Get the free Tax rate approved, increase in water, sewer and sanitation ...

Get, Create, Make and Sign tax rate approved increase

Editing tax rate approved increase online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax rate approved increase

How to fill out tax rate approved increase

Who needs tax rate approved increase?

Comprehensive guide to the tax rate approved increase form

Overview of tax rate approved increase form

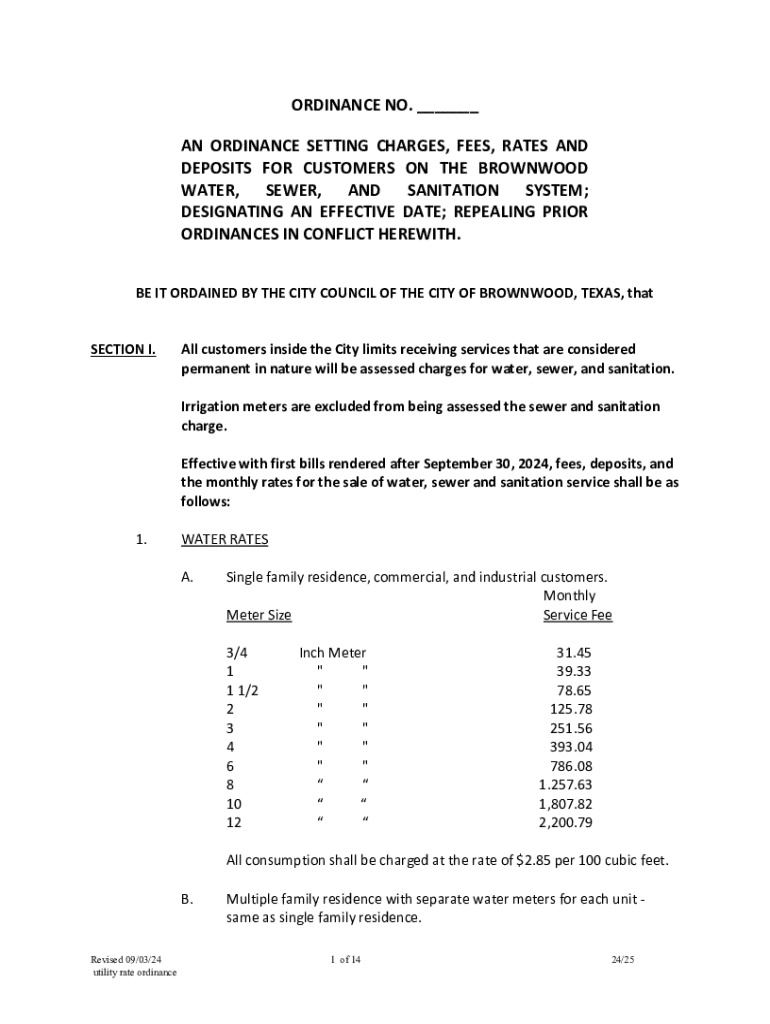

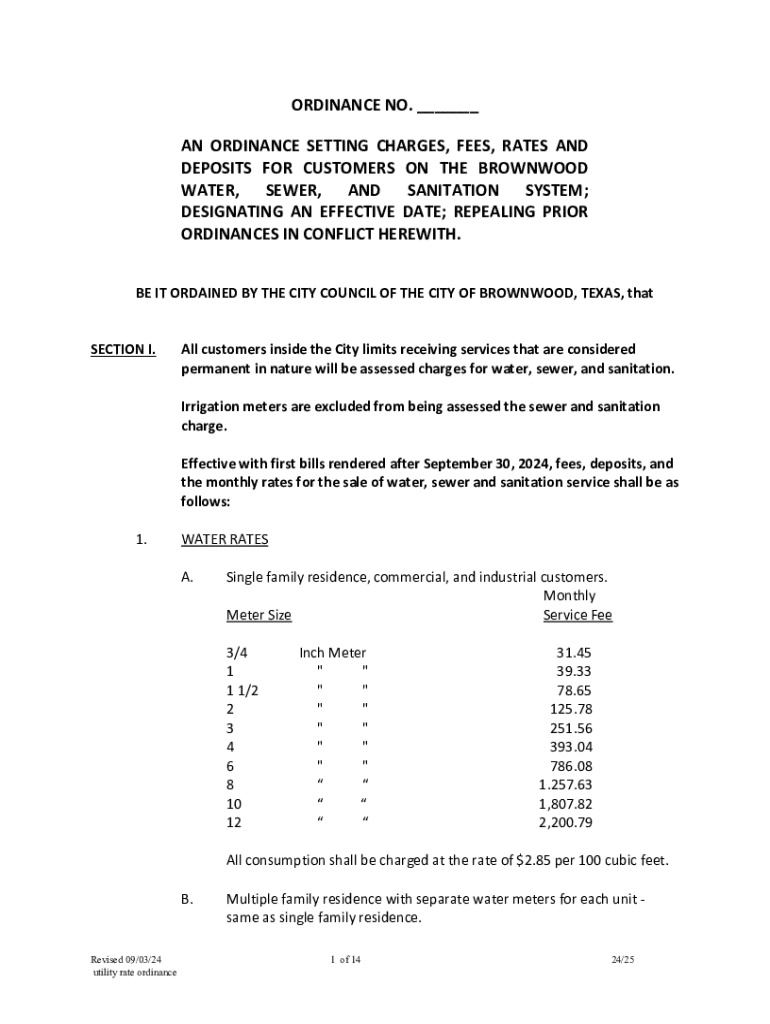

The tax rate approved increase form is an essential document used to notify relevant authorities about approved changes to local tax rates. This form not only outlines the details of the tax increase but also serves as a crucial tool for ensuring compliance with new regulations set by tax authorities.

Understanding tax rate changes is vital for both individuals and businesses, as it impacts budgeting and financial planning. Misunderstanding or neglecting to comply with these changes can lead to penalties or financial shortfalls.

Use the tax rate approved increase form when there are official announcements or local government resolutions indicating an approved increase in tax rates. This could apply to various taxes including property, income, or sales taxes.

Who needs to file the tax rate approved increase form?

Individuals subject to increased tax rates, such as property owners, should file the tax rate approved increase form to adjust their financial records and tax obligations accordingly. This includes any homeowner receiving a property tax increase notice.

Business entities, especially organizations that operate in regions where tax rates have increased, must also consider filing this form. This includes corporations, limited liability companies, and partnerships that are subject to local, state, or federal tax increases.

However, some exemptions may apply based on local legislation or organizational status, so it's essential to consult local tax codes or a tax professional.

Step-by-step instructions for completing the form

Filling out the tax rate approved increase form requires careful attention to detail to ensure compliance and accuracy. Below is a guide on the required information needed.

When completing the form, pay careful attention to the following sections:

When filling out the form, common mistakes include incorrect personal information, misreporting financial data, and failing to provide necessary documentation. Double-check every field to avoid issues.

Editing and managing your tax rate approved increase form

Once the tax rate approved increase form is completed, it's important to have the tools to edit and manage the document. pdfFiller provides excellent features for modifying forms easily.

Utilizing pdfFiller's tools, users can make changes, add signatures, or include necessary details before finalizing the form.

Managing your forms effectively ensures you have a clear audit trail and can provide evidence of compliance during any future inquiries or audits.

Signing and submitting the form

After completing the document, a signature is often required to validate the submission. Understanding the eSignature requirements is critical, as many jurisdictions now allow electronic submission.

