Get the free FY24 Sec

Get, Create, Make and Sign fy24 sec

How to edit fy24 sec online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fy24 sec

How to fill out fy24 sec

Who needs fy24 sec?

Comprehensive Guide to the FY24 SEC Form: Everything You Need to Know

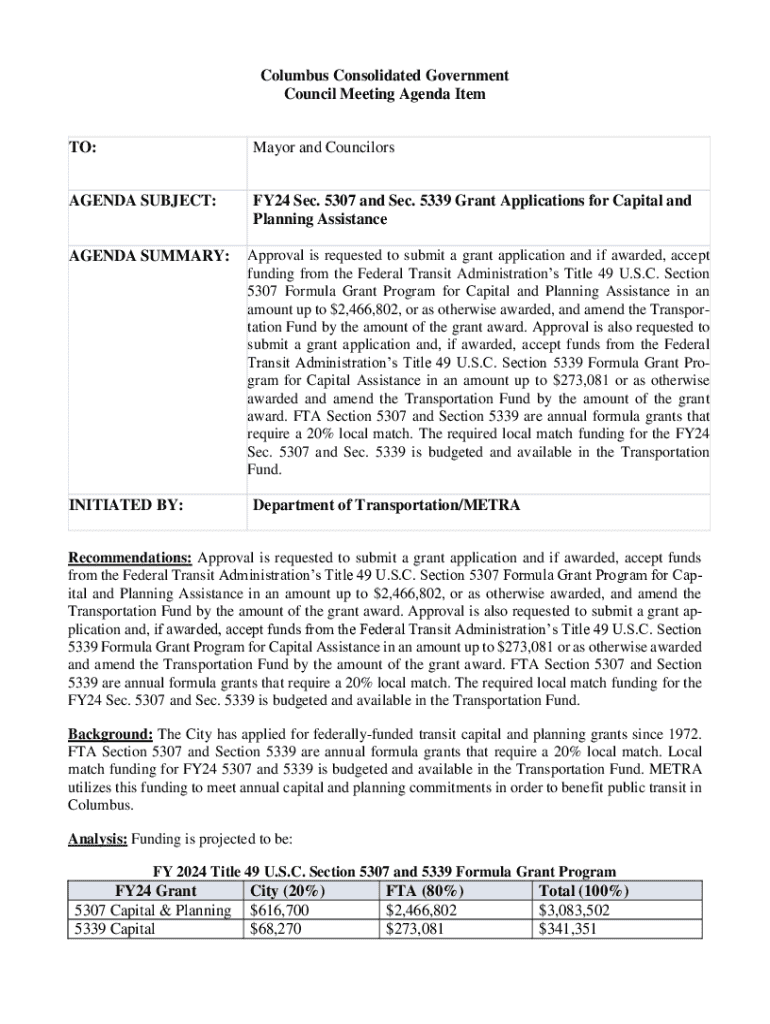

Understanding the FY24 SEC Form

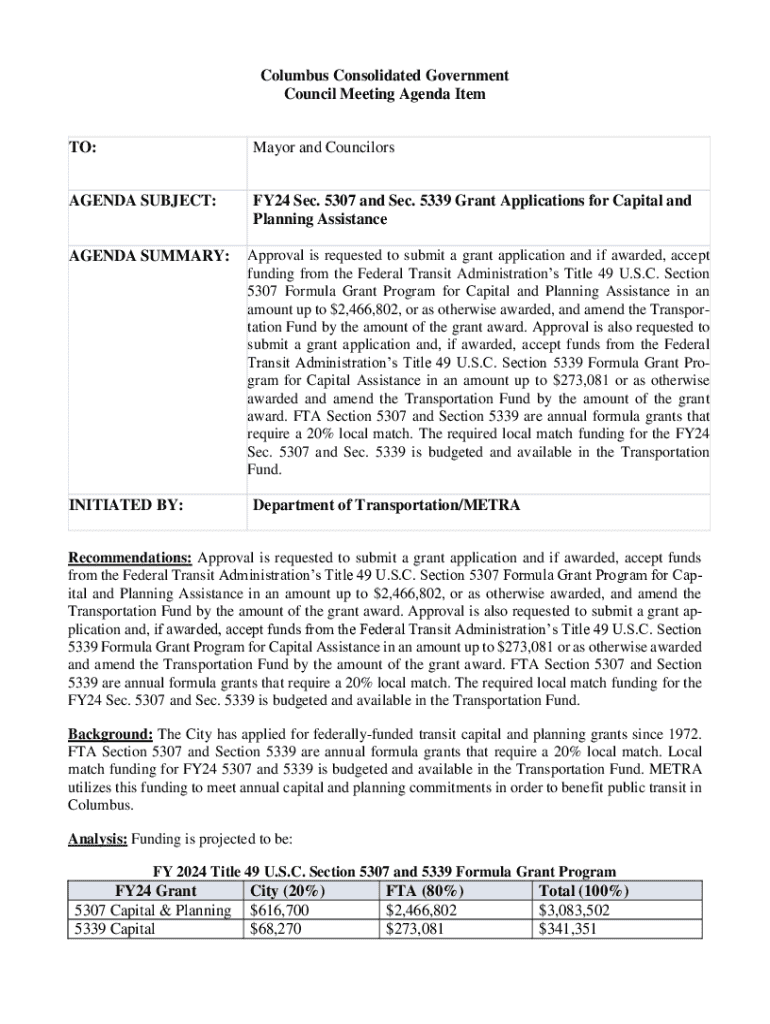

The FY24 SEC Form is a crucial document used by public companies to report their financial information to the U.S. Securities and Exchange Commission (SEC). This form plays a significant role in ensuring transparency and accountability within the financial markets. It helps regulate the integrity of financial reporting, allowing investors and stakeholders to make informed decisions based on accurate and timely information.

In addition to standard financial disclosures, the FY24 SEC Form outlines trends, risks, and future projections that are vital for stakeholders. As companies navigate regulatory landscapes, understanding the nuances of this form becomes paramount for compliance and strategic planning.

Key changes from previous years

Every fiscal year, the SEC introduces updates and modifications to improve the robustness of financial disclosures. For FY24, notable changes may include altered reporting timelines, enhanced risk factor disclosures, and updates to management discussion and analysis sections. These changes are designed to provide investors with better insights into companies’ performance and future expectations.

Filers need to be aware of these modifications, as they could significantly impact how financial information is presented. For instance, the new risk disclosures might require companies to delve deeper into potential administrative and operational risks, reflecting an evolving economic landscape.

Who needs to file the FY24 SEC Form?

