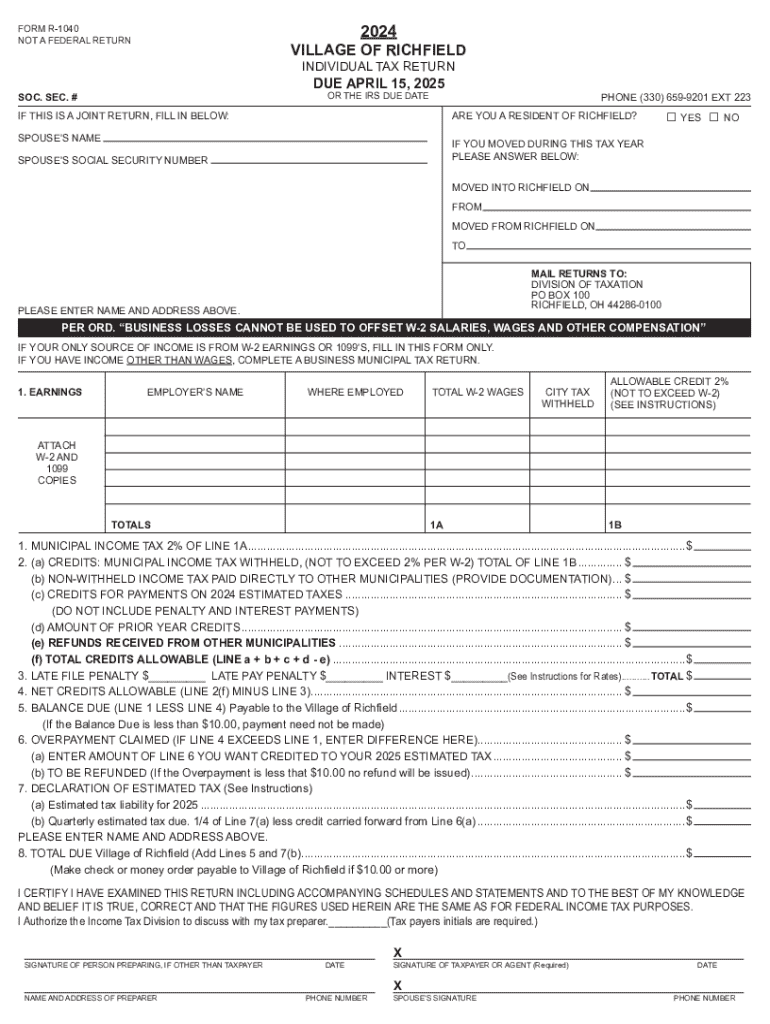

Get the free Downloadable Tax DocumentsRichfield, OH

Get, Create, Make and Sign downloadable tax documentsrichfield oh

Editing downloadable tax documentsrichfield oh online

Uncompromising security for your PDF editing and eSignature needs

How to fill out downloadable tax documentsrichfield oh

How to fill out downloadable tax documentsrichfield oh

Who needs downloadable tax documentsrichfield oh?

