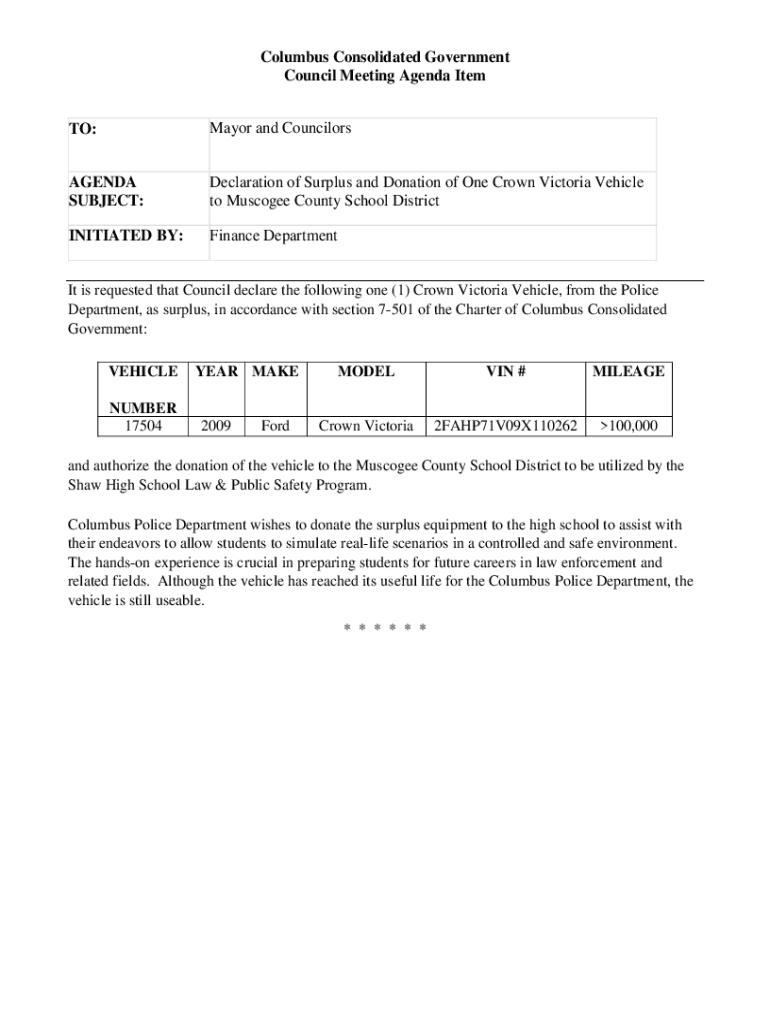

Get the free Declaration of Surplus and Donation of One Crown Victoria Vehicle

Get, Create, Make and Sign declaration of surplus and

Editing declaration of surplus and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration of surplus and

How to fill out declaration of surplus and

Who needs declaration of surplus and?

Understanding the Declaration of Surplus and Form

Understanding the declaration of surplus

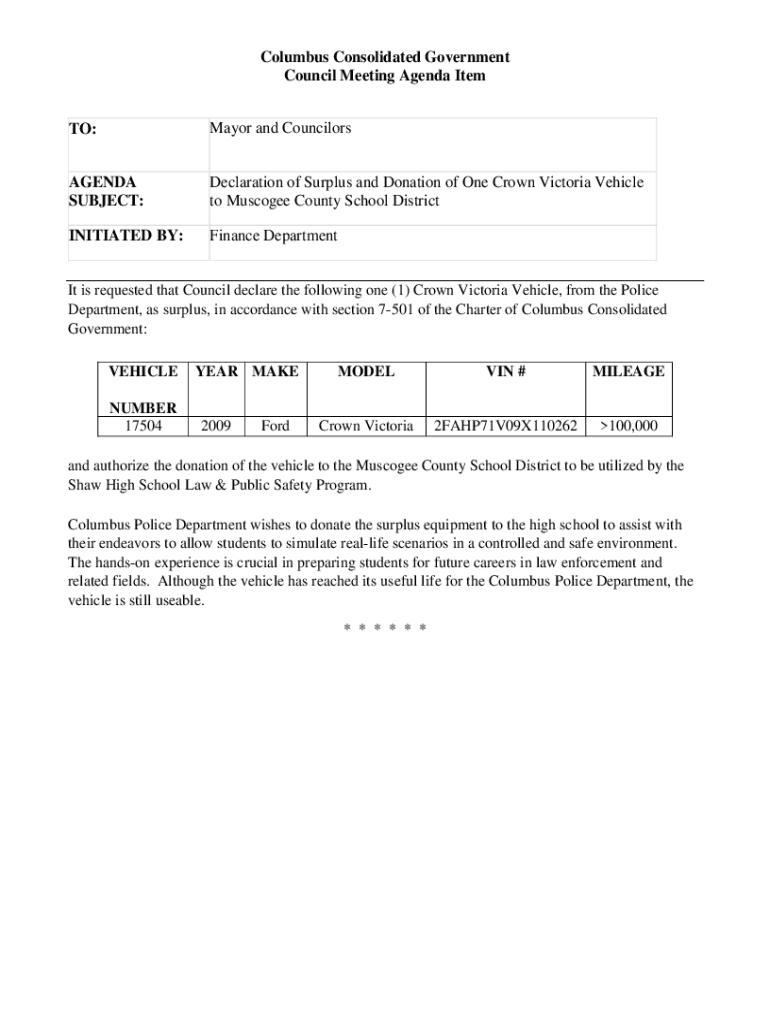

A declaration of surplus is a formal statement indicating that a person or organization has determined its assets, resources, or funds exceed current needs or requirements. This document serves several purposes, including reporting excess financial resources, physical properties, or materials that can be repurposed or sold. The primary aim of a surplus declaration is accountability and transparency, ensuring that stakeholders are informed about the organization’s resources.

