Get the free TRANSFER-ON-DEATH DEED - Rogers County

Get, Create, Make and Sign transfer-on-death deed - rogers

Editing transfer-on-death deed - rogers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer-on-death deed - rogers

How to fill out transfer-on-death deed - rogers

Who needs transfer-on-death deed - rogers?

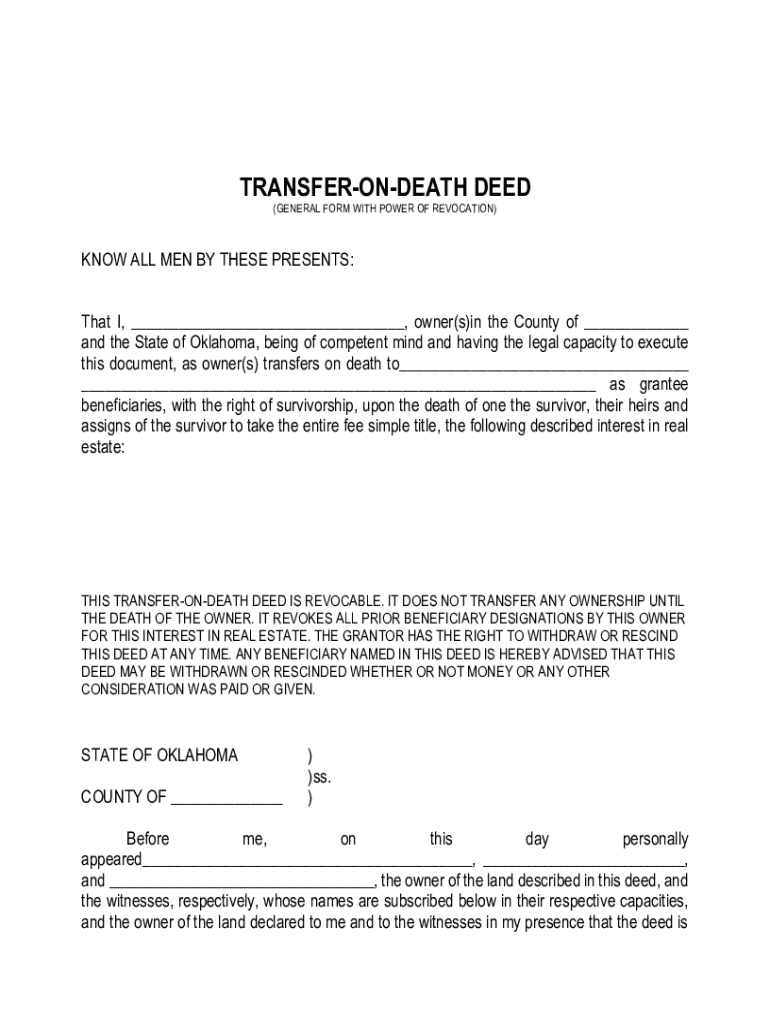

Transfer-on-Death Deed - Rogers Form

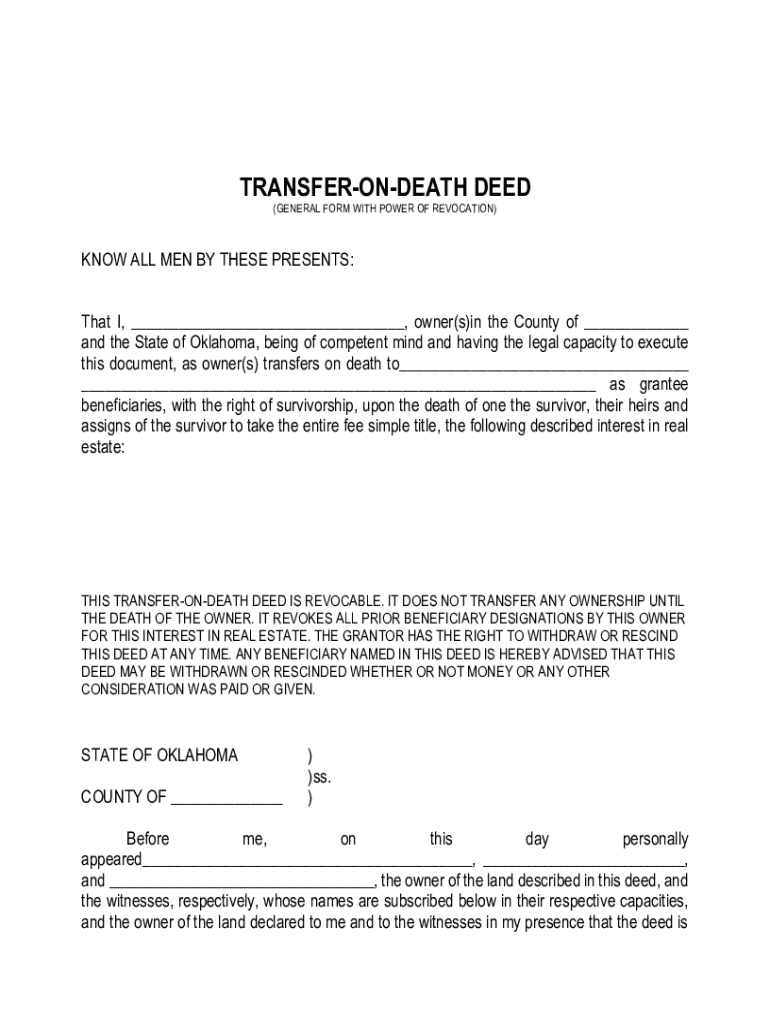

Understanding the Transfer-on-Death Deed

A Transfer-on-Death (TOD) deed is a legal document that allows property owners to designate beneficiaries who will receive their property upon the owner's death, bypassing the costly and often lengthy probate process. This deed ensures that the transfer of property is automatic, allowing for a seamless transition without the complications of a will or trust. The primary purpose of the TOD deed is to simplify the transfer of real estate assets, providing clarity and immediate ownership to the named beneficiaries.

Once the TOD deed is executed and properly recorded, the named beneficiaries retain no rights to the property until the owner's death. This arrangement offers great flexibility as the owner retains full control over the property throughout their lifetime. Additionally, should the owner choose to amend the deed or sell the property, they can do so without the consent of the beneficiaries.

Overview of Rogers County Transfer-on-Death Deed

In Rogers County, Oklahoma, the Transfer-on-Death deed follows specific regulations pertaining to its execution and recording. These local rules ensure that property owners can efficiently utilize this form while complying with state mandates. When comparing the Rogers County transfer-on-death deed with forms from other Oklahoma counties, there may be slight variations in formatting or requirements, but the core function remains the same.

Choosing the Rogers Form is particularly advantageous for residents in this area, as it is tailored to meet local needs and standard practices. Moreover, utilizing a county-specific form can minimize the risk of errors that may occur when using a generalized state form.

Step-by-step guide to completing the Rogers County Transfer-on-Death deed

To complete the Rogers County Transfer-on-Death deed correctly, follow these detailed steps to ensure all requirements are met.

Local supplemental documents for Rogers County

Besides the Transfer-on-Death deed itself, Rogers County may require additional forms and documents depending on the specific circumstances surrounding the property and beneficiaries. These local supplemental documents can include tax forms, identification verification documents, or any special requirements specific to the locality.

