Get the free FinanceFinancial Analyst Bachelor of Science - cba k-state

Get, Create, Make and Sign financefinancial analyst bachelor of

Editing financefinancial analyst bachelor of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financefinancial analyst bachelor of

How to fill out financefinancial analyst bachelor of

Who needs financefinancial analyst bachelor of?

Navigating the Finance Financial Analyst Bachelor of Form: Your Comprehensive Guide

Understanding the financial analyst role

A financial analyst plays a critical role within firms by interpreting data and preparing financial reports. Analysts are responsible for assessing the financial health of an organization and offering insights for investment decisions. This role encompasses duties such as performing financial forecasting, analyzing market trends, and preparing reports that help guide business strategies. Financial analysts are essential in driving strategic decisions that impact growth and the overall success of a company.

Career progression for financial analysts often starts with entry-level analyst roles, followed by positions such as senior financial analyst and finance manager. This path can lead to top executive roles in finance, making it an attractive career choice for those interested in both finance and strategy.

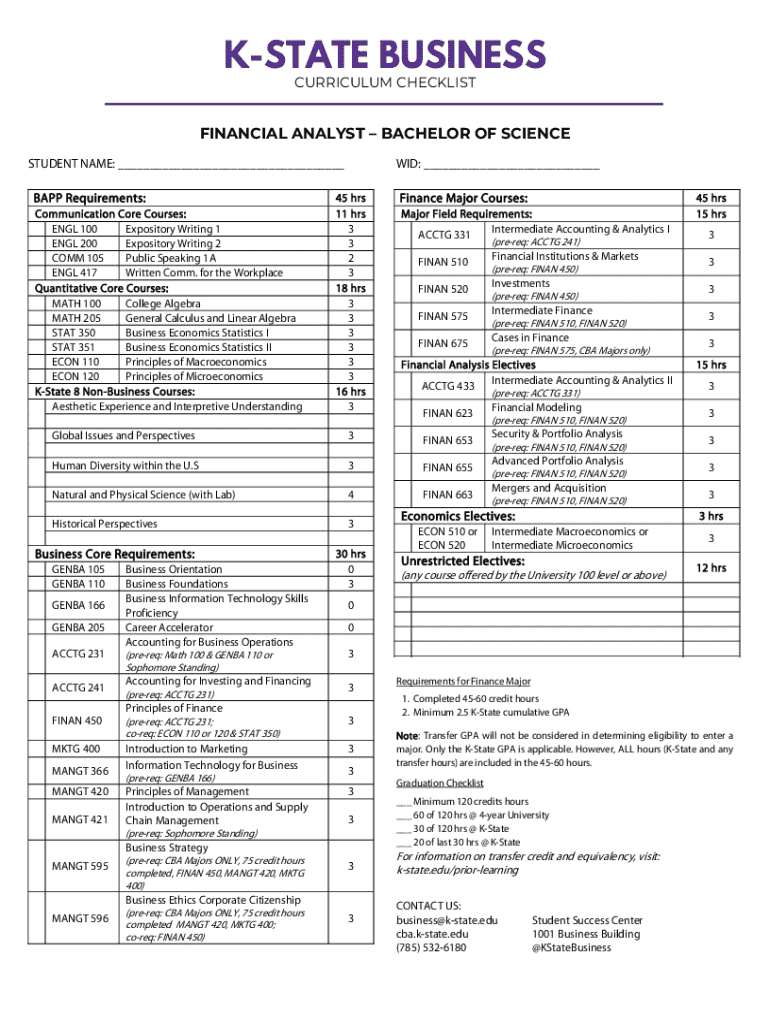

Educational path to becoming a financial analyst

To become a financial analyst, pursuing a relevant degree is essential. Many analysts hold a Bachelor’s Degree in Finance, but degrees in related fields such as Economics or Accounting can also be beneficial. These programs equip students with the foundational knowledge necessary for financial analysis, including understanding complex financial concepts and models.

Specialized coursework is equally important. Courses in financial modeling, corporate finance, and investment strategies can give students an edge in the job market. Recommended electives like Introduction to Statistics can sharpen analytical skills, providing the tools necessary to interpret financial data effectively.

