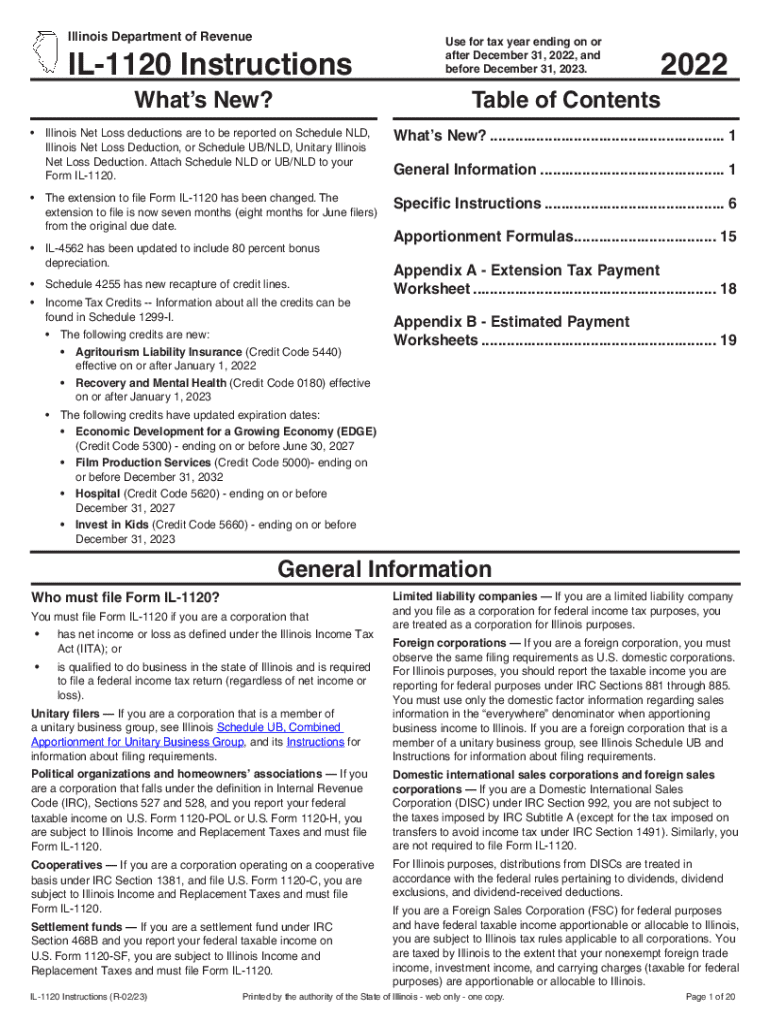

Get the free 2025 IL-1120-ST Instructions - Illinois Department of Revenue

Get, Create, Make and Sign 2025 il-1120-st instructions

How to edit 2025 il-1120-st instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 il-1120-st instructions

How to fill out 2025 il-1120-st instructions

Who needs 2025 il-1120-st instructions?

2025 -1120-ST Instructions Form

Overview of the 2025 -1120-ST form

The 2025 IL-1120-ST form is designed specifically for small business corporations operating in Illinois that wish to report their income and calculate their replacement tax obligations. This form is a vital tool for ensuring compliance with state tax laws, as small business corporations are subject to a unique set of tax regulations known as the Illinois Replacement Tax. Accurate filing is crucial, as it affects not only how much tax is owed but also the overall financial health of the business.

Filing the IL-1120-ST accurately not only protects businesses from penalties and fines but also enhances their credibility with stakeholders, including investors and lenders. Failing to adhere to the instructions could lead to costly mistakes, making it essential for small businesses to understand the requirements thoroughly.

Who needs to file the 2025 -1120-ST?

Not every business in Illinois needs to file the 2025 IL-1120-ST form. Only corporations that meet the criteria for small business corporations as defined by the Illinois Department of Revenue are required to use this form. Small business corporations are generally those with a limited annual revenue threshold, and typically include S corporations, which choose to be taxed under Subchapter S of the Internal Revenue Code.

Examples of organizations that usually need to file this form include local retail shops, service providers, and small manufacturing businesses established as corporations. Understanding this eligibility is critical for ensuring that the appropriate corporate structure is maintained and the correct forms are filed to avoid unintended tax liabilities.

Key dates and filing requirements

Filing the 2025 IL-1120-ST form requires adherence to specific deadlines. For most small corporations in Illinois, the filing deadline is the 15th day of the third month following the end of the tax year. Therefore, for most businesses that operate on a calendar year, the due date for the 2025 form would be March 15, 2026. It’s essential to be aware of these deadlines to avoid penalties.

