appear in salary earnings but contribute to the employee's overall remuneration package. Accurate reporting on the P11D is not only good practice but necessary to avoid penalties.

Employers must file P11D forms by July 6th following the end of the tax year. Late submissions can result in penalties, making timely compliance crucial for both employers and employees.

Filling out your forms correctly

Completing P45, P60, and P11D forms accurately is vital for ensuring proper tax deductions and compliance with employment regulations. For the P45, employers must fill out the relevant details while the employee checks them for errors. A P60 is generally generated automatically by the payroll system at year-end, but employees must review it for accuracy, particularly if there were any adjustments during the year.

When filling out a P11D, it's essential to report all provided benefits clearly. Use the correct form layout and adhere to guidelines set by HMRC to avoid penalties. Here are common mistakes individuals encounter that lead to complications:

To ensure accuracy, employees and employers should consult with tax professionals or resource guides, ensuring compliance and leveraging their rights regarding tax deductions.

Electronic tools for form management

Utilizing modern tools like pdfFiller for managing P45, P60, and P11D forms can significantly enhance efficiency in handling these crucial documents. pdfFiller allows users to edit, sign, and manage forms from a single, cloud-based platform, making document management easier.

The platform features interactive tools, such as templates specifically designed for each form, allowing customized entries. Collaborating on documents via pdfFiller is straightforward, enabling team submissions and edits without the hassle of traditional paper forms.

With the ability to access documents anywhere, pdfFiller empowers businesses and employees to maintain flexibility and organization during their employment transitions or annual reporting periods.

Tax implications of your forms

Each of these forms has distinct tax implications that individuals should thoroughly understand. The P45 affects the individual's tax code, particularly if there are job changes, as it guides the new employer in withholding the correct amount of tax. Misemployment can lead to tax discrepancies, which can impact future paychecks.

The P60 summarizes an employee’s tax contributions for the year and provides vital details for annual tax returns. Any discrepancies between the P60 and what the HMRC has on record can lead to tax complications, such as refunds or additional payments owed.

When in doubt or when the financial situation becomes complicated, it is advisable to seek professional tax advice. Tax professionals can provide tailored guidance that optimizes tax outcomes based on individual circumstances.

Frequently asked questions

Many employees have questions regarding the P45, P60, and P11D forms. One frequent concern is how to address discrepancies in these forms if they arise. Employees should first consult with their employer and compare relevant documents, including payslips and tax letters, to ensure everything aligns correctly.

Another common question is regarding how to handle issues with an employer regarding delays or denials in issuing these forms. If an employer fails to provide a P45 upon employment termination, employees have the right to contact HMRC for assistance, ensuring that their tax obligations remain valid and appropriately documented.

Related insights and services

For those looking to deepen their understanding of UK taxation and employment documentation, exploring additional resources on tax laws and compliance can be beneficial. There are numerous articles and guides available that detail changes to tax policy and how they may affect both employers and employees.

Employing document solutions like pdfFiller combines efficiency with compliance, ensuring that all forms are handled correctly and submitted on time. This offers great peace of mind for businesses managing numerous employee records.

Getting help with your documents

Navigating the world of employment documentation can be daunting, but help is available through platforms like pdfFiller. The customer support options provided ensure that users can receive assistance for any form-related queries they might have. Whether it’s about filling out a form or understanding a specific requirement, support is just a click away.

Additionally, tapping into user forums offers a great way to engage with others who share similar challenges and experiences. These communities provide a wealth of knowledge and tips drawn from real-life scenarios.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute p45 p60 and p11d online?

Can I create an electronic signature for signing my p45 p60 and p11d in Gmail?

Can I edit p45 p60 and p11d on an iOS device?

What is p45 p60 and p11d?

Who is required to file p45 p60 and p11d?

How to fill out p45 p60 and p11d?

What is the purpose of p45 p60 and p11d?

What information must be reported on p45 p60 and p11d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.