Understanding the Declaración Jurada de Colección Form

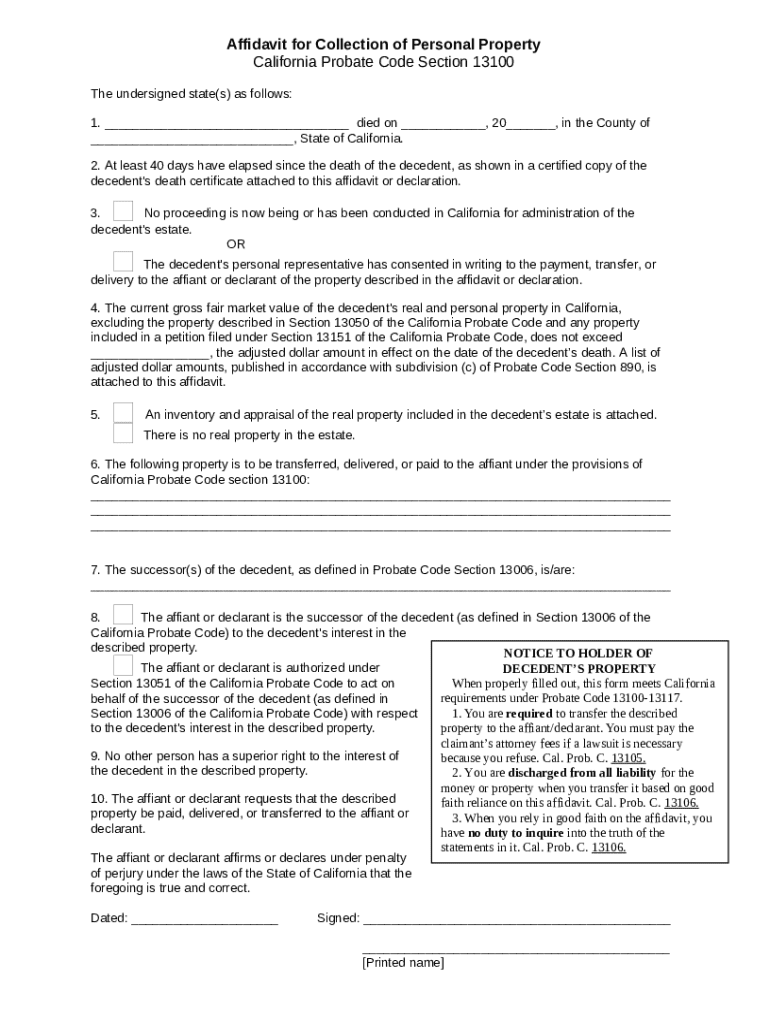

Overview of declaración jurada de colección

The declaración jurada de colección is a sworn statement often used in legal and financial contexts to affirm the correctness of certain claims regarding property collection. This document serves as a formal declaration by an individual, typically the executor or administrator of an estate, to collect assets on behalf of beneficiaries or heirs. The importance of this document cannot be overstated, as it aids in establishing the legitimacy of claims and facilitates the distribution of assets in accordance with legal requirements.

In many jurisdictions, the form is essential for expediting the process of asset distribution, especially in situations where the estate qualifies for a small estate exemption. Overall, it plays a vital role in maintaining legal transparency and ensuring that the rights of heirs and creditors are respected.

Variations of the form

There are various names and types associated with the declaración jurada de colección. While the term itself is commonly used, individuals may also encounter forms referred to as an Affidavit for Collection of Personal Property or a Small Estate Affidavit. The distinction among these forms lies mainly in the context of their use and the specific legal criteria they address.

For instance, a Small Estate Affidavit is designed for quick and simplified processing when the estate falls below a certain value threshold. Conversely, the Affidavit for Collection of Personal Property can be more detailed, often requiring specified inventories and valuations. Understanding these differences is crucial for individuals seeking to navigate the complexities of estate management and collection.

Eligibility criteria

The eligibility to use a declaración jurada de colección primarily revolves around the individual’s relationship to the decedent and the value of the estate in question. Generally, heirs, beneficiaries, or legal representatives of the estate are required to complete this form in situations where assets must be collected or distributed without undergoing formal probate.

Common circumstances necessitating this form include the passing of a loved one with minimal assets, where the straightforward collection of items is warranted. However, it's important to note limitations and exceptions; for instance, debts exceeding asset value, or multiple claimants may complicate the process, potentially disqualifying individuals from utilizing this form.

Necessary information for completion

To accurately complete the declaración jurada de colección form, certain necessary information is required. First and foremost, personal details will include the names, addresses, and identification numbers of all parties involved, including the decedent, beneficiaries, and the individual collecting the assets. These identifiers are crucial for establishing ownership and legitimacy.

