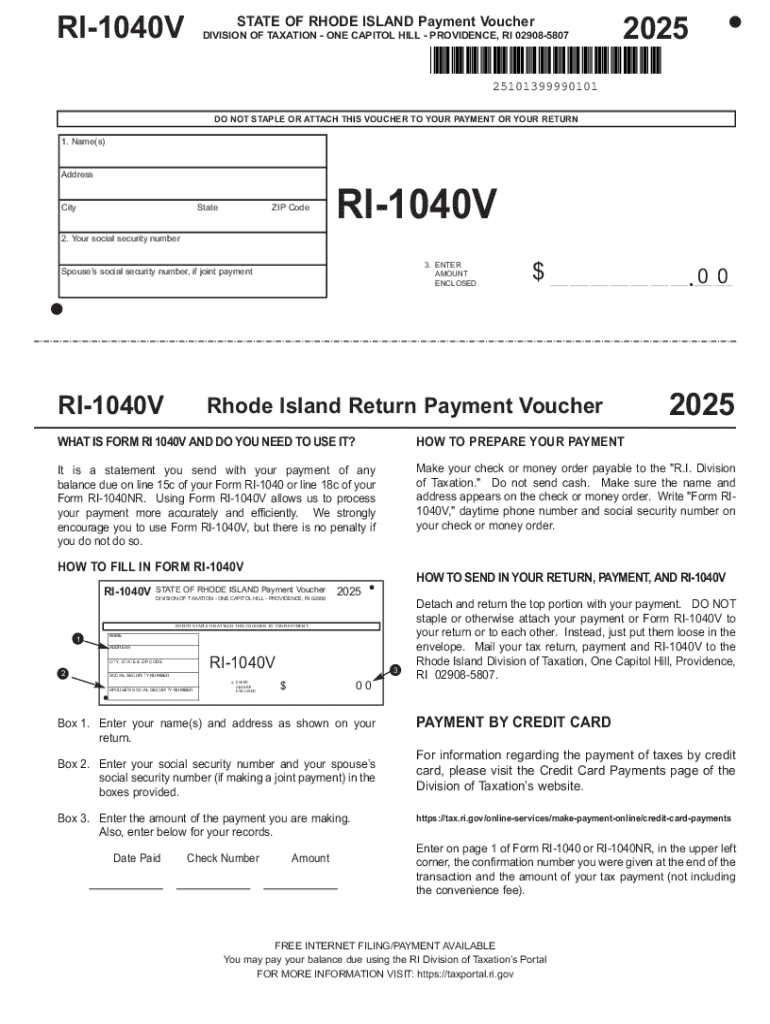

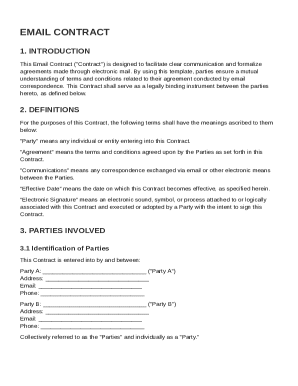

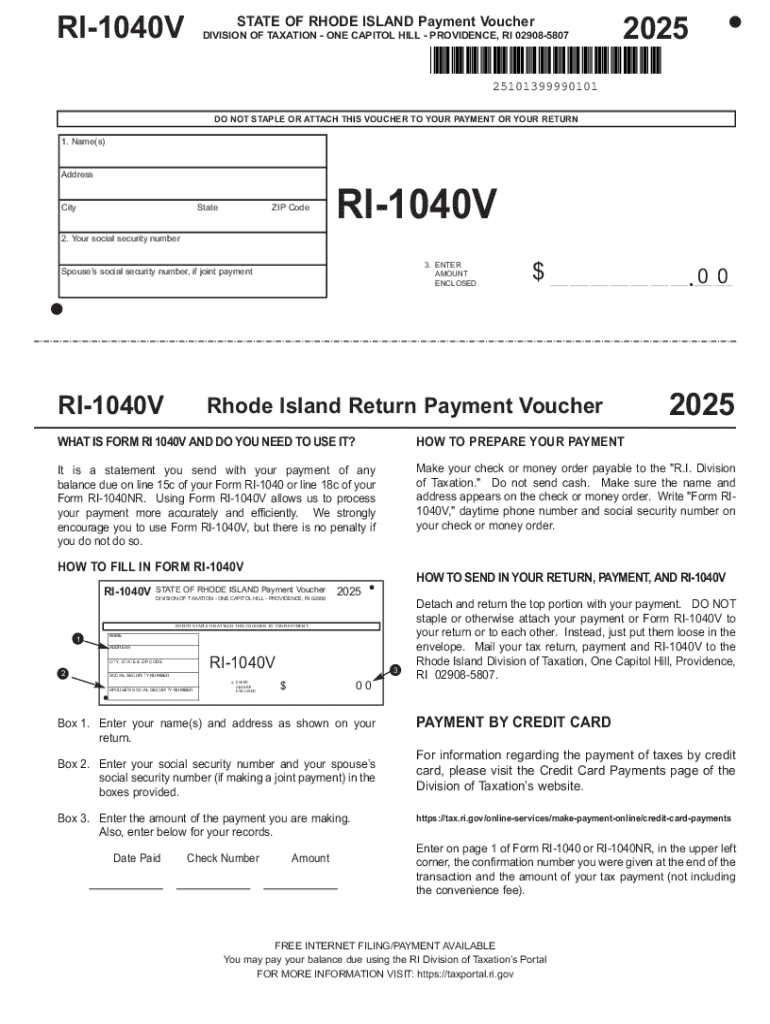

Get the free DO NOT STAPLE OR ATTACH THIS VOUCHER TO YOUR PAYMENT OR YOUR RETURN - tax ri

Get, Create, Make and Sign do not staple or

How to edit do not staple or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out do not staple or

How to fill out do not staple or

Who needs do not staple or?

