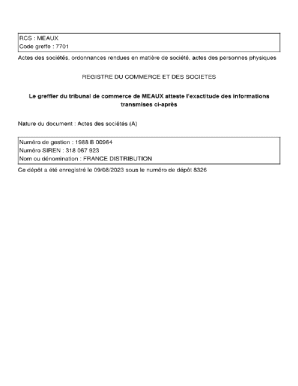

Get the free PlanningRedevelopmentTax Allocation Districts

Get, Create, Make and Sign planningredevelopmenttax allocation districts

How to edit planningredevelopmenttax allocation districts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out planningredevelopmenttax allocation districts

How to fill out planningredevelopmenttax allocation districts

Who needs planningredevelopmenttax allocation districts?

Planning Redevelopment Tax Allocation Districts Form: A Comprehensive Guide

Understanding tax allocation districts (TADs)

Tax Allocation Districts (TADs) are designated zones within urban areas that leverage tax increment financing to stimulate redevelopment and improve local economies. TADs allow municipalities to capture future tax revenue generated by increased property values resulting from redevelopment efforts. This unique financing mechanism helps municipalities invest in public infrastructure and services, ultimately fostering economic growth.

Key terms related to TADs include tax increment financing, which refers to the method of redirecting future property tax revenue to fund redevelopment projects; redevelopment, which encompasses the revitalization of underutilized or outdated properties; and allocation, which pertains to how tax revenues are distributed to support various improvements within the TAD.

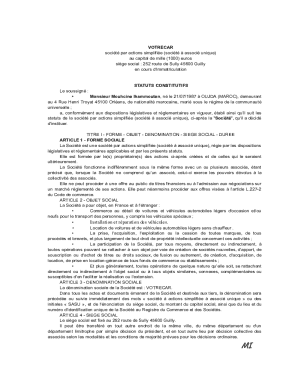

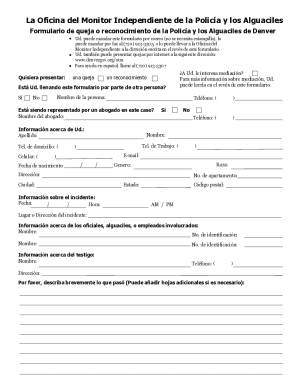

Filling out the planning redevelopment tax allocation districts form

The Planning Redevelopment Tax Allocation Districts form is a structured document designed to gather necessary information about proposed projects. Understanding the structure of the form is vital for a successful application. It typically consists of several sections that need to be filled out accurately, including specific required attachments and documentation that support the project proposal.

Avoiding common mistakes is essential when working on the TAD form. Incomplete information can lead to delays or rejections. Misinterpretation of questions can result in inaccurate data, which may hinder the success of your project.

Editing and signing the TAD form

Using pdfFiller for document editing makes the process of completing the TAD form more manageable. The platform offers an intuitive interface for uploading and editing PDF documents with ease. Users can highlight sections, fill in fields, and clearly format their submissions, ensuring that the final product is polished and professional.

eSigning the form is crucial in this digital age. It serves as a legally binding confirmation of the applicant's agreement to the content provided. In pdfFiller, users can eSign documents easily and securely. Step-by-step guidance within the platform walks users through the eSigning process, ensuring compliance and adherence to all necessary legal protocols.

Collaborating on the TAD form

Collaboration is key when dealing with TAD proposals, particularly for projects involving multiple stakeholders. pdfFiller's collaborative features allow for real-time editing and feedback. Multiple users can work on the same document simultaneously, making it easier to incorporate diverse perspectives and expertise into the form.

Best practices for collaborative document management involve establishing clear deadlines and communication channels to ensure all aspects of the form receive adequate attention. Utilizing comment functions and notes can clarify intentions and expectations among team members.

Managing submitted TAD forms

After submitting the Planning Redevelopment Tax Allocation Districts form, effective management of your documentation is necessary. Implementing best practices for documentation ensures all submissions are easily tracked and referenced. pdfFiller's management tools simplify this process, allowing users to store forms securely and access them readily when needed.

Handling possible revisions or rejections can be daunting, but being organized and proactive in addressing feedback can significantly improve your chances of success. Always be prepared to consult with your team and revise based on insights or requirements from authorities.

Interactive tools and resources for TAD management

Utilizing online tools like those integrated within pdfFiller can provide significant advantages for managing TAD projects. Interactive forms and calculators assist in estimating tax increments and financial projections, ensuring accurate data entry and assessment.

Leveraging technology for efficient TAD planning is crucial. Cloud solutions offer ease of access and real-time collaboration, making project management seamless. Studying case studies of successful TAD projects can provide insight and inspire innovative approaches in your redevelopment efforts.

Expert insights on TADs and redevelopment planning

Gaining insights from industry professionals can enhance your understanding and execution of TAD projects. Urban planners can provide valuable perspectives on zoning regulations and community needs, while property developers often have firsthand experience with financing strategies and project execution.

Current trends in redevelopment tax allocation reveal a growing emphasis on sustainability and community engagement. Highlighting successful examples of TADs across the country can motivate stakeholders to embrace innovative solutions and emerging best practices that foster collaboration and accountability.

Legal considerations and compliance for TADs

Navigating local, state, and federal regulations is imperative when planning TAD projects. Understanding compliance requirements can prevent potential legal challenges and ensure a smoother approval process. Each jurisdiction may have specific guidelines that dictate how TADs are established and how funds can be utilized.

Selecting knowledgeable legal advisors who understand TAD processes can pay dividends in ensuring that your proposal is compliant and addresses all necessary legal frameworks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find planningredevelopmenttax allocation districts?

How do I execute planningredevelopmenttax allocation districts online?

How do I edit planningredevelopmenttax allocation districts online?

What is planning redevelopment tax allocation districts?

Who is required to file planning redevelopment tax allocation districts?

How to fill out planning redevelopment tax allocation districts?

What is the purpose of planning redevelopment tax allocation districts?

What information must be reported on planning redevelopment tax allocation districts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.