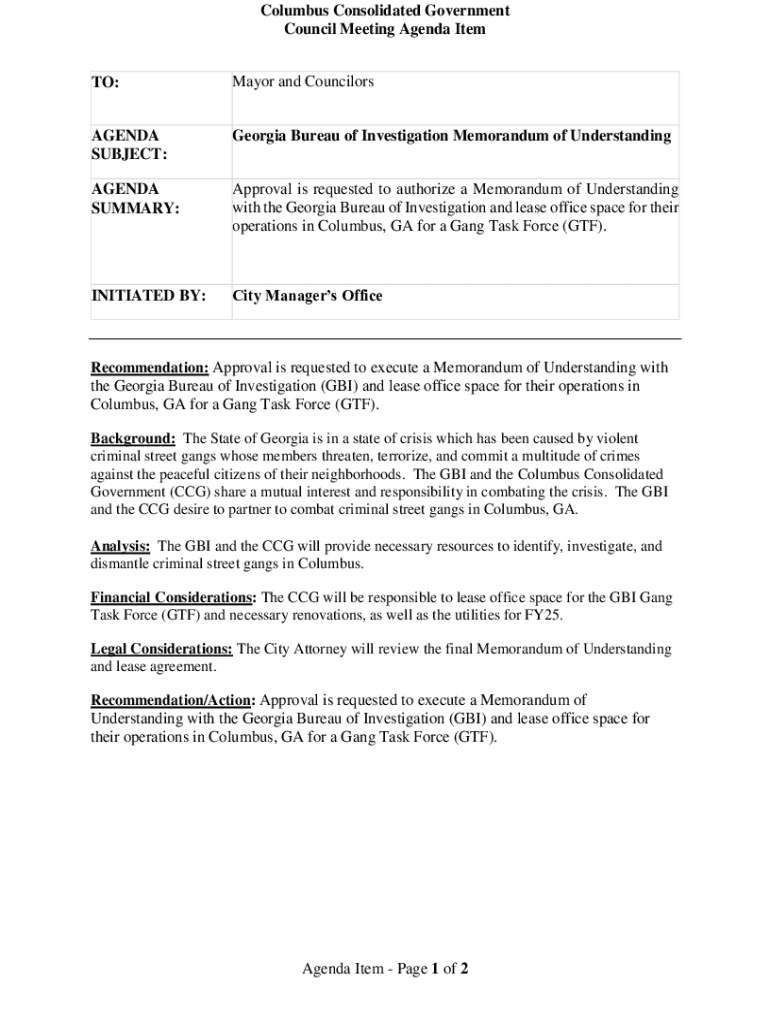

Get the free What led to audit of Columbus, Georgia finance department?

Get, Create, Make and Sign what led to audit

How to edit what led to audit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what led to audit

How to fill out what led to audit

Who needs what led to audit?

What led to audit form: A comprehensive guide

Understanding audit forms

An audit form is a structured document used by tax authorities, such as the IRS, to gather information during the audit process. The primary purpose of this form is to ensure that all financial details are accurate and compliant with regulations. Users of audit forms include individual taxpayers, businesses, and even nonprofits who may be selected for an audit due to various triggers. It not only helps in clarifying discrepancies but also serves as a vital record in legal contexts.

Common scenarios requiring an audit form encompass instances where there are inconsistencies in tax returns. For example, individuals claiming high deductions relative to their income may warrant further examination. Additionally, the legal implications of failing to submit accurate audit forms can range from penalties to serious legal repercussions, emphasizing the importance of meticulous documentation.

Factors leading to an audit

The first step in understanding what led to an audit form is recognizing the various audit triggers that often initiate the process. These can include underreported income, high levels of deductions, or engaging in unusual tax credit claims. Each of these factors is assessed within the broader context of taxpayer behavior and records. Accuracy in documentation becomes paramount, as it helps avoid the pitfalls that might lead to an audit.

The IRS employs sophisticated methods to identify potential audits. One major factor includes data matching, where reported income is cross-referenced against third-party sources like banks and employers. If discrepancies arise, further examination ensues, resulting in the need for an audit form. It’s crucial for taxpayers to maintain organized records to streamline any potential audit processes.