Do not staple or form: A how-to guide for effective document handling

Understanding the importance of document handling

Proper document management is crucial in various contexts, especially when dealing with sensitive forms such as tax documents, legal submissions, and financial records. The instruction 'do not staple or form' is not merely a suggestion but a directive rooted in the necessity of maintaining document integrity and ensuring compliance with regulations.

When to use 'do not staple' instructions

'Do not staple' instructions apply to specific types of documents that may be processed electronically or require certain formatting. Commonly, tax forms, like the Georgia tax filings, and legal documents must remain flat and unfolded to ensure they can be scanned accurately without missing data or causing misalignments.

Another scenario where stapling is prohibited is during online submissions through digital platforms. Many organizations, including government agencies, prefer separate file uploads to maintain organization and searchability in their email systems.

Steps to properly prepare documents without staples

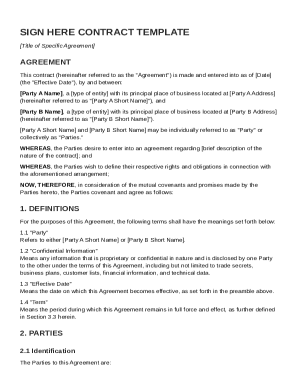

Preparing documents without staples involves several steps to ensure format compliance and efficient submission. First, choose the appropriate document format. PDFs are recommended over paper due to their consistent presentation across devices, which is especially beneficial for professionals working in teams.

Utilizing tools like pdfFiller can significantly aid in this process. Start by uploading your document into the platform, where you can easily edit it without worrying about physical staples damaging its structure.

Subsequently, insert fields for signatures or initials as necessary. It is a seamless process that enhances your document's interactivity without traditional fastening methods. Once edits are complete, download your document in PDF format or send it directly through the platform’s sharing options.

Interactive tools to enhance document management

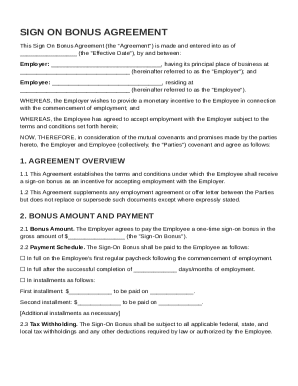

In today’s document processing environment, interactive tools are pivotal. eSignature integrations allow users to sign documents electronically, eliminating the need for printouts and stapling altogether.

Moreover, with tracking features in pdfFiller, you can revisit document changes and comments from the original upload. This not only facilitates better teamwork but also ensures that all edits have been accounted for and are in compliance with the necessary guidelines.

Detailed instructions for specific forms

When it comes to commonly used forms—especially tax forms—it’s crucial to follow a step-by-step approach.

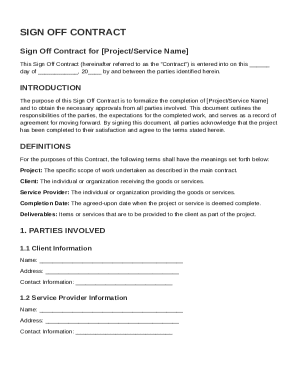

For business forms, including employment contracts, similar guidelines can be applied. Each document should be formatted and edited according to company standards but always sent without staples to ensure they are processed efficiently by human resource departments or state compliance offices.

Best practices for managing documents effectively

Effective document management requires organization and compliance. Start by organizing files in a digital workspace. Using folders for specific projects or categories, along with tagging for enhanced searchability, can simplify navigation.

It's also vital to ensure compliance with state regulations, especially in jurisdictions like Georgia, where document submission rules can vary significantly. Protecting sensitive information and understanding the legal implications of document handling is essential to avoid penalties and complications.

Troubleshooting common document submission issues

Even with meticulous preparation, issues can arise during document submissions. If your document is not accepted, double-check if it complies with the required guidelines, particularly the 'do not staple or form' instruction.

Frequently asked questions often highlight misunderstandings about why forms are returned due to staples. Clear communication of guidelines before submission can significantly reduce resubmissions and lead to improved acceptance rates.

Insights from document management experts

Understanding the common pitfalls of document submission is essential. Insights from professionals in the field show that many errors stem from improper fastening methods, including stapling. Experts suggest actively educating users on submission protocols to minimize these issues.

User testimonials showcase that adapting to a staple-free submission method enhances overall efficiency and accuracy in the document management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find do not staple or?

Can I sign the do not staple or electronically in Chrome?

Can I create an eSignature for the do not staple or in Gmail?

What is do not staple or?

Who is required to file do not staple or?

How to fill out do not staple or?

What is the purpose of do not staple or?

What information must be reported on do not staple or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.