Get the free 2025 Individual Income Tax Forms

Get, Create, Make and Sign 2025 individual income tax

How to edit 2025 individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 individual income tax

How to fill out 2025 individual income tax

Who needs 2025 individual income tax?

2025 Individual Income Tax Form How-to Guide

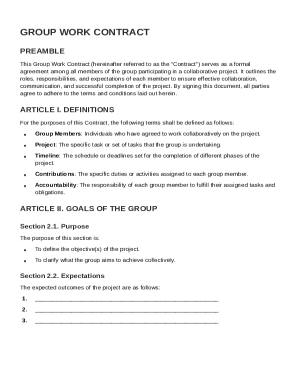

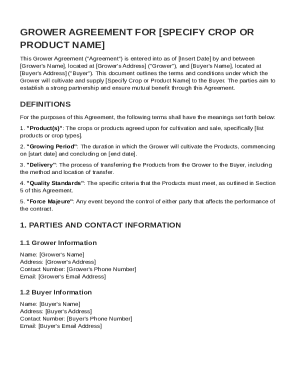

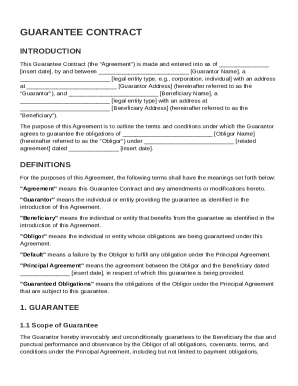

Understanding the 2025 individual income tax form

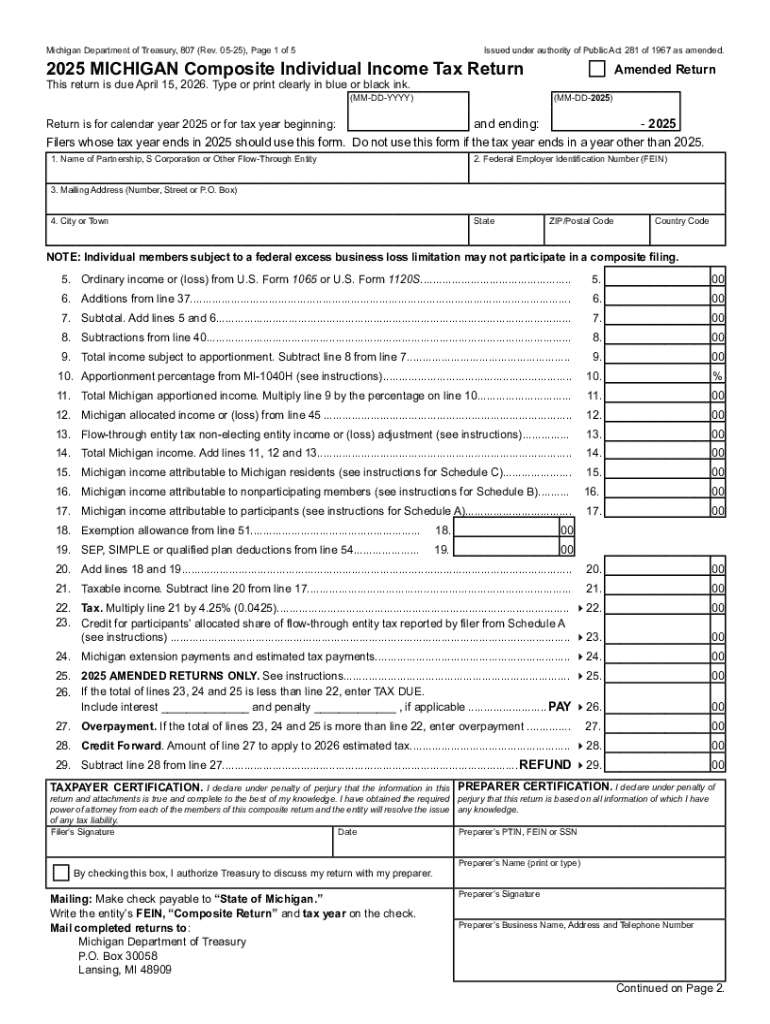

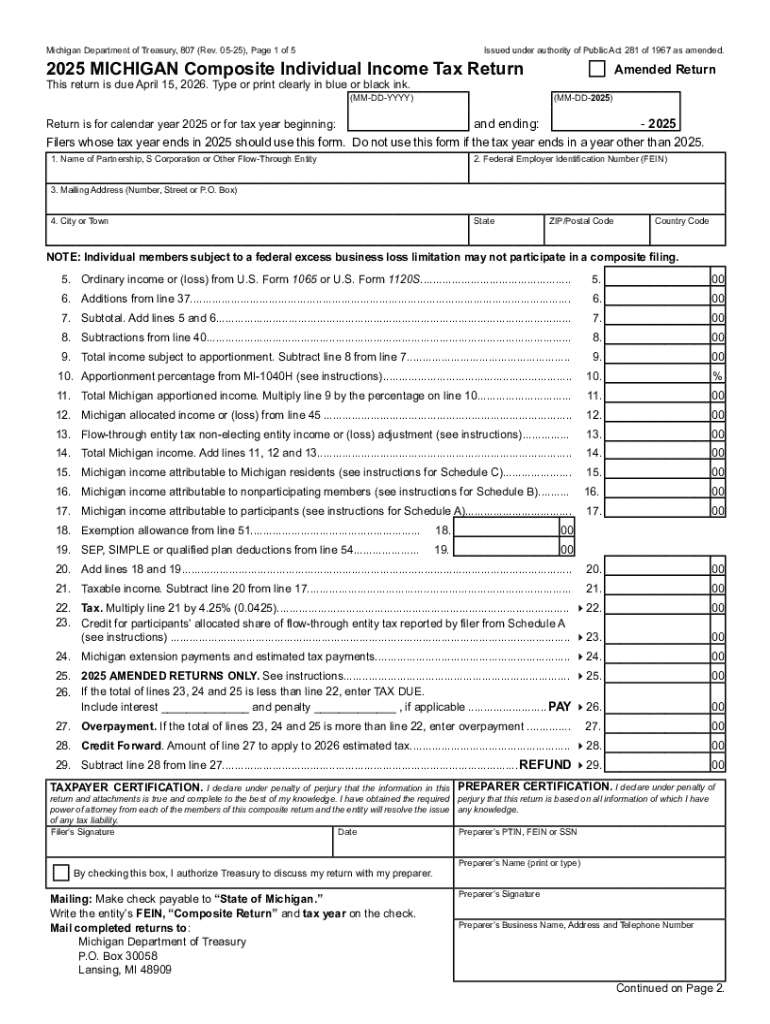

The 2025 Individual Income Tax Form is a vital document for every taxpayer in the United States, serving as the official means by which income tax obligations are reported to the Internal Revenue Service (IRS). Accurate reporting and compliance are crucial, as improper filings can lead to penalties and potential audits. This year's form reflects several changes to tax regulations — a necessary evolution to address economic shifts and legislative amendments.

Taxpayers will find that the 2025 form incorporates updates that aim to simplify the filing process, while also aligning with the latest tax laws and brackets. Staying informed about these key changes not only aids in compliance but also can uncover opportunities for minimizing tax liabilities.