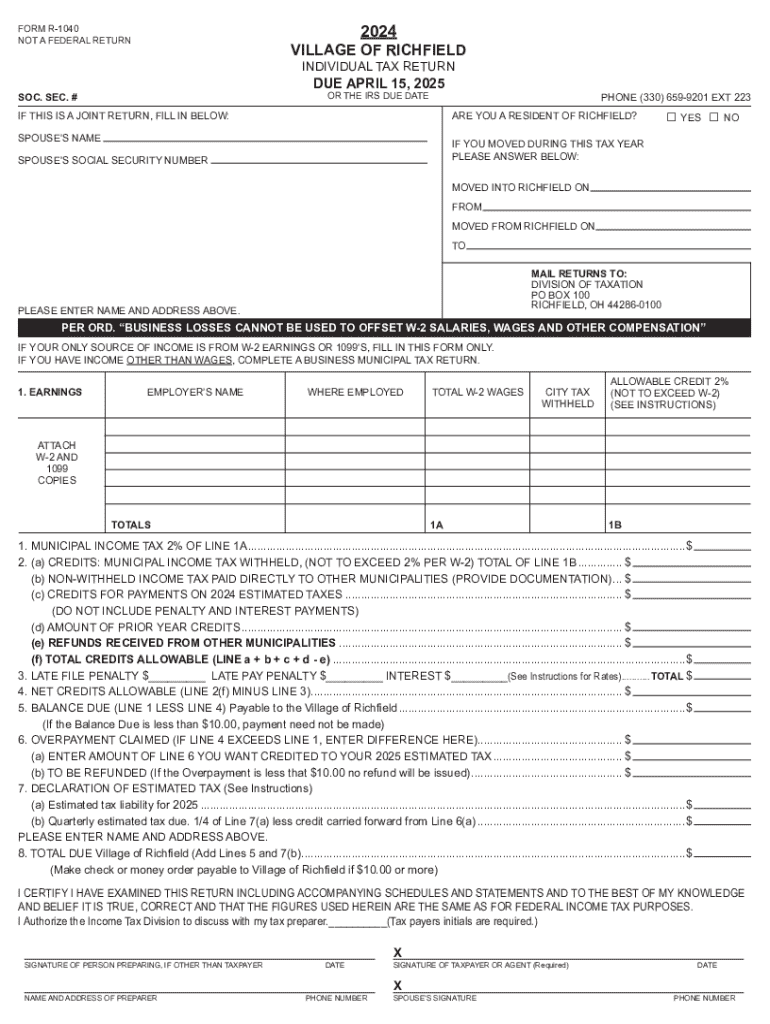

Comprehensive Guide to Downloadable Tax Documents in Richfield, OH

Understanding tax documents and their importance

Tax documents are essential for personal and business finance management. They serve as proof of income, deductions, and overall financial activities for a specific tax year. In Richfield, OH, recognizing the significance of these documents can prevent complications during tax season and potentially maximize your refund status.

Proper documentation ensures compliance with local and federal tax regulations, reaffirming the necessity of accurate and timely filings. The consequences of neglecting tax documentation can lead to unwanted audits, penalties, or loss of credits. Thus, staying organized and informed can significantly ease the tax-filing process.

Downloading tax documents in Richfield, OH

Locating and downloading tax documents in Richfield is a straightforward process. The first step is to visit relevant governmental websites, which serve as official repositories for tax forms. The City of Richfield's municipality pages, as well as the Ohio Department of Taxation and the IRS websites, offer a comprehensive selection of forms accessible at no cost.

These platforms allow residents to filter forms based on their requirements, such as individual or business tax filings. Users should be aware that tax forms may differ based on local ordinances. Therefore, checking for updates and changes regularly is crucial.

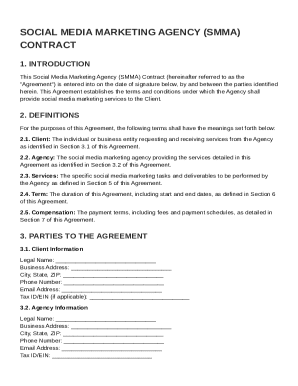

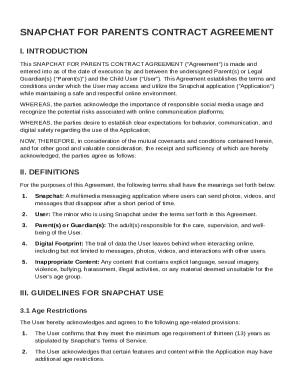

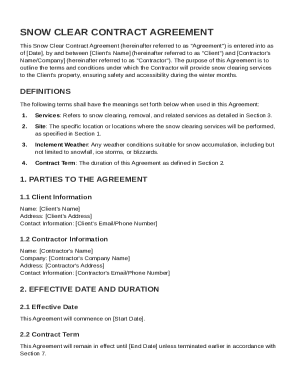

Using pdfFiller for tax document management

pdfFiller offers a robust solution for managing your downloadable tax documents in Richfield, OH. With its cloud-based access, users can edit, store, and retrieve their tax forms from anywhere, promoting flexibility and efficiency. Beyond simply downloading and printing, pdfFiller allows for easy collaboration and sharing of documents.