The FY24 SEC Form is mandatory for all publicly traded companies listed on stock exchanges. These entities are defined as those offering securities to the public and who meet certain asset thresholds. Smaller reporting companies and foreign companies listed in the U.S. might also need to file this form, albeit with some differences in detailed requirements.

However, certain exemptions exist. For instance, private companies, non-profits, and those below the asset thresholds are generally excluded from this filing requirement. Understanding who qualifies for filing is vital, as non-compliance can lead to significant penalties and impact investor trust.

Importance for investors and stakeholders

The FY24 SEC Form significantly influences investment decisions. Accurate and timely financial disclosures help investors assess the viability of their investments, leading to more informed market choices. This transparency fosters greater confidence among the investing public.

For stakeholders, including creditors, suppliers, and employees, the information contained in the FY24 SEC Form serves as an essential tool for evaluating risk and strategic direction, influencing their actions and expectations.

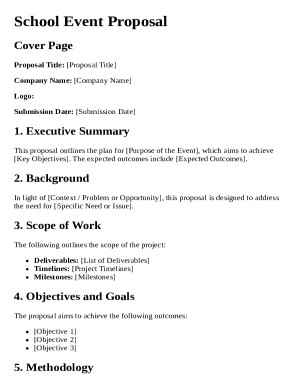

Step-by-step guide to completing the FY24 SEC Form

Filing the FY24 SEC Form requires meticulous preparation. Start by gathering necessary documents such as income statements, balance sheets, and previous SEC filings. The timeline for submission is critical; companies often have specific deadlines that vary depending on their size and type. Understanding this timeline allows firms to work within the allotted framework and avoid penalties.

Section-by-section breakdown

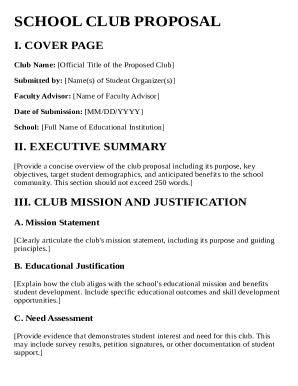

1. Company Information: Ensure all required details such as the company's legal name, address, and SEC file number are correctly entered. Accurate information is crucial to avoid delays.

