Get the free Internal Revenue Service - Prometric

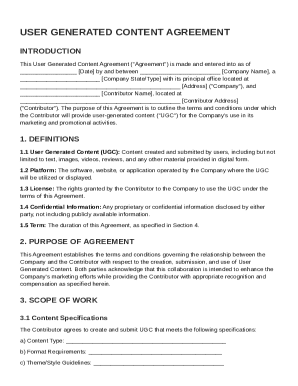

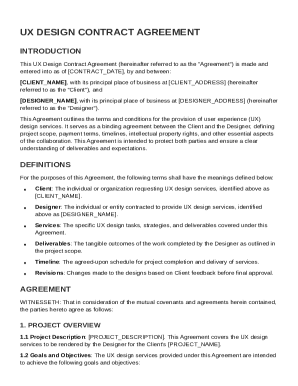

Get, Create, Make and Sign internal revenue service

Editing internal revenue service online

Uncompromising security for your PDF editing and eSignature needs

How to fill out internal revenue service

How to fill out internal revenue service

Who needs internal revenue service?

Comprehensive Guide to Internal Revenue Service Forms

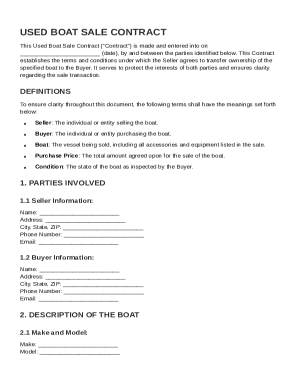

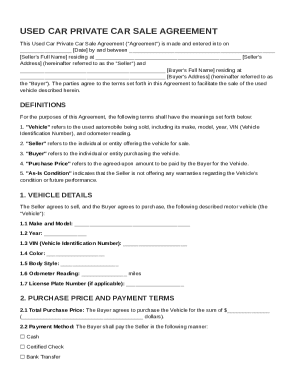

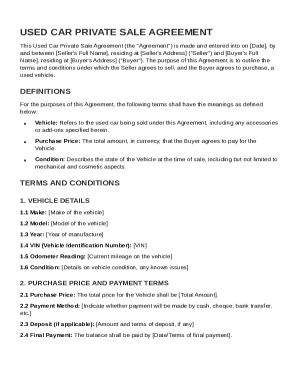

Overview of Internal Revenue Service forms

Internal Revenue Service forms are official documents required for federal taxes in the United States, serving as a structured way for taxpayers to report their income, deductions, and credits to the IRS. These forms play a crucial role in ensuring tax compliance, as they provide the government with necessary information to assess tax liabilities accurately.

The importance of these forms cannot be overstated; they allow the IRS to compute the amount owed or the refund due to taxpayers. Each form is designed for specific circumstances and is a key element in the tax filing process, providing a consistent format that both the IRS and taxpayers can reliably work with.

Types of IRS forms

The IRS produces a multitude of forms tailored to various needs, categorized mainly into individual income tax forms, business and employment forms, specialized forms, and payment/refund forms.

How to obtain IRS forms

Obtaining IRS forms is straightforward and can be done in several ways, facilitating easy access for taxpayers in need.

