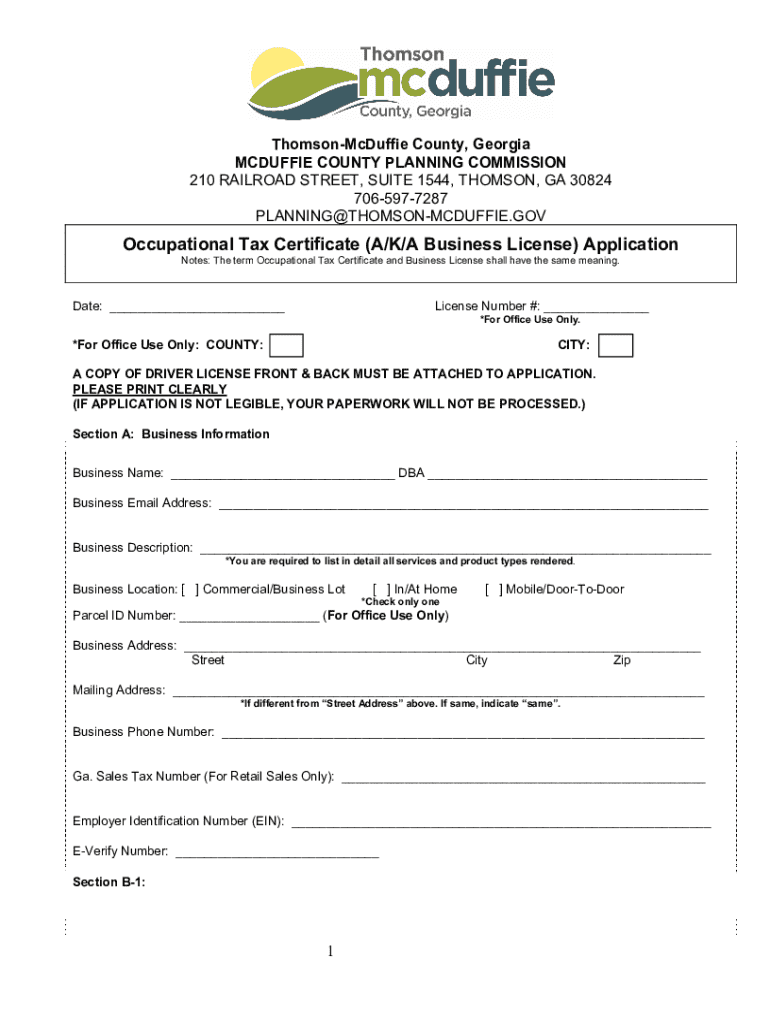

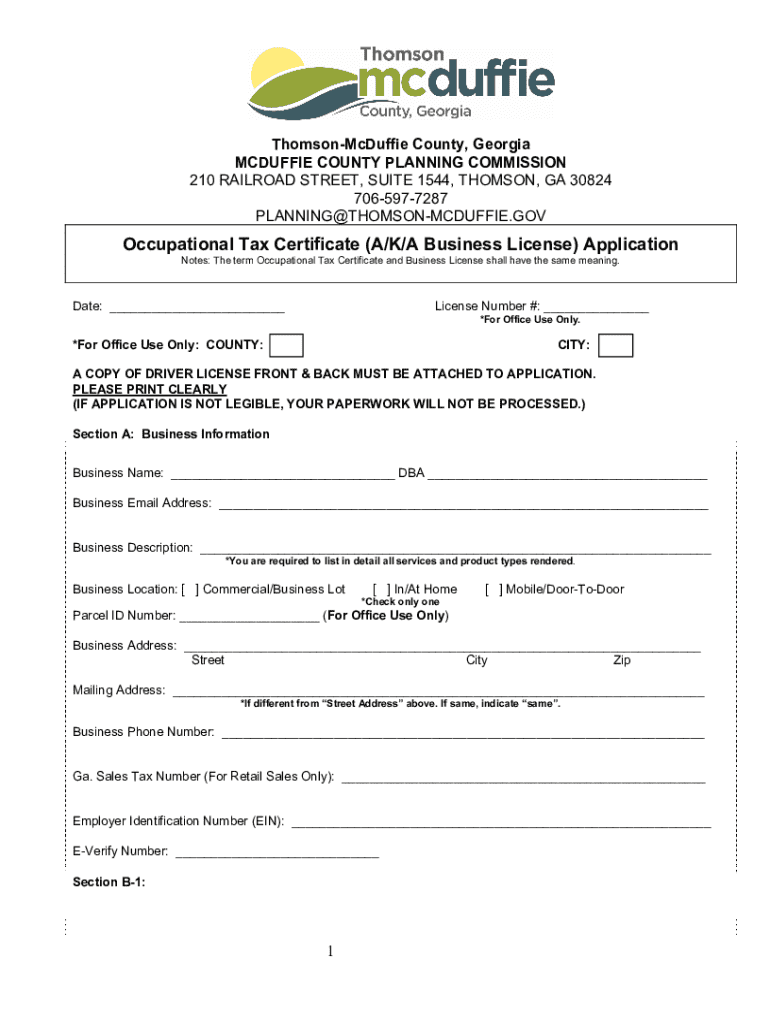

Get the free Occupational Tax Certificate (A/K/A Business License) Application

Get, Create, Make and Sign occupational tax certificate aka

Editing occupational tax certificate aka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out occupational tax certificate aka

How to fill out occupational tax certificate aka

Who needs occupational tax certificate aka?

