Get the free Workers Compensation Excess Coverage and Loss Control Services

Get, Create, Make and Sign workers compensation excess coverage

Editing workers compensation excess coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out workers compensation excess coverage

How to fill out workers compensation excess coverage

Who needs workers compensation excess coverage?

Understanding the Workers Compensation Excess Coverage Form

Understanding workers compensation excess coverage

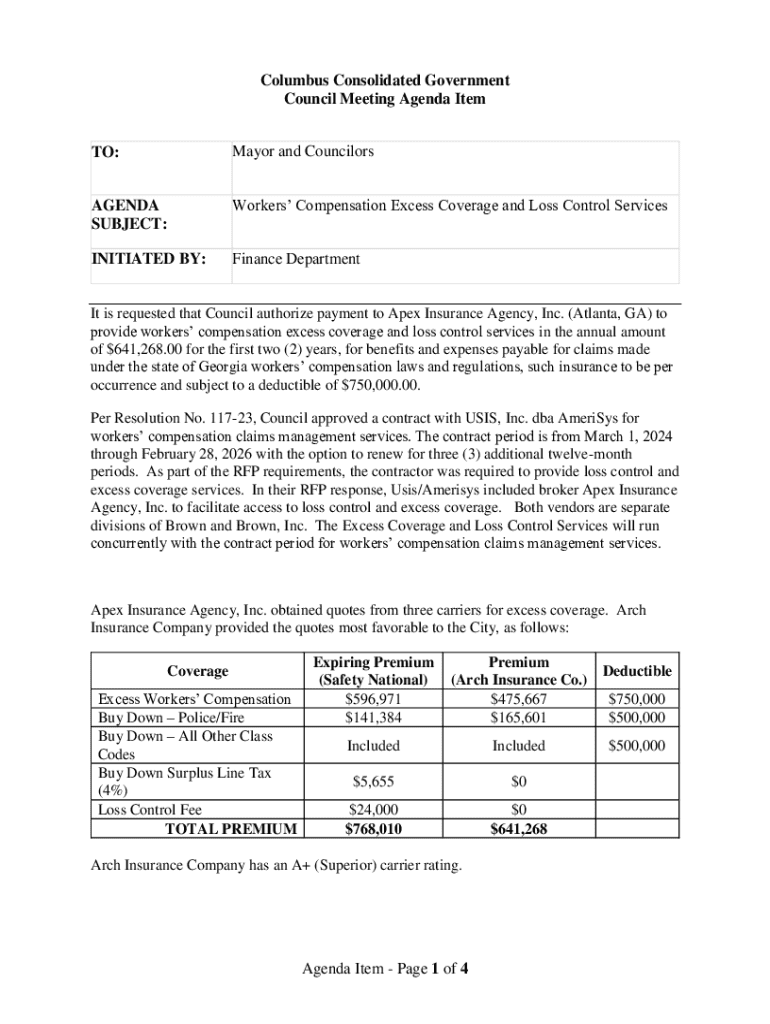

Excess coverage in workers compensation serves as an additional layer of insurance that kicks in when primary coverage limits are exhausted. This form of coverage is crucial for businesses with high risk or those operating in industries where workplace injuries are more likely. Beyond simply protecting a business's bottom line, excess coverage shields it from potentially devastating financial consequences that could arise from severe employee injuries.

The importance of excess coverage cannot be overstated. It acts as a financial safety net, ensuring that employees receive the necessary compensation for injuries while safeguarding the business from crippling costs. Key differences between primary and excess coverage include coverage limits and the extent of financial risks each type addresses. Primary coverage often covers the immediate costs of workplace injuries, while excess coverage provides an additional buffer against high claims.

When is excess coverage necessary?

Excess coverage is particularly essential for businesses operating in high-risk environments, such as construction, manufacturing, and healthcare. These industries often encounter hazardous conditions that significantly increase the likelihood of employees being injured. Assessing risks is a proactive approach to identifying potential coverage gaps that could expose businesses to significant liabilities.

In industry-specific scenarios, excess coverage proves critical. For instance, a construction firm that frequently handles large-scale projects may face lawsuits that exceed their primary coverage limits. Here, excess coverage can guard against high costs associated with potential long-term care for injured employees.

