Get the free Timber Land Appraisal Tax Year

Get, Create, Make and Sign timber land appraisal tax

How to edit timber land appraisal tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out timber land appraisal tax

How to fill out timber land appraisal tax

Who needs timber land appraisal tax?

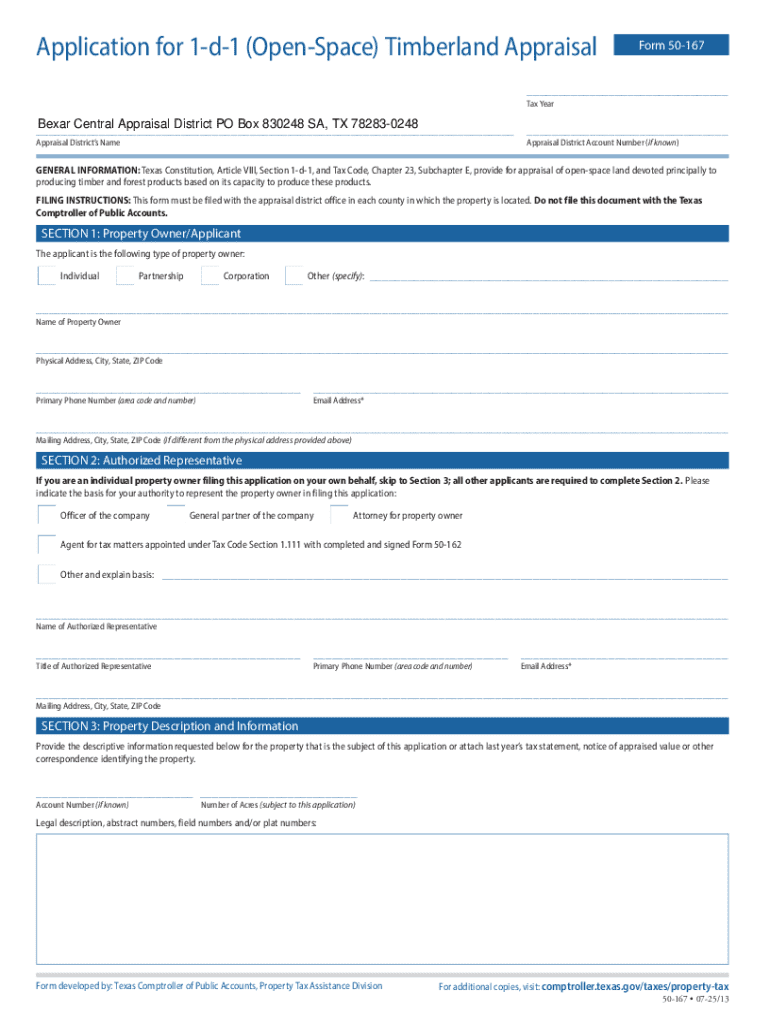

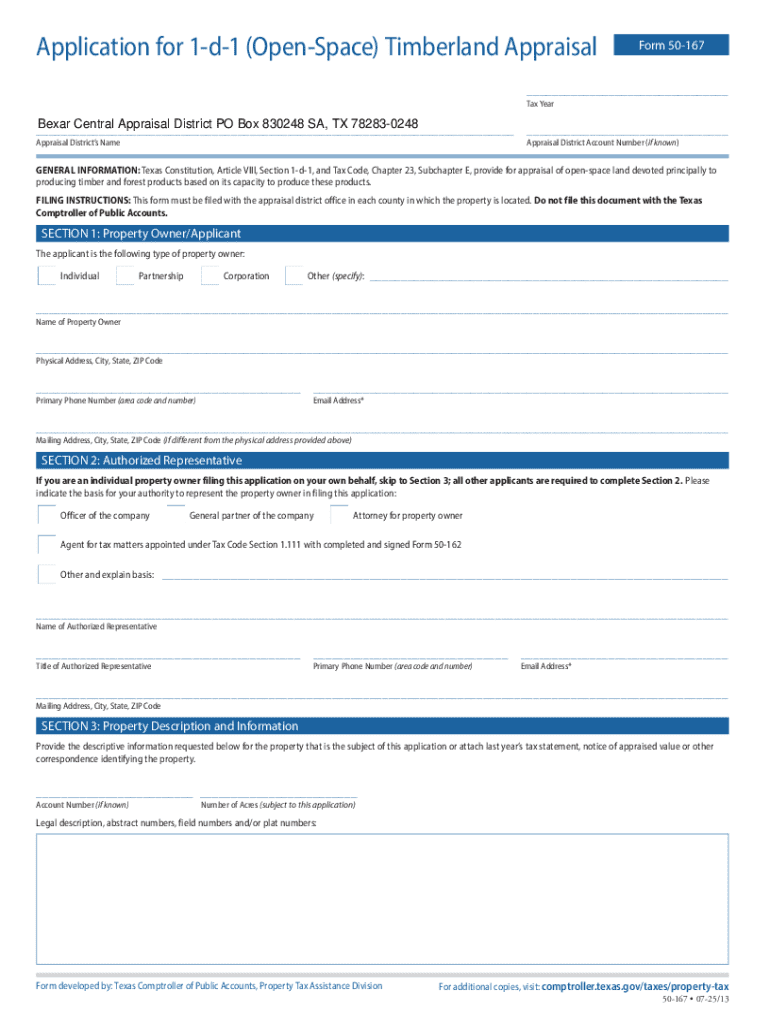

Understanding the Timber Land Appraisal Tax Form

Understanding timber land appraisal

Timber land appraisal is a specialized assessment of forested property to determine its value primarily for taxation purposes. This process plays a crucial role in ensuring that timberland owners are fairly taxed based on the actual worth of their property. Unlike ordinary land appraisals, timberland assessments must consider not only the land but also the timber resources, which can significantly influence the overall valuation.

The significance of timber land appraisal extends beyond mere property taxes. For property owners, understanding the appraisal ensures they are not overtaxed and allows them to plan for sustainable timber management. Meanwhile, tax authorities utilize these appraisals to ensure equitable tax distribution and to manage forest resources effectively.

Importance of the timber land appraisal tax form

