Get the free 2024-INDIVIDUAL-TAX-RETURN.pdf - Village of Middlefield, Ohio

Get, Create, Make and Sign 2024-individual-tax-returnpdf - village of

How to edit 2024-individual-tax-returnpdf - village of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024-individual-tax-returnpdf - village of

How to fill out 2024-individual-tax-returnpdf - village of

Who needs 2024-individual-tax-returnpdf - village of?

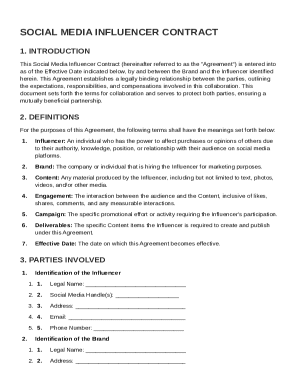

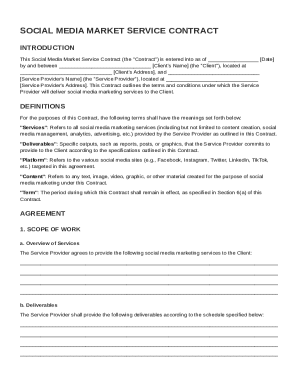

2024 Individual Tax Return PDF - Village of Form

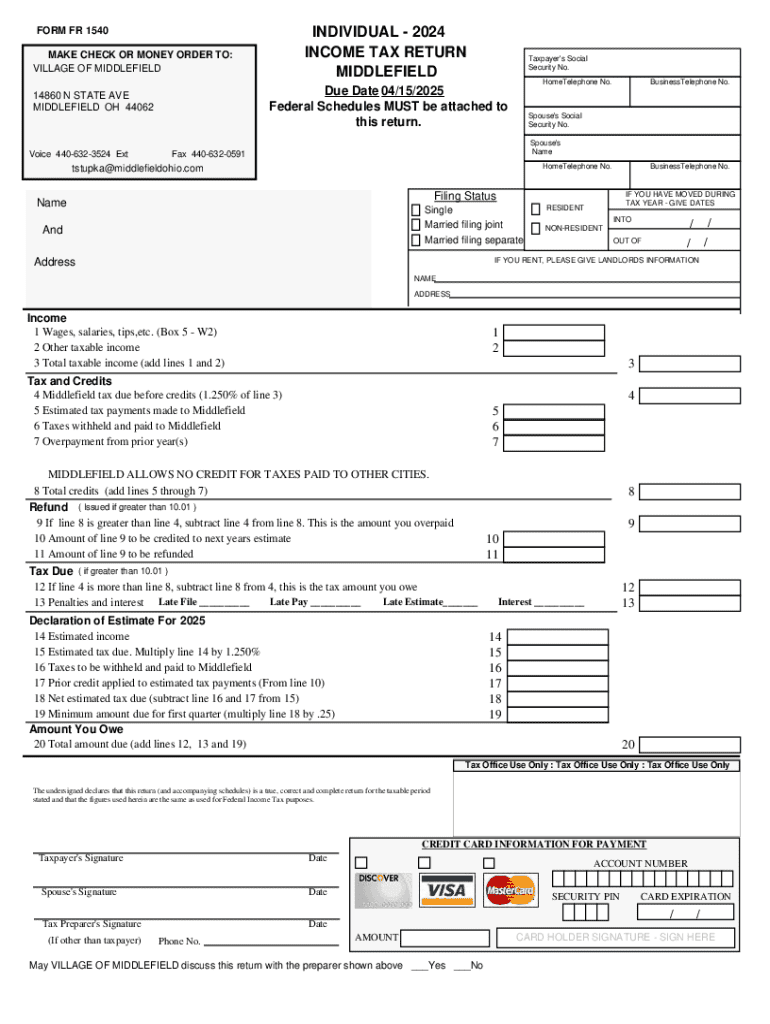

Overview of the 2024 Individual Tax Return PDF

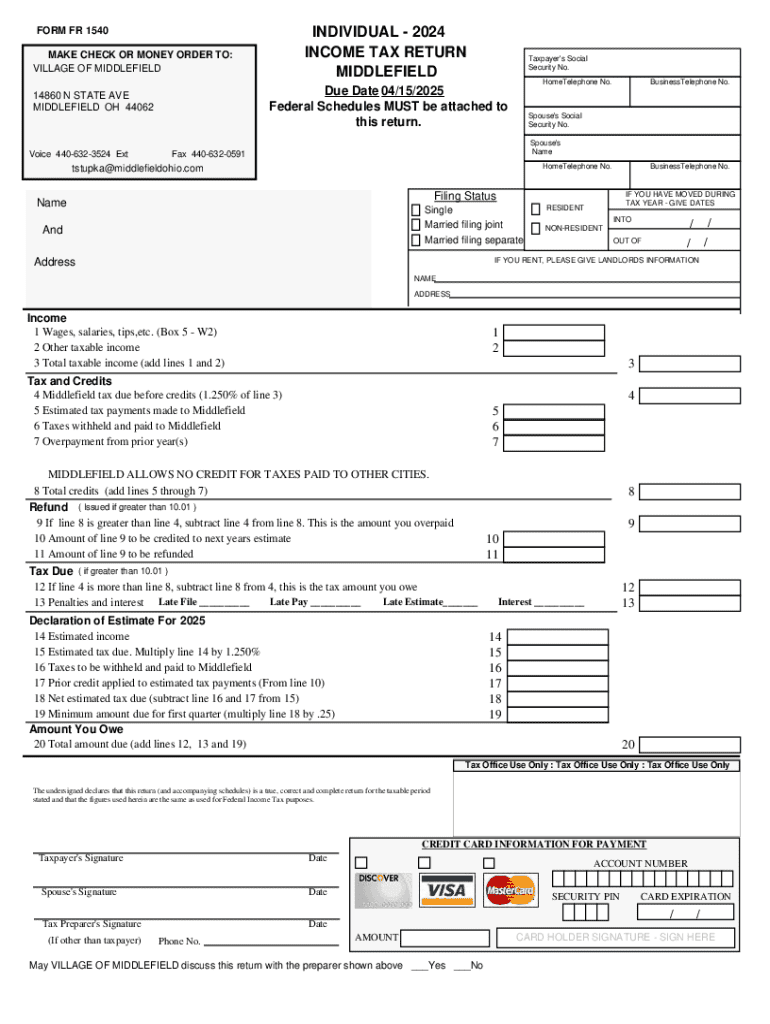

The 2024 Individual Tax Return PDF is a critical document used by residents of the Village of Form to report their earnings and calculate their tax responsibilities for the year. This standardized form not only helps in complying with federal tax regulations but also allows individuals to claim any deductions and credits for which they may be eligible.

Anyone who earned an income in 2024 is generally required to file this tax return. This includes salaried employees, freelancers, and anyone who may have received income from side businesses or investments. Understanding the filing requirements is essential to avoid penalties.

Key deadlines for filing the tax return typically include April 15, 2025, unless special provisions are made. Extensions can be filed, but it is crucial to know that any taxes owed are still due by the original deadline.

