Get the free Donation of Surplus Vehicl

Get, Create, Make and Sign donation of surplus vehicl

Editing donation of surplus vehicl online

Uncompromising security for your PDF editing and eSignature needs

How to fill out donation of surplus vehicl

How to fill out donation of surplus vehicl

Who needs donation of surplus vehicl?

Comprehensive Guide to the Donation of Surplus Vehicle Form

Understanding the donation of surplus vehicles

Surplus vehicles refer to those that are no longer used or needed, often due to overcapacity, changes in operational needs, or simply age. Whether you're an individual looking to upgrade your car or a business with a fleet of now-unnecessary vehicles, donating surplus vehicles can be a responsible way to dispose of these assets. Not only does it clear space and reduce warehousing costs, but it also provides an opportunity to contribute positively to society.

The benefits of donating surplus vehicles extend beyond personal gain. Environmentally, by donating rather than disposing of your vehicle, you help reduce waste and promote recycling. Furthermore, social impacts are significant; local charities and nonprofit organizations often rely on vehicle donations to support their missions, providing transportation services to those in need or funding educational programs.

Eligibility criteria for surplus vehicle donation

When considering the donation of a surplus vehicle, several eligibility criteria come into play. Typically, the types of vehicles accepted for donation include cars, trucks, vans, and sometimes even motorcycles, depending on the charity's needs. Nonprofit organizations often have specific programs that can benefit from various types of vehicles, making it crucial to check which donations are welcomed.

Many charitable organizations, including those focused on veteran services, youth support, or environmental conservation, accept vehicle donations. Before donating, individuals and businesses should review the guidelines set forth by these organizations to ensure compliance with their acceptance criteria. Note that local laws may affect the requirements for vehicle donations, and it is wise to consult with the specific charities or agencies involved.

The donation process

Donating a surplus vehicle involves several essential steps, ensuring the process is smooth and legally sound. Here’s a step-by-step guide:

Each of these steps plays a critical role in ensuring your vehicle donation serves its intended purpose and complies with legal requirements.