Common reasons for audits

Understanding the most common reasons that lead to audits can help taxpayers navigate their reporting more responsibly. Discrepancies in reported income often top the list. Few things raise red flags faster than underreporting income or misclassifying sources of income, which can dramatically affect tax liabilities. Therefore, ensuring accurate income reporting is foundational.

Large deductions compared to income can also prompt an audit. This includes situations like substantial charitable donations or business expenses where the claimed amounts seem disproportionate to the reported income. Such anomalies catch the attention of audit triggers. Tax credits that appear unusual, such as those for education or energy-efficient home improvements, can lead to scrutiny as well, especially if they are outliers when viewed against your income pattern.

The audit process

Understanding the audit process can demystify what can often seem overwhelming. The audit begins when the IRS sends an initial notification, informing the taxpayer of the audit's commencement. From there, individuals or businesses must prepare to submit not only their tax returns but also a range of supporting documents that substantiate their claims. Clear communication is vital at this stage.

There are two main types of audits: correspondence audits and field audits. A correspondence audit typically involves requests for information via mail, allowing taxpayers a more straightforward engagement process. In contrast, field audits are in-depth examinations conducted at the taxpayer's premises, often requiring more significant document submission. Understanding these distinctions empowers taxpayers to prepare effectively regardless of the audit type they face.

Preparing for an audit

Preparation is essential for successfully navigating an audit. Gather all essential documents such as tax returns and related support forms, along with bank statements and transaction records. This preparation sets the foundation for a smoother audit process. It’s advisable to maintain thorough documentation over the tax year to ensure that when preparation time comes, databases do not require extensive last-minute organization.

Organization is key—label documents, create summaries, and utilize digital management tools. pdfFiller offers useful tools that help in document management, allowing for easy editing and eSigning, which can streamline your audit preparation. Methods such as tagging or categorizing documents can significantly reduce the stress associated with providing the necessary paperwork during an audit.

Filling out the audit form

Completing the audit form is a vital step in the process, and following a structured approach ensures accuracy. Begin with a thorough section breakdown, focusing on what information is required in each area of the form. Correctly fill out personal details, financial information, and any explanations for potential discrepancies. Each entry needs a factual basis to support the forms’ claims.

Avoiding common mistakes is essential; these might include lacking supporting documents or overlooking crucial financial details. Use pdfFiller for audit form completion to take advantage of their interactive tools that simplify the filling process, helping you keep your forms accurate and compliant.

After submission: what to expect

Once an audit form is submitted, wait times for a response from the IRS can vary. Typically, your review may take several weeks, depending on the complexity of the audit and the thoroughness of the documentation provided. It’s beneficial to remain patient, as temporary hold-ups are common during the review process.

Possible outcomes can include acceptance of claims, requests for additional information, or adjustments to your tax liability. In case of IRS communication, responding promptly and appropriately is crucial to ensure that your inquiries and any subsequent requests for information are addressed comprehensively.

Learning from an audit

Audits provide invaluable lessons, especially when it comes to improving tax practices. After an audit, reflect on the records submitted and identify areas for documentation enhancement. Regular reviews of document processes enhance compliance and prepare you better for future audits.

Utilizing platforms like pdfFiller can facilitate ongoing organization efforts, ensuring that you maintain an efficient document management system. This continuous learning attitude not only prevents potential audit triggers but also cultivates better financial practices overall.

Conclusion: maintaining audit readiness

The key to maintaining audit readiness lies in continuous learning about tax regulations and their implications. Enhancing personal and business financial management practices can bolster your confidence in dealings with the IRS. Whenever in doubt, engage with professional resources to ensure understanding and compliance with ever-evolving tax laws.

Moreover, leveraging pdfFiller’s platform for effective document management can facilitate real-time updates to ensure that all data and forms are up-to-date and compliant. Audit readiness becomes second nature when there’s a systematic approach to documentation and an understanding of the requirements involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify what led to audit without leaving Google Drive?

How do I edit what led to audit on an iOS device?

Can I edit what led to audit on an Android device?

What is what led to audit?

Who is required to file what led to audit?

How to fill out what led to audit?

What is the purpose of what led to audit?

What information must be reported on what led to audit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.