Getting started with your 2024 Individual Tax Return

Before diving into filling out the 2024 Individual Tax Return PDF, it’s essential to gather all the necessary documents. Key documents include various forms that report your income, such as the W-2 forms from employers and 1099 forms for freelance or contract work.

It's also important to assess your tax filing status. There are several categories, including Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Your status can impact your tax rates and eligibility for various deductions or credits.

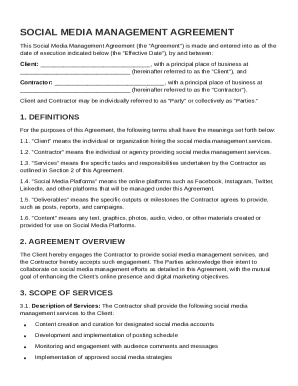

Navigating the 2024 Individual Tax Return PDF

Accessing the 2024 Individual Tax Return PDF can be easily done through the pdfFiller platform. Users can download the document for completion on various devices, whether it be a computer, tablet, or smartphone, optimizing for user convenience.

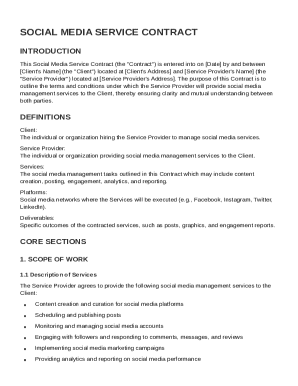

Understanding the layout of the form is crucial. The form is typically divided into sections that include personal information, income reporting, deductions, and tax calculations. Each section plays a vital role in accurately assessing your tax liability and ensuring compliance.

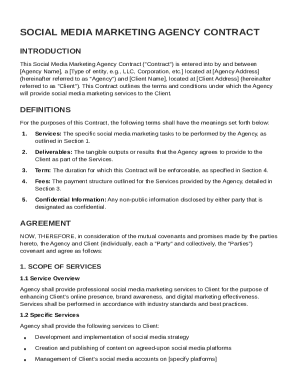

Step-by-step guidelines for completing your tax return

When filling out your 2024 Individual Tax Return PDF, start by entering your personal information meticulously—this ensures no delays or rejections due to misinformation. Make sure to double-check your name, address, and Social Security Number before proceeding.

