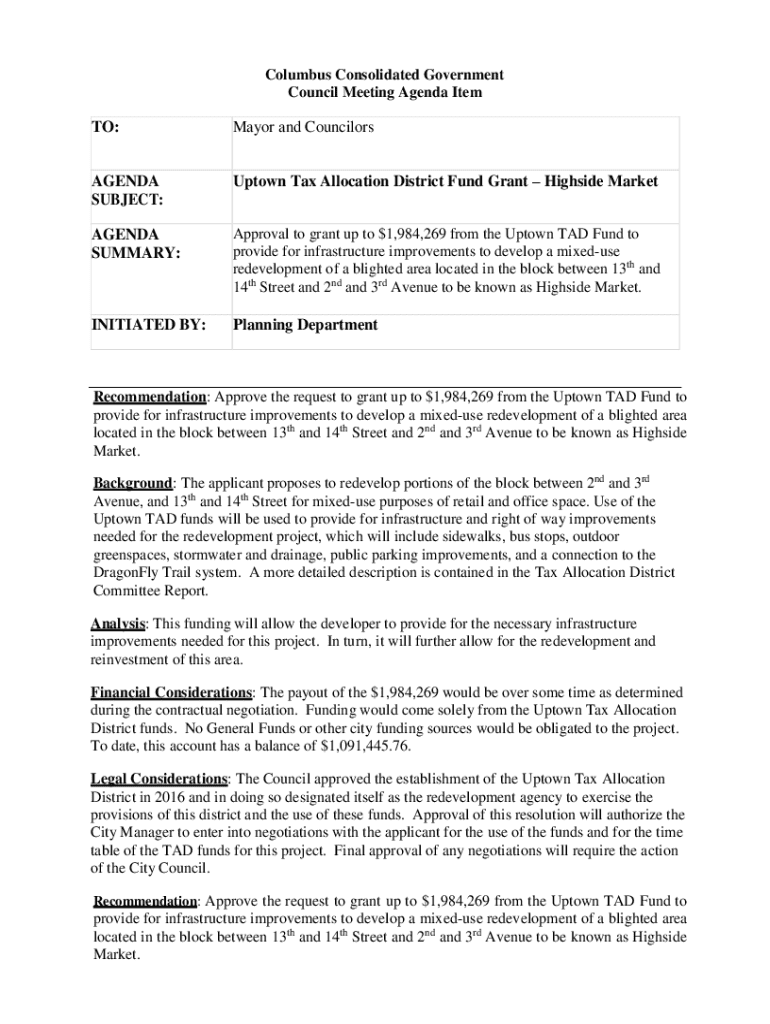

Get the free Uptown Tax Allocation District Fund Grant Highside Market

Get, Create, Make and Sign uptown tax allocation district

Editing uptown tax allocation district online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uptown tax allocation district

How to fill out uptown tax allocation district

Who needs uptown tax allocation district?

