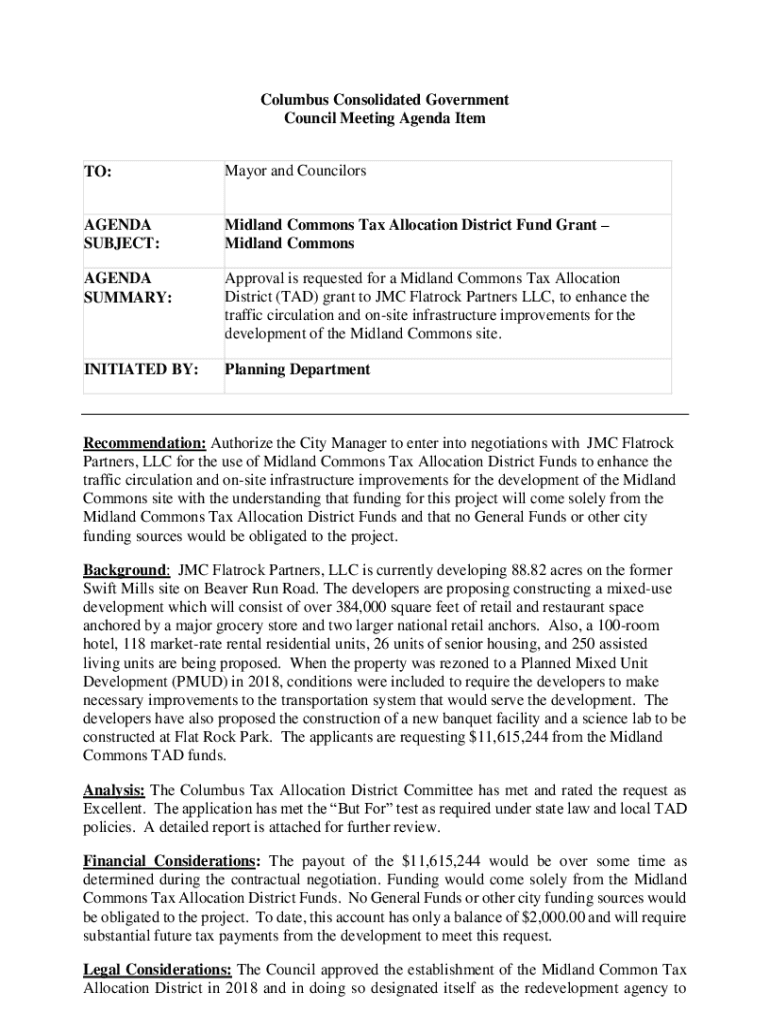

Get the free Midland Commons Tax Allocation District Fund Grant

Get, Create, Make and Sign midland commons tax allocation

How to edit midland commons tax allocation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out midland commons tax allocation

How to fill out midland commons tax allocation

Who needs midland commons tax allocation?

Your Complete Guide to the Midland Commons Tax Allocation Form

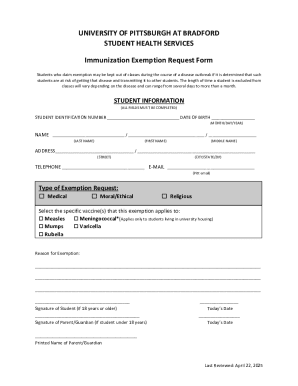

Understanding the Midland Commons Tax Allocation Form

The Midland Commons Tax Allocation Form is a vital document within the framework of local governance, designed to serve the purpose of tax allocation in Midland Commons. Understanding this form is essential for any individual or entity that deals with property tax evaluations or local funding distributions. Tax allocation refers to the process of distributing collected taxes back into community services and infrastructure, impacting various aspects of residents' daily lives.

The importance of the Midland Commons Tax Allocation Form cannot be overstated; it plays a crucial role in how local governments budget their resources and allocate funding for essential services, ranging from education to public safety. The issuance and completion of this form contribute directly to ensuring transparency and integrity within the tax system at the local level.