These documents are essential for ensuring a smooth recording process and minimizing the chance of any legal disputes in the future. Accessing local supplemental documents can easily be done through pdfFiller, which provides comprehensive options for printing and submitting necessary paperwork.

Submitting your Transfer-on-Death deed

Once the Rogers County Transfer-on-Death deed is completed, you need to submit it for recording. This can be done at the Rogers County Recording Office, located at [insert address], during their hours of operation, typically Monday through Friday, 8:00 AM to 5:00 PM.

Frequently asked questions about the Transfer-on-Death deed

As individuals consider using the Transfer-on-Death deed, several questions often arise, reflecting common concerns about the legalities and practicalities involved in the process.

Guarantee and legal forms disclaimer

While completing the Transfer-on-Death deed is straightforward, legal compliance is paramount. It’s essential to ensure that the deed adheres to all state and local laws to remain effective. If in doubt, seeking legal counsel can provide clarity and assurance regarding the validity of the document.

Additionally, individuals utilizing pdfFiller for form preparation should be aware of the limitations of liability for self-prepared documents. Users must ensure accurate completion and filing to avoid any potential legal complications.

Our promise to users

At pdfFiller, our commitment is to empower users with cloud-based solutions that facilitate document management. We provide various tools to ensure that forms can be easily edited, eSigned, and shared, all from a single accessible platform. Whether you are preparing a Transfer-on-Death deed or any other essential document, we strive to simplify the entire process.

We understand the importance of easy access to documents and ensure our users can manage their files efficiently, with comprehensive support and guidance available at every step. Our goal is to make your document experience as smooth as possible, promoting confidence in managing your important legal paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out transfer-on-death deed - rogers using my mobile device?

Can I edit transfer-on-death deed - rogers on an iOS device?

How do I complete transfer-on-death deed - rogers on an Android device?

What is transfer-on-death deed - rogers?

Who is required to file transfer-on-death deed - rogers?

How to fill out transfer-on-death deed - rogers?

What is the purpose of transfer-on-death deed - rogers?

What information must be reported on transfer-on-death deed - rogers?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.