Using pdfFiller, you can easily sign your document electronically. This feature not only facilitates quick signing but also ensures that the form meets legal standards.

Keeping track of your submission is essential to ensure compliance and to address any potential issues promptly.

Important deadlines and filing dates

Filing the tax rate approved increase form comes with important deadlines that you must adhere to. Typically, local jurisdictions set annual deadlines for filing these documents, which may vary by region.

Failure to submit on time can lead to penalties or complications with your tax filings. It's essential to stay informed about key dates relevant to any tax rate changes that impact your obligations.

Setting reminders for these deadlines can help ensure timely and accurate submissions.

Resources for further information

For those seeking more information regarding the tax rate approved increase form, there are several valuable resources available. Official tax authority websites often provide guidance on regulations and specific forms.

Utilizing these resources can empower you to navigate through any complexities surrounding tax rate increases effectively.

Tips for staying informed on future tax rate changes

Staying updated on potential tax rate changes is critical for effective financial planning. Consider subscribing to tax newsletters or updates from reputable financial news sources or tax authority sites.

Engaging with these resources ensures that you remain informed, proactive, and well-prepared for any changes.

Integration with pdfFiller's features

pdfFiller offers a streamlined approach to document management, particularly for forms like the tax rate approved increase form. By leveraging pdfFiller's functionalities, users can enhance their efficiency and organization in handling vital documents.

The benefits of using pdfFiller include easy editing, seamless eSigning, and the ability to collaborate with others, all within a single cloud-based platform.

Incorporating pdfFiller into your process for managing tax forms ensures that you have a reliable solution to meet all your documentation requirements.

Frequently asked questions (FAQs)

1. What if I make a mistake on the form? It's important to address any mistakes immediately. Correct them as soon as possible or contact the relevant authority for further instructions.

2. Can I submit the form electronically? Yes, many jurisdictions accept electronic submissions. Check your local tax authority for specifics.

3. How do I know if my submission was successful? After submitting, ensure you receive a confirmation email or receipt, which serves as proof of submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax rate approved increase without leaving Chrome?

How do I fill out tax rate approved increase using my mobile device?

How do I edit tax rate approved increase on an iOS device?

What is tax rate approved increase?

Who is required to file tax rate approved increase?

How to fill out tax rate approved increase?

What is the purpose of tax rate approved increase?

What information must be reported on tax rate approved increase?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.