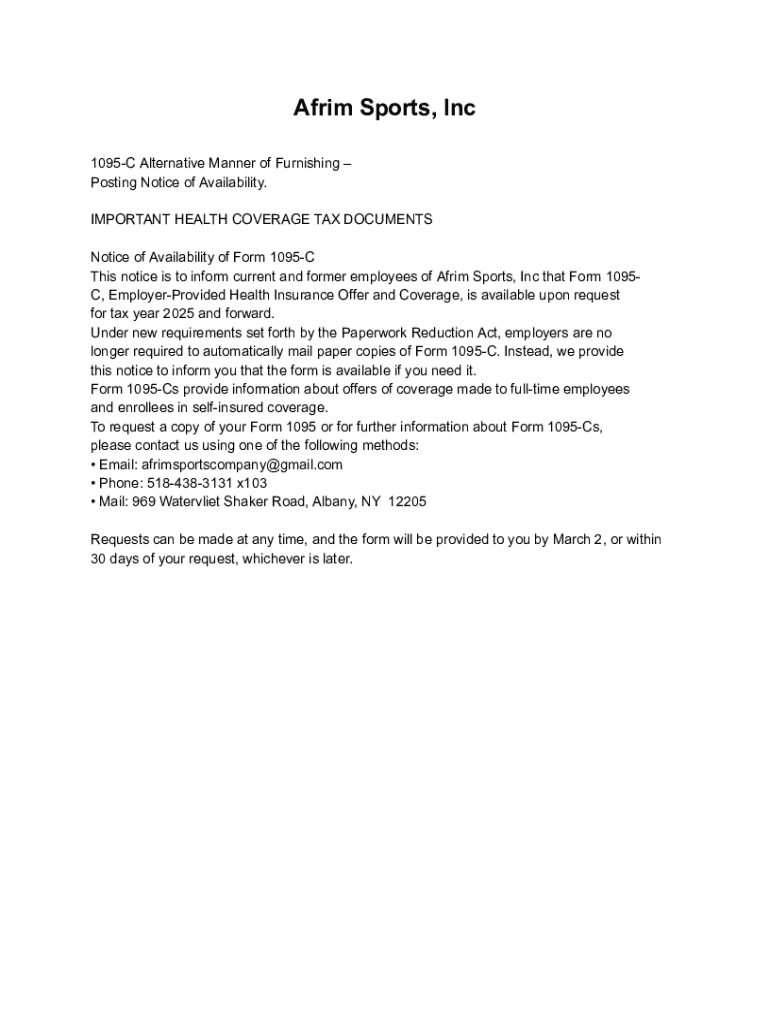

Get the free Form 1095-C DistributionPosting Notice of Availability

Get, Create, Make and Sign form 1095-c distributionposting notice

Editing form 1095-c distributionposting notice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1095-c distributionposting notice

How to fill out form 1095-c distributionposting notice

Who needs form 1095-c distributionposting notice?

Form 1095- Distribution Posting Notice Form: A Comprehensive Guide

Understanding Form 1095-

Form 1095-C is a critical document used by applicable large employers (ALEs) to report information about the health coverage they offer to their full-time employees. This form plays a vital role in fulfilling the reporting requirements set forth by the Affordable Care Act (ACA). The primary purpose of Form 1095-C is to provide employees with information about their health insurance coverage, which they may later need when filing their taxes.

For employers, this form not only ensures compliance with federal regulations but also helps in demonstrating that they meet the employer mandate to provide adequate health insurance. The key components typically included in the form are details of the employee, the type of coverage offered, the months the coverage was available, and information about dependents covered under the plan.

Legal requirements for Form 1095- distribution

Under the ACA, employers with 50 or more full-time employees are required to report on their health insurance offerings using Form 1095-C. This legal responsibility ensures that coverage information is accurately provided to both the IRS and employees. Employers must distribute the completed forms to employees by specific deadlines to maintain compliance with the ACA regulations.

