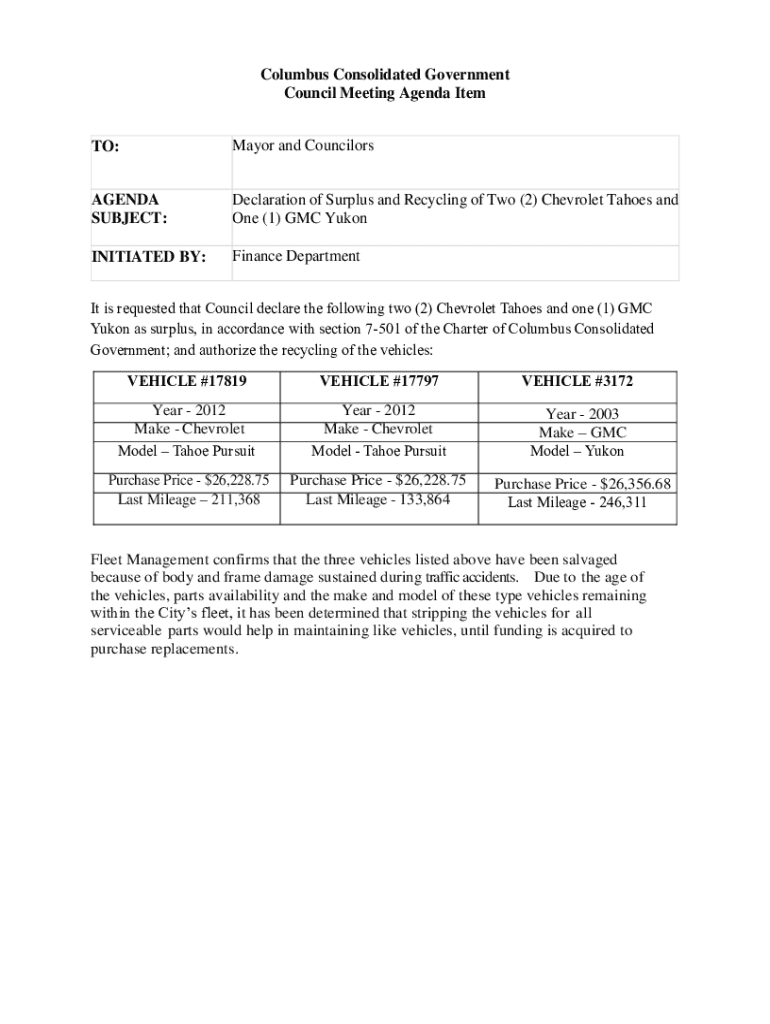

Get the free Declaration of Surplus and Recycling of Two (2) Chevrolet Tahoes and

Get, Create, Make and Sign declaration of surplus and

How to edit declaration of surplus and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration of surplus and

How to fill out declaration of surplus and

Who needs declaration of surplus and?

Declaration of Surplus and Form: A Comprehensive How-to Guide

Understanding the declaration of surplus

A declaration of surplus refers to the formal announcement that certain assets have exceeded their useful value or capacity for an organization or individual. These surplus assets can include equipment, furniture, or any property that is no longer needed or has depreciated significantly. The declaration serves as a clear identification of surplus items that will be accounted for in financial statements or disposed of properly.

The primary purpose of the declaration is to facilitate the effective management of resources. For individuals or organizations, this is critical for maximizing efficiency and ensuring financial transparency. Legally, the declaration establishes a framework to account for surplus assets and enables compliance with regulatory requirements.

Key terminology associated with surplus declarations includes: - Surplus assets: Items that exceed the necessary value for current operations. - Depreciation: A reduction in the book value of an asset over time, often reflecting its obsolescence or physical deterioration. - Inventory management: The process of overseeing and controlling the assets that an organization holds, including surplus items.

Overview of the surplus declaration process

The surplus declaration process involves specific steps that individuals or organizations must follow when they have identified assets to declare as surplus. Knowing when to utilize the surplus declaration form is crucial; it is generally used when there is a need to dispose of, sell, or donate assets that are no longer necessary. Common scenarios include organizational restructuring, major upgrades to equipment, or asset replacement strategies.

Both individuals and organizations are responsible for filing surplus declarations. Individuals managing personal assets may need to declare surplus items for tax purposes or when selling personal property. Organizations, on the other hand, must adhere to formal protocols, ensuring that all relevant stakeholders, including finance and legal teams, verify and approve the declarations.

