Get the free Campaign Spending CommissionI received a notice ...

Get, Create, Make and Sign campaign spending commissioni received

Editing campaign spending commissioni received online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign spending commissioni received

How to fill out campaign spending commissioni received

Who needs campaign spending commissioni received?

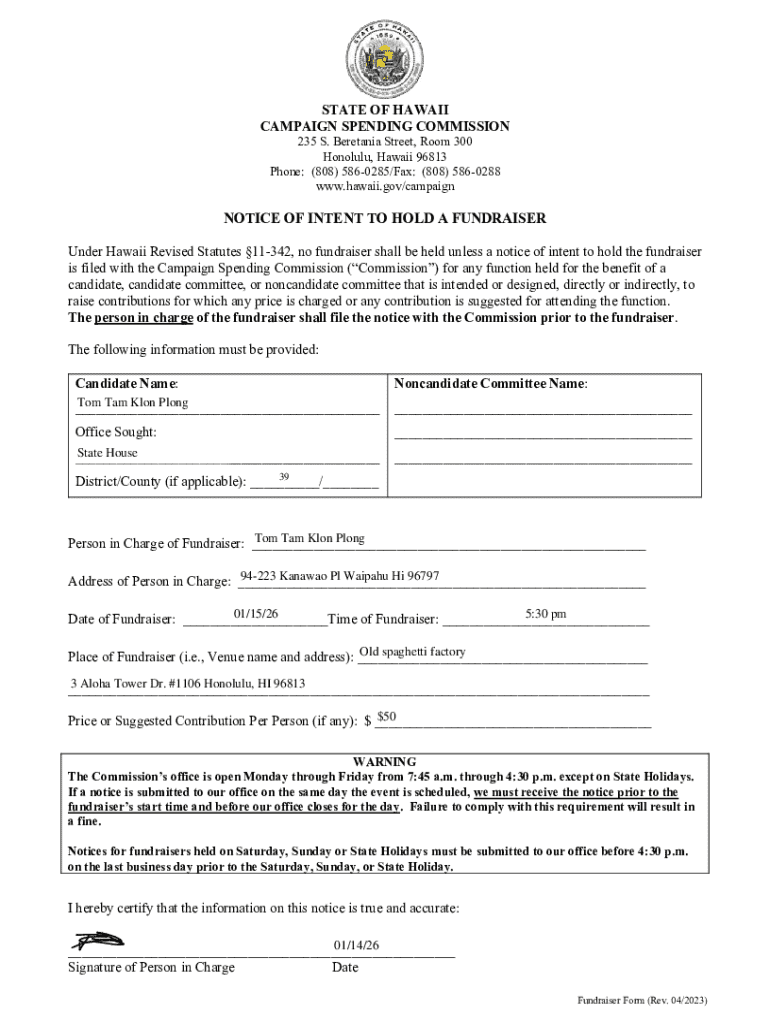

Understanding the Campaign Spending Commission Received Form: A Comprehensive Guide

Understanding campaign spending and its oversight

Campaign spending refers to the financial resources allocated by candidates, political parties, and committees to influence elections and public opinion. This spending includes a range of activities, from advertising and promotional materials to event organizing and staffing. The significance of campaign spending cannot be overstated; it plays a crucial role in shaping electoral outcomes and can determine the success or failure of a candidate's bid for office. With large sums of money involved, transparency and oversight are paramount to ensure fair political practices.

The Campaign Spending Commission serves as a watchdog entity overseeing these expenditures. It aims to maintain the integrity of elections by ensuring compliance with campaign finance laws and regulations. Key functions of the commission include monitoring contributions and expenditures, providing guidance to candidates and their committees, and enforcing penalties for violations. This oversight promotes transparency in campaign financing, which is essential for fostering public trust in the electoral process.