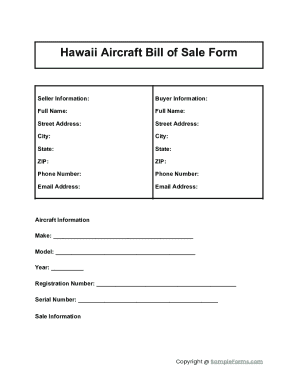

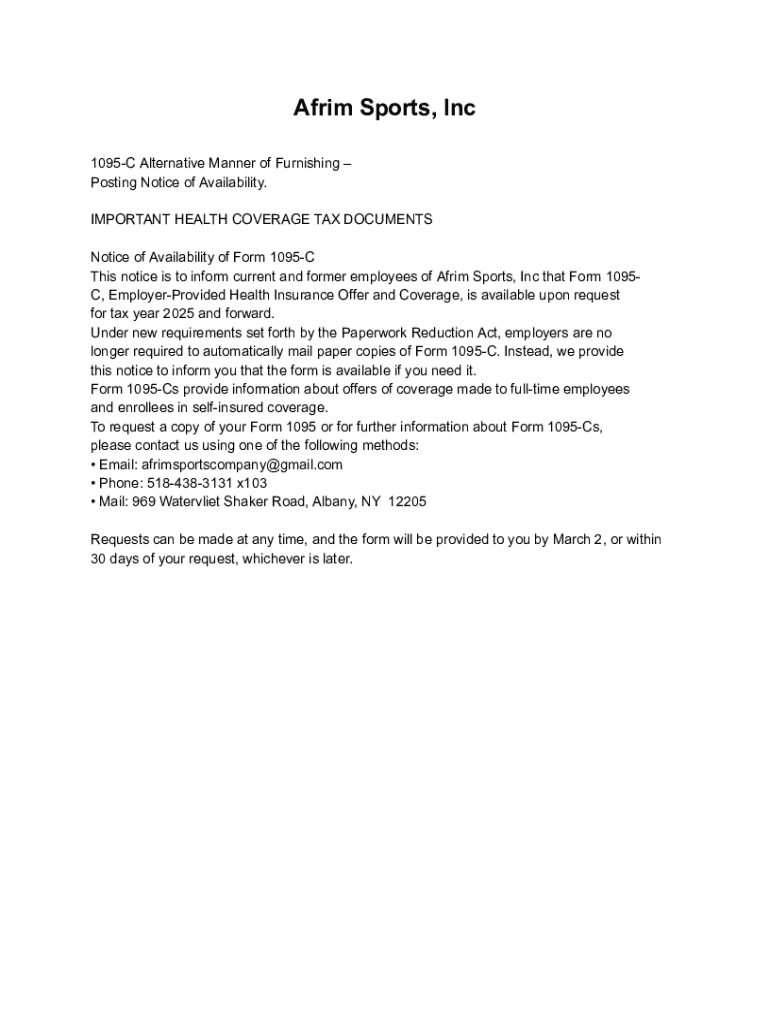

Posting notice of availability

Employers can provide a Posting Notice of Availability as an alternative to mailing individual copies of Form 1095-C, provided certain conditions are met. This notice must inform employees about their available coverage Information and where to access the Form online. The IRS allows this posting method to streamline the distribution process, particularly for large employers.

To qualify for posting, the employer must meet specific requirements such as indicating that the Form is available electronically and ensuring all employees have access to the posted notice. Employers can opt-out of mailing individual forms if they take appropriate steps to communicate this effectively.

Alternative manner of furnishing Form 1095-

Employers may furnish Form 1095-C electronically, which can significantly enhance efficiency in the distribution process. To provide electronic access legally, employers must notify employees of their electronic delivery and obtain consent where necessary. This method not only saves on printing and postage costs but also offers employees immediate access to their coverage information.

Steps for distributing Form 1095-

Successfully distributing Form 1095-C involves a series of organized steps. First, employers must accurately prepare the form while ensuring that all employee information is correct. Reviewing coverage details is crucial, as errors could lead to compliance issues. Once the form is ready, the distribution method can be decided—either mail individual forms directly or utilize electronic delivery methods such as posting on an employer's intranet.

Related compliance issues

Non-compliance with Form 1095-C distribution regulations can lead to significant penalties for employers. Missing deadlines or failing to provide accurate information can result in fines imposed by the IRS. Therefore, it is essential to establish best practices for timely and accurate Form 1095-C distribution to avoid such consequences. Keeping robust records of all distribution efforts will also aid in compliance and defense against potential audits.

Benefits of using pdfFiller for form management

pdfFiller stands out as an ideal solution for managing the complexities of Form 1095-C distribution. With its cloud-based platform, it offers comprehensive document creation and management capabilities that simplify the reporting process. Users can quickly edit, sign, and collaborate on forms, ensuring that all information is accurate and compliant with regulations.

Best practices for managing Form 1095- distribution

To ensure smooth management of Form 1095-C distribution, tracking is essential. Keeping detailed records of who has received their forms, whether via mail or electronic delivery, is crucial for audit purposes. Regular updates and reviews of employee records should be conducted to avoid errors. Additionally, using technology, like pdfFiller, can lead to more efficient document management processes while ensuring compliance with ACA regulations.

Common challenges and solutions in 1095- distribution

Employers often face challenges with distributing Form 1095-C, such as employees refusing to acknowledge receipt. Clear communication and transparency are critical in these situations. Implementing electronic delivery can sometimes eliminate this issue by providing timestamped access records. Technical difficulties with electronic distribution also pose a challenge; ensuring IT resources are in place can mitigate these risks and maintain compliance.

Engaging employees with their Form 1095-

Effective communication strategies are vital in helping employees understand their Form 1095-C. Employers should provide resources and materials to explain the importance of the form and how it impacts their tax filings. Transparency in benefits reporting not only builds trust but also engages employees in understanding their health coverage and rights under the ACA.

Future of Form 1095- distribution

The landscape of Form 1095-C distribution is evolving, with digital solutions increasingly shaping how employers manage compliance. Platforms like pdfFiller are at the forefront of this transformation, offering tools that simplify document distribution and compliance management. With ongoing changes in regulations expected, staying adaptive and informed will be crucial for employers to navigate future requirements effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 1095-c distributionposting notice from Google Drive?

How do I make changes in form 1095-c distributionposting notice?

How can I fill out form 1095-c distributionposting notice on an iOS device?

What is form 1095-c distributionposting notice?

Who is required to file form 1095-c distributionposting notice?

How to fill out form 1095-c distributionposting notice?

What is the purpose of form 1095-c distributionposting notice?

What information must be reported on form 1095-c distributionposting notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.