Get the free One (1) 2026 E350 Transit Van For The Columbus Fire ...

Get, Create, Make and Sign one 1 2026 e350

Editing one 1 2026 e350 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out one 1 2026 e350

How to fill out one 1 2026 e350

Who needs one 1 2026 e350?

Everything You Need to Know About the One 1 2026 E350 Form

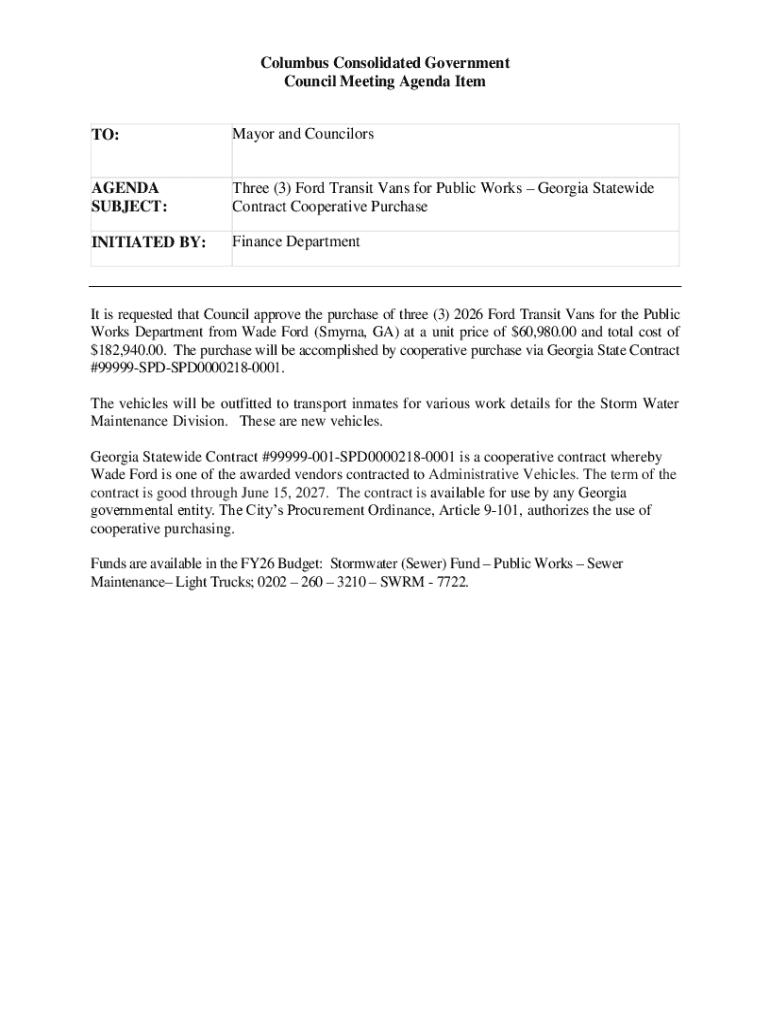

Overview of the One 1 2026 E350 Form

The One 1 2026 E350 Form is a crucial document designed to address specific needs within tax or legal frameworks. Its purpose is to collect essential information that can support an individual's or entity's compliance with regulatory requirements. This form is especially important for individuals or organizations that must report or disclose certain financial, operational, or demographic data.

Typically, this form is required by businesses, non-profits, or professionals seeking to maintain proper documentation for tax purposes or other legal obligations. Understanding the nuances of this form can help ensure that users avoid potential fines or legal complications.

Key features of the One 1 2026 E350 Form

The One 1 2026 E350 Form consists of several key components that facilitate its purpose. These sections cover a range of critical information such as personal or business identification, financial disclosures, and compliance confirmation. Each field within the form plays a vital role in ensuring complete and accurate reporting.

Understanding the important dates associated with this form is equally critical. Most users need to submit the One 1 2026 E350 Form annually, aligned with their fiscal year-end. Specific deadlines might vary, so checking with relevant authorities or the issuing agency can guarantee timely fulfillment.