Who needs to use the Midland Commons Tax Allocation Form?

The Midland Commons Tax Allocation Form is primarily targeted at property owners, business operators, and municipal authorities within the Midland area. Individuals or entities that are responsible for property tax payments or adjustments must fill out this form to ensure that they are contributing to, and benefiting from, local tax allocations. Sectors influenced by these allocations include education, public health, transportation, and community development.

Before filling out the form, applicants should gather necessary documentation, such as property deeds, tax identification numbers, and any relevant financial records. Common misconceptions include assuming that only large businesses are required to submit this form; in reality, residential property owners may also need to participate in the tax allocation process to ensure comprehensive funding for local initiatives.

Detailed instructions for completing the Midland Commons Tax Allocation Form

Completing the Midland Commons Tax Allocation Form involves several steps to ensure that all information is accurately recorded. The form consists of sections that require personal identification, property details, tax history, and specific allocation requests. A section-by-section breakdown will provide clarity on what each part entails, leading to a smoother filling experience.

When entering information, applicants should take care to avoid common mistakes, such as misreporting financial data or incorrectly filling in property details. Adhering to best practices for data entry can significantly reduce the chance of submission errors and streamline the processing time. Glossaries of terms often misunderstood are included in several tax documentation resources to enhance clarity.

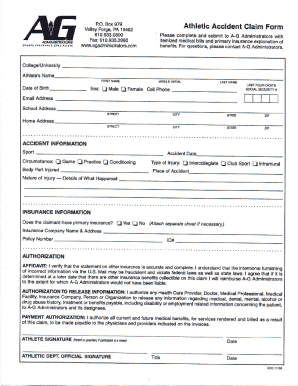

Utilizing pdfFiller for completion

pdfFiller offers enhanced features for completing the Midland Commons Tax Allocation Form, such as editing options, ease of electronic signatures, and the ability to annotate directly on the document. The software provides a user-friendly interface that guides users through the form-filling process, making it accessible for both individuals and larger teams.

Submitting the Midland Commons Tax Allocation Form

Submission of the Midland Commons Tax Allocation Form can occur through various channels, depending on the local government's guidelines. Generally, the choice lies between digital submission via a dedicated portal or physical submission to the appropriate local office. Understanding e-signature capabilities enhances the efficiency of digital submissions, allowing for quick and secure transmission of documents.

It's essential to be aware of submission timelines, as delays can affect processing and potentially impact funding allocations. Typically, local governments provide a schedule for when forms must be received to be considered for the current tax year. After submission, applicants can usually expect a confirmation notice within a designated timeframe and will be advised on further steps.

Managing and tracking your Midland Commons Tax Allocation Form

Effective management of your Midland Commons Tax Allocation Form doesn’t end with submission. Utilizing pdfFiller's cloud-based storage options can significantly simplify keeping track of all completed forms. This storage feature allows users to organize their documents efficiently, giving access to both individual and collaborative review capabilities.

To check the status of a submitted form, it’s advisable to follow the local government's established inquiry process, often available through their official website or customer service channels. Additionally, leveraging online resources for electronic documents allows for quick follow-up and resolution of any potential issues.

