Get the free E-file Form 990N Postcard: How-to-File Guide for Nonprofits

Get, Create, Make and Sign e-file form 990n postcard

Editing e-file form 990n postcard online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e-file form 990n postcard

How to fill out e-file form 990n postcard

Who needs e-file form 990n postcard?

E-file Form 990-N Postcard Form: A Comprehensive Guide

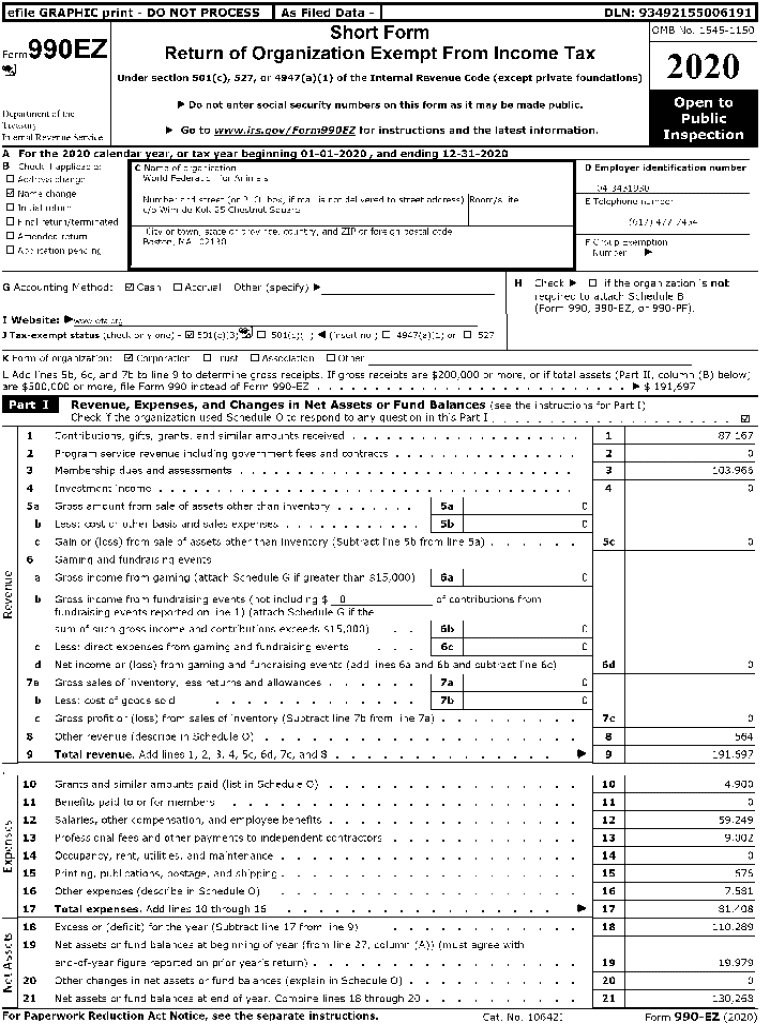

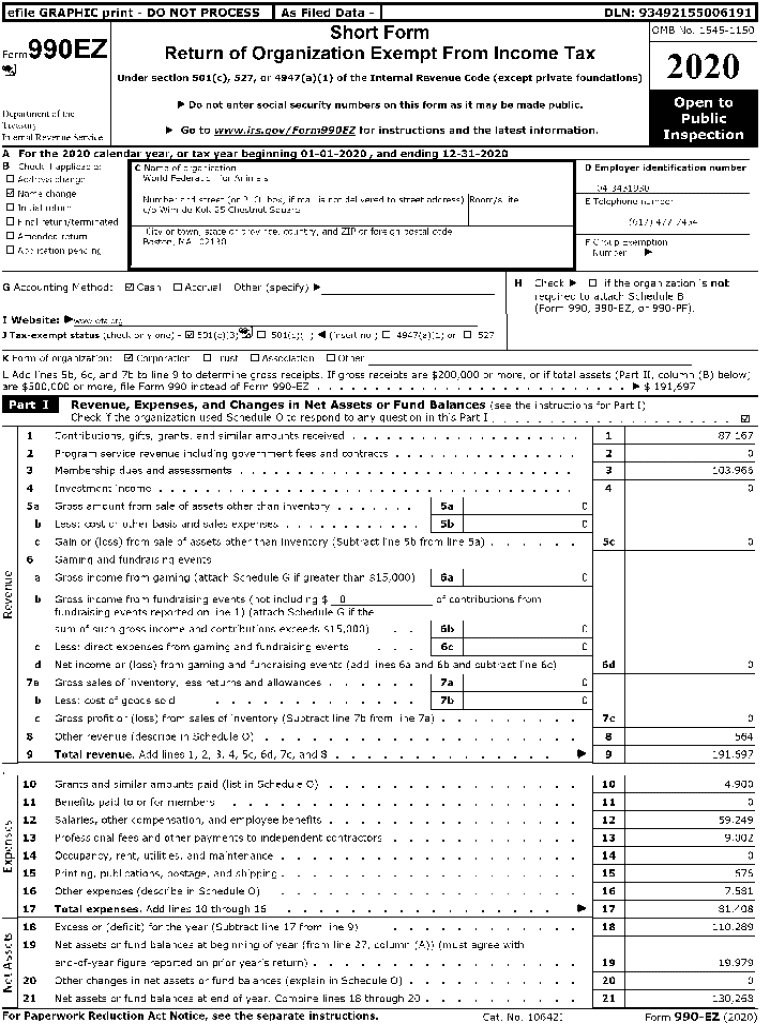

Understanding the e-file Form 990-N

Form 990-N, commonly known as the e-postcard, was designed specifically for small tax-exempt organizations. Its primary purpose is to provide the IRS with necessary information about the organization’s financial activity, allowing them to keep track of these entities without burdening them with lengthy reporting requirements. It serves as a simplified reporting option for groups with minimal financial activity, ensuring that they can maintain their tax-exempt status while meeting federal requirements.

