Get the free 17 CFR Part 23 -- Swap Dealers and Major ...

Get, Create, Make and Sign 17 cfr part 23

Editing 17 cfr part 23 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 17 cfr part 23

How to fill out 17 cfr part 23

Who needs 17 cfr part 23?

17 CFR Part 23 Form: A Comprehensive How-to Guide

Overview of 17 CFR Part 23 Form

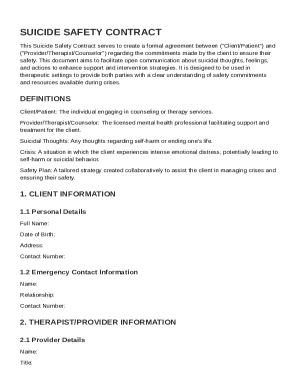

The 17 CFR Part 23 form is a crucial document for compliance in the derivatives market, specifically pertaining to the regulations set forth by the Commodity Futures Trading Commission (CFTC). This form is designed to facilitate the registration process for swap dealers and major swap participants. Its primary purpose is to ensure these entities adhere to regulatory standards aimed at promoting transparency, reducing systemic risk, and protecting market integrity.

Key regulations outlined in 17 CFR Part 23 include requirements for risk management, reporting, and compliance related to swaps. Understanding these requirements is not only essential for legal compliance but is also vital for maintaining a robust operational framework in the derivatives sector. Individuals and teams involved must comprehend the intricacies of this form and its implications on their business practices.

Understanding the regulatory framework

17 CFR Part 23 exists under the broader context of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which introduced significant reforms in financial markets. This part specifically addresses swap regulation, aiming to govern the activities of swap dealers and participants. The CFTC establishes these regulations to ensure equitable trading practices and reduce systemic risks associated with derivatives.

Recent Federal Register releases further elaborate on the shifting compliance landscape, detailing adjustments to registration thresholds and application processes necessary for cross-border activities. Understanding these updates is vital for entities participating in international markets, as it informs their compliance strategy, especially in the context of margin requirements and order processing.

