Get the free P45 Form - Fill Out and Sign Printable PDF TemplateairSlate ...

Get, Create, Make and Sign p45 form - fill

Editing p45 form - fill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p45 form - fill

How to fill out p45 form - fill

Who needs p45 form - fill?

Comprehensive Guide to Filling Out a P45 Form

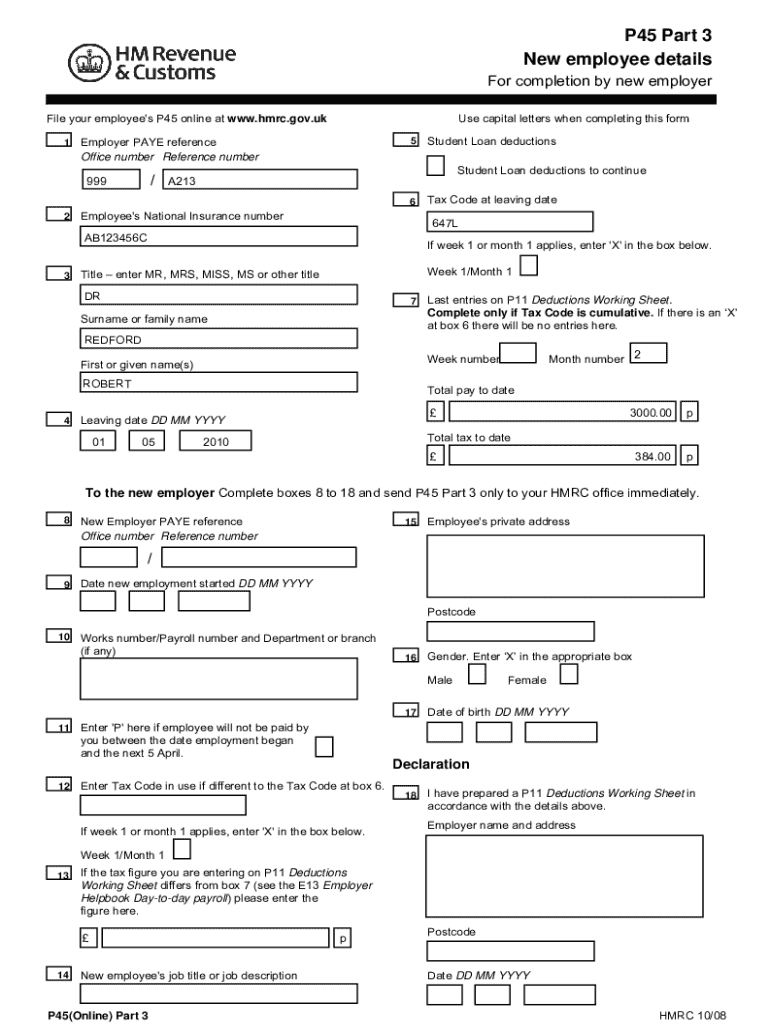

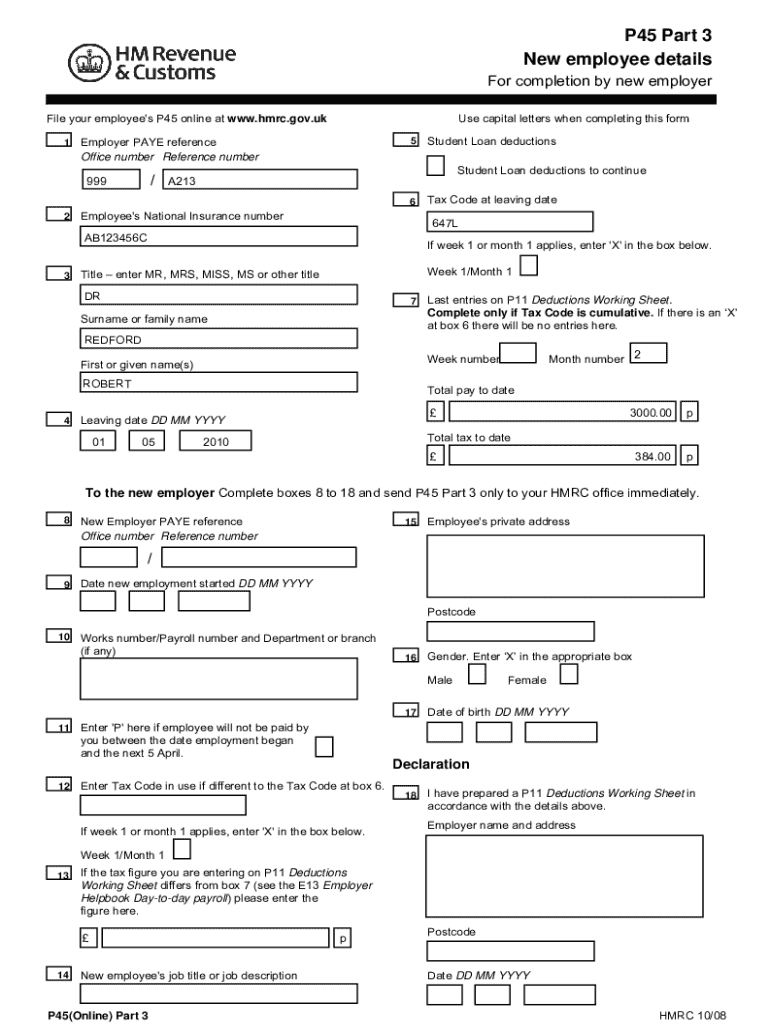

Understanding the P45 form

A P45 form is a crucial document that signifies the end of an individual's employment with an employer in the UK. It details the employee's tax code, the total earnings during the employment period, and the tax deducted, providing essential information for both the employee and employer post-employment. Essentially, it serves to ensure that the employee's tax affairs are up-to-date and that they receive the correct tax deductions from their income in a new job or while claiming benefits.