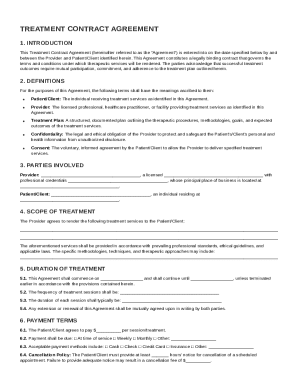

Understanding the Occupational Tax Certificate aka Form

Understanding the Occupational Tax Certificate

An occupational tax certificate, often referred to as a business license, is an official document issued by local or state authorities that allows individuals or businesses to legally practice their occupations or businesses in a specific area. The certificate serves to regulate and monitor various professions and trades, ensuring compliance with local ordinances and laws.

The primary purpose of this certification is to safeguard public interests by verifying that businesses and professionals uphold standards in their respective fields. It's crucial for entities like firms, companies, and corporations to acquire this certificate before starting operations or offering services. Without it, businesses may face fines, legal issues, or even closure.

Common misconceptions about occupational tax certificates include the belief that they are universally required in all jurisdictions or that they are the same as permits. In reality, while many professions do require this certificate, the exact requirements can vary significantly from one locality to another.

Who needs an occupational tax certificate?

Understanding who is required to obtain an occupational tax certificate is essential for compliance. Typically, individuals such as freelancers, independent contractors, or anyone engaging in self-employment activities must secure this certificate. Additionally, businesses and entities, regardless of their size, that provide goods or services to the public must also finalize the necessary registration.

Different jurisdictions may impose varying requirements regarding the certificate. For example, in the City of Albany or Dougherty County, local laws might necessitate specific certificate types depending on the nature of occupation or trade involved. This inconsistency means residents should consult local governing bodies to determine their obligations.

Fees and costs associated with occupational tax certificates

The fees associated with acquiring an occupational tax certificate can vary widely based on the location and type of business. Typically, cities or local governments outline these fees in their municipal code. For instance, in Dougherty County, business owners might expect to pay a flat fee, while additional costs could accrue based on business income or employees.

Beyond the initial fees, businesses should be aware of potential penalties for non-compliance, which could result from failing to obtain the necessary certification or missing renewal dates. Such penalties can significantly impact budgeted expenses, so it’s vital to remain proactive.

The process of obtaining your occupational tax certificate

Acquiring an occupational tax certificate involves a straightforward application process. To ensure timely approval, it's essential to follow the steps carefully.

Upon submission, you will receive confirmation of your application. If approved, your occupational tax certificate will be issued, allowing you to legally operate within your jurisdiction.

Interactive tools for managing your occupational tax certificate

pdfFiller offers a range of tools that facilitate the completion, submission, and management of your occupational tax certificate. By leveraging its interactive features, users can engage with the certificate process more efficiently.

Managing your occupational tax certificate

Regular management of your occupational tax certificate is crucial to maintain compliance and operational legality. Tracking the certificate’s status post-application submission helps ensure that you are prepared for any renewal requirements.

Renewing your certificate typically occurs annually, though some areas may require biannual renewals. Business owners should check renewal dates carefully and submit applications promptly to avoid lapses in compliance.

Exclusions and exemptions related to occupational tax certificates

Certain entities may be exempt from paying fees associated with an occupational tax certificate. Commonly, non-profit organizations engaged in public service activities qualify for such exemptions.

Additionally, temporary exemptions may apply in specific cases, such as during natural disasters or for new businesses within a promotional period. Understanding these nuances can save your business from unnecessary costs.

Business listings and registration with local authorities

After obtaining your occupational tax certificate, the next step is ensuring that your business is accurately listed with local authorities. All businesses should maintain current and correct registration to avoid misleading potential customers and falling afoul of regulations.

Accurate business listings enhance your credibility and visibility in the community. Utilize online platforms, local directories, and city databases to register or update your business information, leveraging it for growth and legitimacy.

Troubleshooting common issues

Despite best efforts, issues may arise during the application process or post-issuance of an occupational tax certificate. Knowing how to address these challenges can save you considerable hassle.

In case your application is denied, it's critical to understand the reasons behind the denial. Contacting the relevant local authority for guidance can help address misconceptions or omitted information on your application.

Additional tools and resources offered by pdfFiller

pdfFiller provides an extensive suite of document management features that cater specifically to those managing their occupational tax certificates. Its capabilities go beyond simple form filling.

Utilize collaboration tools if you have teams involved in documentation. Develop, review, and finalize occupational tax certificate submissions collectively in real-time, enhancing efficiency and reducing errors.

Share your experience

Community feedback can be invaluable for improving the occupational tax certificate experience. Engaging with other professionals and businesses can provide insights into best practices and common pitfalls.

Encouraging users to share their tips and experiences helps foster a collective knowledge base. Social platforms offer excellent avenues for connecting with other users regarding occupational tax certificates, ensuring everyone benefits from shared information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit occupational tax certificate aka from Google Drive?

How can I send occupational tax certificate aka for eSignature?

How do I edit occupational tax certificate aka on an iOS device?

What is occupational tax certificate aka?

Who is required to file occupational tax certificate aka?

How to fill out occupational tax certificate aka?

What is the purpose of occupational tax certificate aka?

What information must be reported on occupational tax certificate aka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.