Preparing to file your taxes

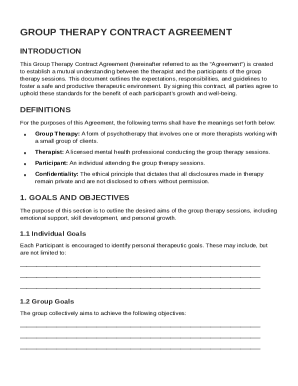

Before starting the filling process, it's essential to gather all necessary documents to ensure your 2025 individual income tax form is completed accurately. This includes W-2 forms from your employers, 1099 forms for any freelance work, and other income statements. Additionally, compile documentation for any potential deductions and credits, such as mortgage interest statements, property taxes, or charitable contributions.

Understanding your filing status is another crucial step in the preparation process. There are five types of filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Each status has distinct implications for your tax rates and potential deductions, affecting your overall tax burden significantly.

Navigating the 2025 tax form

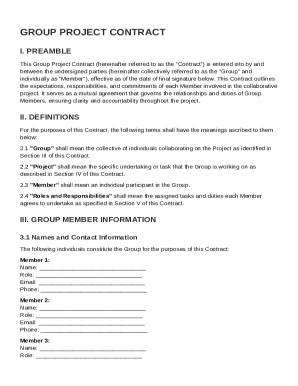

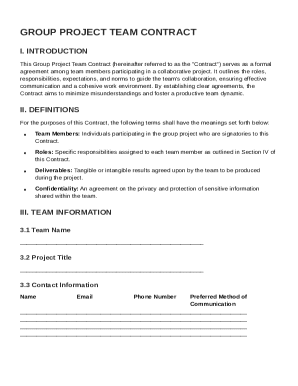

The 2025 Individual Income Tax Form consists of various sections, each designed to capture specific information. The initial pages require personal details such as your name, Social Security number, and filing status. Following this, taxpayers must detail their income sources, ensuring each entry is accurate to avoid discrepancies.