Comprehensive Guide to the Uptown Tax Allocation District Form

Understanding the Uptown Tax Allocation District Form

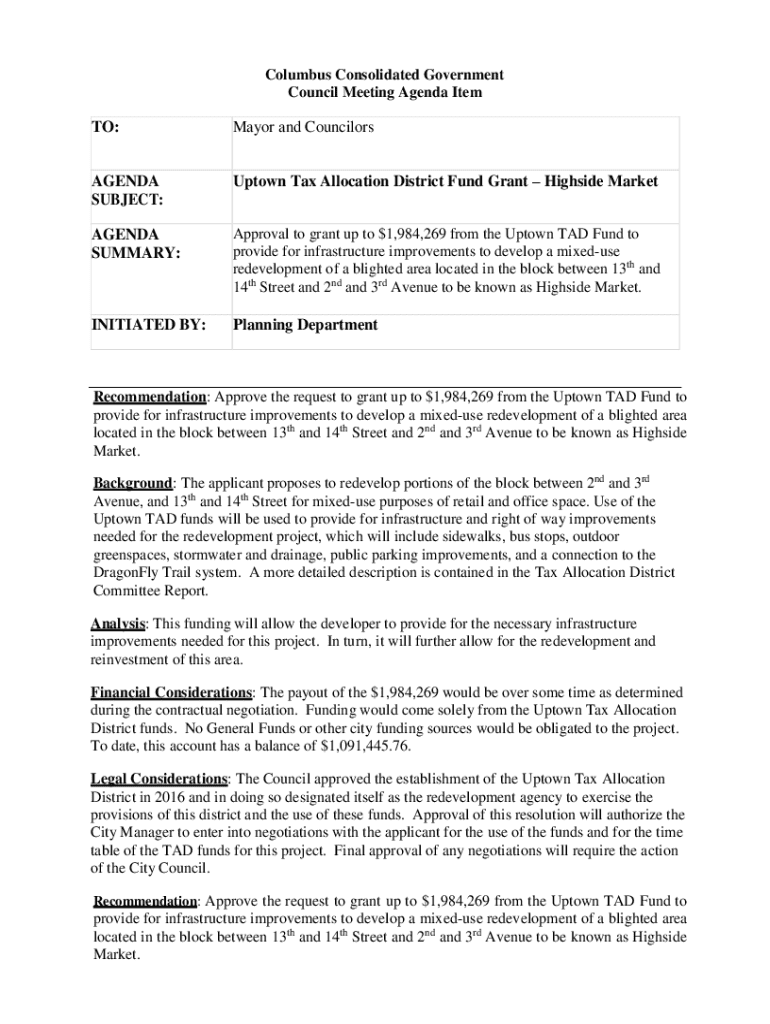

Tax Allocation Districts (TADs) are designated areas within a locality where certain tax revenues collected from property taxes are earmarked for reinvestment in the district itself. The Uptown Tax Allocation District Form serves as an essential tool in this process, enabling effective tracking and management of funds dedicated to urban development projects.

This form is vital not only for local governments but also for taxpayers as it delineates how tax revenues will be utilized. The importance lies in fostering growth and development in urban areas, which can lead to job creation, improved infrastructure, and enhanced community well-being.

Who should use the Uptown Tax Allocation District Form?

The Uptown Tax Allocation District Form is beneficial for a variety of stakeholders. Primarily, community developers leverage this form to align their project scopes with funding availability and regulatory requirements. Local government officials utilize it for oversight and property tax management, ensuring compliance with local regulations and policies.

Property owners and investors also play a crucial role; they can assess their potential taxation benefits and the financial implications of their investments in the district. The versatility of the form extends to collaborative document management, allowing teams to work efficiently together and implement e-signatures to streamline processes.

Key components of the Uptown Tax Allocation District Form

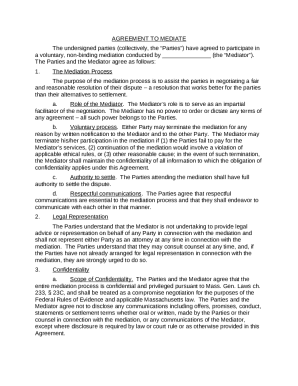

Understanding the key components of the Uptown Tax Allocation District Form is essential for ensuring compliance and accuracy. The form is divided into several critical sections, each serving a distinct purpose in the application process.

The Identification Information section captures basic details such as the name, contact information, and identification number of the applicant. The Property Description section provides a detailed account of the property, including location and size, while the Financial Information section outlines projected taxes and expenditures.

Finally, the Signature Section ensures that all parties consent to the provided information and that the application is legally binding. By understanding the importance of these components, users can effectively navigate the form, minimizing risk and ensuring a smoother submission process.

Step-by-step instructions for completing the Uptown Tax Allocation District Form

Completing the Uptown Tax Allocation District Form requires thorough preparation and attention to detail. The first step involves gathering all necessary information. Applicants should compile documents such as property deeds, tax identification numbers, and financial statements to ensure they have the required data on hand.

Once the necessary documents are gathered, filling out the form is the next step. Each section should be completed meticulously. Pay particular attention to the Financial Information section, as common mistakes here can lead to submission issues. Tools like pdfFiller can assist users by providing guidance throughout the process to avoid errors.

After filling out the form, a thorough review is critical. Users are advised to utilize pdfFiller’s editing features, reviewing for accuracy and completeness. Finally, when ready to sign, electronic signatures can be added securely, ensuring that all parties have consented to the provided information.

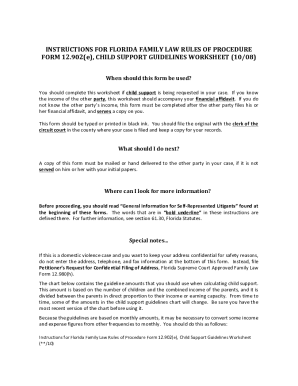

Submitting the Uptown Tax Allocation District Form

The submission process for the Uptown Tax Allocation District Form is straightforward but requires adherence to specific guidelines to ensure acceptance. Completed forms should typically be submitted to the designated local government office managing TADs. It's crucial to confirm the submission format, as some jurisdictions may require physical copies while others may accept digital submissions.