2. Financial Statements: Disclosures must align with GAAP standards, providing details like revenue, expenses, and earnings. Investors will closely scrutinize these figures, so accuracy is paramount.

3. Management Discussion and Analysis (MD&A): This section allows management to explain the company's financial situation in their own words, highlighting critical areas like liquidity and cash flows.

4. Risk Factors: Firms are required to identify the risks that could impact their performance. This includes operational, market, and regulatory risks.

5. Other Required Information: This includes disclosures on governance, compensation, and any changes in the company’s financial situation.

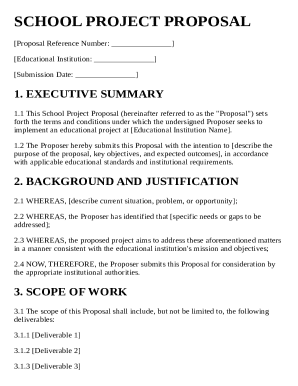

Editing and finalizing your FY24 SEC Form

Once you complete the form, the next step is to ensure it is free from errors and meets all regulatory requirements. Utilizing platforms like pdfFiller can streamline editing and formatting processes. This cloud-based solution provides tools for real-time editing, enabling teams to collaborate effectively from different locations.

Reviewing your form for accuracy is essential; this includes checking numerical entries, disclosures, and compliance with SEC guidelines. Common mistakes to avoid include leaving sections blank, inconsistencies in data, and failing to include necessary disclosures. Conducting a peer review or consulting a tax advisor can help ensure everything is correctly reported.

eSigning the FY24 SEC Form

Electronic signatures have become a standard part of the filing process. To eSign your document using pdfFiller, follow the straightforward step-by-step process outlined in the platform. This adds convenience while maintaining compliance.

It’s crucial to understand that eSignatures are considered legally valid under the E-SIGN Act and similar state laws. Collaborating with team members during this process is also vital — shared tools within pdfFiller enable seamless document revisions before finalization.

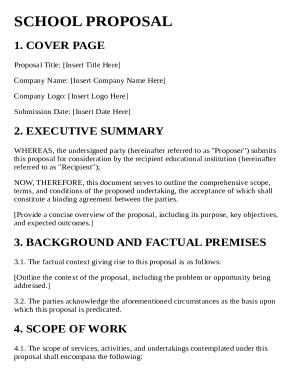

Submitting the FY24 SEC Form

All submissions of the FY24 SEC Form must comply with SEC guidelines, whether submitted electronically or via paper filing. For electronic submissions, filers should utilize the SEC’s EDGAR system, ensuring they understand the applicable deadlines, which often vary based on company size.

Confirming your submission is critical to avoid complications. Filers should keep an eye on their portal for confirmation messages. In case of submission issues, knowing the correct steps to resolve them is beneficial for timely rectification.

Managing your FY24 SEC Form after submission

Post-submission, it is crucial to keep track of filing status. Companies can employ various tools to manage and track their filings effectively. Maintaining accurate records aids in compliance and simplifies future filings.

If any information requires amending after submission, companies should understand the necessary steps. This includes notifying the SEC and re-filing corrected information promptly, thus ensuring ongoing compliance and transparency.

Resources for further information

The SEC provides a wealth of regulatory guidance concerning the FY24 SEC Form, accessible on their website. Filers can find official resources, including instructions and templates, which can be invaluable during the reporting process.

Additionally, pdfFiller hosts a multitude of features aimed at simplifying ongoing filing needs. This includes additional templates and the capability to manage various document forms effectively, ensuring users can handle their compliance obligations without hassle.

FAQs about the FY24 SEC Form

Common queries surrounding the FY24 SEC Form often relate to submission requirements, filing deadlines, and amendments. These frequently asked questions often aim to clear up confusion around complex regulations and ensure that filers are fully aware of their obligations.

For further assistance, the SEC’s website offers vast resources and contact points for additional help. Utilizing these aids ensures that individuals and teams remain informed and prepared during the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fy24 sec without leaving Google Drive?

How do I complete fy24 sec online?

How do I edit fy24 sec on an iOS device?

What is fy24 sec?

Who is required to file fy24 sec?

How to fill out fy24 sec?

What is the purpose of fy24 sec?

What information must be reported on fy24 sec?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.