The surplus declaration form: A comprehensive guide

Completing the surplus declaration form requires attention to detail and accuracy. Each section of the form must be filled out thoughtfully. Essential sections typically include personal information, descriptions of surplus assets, and asset valuation. It’s important to provide accurate details to avoid discrepancies during the review process.

When filling out the form, start with personal or organizational information. Clearly articulate the description of each surplus item, including its condition and relevant history. Valuation is critical; accurately assess the worth of surplus items, considering factors like depreciation. Optional information may include photographs or supplementary notes that can aid in the review process.

Common mistakes to avoid include submitting an incomplete declaration, which can lead to delays in processing, or misclassifying assets, risking penalties or fines. Adhering to guidelines and ensuring clarity in each section will streamline the process.

Tools for filling out the declaration of surplus form

Utilizing effective tools can significantly ease the burden of completing a declaration of surplus. For instance, pdfFiller offers features tailored to simplify document editing. Users can easily fill in required fields, add signatures, and collaborate in real-time. To utilize pdfFiller, simply upload your surplus declaration form and begin editing.

eSigning the declaration holds multiple benefits, particularly for remote teams. It expedites the approval process and ensures secure signing, offering an authenticated alternative to handwritten signatures. pdfFiller makes eSigning straightforward; users can sign digitally using a mouse, stylus, or by uploading a scanned signature.

Interactive tools available through pdfFiller enhance user experience further. Features such as auto-fill options help reduce repetitive entry of similar data, while quick calculations for asset valuations save time and minimize errors.

Submitting your declaration of surplus

Submitting your surplus declaration requires understanding your options as well as relevant deadlines. Online submissions are often preferred in today’s digital age, providing instant delivery and tracking capabilities. Paper submissions, while less common, are still accepted but can slow the process.

Awareness of important deadlines is crucial. Each jurisdiction may have different timelines for when surplus declarations must be submitted, so checking local regulations will ensure compliance. Once submitted, you can expect a review process, during which authorities will assess your declaration. Tracking your submission status will help you stay informed about any additional steps needed.

Managing your surplus declaration documents

Effective document management is essential after submitting your declaration of surplus. Organize your digital files systematically to enhance accessibility and traceability. Creating folders for different categories of surplus items, or maintaining a chronological archive of declarations, can simplify retrieval during audits or reviews.

Using cloud-based platforms such as pdfFiller allows access to your documents from anywhere. This flexibility is particularly beneficial for teams that operate remotely or need to reference documents away from the office. Collaboration features enable sharing options and outline permissions, ensuring that team members can view or edit documents based on assigned rights.

FAQs about the declaration of surplus

Addressing questions about surplus declarations is important for clarity. Common inquiries include the process for amending a declaration or how to retrieve past declarations. Typically, amendments can be made by submitting an updated form along with a note of explanation. To retrieve a past declaration, most jurisdictions maintain archives if forms were submitted properly, allowing for review of previous declarations.

For further guidance, consulting local authorities can provide clarification regarding specific local requirements. Regulatory guidelines are often outlined on municipal websites, ensuring that all parties involved have access to pertinent information.

Contact information for support

If you need help with pdfFiller or have questions regarding your surplus declaration, several customer service channels are available. Typically, direct lines, email support, and live chat options can provide quick assistance, ensuring that users can resolve issues effectively.

Additionally, if your inquiry is legal in nature or involves complex scenarios surrounding declarations, consulting a legal professional may be warranted. Part of this process may involve reading the local legislation and understanding compliance standards specific to your jurisdiction.

Special cases in surplus declaration

Certain types of surplus assets, such as furniture and electronic equipment, may require special consideration when declaring them. For instance, when dealing with electronic waste, it’s essential to follow local regulations for disposal or recycling. Many jurisdictions enforce strict guidelines for e-waste disposal to protect the environment. Organizations should leverage responsible recycling programs or document destruction services to ensure compliance.

Environmental considerations cannot be overlooked. Sustainability practices in surplus declarations can extend beyond compliance; they can enhance an organization's image and demonstrate leadership in corporate responsibility. By adopting sustainable methods in asset management, organizations can contribute positively to their community and comply with environmental regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find declaration of surplus and?

How do I execute declaration of surplus and online?

How do I edit declaration of surplus and straight from my smartphone?

What is declaration of surplus?

Who is required to file declaration of surplus?

How to fill out declaration of surplus?

What is the purpose of declaration of surplus?

What information must be reported on declaration of surplus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.