The timber land appraisal tax form serves as a critical document for forestland owners seeking a fair assessment related to their property. This form captures vital information, allowing for an accurate assessment of timberland value. Understanding when and how to use this form can significantly impact tax obligations. Property owners should file this form during the annual tax assessment cycle or when there are changes in timber resources.

Failing to submit the timber land appraisal tax form can lead to severe consequences, including penalties or inaccurate property valuation. Inaccurate assessments can burden property owners with higher taxes than warranted, making it essential to understand the implications thoroughly.

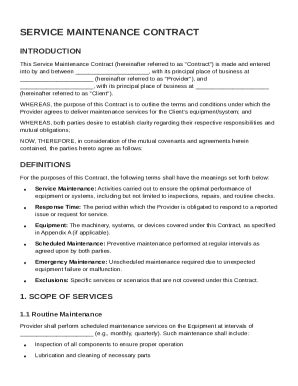

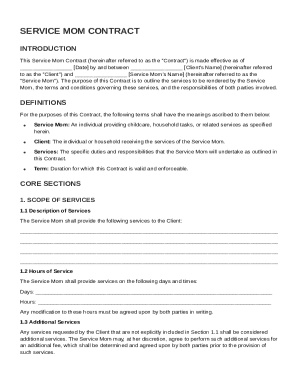

Key components of the timber land appraisal tax form

Completion of the timber land appraisal tax form requires specific information that contributes to a comprehensive appraisal of the land and timber value. Key required details include a thorough property description, owner information, and specifics about the timber itself such as species, quantity, and estimated volume.

In addition to the information in the form, it’s important to attach supporting documentation, including past tax returns and timber management plans. Valuation techniques are also critical to comprehend; common approaches include the market value method, which bases worth on recent sales of similar properties, and the income approach, where potential income generated from timber sales over time is taken into account.