Next, you must report your income accurately. Report all relevant sources of income, starting with your earned income from your W-2 forms. Don’t forget to include any 1099 forms or additional income sources, such as rental income or dividends, to ensure a comprehensive account.

The deductions and credits section can potentially reduce your tax liability significantly. Familiarize yourself with common deductions such as mortgage interest or student loan interest, along with credits potentially applicable, like the Earned Income Tax Credit. Calculating your obligations accurately is essential, and using tax tables or calculators can provide clarity on owed taxes.

Before submission, review common mistakes such as omission of income or misreporting deductions. Taking your time in this phase can save you from costly penalties in the future. Double-checking your calculations can greatly improve the accuracy of your filing.

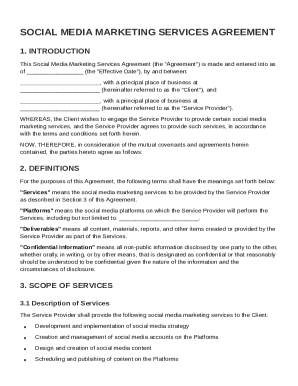

Editing and signing your tax return

Once you have filled in the details, pdfFiller offers intuitive tools to edit your PDF easily. You can modify text, add notes, or make corrections directly on the document before finalizing it. This feature is especially useful to ensure everything is accurate without needing to start over.

Electronic signatures are a game changer when finalizing your 2024 Individual Tax Return PDF. Using pdfFiller’s signing feature allows you to sign documents securely and instantly. This not only expedites the filing process but also offers a record of your consent.

For teams working collectively, pdfFiller provides collaborative capabilities. Team members can share documents, make comments in real-time, and ensure everyone is aligned to submit a complete and accurate tax return together.

Managing your completed tax return

After completing your 2024 Individual Tax Return PDF, managing the document correctly is key. A best practice is to save your PDF in multiple secure locations, such as cloud storage and local disks, ensuring you have access if needed for future reference. Setting calendar reminders for filing and payment deadlines can prevent accidental late penalties.

When submitting your tax return, you have options: e-filing or mailing. E-filing is generally faster and can provide immediate acknowledgment of receipt, whereas mailing may require a longer processing time. Tracking your submission and obtaining confirmation receipts are critical steps to ensure your documents were received.

Common questions and troubleshooting

Users often have several questions regarding the 2024 Individual Tax Return process. It's encouraged to consult resources provided by the IRS or state tax authority for clarity on complex tax issues. Common uncertainties include eligibility for deductions or understanding filing statuses.

If you face hurdles, turning to faq sections, official tax guides, or community forums can provide insight. Assistance groups and licensed tax professionals are also invaluable resources when handling complex returns.

Additional tools and resources via pdfFiller

pdfFiller isn’t just for the 2024 Individual Tax Return; it offers access to various tax-related forms and resources. Users can find other relevant forms that may intersect with their filing needs, ensuring all necessary documentation is available.

Interactive calculators available on the pdfFiller platform can assist in planning finances, helping users understand potential tax implications and when to maximize deductions. Using templates helps facilitate a more straightforward experience when completing various tax forms, further streamlining the process.

Related links for further exploration

For users looking to delve deeper into their tax return preparations, pdfFiller provides links to state-specific tax instructions that can greatly aid in compliance. Many resources directly connect to reliable tax filing software recommendations that can complement your filing method.

Staying informed on current tax law changes is also essential, as this knowledge can directly impact tax returns. Engaging with informative articles available can enhance understanding and better preparation for future filings.

Connecting with pdfFiller

For any document-related inquiries, connecting with pdfFiller's support team is straightforward. Expert assistance is available for navigating the platform or resolving any issues while managing your forms. Providing feedback and suggestions helps pdfFiller continue improving their services, ensuring a seamless experience for all users.

Leveraging pdfFiller’s features transforms how individuals and teams handle their tax forms, ultimately leading to an optimized and simpler filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024-individual-tax-returnpdf - village of without leaving Google Drive?

Can I sign the 2024-individual-tax-returnpdf - village of electronically in Chrome?

Can I edit 2024-individual-tax-returnpdf - village of on an Android device?

What is 2024-individual-tax-returnpdf - village of?

Who is required to file 2024-individual-tax-returnpdf - village of?

How to fill out 2024-individual-tax-returnpdf - village of?

What is the purpose of 2024-individual-tax-returnpdf - village of?

What information must be reported on 2024-individual-tax-returnpdf - village of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.