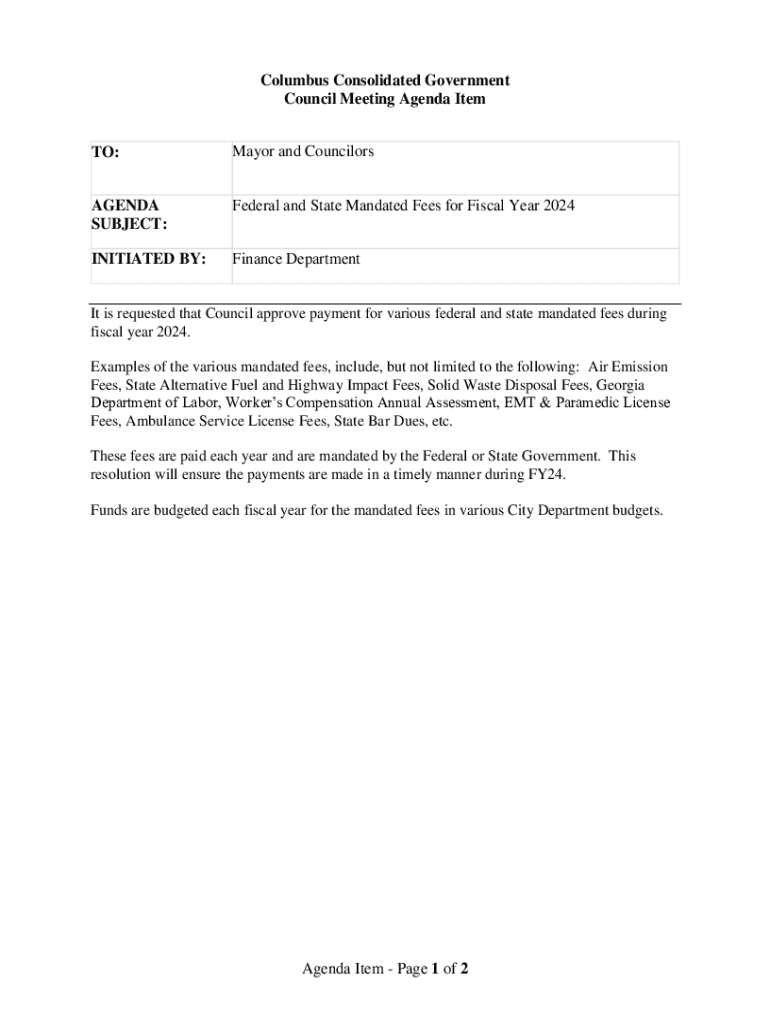

Get the free Federal and State Mandated Fees for Fiscal Year 2026

Get, Create, Make and Sign federal and state mandated

Editing federal and state mandated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal and state mandated

How to fill out federal and state mandated

Who needs federal and state mandated?

Federal and State Mandated Forms: A Comprehensive Guide

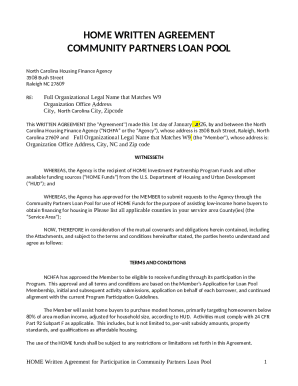

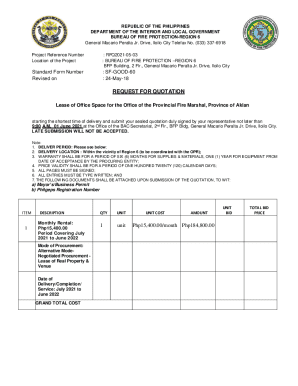

Understanding federal and state mandated forms

Federal and state mandated forms are critical documents required by governmental agencies for various regulatory purposes. These forms serve as formal requests or disclosures necessary for compliance, ensuring that individuals and organizations adhere to specific legal standards. Whether for tax purposes, employment verification, or compliance with health and safety regulations, these forms carry significant weight. Understanding the importance of these mandated forms is vital for both individuals and organizations, as non-compliance can lead to serious legal implications.

There are two primary categories of mandated forms: federal and state. Federal mandated forms are required by national laws and regulations, while state mandated forms are governed by state laws that can vary significantly from one jurisdiction to another. For example, an individual filling out a W-4 form for federal tax withholding needs to understand its role in their tax obligations, just as a business must comply with state-specific employment forms. By recognizing the distinct requirements within these categories, individuals and organizations can better navigate their compliance responsibilities.

Key requirements for federal mandated forms

Federal regulations dictate numerous laws and requirements that necessitate specific forms. Key legislation includes the Fair Labor Standards Act (FLSA), the Internal Revenue Code, and various health and safety regulations. Each of these laws has corresponding forms that must be completed correctly to ensure compliance. For instance, the IRS requires forms such as the W-2 for employee tax reporting, and the I-9 form for verifying employment eligibility for work in the United States.

Some common federal mandated forms include employment forms like the W-4—used for tax withholding and the I-9 for employment eligibility verification. Tax forms are also critical, including the 1040 for individual income tax returns and form 941 for quarterly payroll tax. Additionally, there are insurance-related forms like the Health Insurance Claim Form (CMS-1500), which health providers submit for reimbursement. Understanding the purpose and requirements of these forms is essential for compliance in various sectors.

Key requirements for state mandated forms

State regulations can differ drastically, with each state imposing its specific laws and requirements for mandated forms. Understanding the unique stipulations of your state is critical for compliance. For instance, certain states may have additional employment forms that businesses must file regularly, like state income tax withholding forms or workers’ compensation forms. Non-compliance with state regulations can result in fines or penalties, further stressing the importance of understanding local mandates.

