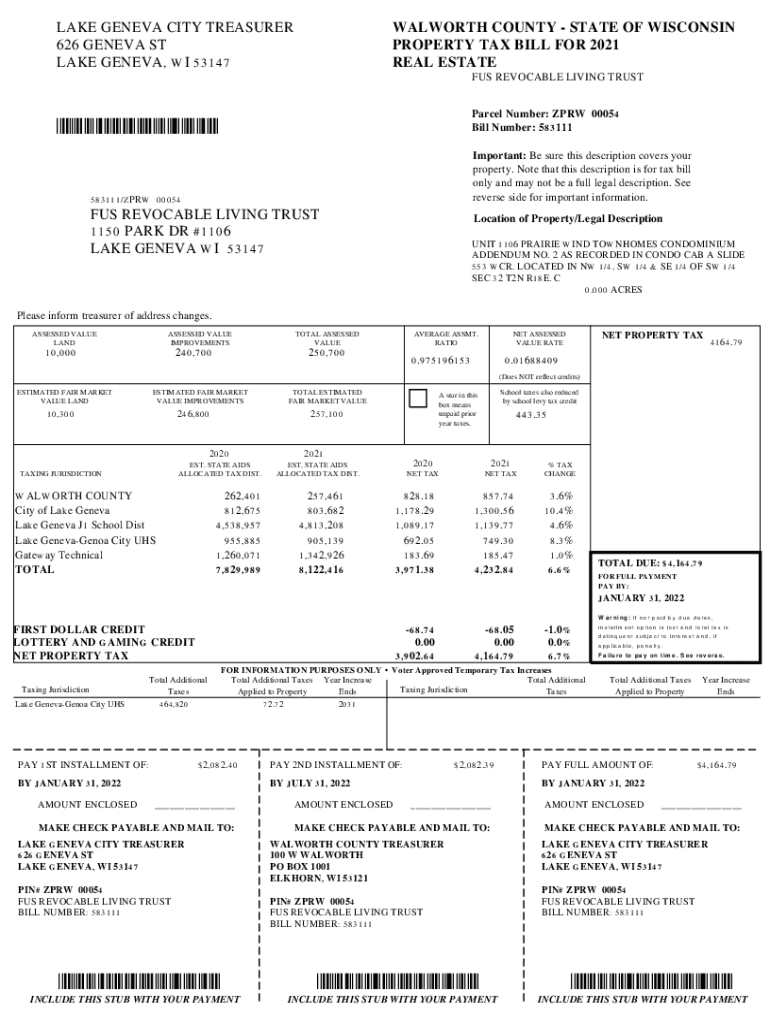

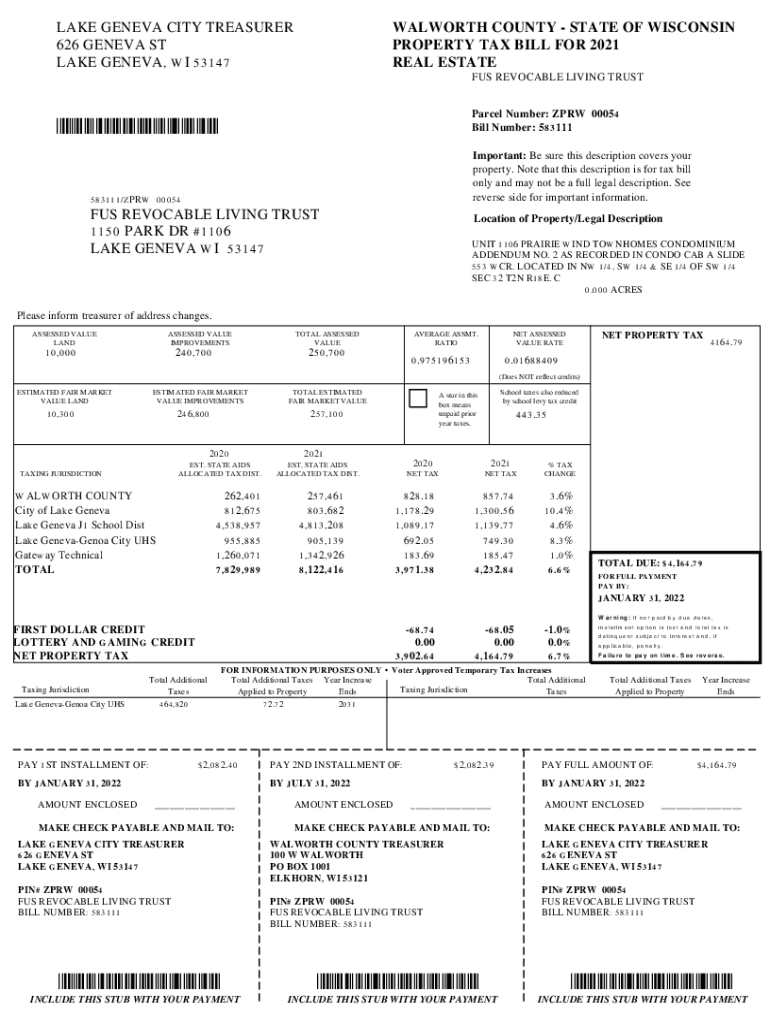

Get the free 2021 Tax Bill, City of Lake Geneva, Parcel ZPRW 00054

Get, Create, Make and Sign 2021 tax bill city

Editing 2021 tax bill city online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 tax bill city

How to fill out 2021 tax bill city

Who needs 2021 tax bill city?

Comprehensive Guide to the 2021 Tax Bill City Form

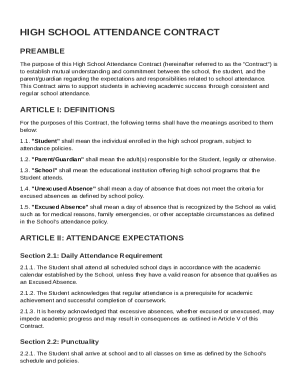

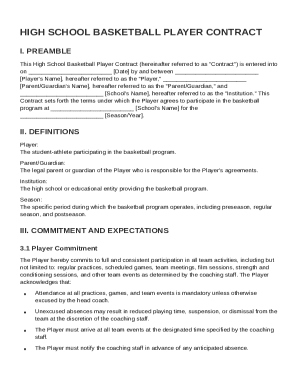

Understanding the 2021 Tax Bill City Form

The 2021 Tax Bill City Form serves a critical role in the local tax filing landscape, helping to determine the tax liabilities of residents within a city jurisdiction. This form is specifically designed for municipal taxation, allowing cities to collect funds necessary for local services such as schools, roads, and emergency services. Understanding its purpose is vital for taxpayers to avoid penalties and ensure compliance with local regulations.

Key deadlines associated with this form are especially important to note. Typically, residents must submit their forms by a specific date in April; however, variations may exist depending on local laws. Timeliness in submission not only aids in securing accurate assessments but also avoids late penalties levied by the city.

Eligibility criteria

Determining whether you need to file the 2021 Tax Bill City Form involves understanding the eligibility criteria. Individual taxpayers who reside within city limits are generally mandated to complete this form. It's also crucial for organizational teams, such as non-profits, to register and file the form to remain compliant with local tax requirements.

There are potential exemptions based on factors such as income level or residency status. For example, certain low-income brackets may qualify for waivers, and age exemptions may apply to seniors. Researching these nuances can alleviate unnecessary tax burdens.

Required information and documentation

Completing the 2021 Tax Bill City Form requires specific personal identification information. Essential details include the taxpayer's full name, current address, and Social Security Number. Accurate information here is critical for processing and ensuring that you receive any applicable refunds.

Additionally, your financial information should outline your income details clearly. This typically includes all sources of income for the tax year, as well as any deductions you may qualify for. Essential documentation may include previous tax returns and any necessary residency proofs, facilitating a smooth filing process.

Step-by-step instructions for completing the 2021 Tax Bill City Form

Completing the form can be intimidating, but breaking it down into manageable sections makes it easier. Begin with the personal information section, inputting your name, address, and Social Security Number accurately. Following this, you will need to report your total income and any deductions or credits you are eligible for. Be diligent about this as it influences your tax liability.

Common pitfalls include misreporting income or neglecting to claim deductions that you qualify for. Double-checking calculations and ensuring all forms of income are reported can mitigate errors. Implementing a checklist of requirements based on the instructions associated with the form can be a valuable way to navigate the process.

