Get the free Dependent Student Parent Income Verification Worksheet ...

Get, Create, Make and Sign dependent student parent income

How to edit dependent student parent income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dependent student parent income

How to fill out dependent student parent income

Who needs dependent student parent income?

Understanding the Dependent Student Parent Income Form

Understanding the dependent student parent income form

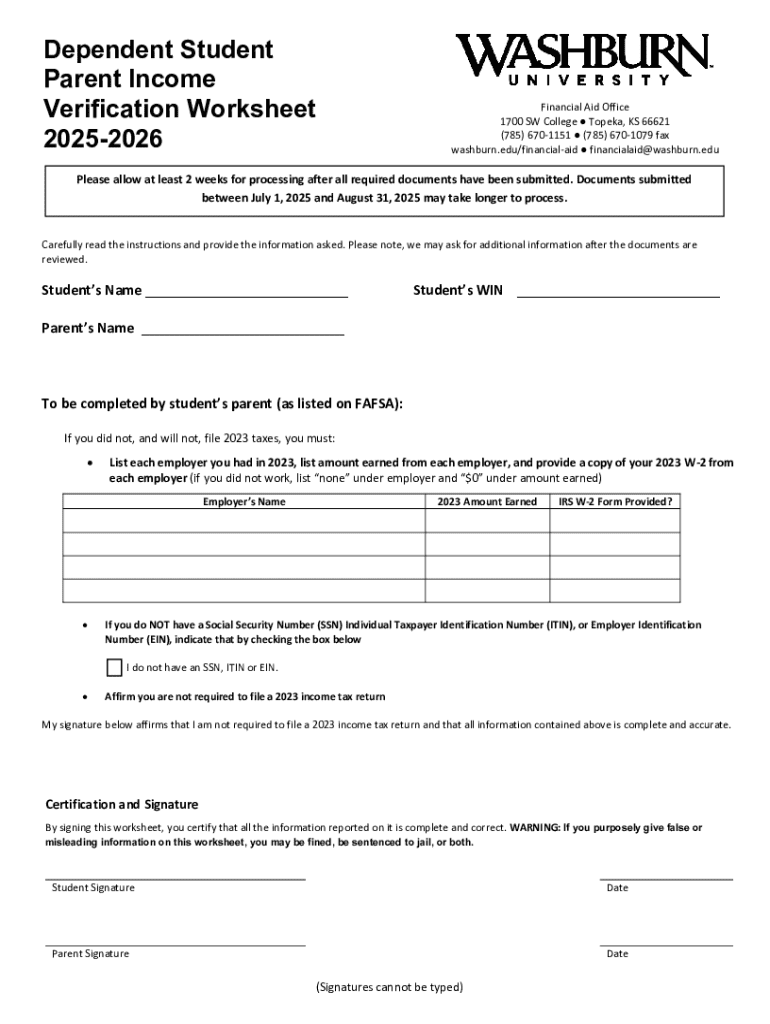

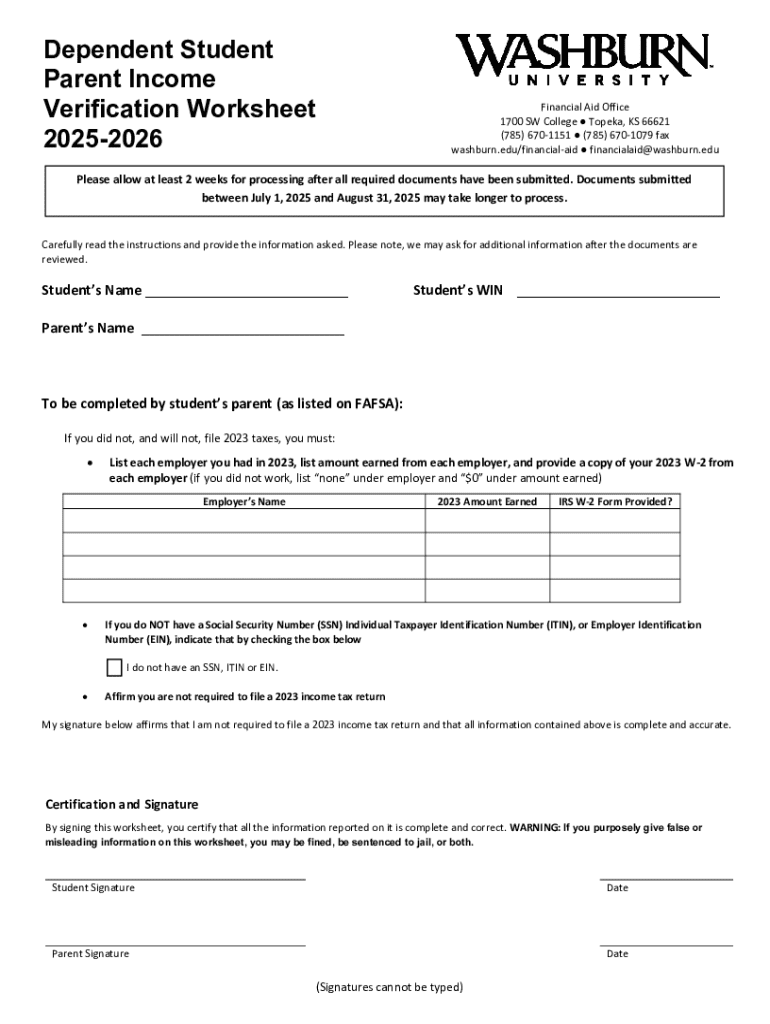

The dependent student parent income form plays a crucial role in determining the financial aid eligibility for students attending college or university. This form serves as a means for colleges and universities to gather essential financial data from parents of dependent students, ensuring that aid distribution is based on accurate and comprehensive financial profiles. The accurate completion of this form can significantly influence a student's ability to secure grants, loans, and scholarships, making it an essential element of the financial aid process.