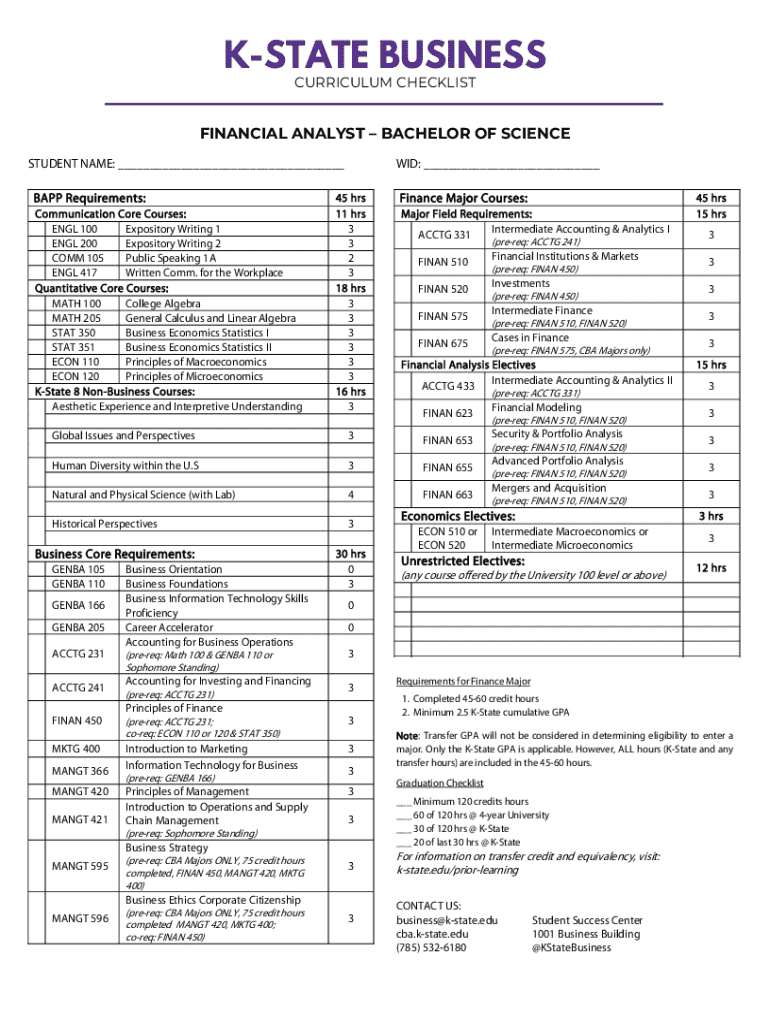

Bachelor of finance in detail

A Bachelor of Finance typically consists of a curriculum that combines core finance courses with electives tailored to individual interests. Core courses usually cover topics such as financial management, investment principles, and financial statement analysis. Electives may include advanced topics in strategy, statistics, and risk management, providing a well-rounded education.

Accreditation is key when choosing a finance program. High-quality programs from recognized institutions not only enhance learning but also improve employability post-graduation. Firms often seek graduates from accredited programs due to the rigorous standards required.

Skills required for financial analysts

Successful financial analysts possess a combination of analytical and quantitative skills that allow them to dissect complex financial data. Technical skills are equally crucial; proficiency in software such as Excel and financial modeling tools is essential for analysis and reporting. Additionally, familiarity with statistical software can help in deciphering trends and building forecasts.

Soft skills, including effective communication and collaboration, are essential as financial analysts often work in teams and must present insights clearly to diverse stakeholders. The blend of technical and interpersonal skills is vital for thriving in any financial firm.

Gaining practical experience as a finance student

Gaining real-world experience through internships is crucial for finance students. These experiences provide invaluable insights into how firms operate and the practical application of financial theories learned in the classroom. Securing internships often involves networking within the finance industry and leveraging connections made through university programs.

Students should actively seek opportunities to build their portfolios, showcasing their skill sets through projects completed during internships or coursework. A robust portfolio not only enhances job applications but also demonstrates practical experience to potential employers.

Certification and licensing for financial analysts

Professional credentials are increasingly important for financial analysts. Certifications like the Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) enhance credibility and validate expertise. Obtaining these designations often requires significant preparation and a deep understanding of financial concepts, thus playing a key role in career advancement.

Preparing for certification exams can be intensive, so using reliable study materials and practice tests is essential. Moreover, networking with other candidates can provide insights and support throughout the preparation journey.

Creating your financial analyst career plan

To establish a successful career path as a financial analyst, setting specific short-term and long-term goals is critical. Short-term goals might include securing internships and enhancing technical skills, while long-term goals could focus on achieving certifications or advancing into managerial roles within financial firms.

Effective job search strategies include tailoring your resume to highlight relevant skills and preparing thoroughly for interviews. Practicing common financial analyst interview questions can significantly increase confidence and performance during the actual interview.

Essential tools for financial analysts

Financial analysts rely on various software tools for analysis and reporting. Key industry-standard software includes financial analysis and reporting tools that help analysts analyze data trends and generate reports efficiently. Familiarity with tools such as Bloomberg Terminal or SAS can be a tremendous asset.

Using advanced cloud-based solutions, such as pdfFiller, offers additional efficiency. This platform enables users to seamlessly edit, eSign, and manage documents from anywhere, enhancing workflow and collaboration across teams.

Enhancing your resume with financial analyst skills

To stand out in the competitive finance job market, it's crucial to highlight key skills on your resume. Focusing on analytical skills, software proficiency, and relevant coursework can make a significant difference. Listing internships and projects clearly outlines practical experience and expertise.

Leveraging example resume templates can assist finance students in formatting their resumes effectively while ensuring all crucial details are included. A well-organized resume can capture the attention of hiring managers and pave the way to interviews.

The future of the financial analyst profession

The financial analyst profession is evolving due to trends impacting finance careers. These trends include the rising influence of technology, where automation is streamlining data analysis and reporting tasks. Analysts who adapt to new technologies will maintain a competitive edge and continue to thrive in this changing landscape.

Preparing for changes in the finance industry will require commitment to ongoing professional development. By staying informed about industry developments and enhancing skills regularly, current and aspiring financial analysts can ensure their future success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute financefinancial analyst bachelor of online?

How do I edit financefinancial analyst bachelor of on an iOS device?

Can I edit financefinancial analyst bachelor of on an Android device?

What is financefinancial analyst bachelor of?

Who is required to file financefinancial analyst bachelor of?

How to fill out financefinancial analyst bachelor of?

What is the purpose of financefinancial analyst bachelor of?

What information must be reported on financefinancial analyst bachelor of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.