Interactive tools and calculators

Utilizing budgeting tools can provide clarity when it comes to estimating tax liabilities. Interactive tax calculators available on the pdfFiller platform can furnish insights on how various factors influence your liabilities, including the nuances of local tax laws. By imputing your financial information, these tools can help quantify your tax obligations.

These calculators also offer exploratory options, allowing you to simulate different scenarios — for instance, how deductions from charitable donations may affect overall tax liability. An informed approach makes handling finances substantially less stressful, particularly during the tax season.

Filing options for the 2021 Tax Bill City Form

Deciding how to file your 2021 Tax Bill City Form can greatly influence your experience. Online submission has become the preferred method, with platforms like pdfFiller streamlining the process. Users can easily navigate the platform to fill out and submit forms without printing or mailing physical copies.

For those who prefer traditional methods, paper filing remains an option. Carefully verify where to send your completed form, which is typically directed to your local tax office. Ensuring timely delivery is paramount, and opting for certified mail can further safeguard against issues with lost documents.

Editing and managing your form

pdfFiller offers robust document management features that allow users to edit their forms as necessary. Should circumstances change — such as amendments or additional incomes — taking advantage of pdfFiller’s editing features simplifies the adjustments. This is especially handy for teams representing organizations that may have multiple contributors.

Collaboration tools are also available, facilitating team submissions. Teams can work together remotely, ensuring compliance and accuracy, which is increasingly valuable in today's work environment where many operate from different locations.

eSigning your 2021 Tax Bill City Form

One of the benefit features of using pdfFiller is the ease of eSigning your 2021 Tax Bill City Form. With just a few clicks, users can digitally sign their documents, making the process faster and more efficient compared to traditional ink signatures.

Step-by-step, initiate your signing by selecting the eSigning option on the platform, inputting the necessary fields, and confirming your signature through secure methods. This process not only ensures your form’s authenticity but also helps in protecting personal information through encryption.

Frequently asked questions (FAQs)

Encountering questions during the process of filing your 2021 Tax Bill City Form is normal. Common inquiries include how to troubleshoot typical issues such as missing information or errors that need correction. Relying on reliable platforms like pdfFiller can provide quick access to support.

Another frequent question revolves around the availability of assistance. Taxpayers may need clarity on where to find help if they encounter complexities beyond their understanding. Utilizing local tax offices or tax assistance hotlines is a great start for getting reliable answers.

Additional support and resources

For those needing additional support while filing the 2021 Tax Bill City Form, accessing local tax offices can be a practical solution. Many municipalities provide resources to assist residents with tax-related inquiries, which can significantly alleviate stress during tax season.

Furthermore, connecting with resources that offer legal tax assistance can also prove beneficial. Many organizations, especially those catering to low-income households, offer free or low-cost assistance. They provide insights into changes in tax laws for the year 2021, ensuring taxpayers stay compliant amidst evolving regulations.

Community and peer support

Engaging with fellow taxpayers can provide additional insights and support when dealing with the 2021 Tax Bill City Form. Various online forums and community groups offer platforms for individuals to share experiences and solutions regarding taxes. Participating in discussions can illuminate strategies others have found helpful.

Social media can also be a useful tool for gathering tips and advice. Following reputable tax advisors or related organizations on platforms like Facebook or Twitter can keep individuals informed about ongoing changes, deadlines, and useful best practices in tax filing.

Compliance and record-keeping

Maintaining adequate records is crucial for meeting tax obligations effectively. Keeping well-organized documentation of submitted forms can assist in the event of audits or discrepancies in tax assessments. Storing files securely with services like pdfFiller ensures that you have everything readily accessible.

To streamline this process, consider utilizing tools specifically designed for tracking tax documents. Most users find that maintaining a dedicated folder for tax-related materials greatly eases organization and retrieval when needed, contributing to long-term compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2021 tax bill city directly from Gmail?

How do I execute 2021 tax bill city online?

How can I edit 2021 tax bill city on a smartphone?

What is 2021 tax bill city?

Who is required to file 2021 tax bill city?

How to fill out 2021 tax bill city?

What is the purpose of 2021 tax bill city?

What information must be reported on 2021 tax bill city?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.