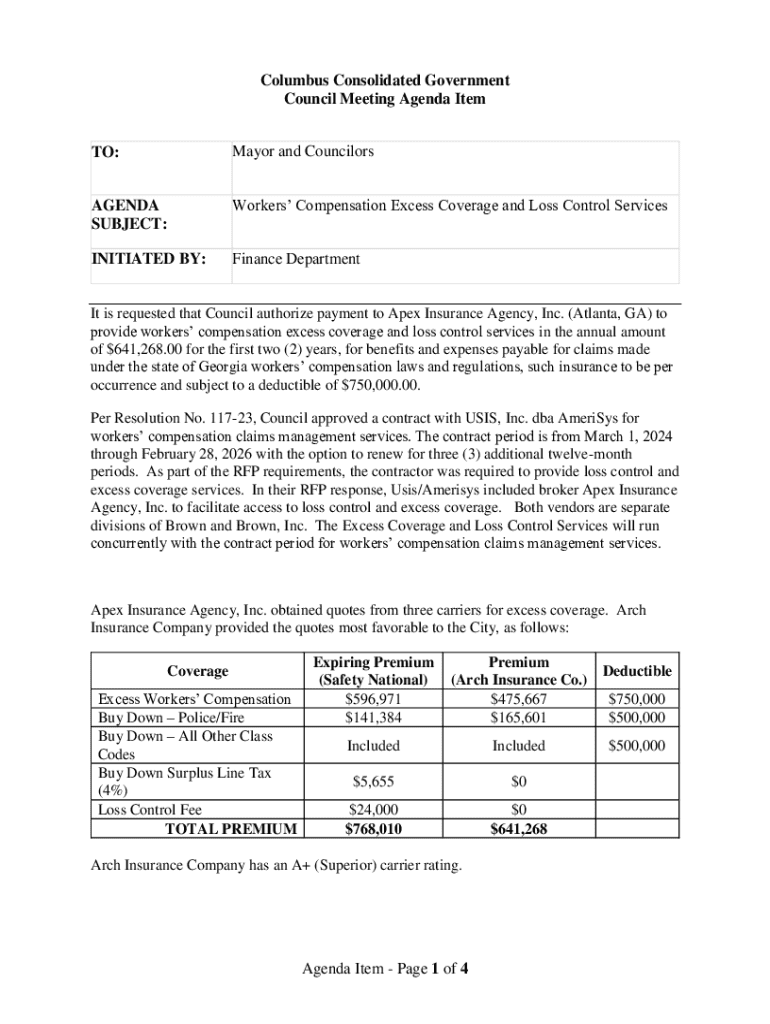

Key components of the excess coverage form

Filling out the workers compensation excess coverage form requires several key components. Businesses must provide detailed information regarding their operations, employee structure, and desired coverage limits. Required information typically includes business details such as the company's name, location, and type of operations, along with specific employee information, including job roles, number of employees, and their associated risks.

Common terminology related to the coverage form includes deductibles, policy limits, and endorsements. Understanding these terms helps in making informed decisions regarding the extent of coverage required, as they can significantly impact both premium costs and overall protection.

Step-by-step guide to filling out the excess coverage form

Completing the workers compensation excess coverage form is a systematic process that involves several steps. First, gather all necessary documentation, including existing insurance policies and relevant employee information. This initial organization will streamline the following steps.

Common mistakes include omitting critical information or underestimating coverage needs, both of which can lead to inadequate protection.

Editing and customizing your form

Editing your workers compensation excess coverage form can enhance clarity and ensure accuracy. Using pdfFiller's editing tools, users can easily modify entries and incorporate additional notes. Whether adjusting business information or specifying unique coverage requirements, customization can make your form more precise.

These tools not only facilitate smoother document processing but also allow for real-time updates and organization, ensuring that your documentation remains up-to-date.

Collaboration features for team management

Collaborating on the workers compensation excess coverage form is essential, especially for organizations with multiple stakeholders. PdfFiller offers several features that enable team management, such as sharing forms with team members and engaging in real-time collaboration.

These collaboration tools ensure that every stakeholder is aligned and enables efficient document management throughout the process, minimizing the potential for errors.

Managing your document post-submission

After submitting your workers compensation excess coverage form, managing the document securely is paramount. pdfFiller allows users to save and access their forms easily, ensuring that they remain organized for any future review or amendments.

This proactive document management approach prepares businesses for any issues that may arise related to claims or policy changes.

eSigning the excess coverage form

eSigning the workers compensation excess coverage form streamlines the submission process, allowing for quick approval and execution. The step-by-step process for secure eSigning involves accessing the form within your pdfFiller account, where you can easily insert your digitized signature.

It's crucial to understand the legal validity of eSignatures in insurance contracts to ensure compliance with applicable regulations, particularly with varying state laws.

Frequently asked questions (FAQs)

There are several common questions regarding the workers compensation excess coverage form that users should be aware of. For instance, if an error occurs on the form post-submission, there are often corrective procedures available for adjustments. Additionally, it's important to know how long the approval process typically takes, as this can vary by insurer.

Addressing these questions can clarify expectations and reduce confusion during the claims process.

Additional considerations

Understanding the impacts of excess coverage on premiums is vital for businesses to budget effectively. While excess coverage can incur higher premiums than standard policies, the financial protection it offers can outweigh these costs in high-risk scenarios. Business owners should stay updated on industry regulations and changes to ensure that their policies remain compliant and effective.

Utilizing resources and expertise can help businesses navigate the complexities of workers compensation insurance effectively.

Contact support for further assistance

For additional help regarding the workers compensation excess coverage form, reaching out to pdfFiller's support team can provide valuable guidance. Their support channels include live chat options and various help resources to assist users in completing forms accurately.

Professionally navigating workers compensation issues ultimately leads to a more secure and prepared business environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send workers compensation excess coverage for eSignature?

How do I execute workers compensation excess coverage online?

How do I make changes in workers compensation excess coverage?

What is workers compensation excess coverage?

Who is required to file workers compensation excess coverage?

How to fill out workers compensation excess coverage?

What is the purpose of workers compensation excess coverage?

What information must be reported on workers compensation excess coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.