Navigating the 17 CFR Part 23 Form

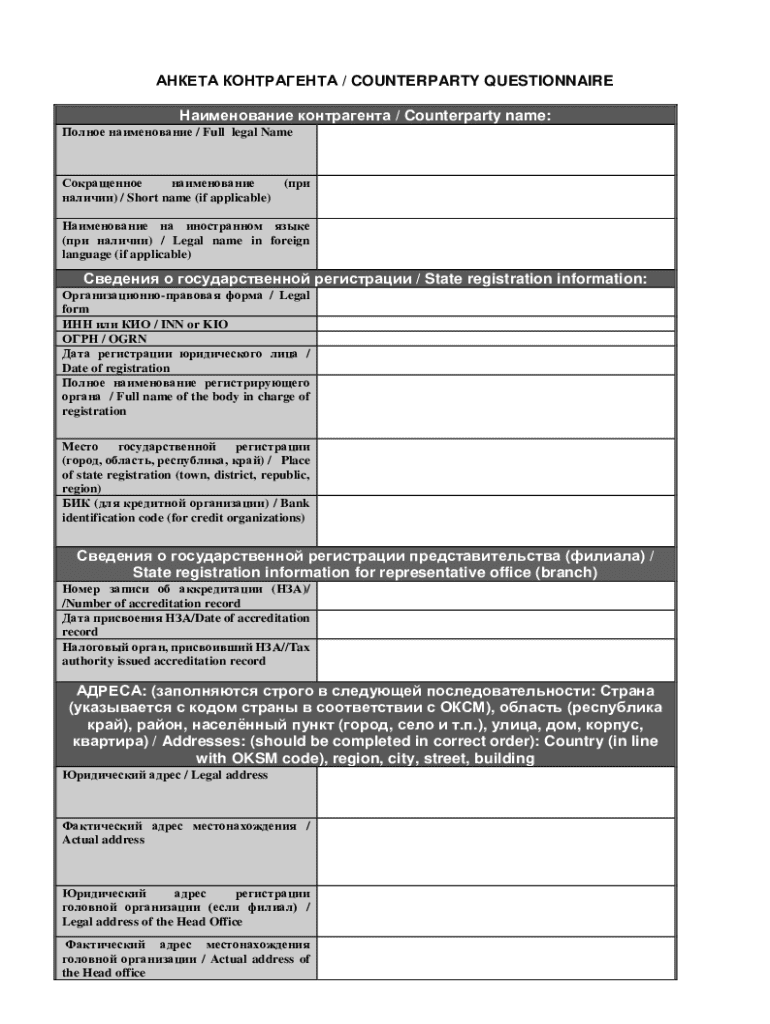

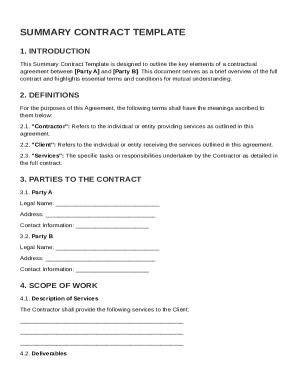

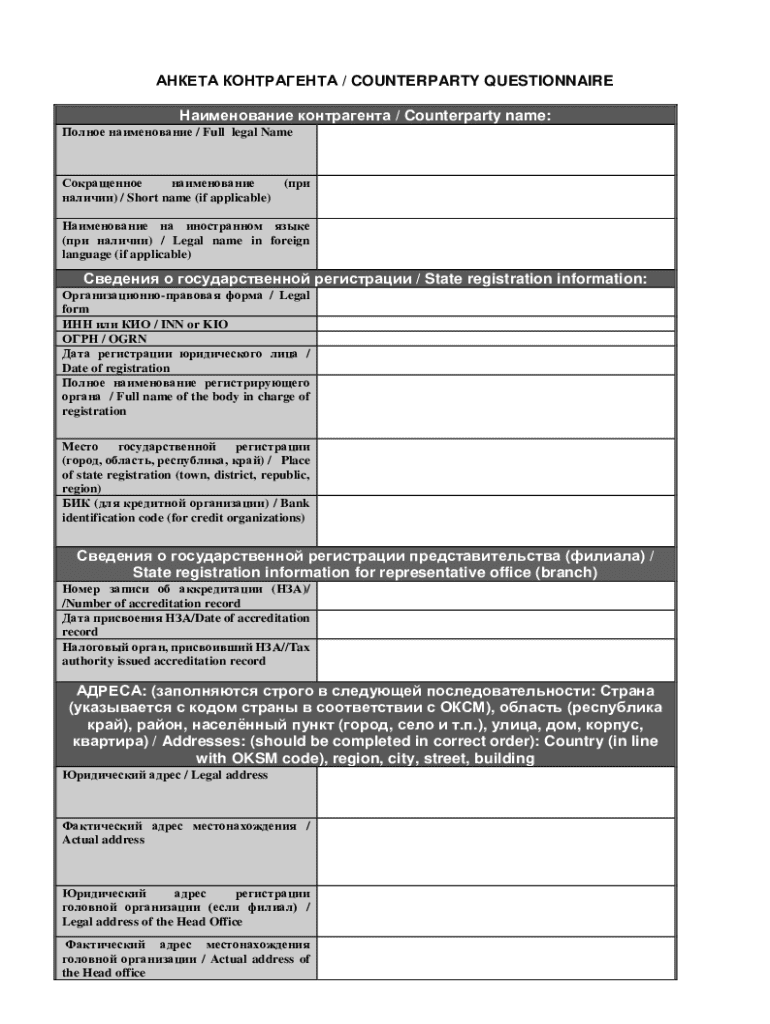

Filling out the 17 CFR Part 23 Form requires attention to detail, as accuracy is paramount for regulatory compliance. The form is structured into several sections, each containing specific requirements. Understanding these sections helps ensure that individuals and entities provide the necessary information correctly.

Begin with the header information, which demands details such as the entity’s name, registration number, and the reporting period. The entity information section requests further identifying details about your organization, ensuring accurate representation of your business’s operational status. Subsequently, the financial data section calls for critical elements including balance sheets, income statements, and other pertinent financial disclosures.

The regulatory compliance data section delves into compliance with margins and other requirements stipulated by CFTC rules. Finally, the form concludes with signature and submission guidelines, where electronic options for signing are available, along with submission deadlines to be mindful of. As a crucial tip, double-check all entries and be wary of common mistakes such as incorrect financial information or misrepresenting the entity's identification.

Interactive tools for optimizing form usage

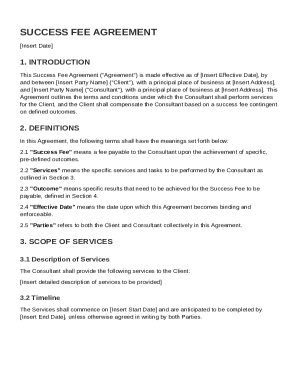

Using digital platforms like pdfFiller can significantly enhance your experience when managing the 17 CFR Part 23 form. pdfFiller features a suite of tools that enables users to edit, sign, and share documents seamlessly from a cloud-based interface. The collaborative options allow team members to review and input data from various locations, fostering an efficient workflow.

Accessing the form from anywhere at any time simplifies the management process and eliminates traditional barriers associated with paper forms. The platform supports PDF editing, allowing users to modify the document without the need to print and scan, making the entire compliance process more streamlined and user-friendly. Utilizing pdfFiller's cloud-based access empowers individuals and teams to stay on top of compliance efforts proactively.

