Get the free Annual Report of the Attorney General of the United States ...

Get, Create, Make and Sign annual report of form

Editing annual report of form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual report of form

How to fill out annual report of form

Who needs annual report of form?

Comprehensive Guide to the Annual Report of Form

Understanding the annual report form

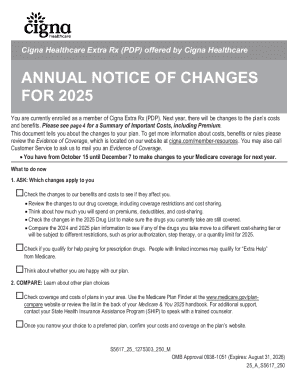

The annual report form is a crucial document that outlines a company’s performance over the past fiscal year. It not only serves to inform shareholders, employees, and the public about the firm’s financial health but also ensures transparency and accountability. This form typically includes financial statements, insights into company operations, and strategic objectives.

In the realm of business reporting, this document holds significant importance for several reasons. Firstly, it fulfills legal requirements set by regulatory bodies, ensuring companies adhere to standards of financial disclosure. Secondly, it facilitates effective communication with stakeholders by summarizing key developments and financial outcomes. Lastly, it enhances financial transparency, which builds trust and credibility among investors, employees, and the public.

Preparing to complete the annual report form

Before diving into the specifics of the annual report form, one must gather the essential documents and information necessary for a thorough and accurate report. Understanding what is required will streamline the filling process and minimize errors.

With these key documents gathered, you’ll be well-equipped to complete the annual report form in a manner that accurately reflects your firm’s performance.

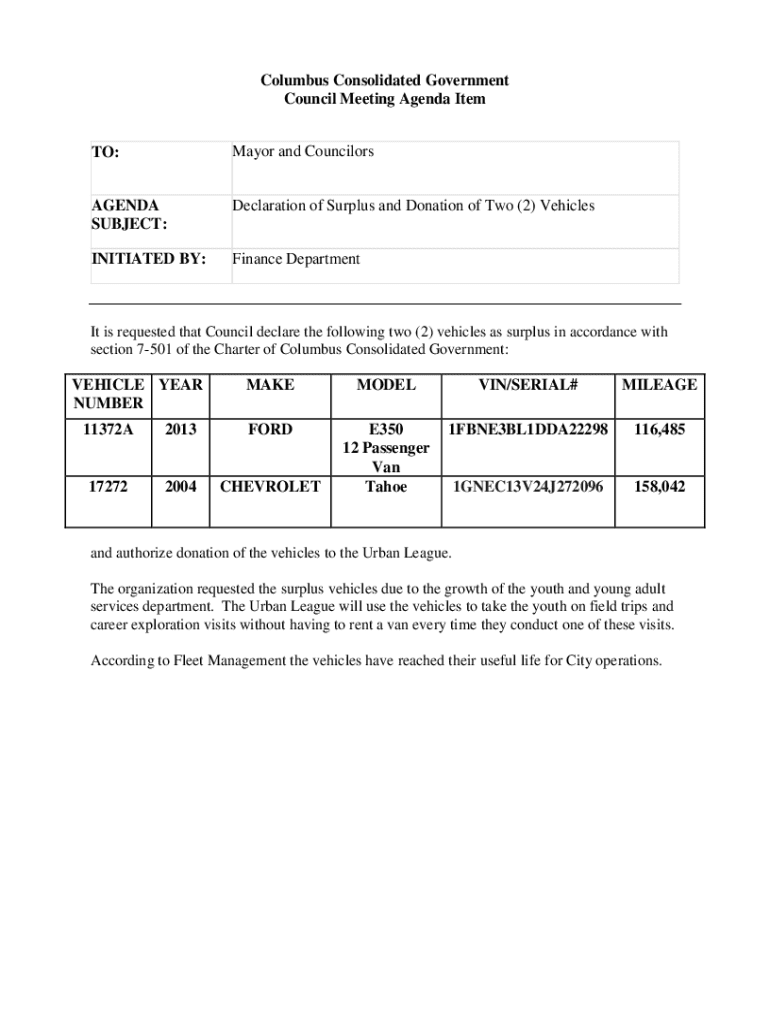

Detailed sections of the annual report form

The annual report form consists of several critical sections that offer a comprehensive view of your firm. Understanding these sections is vital for producing a complete and coherent report.