Step-by-step guide to completing the One 1 2026 E350 Form

Completing the One 1 2026 E350 Form efficiently requires thorough preparation. Start by gathering necessary documents—these may include tax returns from previous years, financial statements, and identification credentials. Collecting these prior to beginning the form will streamline the process.

Next, head over to pdfFiller to access the One 1 2026 E350 Form. You can find it directly by searching on the pdfFiller website, making downloading and filling out the form convenient.

While filling out the form, pay special attention to each section. Personal information typically needs to be filled out accurately, including full names, addresses, and relevant account numbers. Financial details should align with the most recent fiscal data. Double-checking for common mistakes, such as misentering figures or leaving blanks, can save a lot of time down the road.

After completing the form, review it thoroughly. A checklist for accuracy can help verify that all sections are completed properly, including ensuring that the correct formatting is used and that required signatures are included for compliance.

Editing and customizing the One 1 2026 E350 Form on pdfFiller

Once you have access to the One 1 2026 E350 Form through pdfFiller, editing it becomes an intuitive process thanks to the platform's comprehensive tools. Users can modify any PDF text or images directly within the platform, which is invaluable for ensuring that the document meets personal or organizational standards.

Moreover, pdfFiller allows you to add annotations and comments, providing context or additional explanations that may be required. These features are especially auspicious for group submissions where several stakeholders may need to collaborate.

To ensure compliance with regulations, it is crucial to keep in mind the guidelines associated with the form. Regularly consult the official instructions to verify that your modifications don't breach legal protocols.

Signing the One 1 2026 E350 Form

Submitting the One 1 2026 E350 Form often requires signatures from relevant parties. Fortunately, pdfFiller provides multiple e-signing options that make this process exceptionally seamless. Users can electronically sign the document without needing to print it out, saving both time and resources.

The legal validity of e-signatures is well-established, making them a convenient choice for modern document management. Additionally, if the input from multiple parties is necessary, pdfFiller enables collaboration to gather all required signatures efficiently.

Management of the One 1 2026 E350 Form

Proper management of the One 1 2026 E350 Form post-submission is equally important. Ensure that you store your completed form in a secure location, whether through pdfFiller’s cloud storage or another reliable platform. This not only facilitates easy access but also guarantees the safety of sensitive information.

Tracking the status of your submissions can also provide peace of mind. Use tools within pdfFiller to monitor when forms are reviewed or approved, allowing you to keep your records up-to-date.

Troubleshooting common issues with the One 1 2026 E350 Form

Even with the best intentions, issues can arise when completing the One 1 2026 E350 Form. A commonly asked question revolves around what to do if an error is discovered after submission. In such cases, promptly reaching out to the relevant agency can often resolve issues or provide guidance on necessary corrections.

Frequently asked questions often include concerns about filing deadlines and the consequences of late submissions. Staying informed about these details is essential to prevent potential penalties associated with late filings.

Benefits of using pdfFiller for your One 1 2026 E350 Form needs

Choosing pdfFiller as your go-to platform for managing the One 1 2026 E350 Form offers several advantages. The accessibility of the platform allows users to fill out forms easily from anywhere, which is particularly valuable for those who may be on the go or without immediate access to a printer.

Moreover, pdfFiller enhances collaboration among team members. Users can easily share documents, gather multiple inputs, and receive quick feedback, which is essential in a team-driven environment.

Exploring additional features related to form management

pdfFiller not only caters specifically to the One 1 2026 E350 Form but also integrates seamlessly with various other platforms, enhancing overall document management workflows. This interoperability ensures that users can connect their other tools, like cloud storage or project management systems, for smoother operations.

Additionally, staying updated with evolving regulatory requirements and digital document trends can ensure your organization's compliance and effectiveness. pdfFiller continually adapts, making it a future-proof solution for your documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete one 1 2026 e350 online?

How can I edit one 1 2026 e350 on a smartphone?

How do I edit one 1 2026 e350 on an Android device?

What is one 1 2026 e350?

Who is required to file one 1 2026 e350?

How to fill out one 1 2026 e350?

What is the purpose of one 1 2026 e350?

What information must be reported on one 1 2026 e350?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.