Each locality also has strict deadlines for form submissions. Missing these deadlines can result in penalties or even disqualification from potential benefits. Hence, it is advisable to consult local guidelines early in the process. Understanding these requirements will lessen the risk of complications resulting from late or inaccurate submissions.

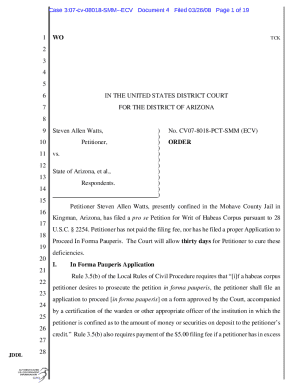

Tracking and managing the Uptown Tax Allocation District Form

Effectively tracking and managing the Uptown Tax Allocation District Form is essential for stakeholders throughout the submission and review process. Utilizing pdfFiller's document management features allows users to monitor the status of their submitted forms, making it easier to follow up on pending reviews or additional information requests.

Setting reminders for important deadlines is another feature that can enhance compliance. Users can customize their digital calendars to reflect upcoming submissions or review dates, which can prevent lapses in important timelines. Best practices also include maintaining organized digital records that enable quick access to previously submitted forms when needed.

Troubleshooting common issues with the Uptown Tax Allocation District Form

Users completing the Uptown Tax Allocation District Form may encounter a variety of issues, such as missing information or technical glitches during submission. To troubleshoot these issues, a systematic approach is advised. Initially, reviewing the completed form for any incomplete fields can uncover blatant errors that can easily be rectified.

For technical issues, reaching out to support through pdfFiller is essential. They can provide solutions to common platform-related problems. Furthermore, keeping a list of frequently asked questions handy can be a useful reference while navigating through the form submissions.

How pdfFiller enhances the Uptown Tax Allocation District Form experience

pdfFiller enriches the experience of using the Uptown Tax Allocation District Form with its cloud-based platform that offers flexibility and accessibility. Users can edit their forms from anywhere at any time, making it convenient for those involved in community development or local governance.

Moreover, pdfFiller’s collaborative features allow teams to work together in real-time, improving communication and streamlining workflow. The user-friendly interface, coupled with customizable templates, simplifies the editing process. Importantly, pdfFiller ensures that all data is protected, offering secure solutions that are vital for sensitive information management.

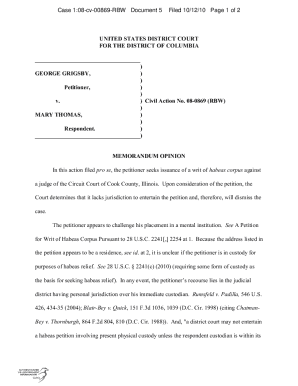

Case studies: Successful use of the Uptown Tax Allocation District Form

Several communities have successfully leveraged the Uptown Tax Allocation District Form to achieve their development goals. For instance, one community utilized the funds allocated through the TAD process to revitalize an underdeveloped area. The project included updating infrastructure and adding local businesses, which led to increased property values and community engagement.

Testimonials from local government officials affirm the effectiveness of using pdfFiller for managing submissions. They cite efficient document tracking and clear communication as key factors that contributed to their successful implementation of urban projects funded through TADs.

Future updates and enhancements to the Uptown Tax Allocation District Form

As regulations surrounding tax allocation districts continue to evolve, so too will the Uptown Tax Allocation District Form. Anticipated changes may include updated financial reporting requirements or alterations in how funds can be allocated, mandating users to stay informed about any modifications.

pdfFiller is dedicated to adapting its services to accommodate these changes. By continually updating its platform and providing resources like FAQs and tutorials, pdfFiller ensures that users remain equipped to handle the evolving landscape of TAD applications efficiently.

Conclusion

The Uptown Tax Allocation District Form is a foundational component in managing and optimizing urban development funding. Its structured approach allows local governments, developers, and property owners to maximize benefits while fostering community investment. Leveraging the resources available through pdfFiller not only simplifies the form-filling experience but also enhances collaboration and compliance, ultimately contributing to successful urban projects.

By understanding the significance and proper use of this form, stakeholders can engage more effectively within their communities, ensuring sustainable growth and improved public infrastructure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in uptown tax allocation district?

How do I fill out uptown tax allocation district using my mobile device?

How can I fill out uptown tax allocation district on an iOS device?

What is uptown tax allocation district?

Who is required to file uptown tax allocation district?

How to fill out uptown tax allocation district?

What is the purpose of uptown tax allocation district?

What information must be reported on uptown tax allocation district?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.