Common state mandated forms can include state-specific employment forms, tax forms unique to the state, and health and safety forms governed by state law. For instance, California has its unique tax withholding form (DE 4) that differs from federal requirements. Similarly, other states may have specific regulations for health and safety compliance that necessitate additional documentation. Familiarity with these forms is necessary for anyone operating or working within a given state.

Interactive tools for managing mandated forms

Managing federal and state mandated forms can be daunting, but tools like pdfFiller streamline the process significantly. With pdfFiller, users can create, edit, and sign forms directly within a cloud-based platform. The platform offers a user-friendly interface for form creation, allowing users to customize templates effortlessly to meet their specific needs. Creating forms tailored to compliance requirements is as simple as dragging and dropping fields, ensuring that no essential information is left out.

Collaboration features within pdfFiller further enhance team efficiency. Multiple users can edit the same document in real-time, which fosters quick completion of mandated forms, ensuring everyone stays informed and compliant. The eSignature capabilities provide a legally binding method for signing documents, a feature especially important for mandated forms where official signatures are required. Finally, the cloud storage aspect means forms can be accessed from any location, vital for remote teams and organizations operating across state lines.

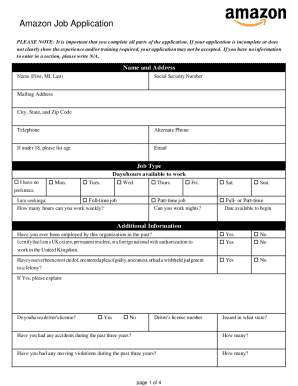

Filling out mandated forms

Filling out mandated forms accurately is crucial for compliance. It is essential to follow clear instructions provided with each form, noting that many have specific fields required to be completed. One common pitfall is providing inaccurate or incomplete information, which can lead to delays or penalties. To avoid these issues, it’s important to take one’s time, double-check all entries, and ensure that the information is consistent with supporting documents.

Additionally, users can customize forms as necessary while adhering to compliance guidelines. This allows individuals and businesses to maintain the specificity and accuracy of each document. A meticulous approach to filling out mandated forms, along with regular training on compliance expectations, is vital to ensuring that all parties understand the importance of accuracy.

Best practices for storing and managing mandated forms

Once filled out, storing mandated forms correctly is just as important as completing them. Utilizing digital storage solutions, such as cloud storage, provides numerous advantages including enhanced security, ease of access, and organization. Ensuring that forms are easily retrievable helps organizations maintain compliance and manage records effectively. Cloud solutions also reduce the risk of data loss associated with physical document storage.

Archiving strategies play a critical role as well. Creating a clear filing system can ensure that forms are quickly accessible when required, while regular updates are vital to maintaining compliance with evolving regulations. Mandated forms should be reviewed and updated per relevant changes to laws or requirements, preventing outdated documents from becoming a compliance risk.

Frequently asked questions (FAQs)

Navigating mandated forms can prompt several questions. One common inquiry is what to do if a mandated form goes missing. In such cases, it’s critical to verify with the issuing agency to ascertain the correct process for obtaining a replacement. Additionally, addressing incorrect information on a mandated form should be approached with caution; typically, it is best to consult with the relevant authoritative body for guidance in correcting the information without incurring penalties.

Another concern arises concerning non-compliance with mandated forms. The consequences may vary based on jurisdiction and the nature of the form; they can range from fines and penalties to more severe legal implications. Therefore, organizations and individuals must take their compliance responsibilities seriously to avoid such repercussions.

Resources for further information

For those requiring additional information about federal and state mandated forms, governmental websites are invaluable resources. Official government agency websites provide up-to-date information on required forms, guidelines for filling them out, and compliance regulations. Websites like the IRS for federal tax forms or state government websites for local mandates can be particularly helpful.

Professional consultation services can also be beneficial, particularly for individuals or organizations that find the regulatory environment overwhelming. Consulting with legal or financial professionals who specialize in form compliance can offer tailored advice and assistance in navigating complex requirements.

Case studies and examples

Real-life scenarios can provide excellent learning opportunities regarding compliance with federal and state mandated forms. For instance, consider a mid-sized company in California that faced fines due to incomplete employee I-9 forms. By utilizing pdfFiller, they streamlined their form completion process, ensuring all fields were filled accurately and timely, which resulted in regulatory compliance and avoided potential penalties.

Another scenario involved a startup dealing with various mandated tax forms. By leveraging pdfFiller’s collaboration features, different departments could work together seamlessly to complete forms, ensuring accuracy. Their proactive approach to form management not only kept them compliant but also fostered a culture of accountability and attention to detail across the company.

Additional support and assistance

Individuals and teams seeking assistance with federal and state mandated forms can benefit from reaching out to pdfFiller support. Their customer service team can provide guidance on using the platform effectively for creating, editing, and managing forms. Additionally, exploring community forums and user groups can yield valuable insights from other users who share tips and experiences regarding form compliance.

Engaging with a community of users can often provide practical knowledge not readily available through official channels. Participants can share their experiences, potential pitfalls, and best practices witnessed during their own form management journeys, contributing to a rich resource of collective knowledge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my federal and state mandated in Gmail?

How can I get federal and state mandated?

Can I edit federal and state mandated on an iOS device?

What is federal and state mandated?

Who is required to file federal and state mandated?

How to fill out federal and state mandated?

What is the purpose of federal and state mandated?

What information must be reported on federal and state mandated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.