Get the free Declaration of Surplus and Donation of Two (2) Vehicles

Get, Create, Make and Sign declaration of surplus and

How to edit declaration of surplus and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration of surplus and

How to fill out declaration of surplus and

Who needs declaration of surplus and?

Declaration of Surplus and Form: A Comprehensive Guide

Overview of declaration of surplus

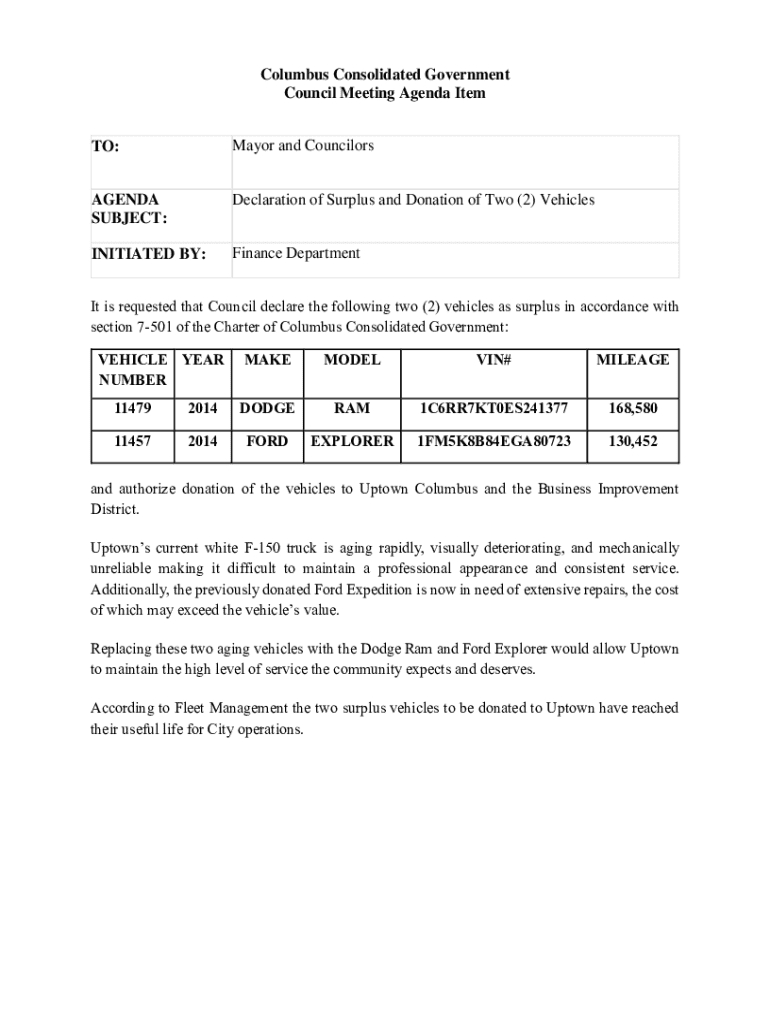

A declaration of surplus refers to the formal process of identifying and documenting surplus assets that an organization or individual no longer requires. The importance of this declaration lies in ensuring transparency and accountability, particularly in organizations that must adhere to strict financial and legal standards. Surplus declarations help manage inventory effectively and assist in decision-making related to asset disposal, donation, or repurposing.

Common scenarios necessitating surplus declarations include end-of-year asset audits, inventory clearances, or organizational downsizings. In these situations, proper documentation through a surplus declaration form not only streamlines the process but also fulfills any legal obligations. Organizations may be required to maintain records of their assets for compliance purposes, making surplus documentation vital.

In terms of legal and organizational context, surplus declarations are primarily governed by accounting principles and organizational policies. Nonprofits, government agencies, and corporations often have specific guidelines that dictate how surplus items should be declared and disposed of, thereby reinforcing the need for proper procedures.

Understanding the surplus declaration form

The surplus declaration form serves as an essential document for reporting surplus assets. This form is typically structured to capture detailed information about the asset, including its identification, value, and intended method of disposal. Filling out the form carefully helps ensure clear communication within the organization and compliance with any relevant laws or regulations.

Key components of the surplus declaration form include:

Accurate and complete information on this form is crucial. An incomplete declaration could lead to compliance issues, potential financial discrepancies, or ineffective asset management.

Step-by-step guide to completing the declaration of surplus form

Completing the declaration of surplus form requires careful attention to detail. The following steps outline the key actions needed to effectively complete the form.

Managing surplus declarations with pdfFiller

pdfFiller simplifies the surplus declaration process with its robust tools designed for efficiency and ease of use. With pdfFiller, users can edit PDFs seamlessly, eSign documents, and collaborate with team members in real-time, all from a single, cloud-based platform. This integration enhances the workflow efficiency of surplus declarations while ensuring compliance.

Moreover, pdfFiller offers integration with e-signature solutions for quick approvals, streamlining the process further. The collaboration features facilitate communication among team members, ensuring that every input is accounted for in the declaration.

Frequently asked questions about surplus declarations

Individuals and organizations may encounter challenges while declaring surplus items. Common challenges include understanding legal requisites, particularly concerning the valuation process and disposal methods. Organizations are often required to adhere to state and federal guidelines which can vary significantly, adding another layer of complexity.

A common question relates to the duration for processing a surplus declaration. Processing times can vary depending on the complexity of the assets involved and the organization’s internal procedures. It is essential to be aware of specific guidelines to anticipate timeframes effectively.

Additional information relevant to surplus management

Best practices for inventorying surplus assets can play a significant role in managing surplus declarations. Regular audits and assessments ensure that organizations maintain an up-to-date inventory, allowing them to identify surplus items proactively.

Furthermore, exploring options for repurposing or donating surplus items is both a responsible and sustainable approach. Many organizations opt to give surplus assets to charities, which can be beneficial for tax purposes as well. Guidelines on waste disposal and environmental considerations are also increasingly critical, urging organizations to consider sustainable options when disposing of non-usable items.

Contact information and support

For any questions or guidance regarding the declaration of surplus, pdfFiller's support team is readily available to assist. Users can access a range of helpful resources within pdfFiller for related forms and templates, ensuring comprehensive support.

Links to other relevant form templates and resources are also conveniently provided on the pdfFiller website, promoting a streamlined approach to managing not just surplus declarations but all forms and documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my declaration of surplus and directly from Gmail?

How do I edit declaration of surplus and online?

How do I complete declaration of surplus and on an iOS device?

What is declaration of surplus and?

Who is required to file declaration of surplus and?

How to fill out declaration of surplus and?

What is the purpose of declaration of surplus and?

What information must be reported on declaration of surplus and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.