Additionally, detailed descriptions of the property being claimed are mandatory. This encompasses a thorough analysis of each item’s worth and its relation to the estate. This section demands care and precision, as inaccuracies could lead to delays or legal complications during the collection process. Identifying signatories and witnesses is equally important as their validation of the form adds credibility to the declaration.

Step-by-step instructions for completing the form

Step 1: Gathering required documents

Before filling out the declaración jurada de colección form, it is essential to assemble all necessary documents. Key documents may include the decedent’s death certificate, proof of relationship with the deceased, bank statements, property titles, and any existing wills. You can obtain supporting evidence through official channels like the county clerk’s office, civil registries, or financial institutions.

Step 2: Filling out the form

When filling out the form, each section requires careful attention. Start with personal details, ensuring that all names and addresses are current and factual. As you list the properties, categorize them based on type — real estate, personal items, and financial accounts. One common pitfall to avoid is vague descriptions; clarity is vital as it ensures the accuracy of the collection process.

Step 3: Reviewing for accuracy

Once the form is filled, thoroughly review it for accuracy. Double-check all information, including spelling and numerical values. Clarity and legibility are imperative to prevent potential disputes or misunderstandings at a later stage. Taking the time to route the form through a meticulous review will save time and effort down the line.

Editing and formatting tools available with pdfFiller

Using a cloud-based platform like pdfFiller provides numerous benefits when editing the declaración jurada de colección form. This platform enables users to modify PDF files seamlessly, ensuring that even those unfamiliar with document editing can create compliant forms with ease. Not only does it allow for real-time collaboration, but it also features interactive tools that help guide users through the document completion process.

By accessing pdfFiller’s range of formatting tools, you can ensure your document adheres to professional standards, enhancing its overall presentation. Features such as text highlighting, shape insertion, and drawing options make it easy to emphasize specific information, ensuring clarity and accuracy throughout the document.

eSigning the declaración jurada

The integration of electronic signatures into the completion of the declaración jurada de colección form signals a modern approach to document handling. eSignatures are legally valid in most jurisdictions, streamlining the process of providing consent and finalizing agreements. To eSign your document through pdfFiller, simply navigate to the designated area on the form where a signature is required.

Once there, you can create your signature using the platform’s interactive tools or upload an existing one. This feature provides added convenience and efficiency, allowing users to finalize the paperwork without the hassle of printing, signing, and scanning physical documents.

Managing and storing your form online

After completing and signing the declaración jurada de colección, managing and storing the document safely is paramount. pdfFiller offers secure cloud storage solutions where you can save your completed forms. This feature eliminates the risk of losing important documents while providing easy access from anywhere, at any time.

For proper organization, pdfFiller allows users to create folders and categorize documents accordingly. This system not only streamlines access but also facilitates sharing relevant forms with involved parties such as beneficiaries or legal representatives, ensuring that everyone can stay updated with vital information regarding the collection process.

Common questions and answers

When working with the declaración jurada de colección form, many individuals have questions regarding its use. Frequently asked questions cover a broad range of topics such as the necessity of notarization, the specific forms to be used in varying contexts, and the potential legal ramifications of inaccuracies. Understanding legal jargon can be daunting, but seeking clarification on complex terms or notary requirements is crucial.

In certain situations, it may be advisable to seek legal advice to ensure compliance with state law. Engaging a legal expert can provide clarity and ease any concerns about the process, which is particularly essential if issues arise during the collection phase.

Best practices for using the declaración jurada de colección

Utilizing best practices when completing the declaración jurada de colección can streamline the process significantly. Begin by ensuring that all relevant documentation is accurate and verifies claims you make within the form. It’s important to avoid common mistakes such as using vague property descriptions or omitting crucial information about the decedent.

Additionally, always comply with local laws that govern estate management. This may include understanding specific state requirements for signatures, witnesses, and notarization. Following these guidelines will enhance the likelihood of your form being accepted without delays or complications.

Navigating state-specific instructions and variations

The requirements surrounding the declaración jurada de colección can differ from state to state, making it essential to understand local laws that may affect how this form is used. Many jurisdictions provide templates or guidelines available through state-specific legal resources or local government websites. These resources can simplify the process significantly by offering insight into particular nuances that vary by territory.

For comprehensive guidance, consider reaching out to local authorities or legal advisors who can offer tailored advice based on your jurisdiction. This ensures that you understand not only the form itself but also the broader context of estate management in your area.

Interactive tools and additional features on pdfFiller

pdfFiller enhances the process of filling out and managing the declaración jurada de colección form through its suite of interactive tools and features. Users benefit from resources that simplify document creation, enhancement, and storage. Options range from templates to collaborative editing, where multiple users can contribute to a single document.

Moreover, pdfFiller offers valuable testimonials from users who highlight the platform’s efficiency in streamlining their documentation processes. The feedback reflects users' enhanced productivity and reduced stress associated with managing important forms.