Understanding the importance of this form is vital for both students and their families. It helps in establishing an Expected Family Contribution (EFC) that colleges utilize to determine how much financial aid you might receive. By accurately reporting parental income, families can ensure that they receive the appropriate level of aid needed for higher education expenses.

Who needs to fill out this form?

Typically, dependent students are those who rely on their parents for financial support. A student is classified as dependent if they are under the age of 24, are not married, have no children or dependents of their own, and are not veterans of the U.S. Armed Forces. These criteria help define the dependency status that clarifies which financial data must be reported, particularly for federal and state financial aid purposes.

Parents play a central role when it comes to providing the necessary information. They are considered contributors to the student’s educational expenses, and their financial data is used to assess overall need for financial assistance. Understanding the differences between dependent and independent student statuses is essential as it directly affects parents' duty to report their financial details.

Components of the dependent student parent income form

The dependent student parent income form requires several components of information from both students and parents to ensure a comprehensive overview of the family's financial standing. Firstly, parents must provide accurate income details such as W-2 forms, 1099 forms, and federal tax returns from the previous year, which give an overview of the family's earnings.

Additionally, asset information is also requested. This includes bank account balances, the total value of investments, and other relevant financial data that contribute to the family's financial picture. Alongside financial data, the form also requests basic demographic information including the number of family members and any other pertinent details that might affect the financial status.

In conjunction with parental information, students are needed to provide their personal details such as contact information, school name, and academic information, including their program of study. Having all of this data readily available can streamline the completion process and reduce potential errors.

Step-by-step guide to completing the form

To successfully complete the dependent student parent income form, the first step is to gather all necessary documentation. This includes the previous year’s tax returns, W-2 forms from each job, current bank statements, and any documentation related to assets such as investment portfolios. Having these documents organized and accessible can simplify the process immeasurably.

Next, when filling out the form, address each section methodically. The Personal Information Section requires basic details about both the student and parents, while the Income Section focuses on total earnings. The Asset Section demands a thorough listing of bank balances and other assets, while Additional Required Sections might pertain to various disclosures that vary by institution. Taking time to carefully navigate each section ensures accuracy.

Common mistakes to avoid include inaccurate reporting; ensure income is reported correctly to reflect all sources, including bonuses and side jobs. It’s also important to double-check each entry for clarity and completeness to avoid delays in processing financial aid requests.

Editing and signing the form

Once the dependent student parent income form is completed, utilizing tools such as pdfFiller for editing can streamline the process significantly. The platform offers numerous editing features that allow users to seamlessly add or remove information, ensuring that the form is as accurate and complete as possible before submission.

To add electronic signatures, pdfFiller provides an intuitive eSigning platform that enhances security while making the signing process expedient. Following the on-screen instructions, users can easily sign the document electronically, affirming its validity for submission. Ensuring every part of the form is signed as required helps in the timely processing of financial aid applications.

Submitting the dependent student parent income form

Upon completing and signing the form, it's critical to know where to submit it. Many institutions provide options for both online and physical submission. Online submission is typically quicker; however, it's essential to adhere to the institution's preferred method. Key deadlines should not be overlooked, as they may vary by school, leading to potential delays in financial aid awards.

To track the status of submitted forms, most colleges allow students to verify receipt through their financial aid portal. In case of any submission issues or delays, students should immediately contact the financial aid office, providing necessary details to resolve any complications swiftly.

Managing your document post-submission

After submission, it's important to manage and store the dependent student parent income form securely. Cloud-based storage solutions, such as those offered by pdfFiller, serve as an effective way to keep important documents organized and easily accessible, which is beneficial for future reference or in cases where updates may be necessary.

If financial situations change or additional information arises, revising submitted forms may be necessary. It’s imperative to keep financial aid offices informed of any changes that may impact the family’s financial situation or aid eligibility, ensuring students can continue to receive the appropriate support throughout their academic journey.

Understanding financial aid implications

The income reported on the dependent student parent income form significantly affects financial aid decisions. The Expected Family Contribution (EFC) derived from this form is a crucial metric utilized by colleges to measure the financial resources available to support a student's education. Families with lower reported incomes may qualify for more need-based financial aid, which can include federal grants, state aid, and institutional funding.

Understanding the distinction between need-based and merit-based financial aid is fundamental for students. Need-based aid relies heavily on demonstrated financial circumstances, while merit-based aid often considers academic performance or other achievements. Families are encouraged to consult with financial aid advisors or utilize online forums for additional support and guidance as they navigate the financial aid landscape.

Conclusion of key takeaways

In summary, successfully completing the dependent student parent income form relies on accurate and organized reporting of financial data. Families should focus on clear documentation and communication with financial aid offices to maximize financial assistance opportunities. It becomes evident that managing this form effectively can mean the difference between financial strains and relief, emphasizing the importance of preparedness in the financial aid process.

Moreover, embracing tools like pdfFiller can enhance the efficiency of filling out forms, providing a more cohesive experience in document management. Students and their families should prioritize staying informed and organized, enabling a smoother pathway through the complexities of financial aid support for higher education.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find dependent student parent income?

How do I edit dependent student parent income on an Android device?

How do I complete dependent student parent income on an Android device?

What is dependent student parent income?

Who is required to file dependent student parent income?

How to fill out dependent student parent income?

What is the purpose of dependent student parent income?

What information must be reported on dependent student parent income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.