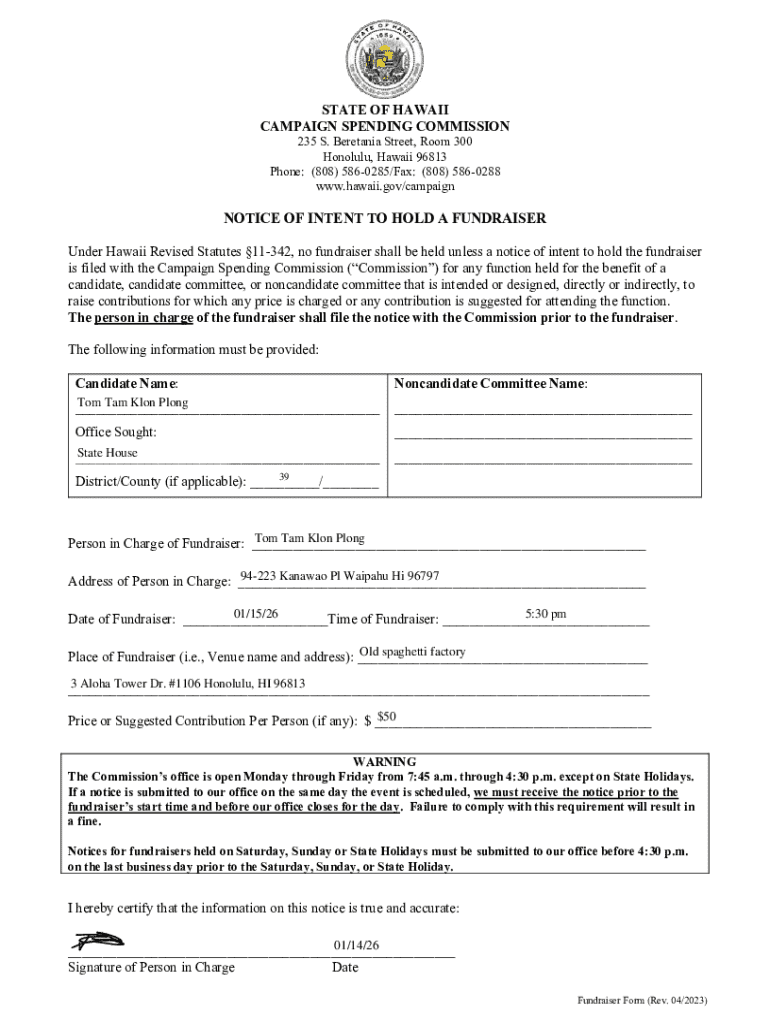

Overview of the Campaign Spending Commission Received Form

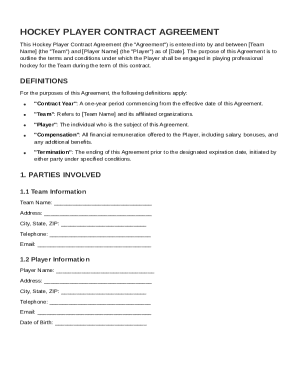

The Campaign Spending Commission Received Form is a crucial document used to report the funds received by political campaigns. It records various financial contributions—whether from individuals, businesses, or political action committees (PACs)—that support a candidate's electoral efforts. Accurate reporting is essential, as it ensures that all donations are transparently disclosed and appropriately accounted for. Failing to provide precise information could lead to serious legal consequences, including penalties or campaign disqualification.

Eligibility to file the Campaign Spending Commission Received Form generally includes candidates running for state offices, committees receiving contributions, and entities raising funds for ballot measures. Understanding who is required to file is integral to ensuring compliance with campaign finance laws, which vary by state. This includes mandates for candidates, recipient committees, and even lobbyists involved in expenditure reporting.

Detailed breakdown of the form structure

The structure of the Campaign Spending Commission Received Form is divided into several critical sections designed to capture relevant financial data comprehensively. Each section has specific information that must be correctly filled out to avoid penalties.

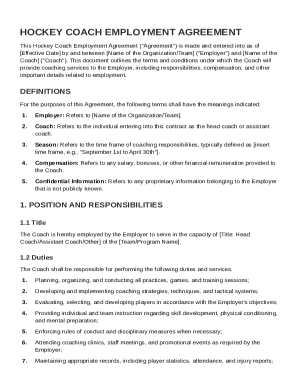

Step-by-step instructions for completing the form

Completing the Campaign Spending Commission Received Form can be straightforward if done systematically. The following steps outline the process for accurate and timely submissions.

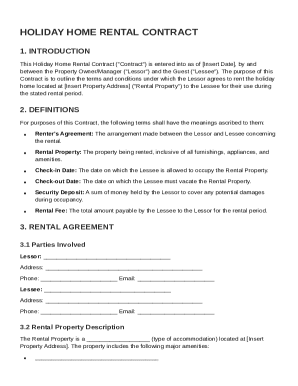

Tools for managing campaign finance documents

Effective management of campaign finance documents is crucial, and using platforms like pdfFiller can enhance your filing process significantly. Within this platform, users can easily create, edit, and share necessary documents, ensuring every form remains up to date.

One standout feature of pdfFiller is its cloud-based documentation solution, which allows users to access and manage their forms from anywhere, at any time. This is particularly beneficial for teams working collaboratively on complex campaign finance documentation.

Common challenges and how to overcome them

Campaign finance can be complex and overwhelming, especially with numerous regulations governing how funds are managed. Many candidates and their committees face challenges navigating these complex legal environments.

Key regulations impact the filing process, outlining precisely what disclosures are required and outlining penalties for non-compliance. It is essential to stay up to date with these laws to avoid complications that could jeopardize the campaign. Resources such as official websites and guidelines from the Fair Political Practices Commission can offer vital information.

FAQs surrounding the Campaign Spending Commission received form

Many candidates have queries regarding the intricacies of the Campaign Spending Commission Received Form. Addressing these common questions can alleviate concerns and guide individuals through the filing process.

Final tips for successfully managing campaign finances

Managing campaign finances effectively is not just about compliance; it is also about establishing best practices that ensure your campaign operates smoothly and transparently. Regular audits and internal oversight mechanisms can help identify areas for improvement in financial reporting.

Leveraging technology, such as the solutions provided by pdfFiller, allows for efficient document management. Tracking changes, maintaining records, and simplifying the filing process are made easier with tailored features. Consider exploring what pdfFiller has to offer, ensuring that you meet all your campaign finance document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get campaign spending commissioni received?

How do I edit campaign spending commissioni received on an iOS device?

How can I fill out campaign spending commissioni received on an iOS device?

What is campaign spending commissioni received?

Who is required to file campaign spending commissioni received?

How to fill out campaign spending commissioni received?

What is the purpose of campaign spending commissioni received?

What information must be reported on campaign spending commissioni received?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.