By utilizing Form 990-N, organizations can enjoy several key benefits. This form is not only straightforward and brief, but it also significantly reduces the administrative tasks involved with tax filing. The simplicity of the form means that small organizations can focus more on their missions rather than on convoluted paperwork, claiming a substantial benefit in terms of time and operational efficiency.

Who needs to file Form 990-N?

Eligibility to file Form 990-N is primarily determined by the organization’s gross receipts. To qualify, an organization must have gross receipts that are normally under $50,000 in a tax year. This criterion allows the IRS to streamline the reporting process for smaller nonprofit entities, reinforcing the commitment to support tax-exempt organizations without overwhelming them.

However, there are exceptions and special cases to consider. Some organizations, such as private foundations, are not eligible to file Form 990-N even if their receipts remain under the threshold. Furthermore, organizations that operate in multiple states or internationally may have additional requirements due to varying local regulations. Understanding these nuances is crucial for ensuring compliance.

Why choose to e-file the Form 990-N?

Opting for electronic filing of Form 990-N comes with numerous advantages that make it an ideal choice for tax-exempt organizations. Firstly, e-filing generally results in faster processing times compared to paper submissions. Organizations receive immediate confirmation of their submissions, thus eliminating uncertainty regarding whether or not the form has been successfully filed.

Moreover, e-filing enhances accuracy due to automated checks integrated into the filing system. These systems help catch errors before submission, reducing the chances of delays or rejections due to minor mistakes. This seamless process allows organizations to focus on their core missions while ensuring compliance with IRS regulations.

IRS acceptance guarantee

E-filing aligns with IRS guidelines that prioritize electronic submissions for various forms, including Form 990-N. By filing electronically, organizations ensure that they stay within compliance parameters set forth by the IRS, which can help in avoiding future audits or penalties. This acceptance guarantee is crucial for maintaining the longevity and credibility of tax-exempt organizations.

Preparing for e-filing Form 990-N

Before diving into the e-filing process for Form 990-N, organizations must ensure they have gathered the necessary information and documents. Key pieces of information required include the Employer Identification Number (EIN), legal name, and a valid mailing address of the organization. Additionally, having the tax year information is essential for accurate reporting.

Recommended resources for gathering this documentation can range from internal records to accounting software that keeps track of financial activities. Organizations should ensure that the information is current and reflects their most recent financial activities to maintain compliance and facilitate easy filing.

Step-by-step guide to e-filing Form 990-N

E-filing Form 990-N can be broken down into a few simple steps to enhance clarity and ease of completion.

Common errors to avoid when filing Form 990-N

Filing Form 990-N may seem straightforward, but certain common errors could delay the processing of your submission. One frequent misstep is the inaccurate entry of essential information, such as the EIN or organization name. Ensuring that all information matches existing records is vital during the filing process.

Another potential pitfall involves missing signatures or filing with the incorrect tax year. These errors can lead to significant complications and necessitate re-filing. To minimize mistakes, organizations should utilize tools available within pdfFiller to review the form. Additionally, maintaining a checklist of common pitfalls can serve as a useful reference during the submission process.

After you file: Next steps and follow-up

After successful submission of Form 990-N, organizations should prioritize keeping records of their filed forms and correspondence. Maintaining copies can prove invaluable in ensuring compliance and managing any potential queries from the IRS. Recommended storage methods include both digital backups and physical files for essential documents.

It is also important to know the implications of missing the filing deadline. Organizations may consider options for late filing or potential penalties incurred. In certain situations, amending a filed Form 990-N may be necessary to correct any errors. Understanding these next steps ensures adequate preparation for organizations in maintaining their tax-exempt status.

Utilizing pdfFiller for your filing needs

pdfFiller offers numerous features that greatly enhance the experience of filing Form 990-N. From easy document management to simplifying the overall filing process, pdfFiller serves as a one-stop solution for tax-exempt organizations looking to streamline their operations. Specific tools cater to needs such as collaboration and communication amongst teams assisting in form preparation.

Numerous client testimonials highlight success stories where users have effectively e-filed Form 990-N using pdfFiller. Many have noted the ease of access and convenience, which supports their overall mission of compliance without excessive obstacles.

FAQs about e-filing Form 990-N

As organizations prepare to e-file Form 990-N, several common questions typically arise. One pressing query often includes, 'What if I don’t file on time?' Organizations should be prepared for potential penalties and have a plan in place for late filing if necessary. Another question frequently posed is regarding the possibility of filing a paper version. While e-filing is preferred, a paper version can be filed if e-filing is not viable.

Lastly, organizations may wonder about any fees associated with e-filing. Typically, e-filing offers a cost-effective means of submission; however, specific providers may impose fees. For additional assistance, organizations can consult resources provided by pdfFiller, ensuring they navigate every step of the filing process accurately and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get e-file form 990n postcard?

How do I complete e-file form 990n postcard on an iOS device?

How do I edit e-file form 990n postcard on an Android device?

What is e-file form 990n postcard?

Who is required to file e-file form 990n postcard?

How to fill out e-file form 990n postcard?

What is the purpose of e-file form 990n postcard?

What information must be reported on e-file form 990n postcard?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.