Filing frequency generally aligns with annual reporting, although depending on the size and type of business, some may need to submit estimated payments quarterly. Late submissions can lead to penalties and interest accrual, which can overwhelm a small business's finances. Thus, maintaining a calendar with important filing dates is advisable.

Preparing to complete the 2025 -1120-ST form

Preparing to complete the 2025 IL-1120-ST form necessitates collecting specific documents and information. Essential documents include financial statements that outline the business’s earnings, expenses, and balance sheets, as well as previous year tax returns. Incorporating data from past filings can facilitate accuracy in the current year’s submission.

Additionally, creating a checklist to gather data can streamline the preparation process. Records such as bank statements, payroll documentation, and receipts for deductible expenses must be organized thoroughly for efficient data entry. This preparation phase minimizes errors during the actual form completion.

Step-by-step instructions for completing the 2025 -1120-ST

Completing the 2025 IL-1120-ST form involves a sequential process that should be approached methodically. Here's a breakdown of each step:

Important calculations and worksheets

Accompanying the IL-1120-ST form are several worksheets designed to assist in accurate calculations. These worksheets simplify the computation of taxable income and replace standard calculations used for unincorporated businesses. It’s advisable to utilize these resources as they provide clear guidelines on deductible expenses and allocation of income.

Using sample data to practice calculations can enhance familiarity with the worksheet processes. Make use of PDF tools to perform calculations efficiently. Software like pdfFiller can streamline these computations, enabling users to maintain accuracy and ensuring compliance with state tax regulations.

Reviewing your -1120-ST form before submission

Before submission, it’s crucial to conduct a thorough review of the completed IL-1120-ST form. This process not only involves checking mathematical calculations for accuracy but also ensuring that all required fields are filled. Items to double-check include company information, income and expense reports, as well as documentation of deductions claimed.

Common mistakes to avoid include misreporting income, skipping required attachments, and overlooking deadlines. Collaboration with team members during the review phase can provide additional perspectives and catch errors that may have been overlooked. Using shared document systems can aid in this collaborative effort, enhancing the accuracy of the final submission.

E-filing options for the 2025 -1120-ST

E-filing provides a modern solution for submitting the 2025 IL-1120-ST form that many businesses find advantageous. Various e-filing systems are available that facilitate direct submission to the Illinois Department of Revenue, significantly reducing paper waste and processing time.

Using e-filing over traditional methods comes with numerous benefits, such as confirmation of receipt and reduction of potential errors encountered in handwritten submissions. pdfFiller offers tools that allow seamless electronic filing of your IL-1120-ST, enhancing the efficiency of the process while ensuring compliance with state requirements.

Managing your 2025 -1120-ST filing

After submitting the 2025 IL-1120-ST form, it’s vital to keep accurate records of the filing. This includes retaining copies of the submitted form, maintaining backup documentation, and noting the submission date. Keeping organized records can help maneuver through any potential queries from the Illinois Department of Revenue.

Using tools such as pdfFiller can further simplify the management of tax documents, enabling ongoing editing, signing, and e-filing capabilities. Maintaining organized files enhances operational efficiency and reduces time spent on future filings.

After submission: what to expect

Following the filing of the IL-1120-ST form, businesses should prepare for the processing phase. Typically, the Illinois Department of Revenue processes forms relatively quickly, though timelines can vary based on the submission method and any potential issues with the form.

It’s essential to be attentive to any follow-up communication from the department, particularly if there are questions regarding the submission. Being proactive can minimize the chances of adjustments or audits, which could disrupt business operations. Keeping informed about any updates regarding tax regulations is also beneficial for future compliance.

Frequently asked questions (FAQ) about the -1120-ST form

Many small business owners have similar questions regarding the IL-1120-ST form, especially concerning penalties for late filings, the specifics of deductible expenses, and the consequences of errors. Addressing common concerns can help businesses navigate the process more effectively.

For instance, it’s wise to clarify that there is typically a grace period for those who can prove an effort was made to file on time. Additionally, specific guidelines about what constitutes deductible expenses in Illinois can save businesses money if adhered to correctly. Engaging with tax professionals can provide expert insights into best practices for filing the IL-1120-ST form and avoiding common pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025 il-1120-st instructions directly from Gmail?

How do I make edits in 2025 il-1120-st instructions without leaving Chrome?

How do I edit 2025 il-1120-st instructions straight from my smartphone?

What is 2025 il-1120-st instructions?

Who is required to file 2025 il-1120-st instructions?

How to fill out 2025 il-1120-st instructions?

What is the purpose of 2025 il-1120-st instructions?

What information must be reported on 2025 il-1120-st instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.