The platform’s features include the ability to fill out forms digitally, ensure secure eSignature, and organize all your tax documentation in a central location. These functionalities not only enhance productivity but also safeguard personal data, making tax management a more streamlined process.

Filling out your tax documents like a pro

Completing tax forms accurately is crucial to facilitate smoother processing by the IRS and local tax authorities. To avoid common pitfalls, it’s essential to read instructions closely. Mistakes made while reporting income, claiming deductions, or miscalculating withholding taxes can result in delays or audits.

Attention to detail when filling out key sections, like amounts and personal identification information, is vital. Knowing which credits you qualify for, understanding tax rates, and adhering to deadlines will ensure that you maximize your potential refunds.

Collaborating and sharing tax documents

Collaboration is a key aspect of tax preparation, whether you're working within a team or with a tax adviser. pdfFiller’s collaboration tools allow you to share tax documents seamlessly, while maintaining control over who can view and edit your files. Setting appropriate permissions is essential to safeguarding sensitive information while promoting necessary interactions.

With pdfFiller, you can invite team members to view payment history or collaborate on various forms. You can also track changes made, giving you peace of mind that all inputs are accounted for and documented.

eSigning your tax documents securely

The importance of using eSignatures cannot be overstated when it comes to tax documentation. Electronic signatures provide a legally binding method to sign documents and help streamline the filing process. Ensuring compliance with eSignature laws protects you and guarantees that your forms are recognized by tax authorities.

Using pdfFiller, the steps for eSigning are simple. After filling out your tax forms, you can initiate the eSigning process with just a click. This feature not only speeds up the filing of your documents but also saves physical resources and maintains security.

Managing your tax documents for future reference

Proper management of tax documents not only helps during tax time but also ensures you maintain an organized approach for future reference. Storing forms in an easily accessible manner prevents loss and provides clarity on your financial situation over multiple years. pdfFiller allows you to organize filed forms systematically, leveraging search features for quick retrieval.

Best practices include classifying documents by year, type, or tax category, which ensures you'll easily locate any document when required. This organization can significantly reduce stress during tax season and help track historical records of net profit and withholding taxes.

FAQs about downloadable tax documents in Richfield, OH

Residents often have questions regarding tax documentation, such as the types of forms needed, eligibility for specific credits, and accessing local ordinances. Here are some frequently asked questions to guide you through the tax season.

Additionally, local news updates on ordinances and tax rate changes can enhance your preparations, giving you the latest information required for accurate filling out of forms. Understanding your rights as a taxpayer can enhance your overall experience.

Final thoughts on efficient tax document management

Achieving efficient tax document management is about staying organized, aware, and prepared. Utilizing platforms like pdfFiller enables residents and businesses within Richfield, OH to handle their tax documents effortlessly. From downloading forms to collaborating with advisors, the entire process can run much smoother than traditional methods.

Encouraging proactive management of tax documents empowers individuals to navigate the complexities of taxes efficiently. As tax laws continue to evolve, being well-equipped with the right tools can lead to greater compliance and potential savings, keeping your financial future secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send downloadable tax documentsrichfield oh for eSignature?

How do I complete downloadable tax documentsrichfield oh online?

How do I edit downloadable tax documentsrichfield oh in Chrome?

What is downloadable tax documentsrichfield oh?

Who is required to file downloadable tax documentsrichfield oh?

How to fill out downloadable tax documentsrichfield oh?

What is the purpose of downloadable tax documentsrichfield oh?

What information must be reported on downloadable tax documentsrichfield oh?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.