Step-by-step guide to completing the timber land appraisal tax form

A detailed approach to completing the timber land appraisal tax form begins with gathering all necessary information. Property owners should prepare documentation such as ownership titles, maps indicating property boundaries, and previous assessments. Ensuring all information is up-to-date and accurate is crucial to facilitate a smooth appraisal process.

When filling out the form, care must be taken to accurately complete each section, particularly any numerical values or timber estimates. A useful tip is to review the form thoroughly after filling it out, ensuring all fields are complete and that any errors are corrected before submission.

Filing the timber land appraisal tax form

Filing the timber land appraisal tax form must be done correctly to avoid delays or complications. Property owners can choose various submission options including online submission through tax authority websites, mailing a physical form, or submitting it in person at local tax offices. Each method has its own set of requirements, so understanding the guidelines for each is vital.

Key deadlines for submission often coincide with annual tax cycles, making it imperative for owners to familiarize themselves with these dates to avoid late penalties. After submitting the form, owners should verify its receipt, either through confirmation emails for online submissions or return receipts for mailed forms, ensuring that their request has been logged.

Common issues and pitfalls in timber land appraisal

Common challenges faced during timber land appraisal may stem from misunderstood requirements or complicated valuation methods that are not easily comprehensible. Landowners must be aware of the intricacies of local tax laws and the specific details required on the appraisal tax form. This knowledge helps alleviate potential pitfalls and ensures a smooth appraisal process.

To avoid common mistakes, property owners should consult with professionals when in doubt, review forms before submission, and keep accurate records of all communications with tax authorities. If issues arise post-submission, such as receiving notices or requests for additional information, timely response is essential to resolve any disputes quickly.

Interactive tools and resources

To assist property owners in estimating the value of their timberland, several online calculators are available. These tools can provide quick assessments based on various valuation strategies, allowing users to input their data and receive an estimate promptly.

Additionally, users on pdfFiller can take advantage of document management features. This platform allows individuals to edit, sign, and store their tax forms securely in the cloud. Specific features such as electronic signatures simplify the process of submitting the timber land appraisal tax form, enhancing efficiency.

Collaboration and assistance

Engaging professionals like tax advisors or certified appraisers can be beneficial at various stages of the timber appraisal process. These experts can provide valuable insights, inform owners of the latest tax laws, and ensure compliance while optimizing tax obligations.

FAQs surrounding timber land appraisal often address common concerns such as filing deadlines, information requirements, and how to handle potential disputes over property valuations. Participating in community forums or local groups can uncover shared experiences from other timberland owners, offering strategies to enhance the filing process.

Updates and changes in timber land appraisal regulations

Timber land appraisal regulations are subject to change, influenced by local policies and broader legislative actions. Recent updates may include adjustments to tax rates or alterations in what constitutes a qualifying timberland parcel for reduced rates. Awareness of these changes is critical for property owners to ensure compliance and avoid unnecessary tax burdens.

The impact on property owners can vary, with some potentially benefiting from reductions while others may face increases. Staying informed about regional regulations ensures that timberland owners can make proactive decisions regarding their property and taxation effectively.

Conclusion and next steps

In summary, the timber land appraisal tax form is a crucial component for forestland owners, providing a structured approach to accurately assessing property value. Knowledge of the filing process, requirements, and potential pitfalls can significantly ease the concerns associated with property taxation.

For further guidance, property owners can reach out to local tax authorities or explore additional resources available on pdfFiller for document management. By leveraging professional expertise and online tools, timberland owners can navigate their appraisal process effectively, ensuring their interests are protected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my timber land appraisal tax directly from Gmail?

How can I send timber land appraisal tax for eSignature?

How do I fill out the timber land appraisal tax form on my smartphone?

What is timber land appraisal tax?

Who is required to file timber land appraisal tax?

How to fill out timber land appraisal tax?

What is the purpose of timber land appraisal tax?

What information must be reported on timber land appraisal tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.