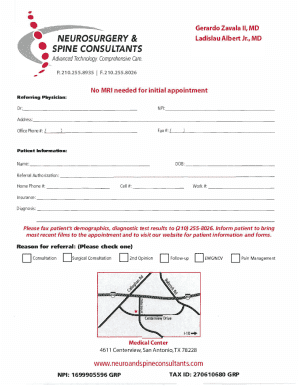

Part : Identity of the firm and contact persons

The first part requires detailed information about your organization, including the firm's name, address, and the identities of key contact persons such as the CEO or CFO. Ensuring accuracy in contact details is crucial for stakeholders attempting to reach out.

Part : General information concerning the report

This section encapsulates the reporting period under review, the objectives of this year’s report, and any notable changes in corporate structure or business model. Clearly stating these elements can set the tone for the rest of the document.

Part : General information concerning the firm

Here, you should provide the company’s history, mission statement, and core operations. It’s wise to include an executive summary of major achievements and challenges faced during the year as this helps contextualize the reported financial data.

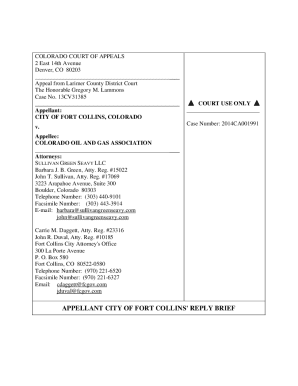

Part : Audit clients and audit reports

This part explains the nature of the audit process, emphasizing the importance of audit clients and the audit reports generated. Stakeholders often scrutinize these reports for transparency and reliability regarding the firm’s financial status.

Part : Offices and affiliations

Listing all business locations and affiliations provides clarity about the firm’s operational landscape. Understanding these aspects helps stakeholders appreciate the breadth of your company’s presence and potential influence.

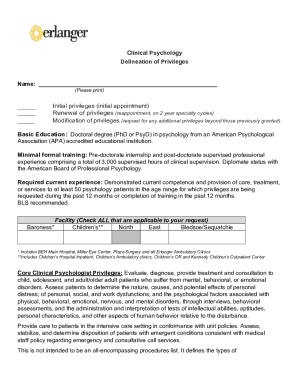

Part : Personnel

This section outlines key management and board personnel while also providing insights into any personnel changes that occurred during the year. Strong leadership can significantly impact strategic decisions and thus deserves emphasis.

Part : Certain relationships

Overviewing related-party transactions is essential in this part. Disclosing such relationships and understanding their implications on financial reporting demonstrates integrity and builds trust with stakeholders.