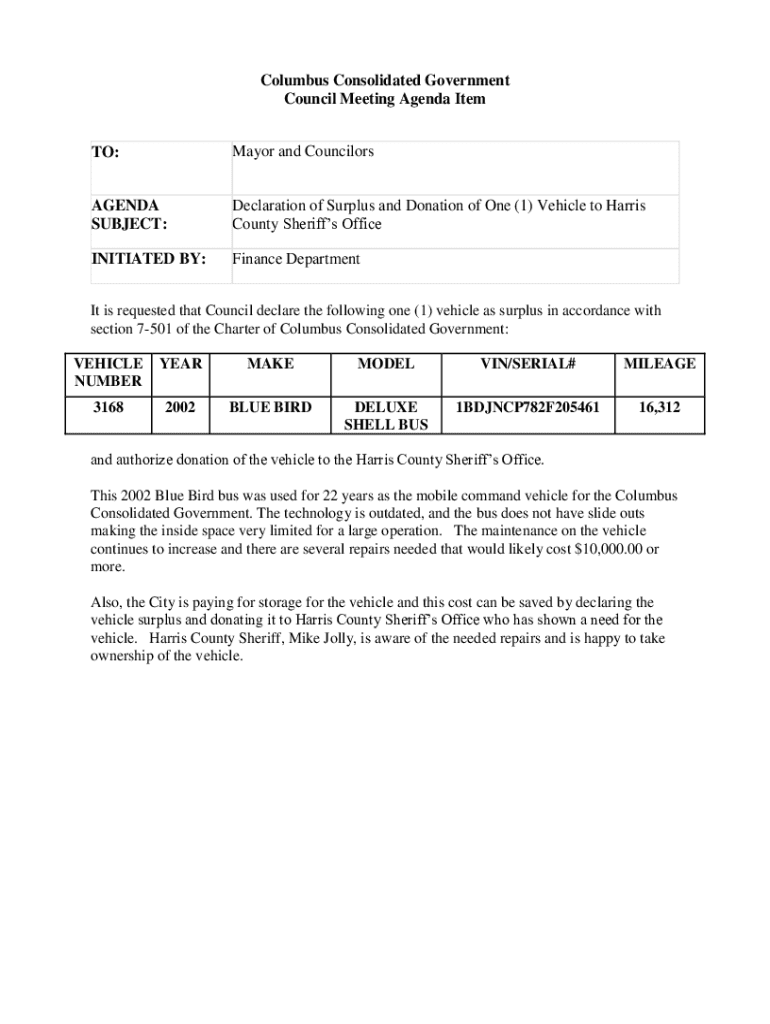

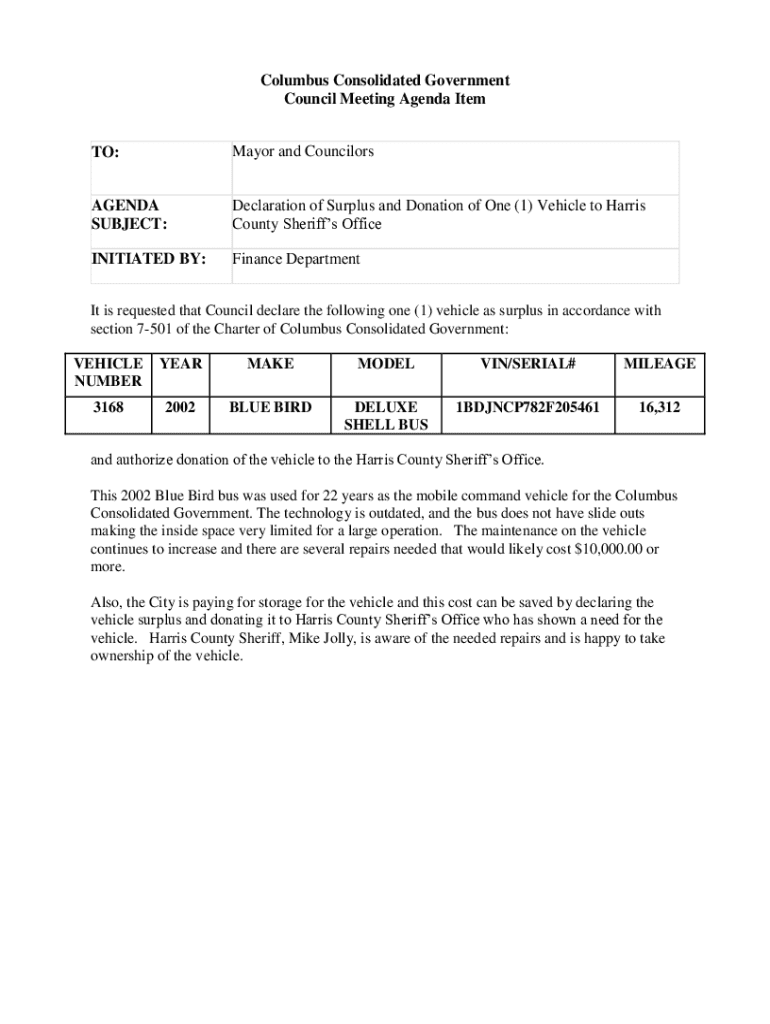

Detailed insights into the donation of surplus vehicle form

The donation of surplus vehicle form is crucial as it captures essential information necessary for both the donor and the charity. Its purpose goes beyond mere paperwork; it creates transparency and facilitates the proper handling of donated assets.

Key sections of the form typically include:

Completing the form accurately is vital for ensuring that the donation is processed efficiently. Miscommunication or errors on this form can delay the donation or prevent tax deductions from being recognized.

Tips for filling out the donation of surplus vehicle form

To ensure your form is filled out correctly, follow these best practices for accuracy:

Avoid common mistakes such as mislabeling vehicle conditions or omitting important information. Such oversights can complicate the donation process and potentially affect tax deductions related to your contribution.

Legal considerations

Understanding the legal ramifications of vehicle donation is critical. Tax implications can be substantial, such as eligibility for deductions that can reduce your taxable income. However, the IRS has specific guidelines for tax deductibility, making it essential to understand what records you need to maintain.

Required documentation usually involves providing a receipt from the charity or a tax-deductible donation letter. Furthermore, transferring ownership correctly is vital; this can typically be achieved by completing the title transfer, which outlines the new transferee’s information accurately to prevent ownership disputes later.

Enhancing your donation experience

Maximizing the impact of your vehicle donation involves not just the act of giving but also understanding its ramifications. Consider how your vehicle can best serve a charity's cause and potentially improve services for the community.

After making your donation, follow up with the charity to ensure you receive a tax receipt. This documentation is crucial for tax reporting and ensures that your generous contribution is recognized appropriately.

Interactive tools for simplifying the donation process

Online platforms, particularly pdfFiller, provide various interactive tools designed to streamline the vehicle donation process. Consider utilizing the following resources:

Employing these tools not only enhances the efficiency of the donation process but also helps alleviate common frustrations associated with paperwork.

Conclusion of the donation process

Completing the donation process correctly is paramount. Each step plays a vital role in ensuring that your generous contribution is effective and appreciated. By following proper procedures, you're not only helping a charity but also giving yourself the advantage of potential tax benefits.

Connect with agencies that facilitate vehicle donations for further assistance or queries. Their guidance can further streamline your experience and ensure your donation leads to a positive impact on the community.

Feedback and further assistance

After your vehicle donation, consider providing feedback to the charity about your experience. This not only aids the organization in improving its services but also helps other potential donors understand the process better.

Should you have questions or require further support throughout your donation journey, contact the designated representatives within the charity. They are often more than willing to assist in your efforts to make a difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send donation of surplus vehicl to be eSigned by others?

How do I execute donation of surplus vehicl online?

How do I make edits in donation of surplus vehicl without leaving Chrome?

What is donation of surplus vehicl?

Who is required to file donation of surplus vehicl?

How to fill out donation of surplus vehicl?

What is the purpose of donation of surplus vehicl?

What information must be reported on donation of surplus vehicl?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.