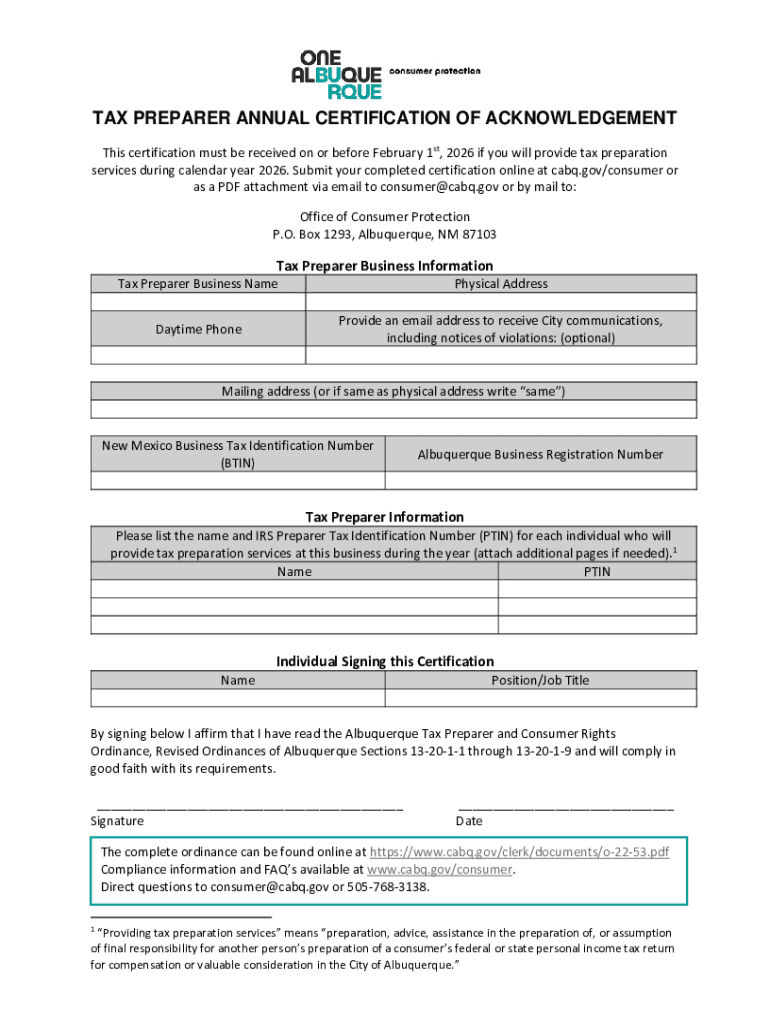

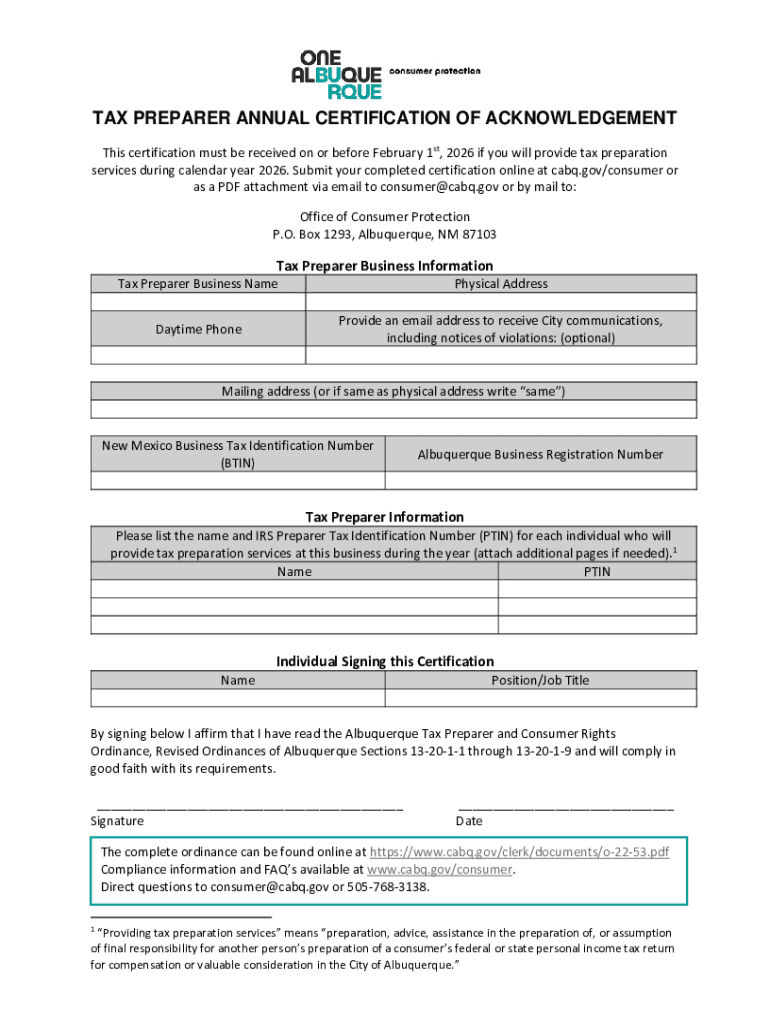

Detailed instructions for filling out IRS forms

Filling out IRS forms requires accuracy and a keen eye for detail. It's critical to complete forms correctly to avoid delays and ensure compliance with tax regulations.

Editing and managing IRS forms

Editing IRS forms has never been easier with tools like pdfFiller, which allows users to upload, edit, and sign forms without hassle. Accessing forms via a cloud-based solution helps users manage their documentation efficiently.

Submitting IRS forms

Submitting IRS forms can be done either electronically or via paper, depending on the taxpayer's preference. Familiarizing yourself with both methods is essential for a smooth filing process.

Troubleshooting common IRS document issues

Errors happen; knowing how to rectify them is vital. If a mistake is made on a form, understanding the amendment process can save time and headaches.

Frequently asked questions (FAQ)

Taxpayers often have questions about IRS forms and processes. Here are some common queries and their answers.

Utilizing interactive tools

Interactive tools enhance the IRS form-filling experience. pdfFiller offers various features that make filling in forms quick and efficient.

Maintaining compliance and managing records

Maintaining accurate records of IRS forms is essential for personal taxes and audits. Best practices entail meticulous organization and secure storage solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit internal revenue service from Google Drive?

Can I sign the internal revenue service electronically in Chrome?

How do I complete internal revenue service on an Android device?

What is internal revenue service?

Who is required to file internal revenue service?

How to fill out internal revenue service?

What is the purpose of internal revenue service?

What information must be reported on internal revenue service?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.