Best practices for filling out the 17 CFR Part 23 form

To ensure compliance while filling out the 17 CFR Part 23 form, several best practices can be adopted. Start by gathering all necessary documents and financial data beforehand. This preparatory step will facilitate a smoother filling process and ensure that no critical information is overlooked. Utilizing spreadsheets or databases can help organize this information efficiently.

Employ tools for data validation to cross-check entries against regulatory guidelines. This proactive approach not only enhances accuracy but also minimizes the risk of submission errors that could lead to rejection. Keeping updated with any changes in regulations related to the form ensures that the information being submitted aligns with current CFTC requirements.

Tracking your submission

Monitoring the status of your 17 CFR Part 23 form submission is critical from the point of submission onward. Many entities overlook this stage, assuming once submitted, their responsibilities cease. Instead, it’s advisable to periodically check in on the status of your application through CFTC online portals or by contacting the relevant department directly.

Should your submission face rejection, understanding why is essential for quick rectification. The CFTC will provide feedback or additional requests for information to address deficiencies highlighted during the review. Maintaining detailed records of your submission alongside any communications with the CFTC further aids in ensuring compliance and expedites the reapplication process if necessary.

Troubleshooting common issues

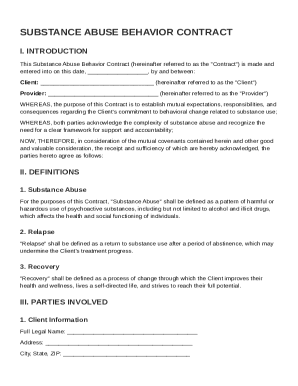

When filling out the 17 CFR Part 23 form, several common errors can arise, often resulting in rejections or additional clarifications needed from regulatory bodies. Inaccurate financial data, missing signatures, or failure to follow formatting guidelines are prevalent issues. Identifying these common pitfalls allows users to take preventive measures to mitigate risks.

Additionally, technical problems such as file transmission issues can occur, especially during peak filing periods. In such cases, having a reliable internet connection and alternative submission channels can be invaluable. Should persistent problems arise, reaching out to compliance experts or legal advisors can provide the necessary insights to navigate complex situations effectively.

Maintaining compliance after submission

Post-submission activities are just as crucial as the filing itself. Establishing ongoing documentation practices keeps your team informed and ensures adherence to evolving regulations. This includes periodic reviews of your firm’s compliance with 17 CFR Part 23 and any related amendments issued by the CFTC.

Additionally, remaining updated about regulatory changes is imperative. The financial landscape can shift swiftly, requiring entities to adapt their practices accordingly. Engaging in training sessions or subscribing to industry updates fosters a culture of compliance within your organization, fortifying your operational integrity.

Resources for further understanding

To deepen your understanding of the 17 CFR Part 23 form and its associated requirements, a variety of resources are available. The CFTC's official webpage provides vital information, including guidance documents and updates. Industry-specific publications often feature analyses and interpretations of these regulations, offering practical insights.

Additionally, online forums and communities can serve as valuable platforms for discussions and shared experiences among professionals facing similar compliance challenges. Engaging in these communities allows for the exchange of best practices and solutions to common issues related to 17 CFR Part 23.

User testimonials and success stories

Real-life examples showcase the effectiveness of using pdfFiller in managing the 17 CFR Part 23 form. Many users have attested to the streamlined process of filling out and submitting their forms efficiently. One testimonial highlights how a financial firm reduced its filing time significantly by leveraging pdfFiller’s collaborative features, resulting in timely compliance with regulatory deadlines.

Additionally, case studies demonstrate how teams have successfully overcome compliance hurdles through pdfFiller’s editing and document management tools. A technology startup reported improved accuracy and fewer rejections after implementing a structured approach to fill out the form. These stories not only validate the utility of the platform but also guide others in adopting effective practices.

Connecting with pdfFiller services

At pdfFiller, we offer enhanced features tailored to meet your document management needs, particularly for compliance-related forms like 17 CFR Part 23. Our platform enables users to edit PDFs with ease, sign documents electronically, and collaborate with team members seamlessly. This unified approach reduces the friction typically associated with document management.

Our customer support services provide targeted assistance for compliance questions, ensuring that users can navigate their obligations confidently. Engaging with our community resources, including webinars and tutorials, enhances your knowledge and supports continuous learning around the 17 CFR Part 23, further empowering your compliance efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 17 cfr part 23 directly from Gmail?

How do I execute 17 cfr part 23 online?

How do I make edits in 17 cfr part 23 without leaving Chrome?

What is 17 cfr part 23?

Who is required to file 17 cfr part 23?

How to fill out 17 cfr part 23?

What is the purpose of 17 cfr part 23?

What information must be reported on 17 cfr part 23?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.