For individuals and organizations alike, the declaration of surplus is not merely a procedural formality; it also plays a critical role in financial planning and resource management. By detailing surplus resources, entities can make informed decisions about asset management, promotional opportunities, and future budgeting. This declaration can also be essential for audits, regulatory compliance, and attracting investment or funding.

Who needs to file a declaration of surplus?

Various actors may need to file a declaration of surplus, including non-profits, corporations, governmental entities, and sometimes individuals. Organizations mandated to report their financial health for tax compliance or state funding may commonly file this declaration. Moreover, businesses that regularly assess their inventory, equipment, or financial reserves for surplus are often subject to this requirement.

Failure to file a surplus declaration can have significant legal and financial implications. For businesses, neglecting to report surplus assets can lead to misleading financial statements, potentially resulting in penalties or audits. For individuals, not documenting surpluses can negatively affect their ability to receive grants or loans for future financial planning.

Navigating the surplus declaration form

The surplus declaration form is typically a structured document that includes several key sections designed to collect essential information about the declared surplus. Common sections often encompass the personal information of the declarant, a detailed description of the surplus items, the reasons for declaring these surpluses, and an acknowledgment space for signatures.

It’s worth noting that variations in surplus declaration forms may occur across different jurisdictions and organizations, reflecting local legal requirements and specific organizational policies. For instance, the form used by a local government agency might differ from that of a private corporation, especially regarding the documentation and justification required.

Accessing the surplus declaration form

To get started with a declaration of surplus, accessing the appropriate form is crucial. Most organizations and government entities offer their surplus declaration forms online. Start by locating the official website relevant to your jurisdiction or organization to ensure you are using the correct form. You may find these forms under sections related to finance or compliance.

After locating the correct form, download it in a format that suits your needs, often as a PDF. Here’s a simple step-by-step guide to help you through this process:

Detailed instructions for filling out the surplus declaration form

When preparing to fill out the surplus declaration form, consider gathering all required documentation that supports your declaration. This could include inventory lists, financial statements, or any relevant supporting documents. Following a structured approach ensures completeness and compliance, crucial for the declaration process.

Here’s a detailed walkthrough of each section of the surplus declaration form:

Common mistakes to avoid

To ensure that your surplus declaration form progresses smoothly through the review process, be vigilant about potential errors. Incomplete forms result in delays, which can disrupt your intended plans. Double-check each section against your supporting documents for consistency. Additionally, consult a checklist to confirm all requirements are met.

If you make an error on the form, don’t panic. Most jurisdictions allow for amendments or resubmissions. Should you encounter issues, it’s advisable to reach out to the reviewing authority directly for guidance.

Editing and managing your surplus declaration

After drafting your surplus declaration, review the entire document for clarity and accuracy. Using tools like pdfFiller can greatly facilitate this process, allowing you to edit, add, or remove content quickly and efficiently without having to start from scratch. Be sure to utilize any collaboration features that pdfFiller offers, which can enable smooth feedback and input from team members.

Here’s how to edit your surplus declaration form effectively using pdfFiller tools:

Signing and submitting your declaration

In today’s digital era, adopting electronic signatures is pivotal. eSigning your surplus declaration not only enhances the document's acceptance but also expedites the review process. With pdfFiller, applying an electronic signature is straightforward. Follow these steps to ensure your document is duly signed:

Regarding submission, it is crucial to understand the different methods by which you can send your declaration. Many organizations accept online submissions via their portals, while others may require mail or personal delivery. Familiarize yourself with submission deadlines to ensure compliance.

Post-submission: tracking and managing your declaration

After submitting your declaration of surplus, the review process will commence, often conducted by a designated authority within your organization or municipality. Knowing how to track your submission status can help alleviate uncertainty. pdfFiller offers features that streamline this, allowing you to check where your form is in the review queue.

Should you receive notices or feedback on your submitted declaration, it’s essential to remain proactive. If follow-up actions are requested, attend to them promptly. In the event you need to amend the declaration based on feedback, pdfFiller provides tools for seamless editing and re-resubmission.

Additional information and support

If you have specific questions regarding your surplus declaration, know where to seek help. Most organizations have dedicated resource channels for inquiries about documentation, compliance, and process details. Consider reaching out via email or utilizing FAQ sections found on organizational websites.

Furthermore, pdfFiller ensures that users have access to a range of tools and support channels specifically designed for document management. Whether through tutorials, online chat, or community forums, assistance is readily available.

For those looking to maximize their use of pdfFiller for diverse forms, exploring tutorials and user documentation can be highly beneficial. Familiarize yourself with related forms that may aid in other administrative tasks.

Real-life applications and testimonials

Success stories offer profound insights into effective filing practices for surplus declarations. A corporation might have streamlined its inventory process, ensuring fewer redundant items through strategic surplus declarations. Another example might include a non-profit that successfully allocated surplus resources to community programs through clearly documented declarations.

User testimonials vary but consistently highlight the efficiency and ease of use associated with pdfFiller. Organizations have reported smoother filing experiences and improved compliance rates by utilizing pdfFiller's capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my declaration of surplus and in Gmail?

How do I edit declaration of surplus and online?

How do I make edits in declaration of surplus and without leaving Chrome?

What is declaration of surplus?

Who is required to file declaration of surplus?

How to fill out declaration of surplus?

What is the purpose of declaration of surplus?

What information must be reported on declaration of surplus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.