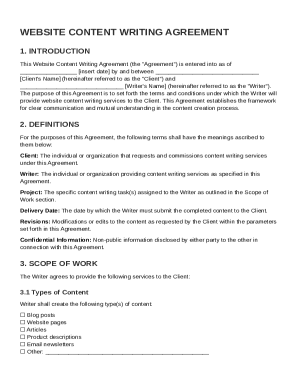

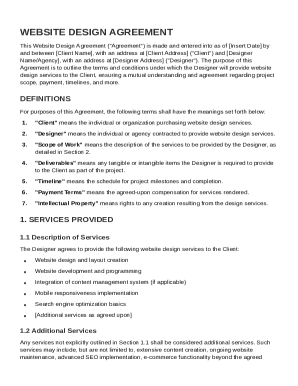

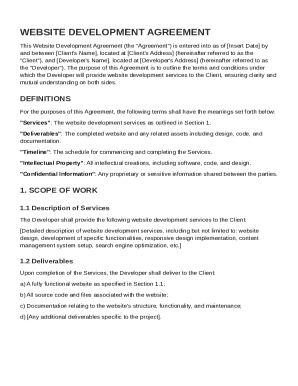

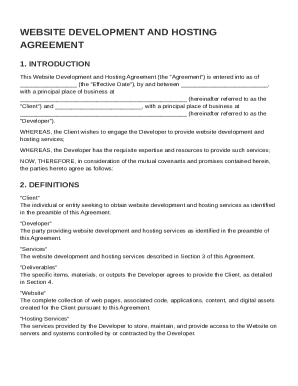

Get the free Tax List INSIDE

Get, Create, Make and Sign tax list inside

Editing tax list inside online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax list inside

How to fill out tax list inside

Who needs tax list inside?

Tax list inside form: A comprehensive guide

Understanding the tax list concept

A tax list is an organized system of information required for tax reporting and compliance, encompassing various items like income, deductions, and credits. It's vital for ensuring that all applicable financial data is recorded accurately. Tax lists enable individuals and businesses to keep track of their tax obligations and ensure that they meet regulatory requirements.

The importance of tax lists cannot be overstated; they serve as a crucial component in documenting financial activities throughout the year. By offering a structured way to view and compile necessary data, tax lists help simplify the often daunting task of preparing tax forms. Common tax forms like the 1040 for individuals or Form 1065 for partnerships typically contain these lists, which streamline the reporting process.

Types of tax lists commonly found in forms

Tax lists vary significantly between individual and business tax forms, each serving different purposes and containing unique requirements. For individuals, tax lists in personal income tax forms include income details, potential deductions, and credits that may be applicable. They commonly feature lists of filers and dependents, ensuring that all claimable circumstances are accounted for.

For businesses, tax lists focus on documenting business income and categorizing expenses and deductions appropriately. Whether using the Schedule C for sole proprietorships or the corresponding forms for corporations, businesses need comprehensive tax lists to navigate tax requirements effectively.

Key components of a tax list inside a form

Various essential fields must be included in any tax list inside forms to enhance clarity and completeness. These fields typically consist of income sources, categories for deductions, and specific identification for filers. Additionally, the IRS provides instructions that accompany forms to guide users in filling out each section.

Common mistakes when completing tax lists include misreporting income, failing to include all applicable deductions, and overlooking dependents. Such errors can lead to delays, penalties, or audits. Careful attention to details and knowing how to read the instructions is crucial for ensuring accuracy.

How to enter data in tax lists effectively

Entering data in tax lists effectively hinges on having a clear understanding of the form's requirements and your financial situation. Individuals should start by collecting all relevant documents, such as W-2s, 1099s, and any receipts for deductions. A step-by-step approach can ease the process.

For businesses, effective data entry starts with a comprehensive accounting system. It's beneficial to categorize income and expenses clearly. Taking time to ensure every item is accounted for will significantly ease tax filing.

Tools and resources for managing your tax lists

pdfFiller stands as a powerful platform for document management, particularly useful for handling tax lists inside forms. Its services enable users to access forms, manage their documents in a cloud-based environment, and fill out tax forms interactively. The beneficial features of pdfFiller simplify the process of tax documentation.

With pdfFiller, users can collaborate securely in real time. This feature becomes crucial for teams needing to share tax documents efficiently, ensuring everyone can contribute to the data entry process.

State tax forms and their specific tax lists

State-specific tax forms often have unique tax lists tailored to the local tax laws. Understanding these forms is crucial for accurate taxation and compliance. Variances can arise in required fields and documentation depending on jurisdiction, necessitating vigilance when filing state taxes.

pdfFiller can assist users in understanding state-specific forms by providing access to the necessary resources and guidelines, ensuring users are equipped with accurate information.

Frequently asked questions about tax lists in forms

It is common to encounter questions regarding tax lists during the filing process. One frequent concern is what to do if certain information is missing. In these cases, seeking relevant documents, contacting employers for necessary information, or checking previous tax filings can be strategies to obtain the needed data.

Navigating complexity in tax lists can be daunting, but leveraging platforms like pdfFiller and consulting tax guidelines or professional help can provide much-needed support.

Advanced tips for managing tax lists

Managing tax lists doesn’t end with filing. Regularly reviewing tax information throughout the year can significantly simplify the preparation process during tax season. Integrating tax lists with financial software enhances efficiency by automating data entry and tracking financial changes directly related to tax obligations.

By scheduling regular updates and utilizing financial tools, both individuals and businesses can maintain a robust understanding of their tax obligations and avoid any last-minute rush or mistakes.

Legal and compliance considerations

Understanding relevant tax codes, compliance deadlines, and recordkeeping guidelines is integral when dealing with tax forms and their associated tax lists. Each jurisdiction operates under specific deadlines, and failure to comply can result in penalties.

Navigating these legal aspects can be simplified using resources like pdfFiller, which provide the necessary tools and guidance for compliance with forms and submissions.

Conclusion: Maximizing the use of tax lists

In the realm of tax preparation, maximizing the effectiveness of tax lists can lead to a more organized and less stressful filing experience. Utilizing platforms like pdfFiller enables users to streamline their document management process, ensuring that forms are filled out accurately and securely.

Ultimately, efficiency in tax documentation translates to peace of mind during tax season, allowing users to focus on their financial goals without the stress of potential mismanagement.

Additional features of pdfFiller

pdfFiller offers various additional features that make the process of managing tax lists and forms even more user-friendly. For instance, eSign capabilities allow for quick signing of documents, which is invaluable when timing is essential.

In summation, pdfFiller's extensive features and secure platform afford users the ability to manage their tax lists and forms effectively, ensuring a smooth workflow and compliance with tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax list inside in Gmail?

How do I fill out the tax list inside form on my smartphone?

How do I complete tax list inside on an Android device?

What is tax list inside?

Who is required to file tax list inside?

How to fill out tax list inside?

What is the purpose of tax list inside?

What information must be reported on tax list inside?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.