Deductions and credits are essential components of the form that can significantly reduce tax liabilities. Understanding where to enter these values is key. For example, standard deductions will be prominently displayed, alongside options to itemize if it benefits your situation more. Remember to verify all calculations and ensure you are confident in what you are claiming.

Interactive tools for simplifying the process

Leveraging tools like pdfFiller can enhance the filing experience for the 2025 individual income tax form. With pdfFiller's interactive tax form template, users can access a user-friendly interface that allows for easy data entry and editing. The benefit of cloud-based editing means that you can work from anywhere, ensuring you have access to your documents whenever needed.

Additionally, the platform enables real-time collaboration. This means that teams or family members can share the form for input and review, allowing everyone involved to ensure accuracy before submission.

Updating and editing your tax form

If you need to make updates to your 2025 tax form, pdfFiller provides a detailed, step-by-step guide on how to proceed. Users can easily edit fields, add information, or adjust figures directly on the form using the intuitive platform. This is particularly beneficial for correcting any errors that might appear after initial entry.

It’s crucial to ensure compliance with electronic filing standards. Before submission, double-check all fields for accuracy, and make certain that signatures are properly affixed, particularly if you’re collaborating with others.

Filing your tax return: what you should know

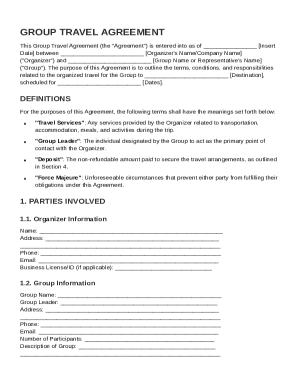

When it comes to submitting the 2025 individual income tax form, taxpayers have two primary options: e-filing or mailing paper forms. E-filing is generally faster and often results in quicker processing times, while mailing paper forms can be more cumbersome and slow. It’s critical to be aware of deadlines to avoid late submission penalties, which can significantly add to your tax burden.

Once your return is submitted, confirmation of acceptance from the IRS will be delivered, either electronically or via postal mail, depending on your filing method. This confirmation is essential for ensuring your submission was processed successfully.

Post-filing: managing your tax documents

After successfully filing your 2025 individual income tax form, organizing and securely storing your tax documents becomes paramount. Keeping physical and digital copies of filed forms and supporting documentation is essential for reference during the year. Utilizing tools from pdfFiller, you can conveniently access filed returns and documents whenever needed.

Additionally, being prepared for potential audits requires meticulous record-keeping. Maintain all relevant records in an organized manner, such as bank statements, W-2 forms, and communications with the IRS.

Frequently asked questions (FAQs)

As taxpayers approach the 2025 individual income tax form, many questions inevitably arise. Common concerns include how to accurately report income, which deductions or credits might apply, and clarification on specific instructions related to new tax regulations. It’s important to research these frequently asked questions to navigate your tax filing confidently.

Resources including the IRS website, tax prep websites, and community forums provide extensive information. Additionally, pdfFiller offers support features tailored to assist users with common inquiries related to tax document management.

Additional support and resources

When preparing your 2025 individual income tax form, other supportive tools can make the experience smoother. Utilizing tax calculators can provide clarity on expected payments or refunds based on your inputs. Budgeting tools may also help manage finances more effectively in anticipation of tax obligations.

For those needing professional advice, reaching out to tax consultants or accountants can remove the complexities associated with navigating tax laws. Furthermore, pdfFiller's robust support resources are available to assist users with document-related questions or issues.

Up-to-date state tax form guidelines

Tax requirements can vary significantly from one state to another, emphasizing the need for familiarity with state-specific guidelines when filling out your 2025 individual income tax form. Each state may have its own regulations, additional forms, or deadlines that must be adhered to.

Locating and accurately filling out these state tax forms is crucial to ensuring comprehensive compliance with tax obligations. Online resources from state tax authorities often provide downloadable and fillable forms, which can be easily managed through platforms like pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2025 individual income tax?

How do I execute 2025 individual income tax online?

Can I sign the 2025 individual income tax electronically in Chrome?

What is 2025 individual income tax?

Who is required to file 2025 individual income tax?

How to fill out 2025 individual income tax?

What is the purpose of 2025 individual income tax?

What information must be reported on 2025 individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.