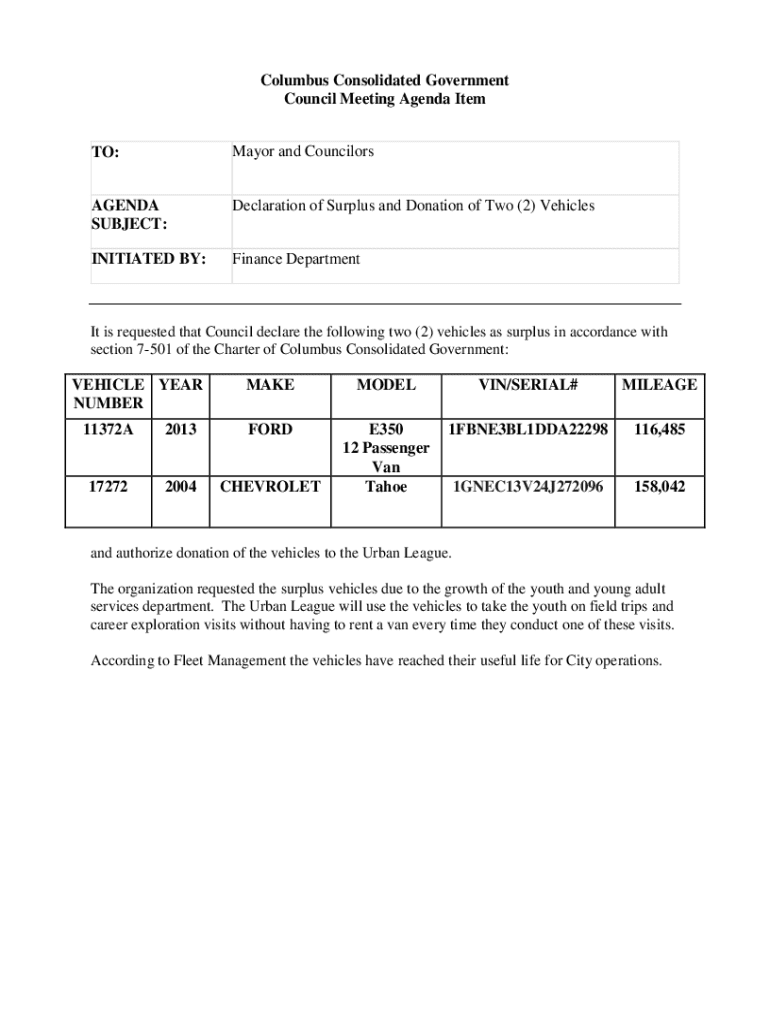

Part : Acquisition of another public accounting firm

If your firm acquired another entity during the reporting period, this section outlines the rationale, process, and the anticipated impact on stakeholders. It’s essential to clarify any potential reporting requirements that come with significant acquisitions.

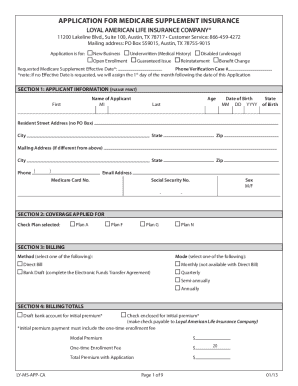

Filling out the annual report form

Completing the annual report form involves a series of systematic steps. Below are guidelines that will facilitate accuracy and ensure effective presentation.

Common mistakes to avoid during this process include misreporting financial data, providing unclear descriptions, and including incomplete or unverified information. Staying vigilant during the drafting stage can prevent these pitfalls and lead to a balanced and reliable report.

Editing and managing the annual report

After completing the initial draft, editing becomes crucial for a polished final product. Utilizing tools like pdfFiller aids this process significantly, allowing you to create, edit, and manage your document efficiently.

Efficiency in document management translates to a better experience as deadlines approach and keeps you organized to handle any last-minute changes or updates. Thus, leveraging such platforms pays off when finalizing the annual report.

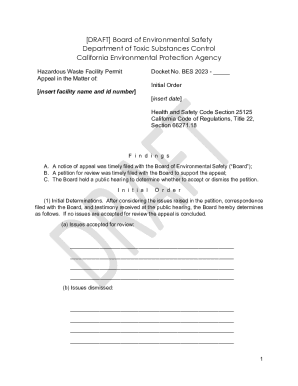

eSigning and finalizing the annual report form

Authenticity is a crucial aspect when dealing with documents like the annual report form. Utilizing eSigning capabilities ensures that all signatures are verifiably linked to the signatories, adding a layer of security and trust.

Upon signing, understanding submission formats and deadlines becomes critical. Ensure compliance with regulatory agencies, as to avoid any penalties or late submissions can negatively impact your firm's reputation in the market.

Frequently asked questions (FAQs)

Completing the annual report form can raise numerous questions regarding the process. For many individuals and teams, it’s beneficial to clarify key requirements and address common concerns. For instance, ensuring all financial data aligns with audit reports is crucial for compliance and transparency.

Addressing these FAQs not only facilitates smoother completion of the annual report form but also empowers users to navigate potential hurdles with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the annual report of form in Gmail?

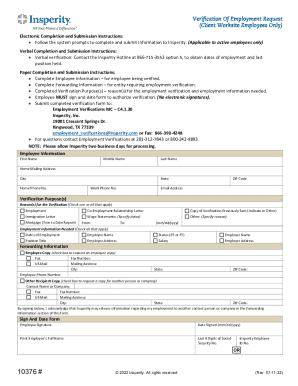

How do I fill out annual report of form using my mobile device?

Can I edit annual report of form on an iOS device?

What is annual report of form?

Who is required to file annual report of form?

How to fill out annual report of form?

What is the purpose of annual report of form?

What information must be reported on annual report of form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.