The importance of the P45 form cannot be overstated, as it is frequently requested when starting a new job or for tax purposes. Without this form, there may be complications in determining the correct tax status, leading to potential overpayments or underpayments in taxes. It keeps the transition from one job to another clear and documented.

When is a P45 issued?

A P45 is issued whenever an employee leaves their job, regardless of the circumstances—be it voluntary resignation, redundancy, or dismissal. Employers are responsible for providing this document to their employees as soon as possible after the termination of employment. Depending on the employer's payroll system and practices, the timeline for issuing the P45 may vary, but it is typically provided before the employee’s last paycheck.

It's worth noting that if an employee is moving to a new job, they need to present their P45 to their new employer promptly. This ensures that the correct tax code can be applied to their earnings and minimizes issues with tax repayments or deductions.

Sections of the P45 form

The P45 is segmented into several distinct parts, each containing important information that helps both the employee and the tax authorities. The sections include Part 1, Part 1A, Part 2, and Part 3, with each part serving a specific purpose.

Providing accurate information in each of these sections is essential. Incorrect details can lead to complications in ensuring tax accuracy, resulting in potential fines or incorrect tax liabilities.

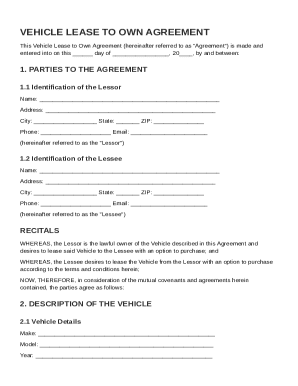

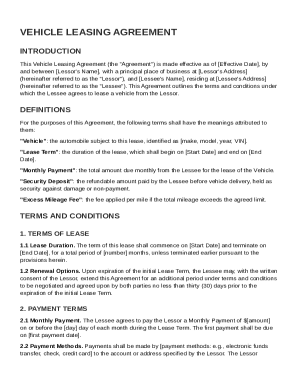

How to fill out a P45 form

Filling out the P45 form correctly is vital for ensuring smooth transitions between jobs and accurate tax calculations. Let’s break down the process step-by-step.

Preventing common mistakes during this process is crucial. Misplaced decimals, wrong dates, or incorrect tax codes can lead to prolonged issues with tax authorities.

Common mistakes to avoid

Many individuals overlook critical parts of the P45 form, leading to complications. Here are some common mistakes to avoid:

Using tools like pdfFiller can significantly simplify the form-filling process. It offers effortless editing and management capabilities, enabling users to ensure they get it right the first time.

Editing and managing your P45 form

Once you have completed the P45 form, editing and managing it can be essential, especially if there are changes needed. pdfFiller’s online tools provide an efficient way to edit your P45 form securely.

To edit your P45 form online, follow these steps:

Best practices for storing your P45 include saving multiple copies in different formats (like PDF and DOCX) and ensuring you back them up with secure online storage solutions to prevent loss. Accessing it becomes seamless when needed for job applications or tax filings.

Sharing your P45 with relevant parties

When it comes to sharing your P45 form, ensure you do so securely. Using pdfFiller, you can send the document directly to employers or financial institutions via a secure link or email through the platform.

Make sure the recipient knows the document's importance and that confidential information is handled appropriately. Sending it via secure channels not only preserves the integrity of the document but also complies with data protection regulations.

Additional insights on the P45 process

After leaving a job, employees often wonder when they can expect to receive their P45. Generally, an employer is obligated to provide the P45 by the time the employee's final paycheck is issued. However, if there are delays, it is advisable to follow up to avoid complications during subsequent job changes.

If you do not receive a P45, here are some steps to take:

Furthermore, understanding how to incorporate your P45 into your tax return is critical. The earnings and tax deducted reported on your P45 form should match what you've declared in your annual tax returns. This ensures that you claim any eligible refunds and avoid unnecessary tax liabilities.

Frequently asked questions about the P45 form

Can I fill out a P45 form electronically? While traditionally a printed document, many online platforms like pdfFiller allow individuals to complete and submit their P45 forms electronically, simplifying the process extensively.

What if my details change after receiving my P45? If there are any changes, it's imperative to inform your new employer to ensure that your records remain updated and tax deductions are calculated accurately.

Will I need a new P45 if I start a new job? You won’t receive a new P45 if you start a new job; rather, your new employer uses the details from your previous P45 to calculate your tax and work out the correct tax code to apply.

Utilizing pdfFiller for document management

pdfFiller is an all-in-one platform that empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based solution. With features tailored for efficiency, users find it easier to work on forms like the P45 while maintaining organization.

Key functionalities like real-time collaboration allow multiple users to view and edit documents simultaneously, which is especially beneficial for teams. This ensures that changes are logged, and versions are controlled, delivering a cohesive experience across your document management strategy. Overall, pdfFiller supports individuals and teams as they navigate their paperwork with ease, empowering them to handle pivotal documents like the P45 form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the p45 form - fill form on my smartphone?

Can I edit p45 form - fill on an iOS device?

How do I edit p45 form - fill on an Android device?

What is p45 form?

Who is required to file p45 form?

How to fill out p45 form?

What is the purpose of p45 form?

What information must be reported on p45 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.