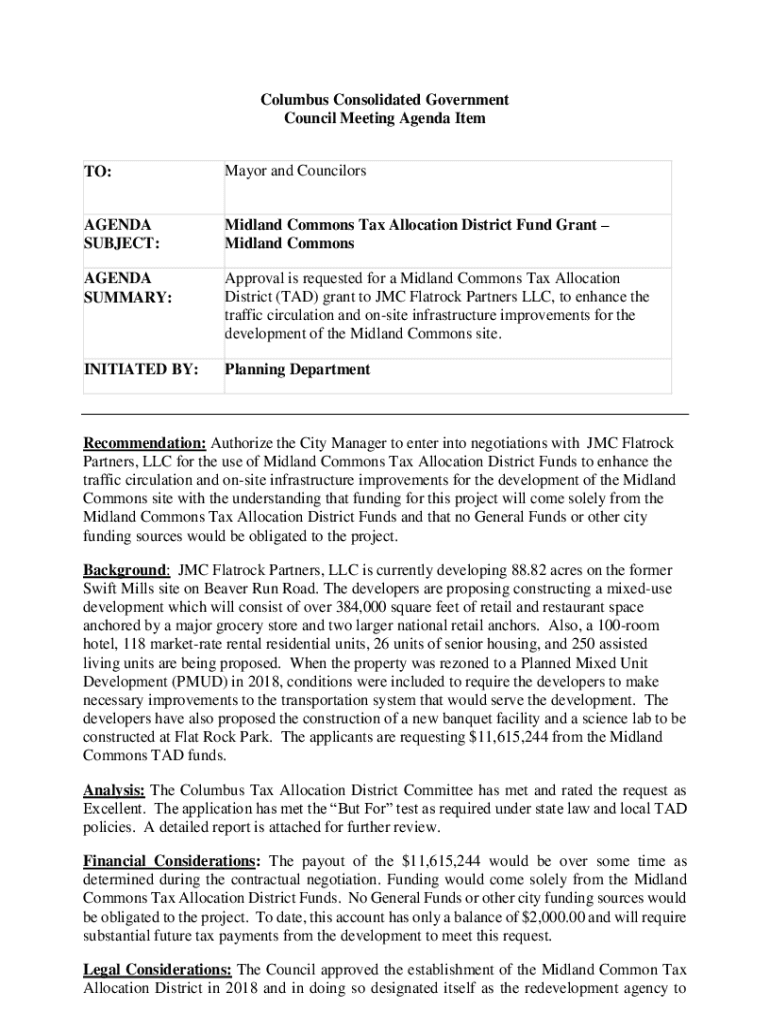

Common issues and FAQs related to the Midland Commons Tax Allocation Form

Filing the Midland Commons Tax Allocation Form can sometimes lead to confusion, especially for first-time applicants. Understanding common problems such as incorrect entry of financial figures, lack of required documentation, or misunderstanding the submission process can mitigate issues before they arise. Conducting a thorough review of all entries and cross-checking against guidelines may resolve these problems efficiently.

Frequent questions revolve around tax obligations, referred to deadlines, and what happens if a form is incorrectly filled out. Engaging with official resources is critical to understanding implications related to tax accountability. For specific queries, consulting with local tax offices can provide tailored guidance and support.

Advanced features of pdfFiller for tax documentation

pdfFiller sets itself apart by offering advanced collaborative tools that allow multiple users to work on the Midland Commons Tax Allocation Form simultaneously. This feature is particularly useful for teams where different departments may contribute specific information, thereby increasing efficiency and accuracy in the final submission.

Leveraging cloud-based accessibility means that users can manage their tax documentation from any location. This flexibility encourages proactive engagement in the tax allocation process for both individual users and large teams, fostering a culture of accountability and transparency in local governance.

Additional considerations for Midland Commons tax allocations

Understanding how tax allocations impact local governance is crucial for participants involved in the Midland Commons Tax Allocation form process. Allocations dictate how community resources are distributed, affecting everything from educational programs to infrastructure maintenance. Active participation in the tax allocation process can help create a more robust community by ensuring accountability and transparency in how funds are utilized.

As regulatory frameworks evolve, future changes may be implemented to the Midland Commons Tax Allocation Form. Staying informed about these changes is essential for anyone involved in local governance or tax documentation. Utilizing platforms like pdfFiller will facilitate adaptations to new requirements swiftly and efficiently, ensuring that your documents remain compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify midland commons tax allocation without leaving Google Drive?

How do I make changes in midland commons tax allocation?

How do I edit midland commons tax allocation straight from my smartphone?

What is midland commons tax allocation?

Who is required to file midland commons tax allocation?

How to fill out midland commons tax allocation?

What is the purpose of midland commons tax allocation?

What information must be reported on midland commons tax allocation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.