Get the free Federal and State Mandated Fees for Fiscal Year 2025

Get, Create, Make and Sign federal and state mandated

How to edit federal and state mandated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal and state mandated

How to fill out federal and state mandated

Who needs federal and state mandated?

Understanding Federal and State Mandated Forms: Your Comprehensive How-to Guide

Overview of federal and state mandated forms

Federal and state mandated forms are essential documents required by government entities that serve various purposes, from tax reporting to employment verification. These forms are designed to ensure compliance with regulations and laws that govern organizations and individuals. Understanding these forms is crucial for avoiding penalties and maintaining good standing with government organizations.

Compliance with federal and state mandated forms is vital, not only to adhere to existing laws but also to facilitate accountability and transparency in operations. Failure to complete these forms can lead to significant fines, legal issues, or even loss of a business license, illustrating the importance of thorough understanding and timely submission. Organizations need to navigate these requirements efficiently to avoid potential repercussions.

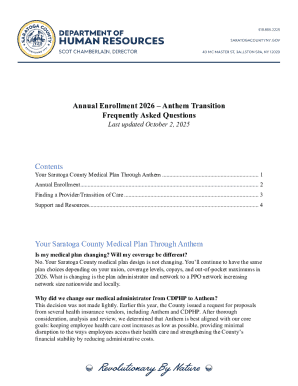

While federal forms are uniform across the entire United States, state forms can differ significantly. For instance, the IRS mandates specific forms for tax returns, which are applicable nationwide, whereas state tax forms may have different requirements regarding deductions, credits, and filing procedures.

Types of federal and state mandated forms

Common types of federal mandated forms include IRS forms such as 1040 for individual income tax returns and W-2 for wage and tax statements. Additionally, OSHA (Occupational Safety and Health Administration) forms are critical for workplace safety compliance. Federal forms are standardized and accessible through government websites, ensuring consistency in the information required.

On the state level, forms can include tax forms, employment verification forms, or business licensing applications. Each state has its own set of requirements, radically differing from one another. For example, while California may require specific disclosures for new employees, Texas might have completely different regulations regarding employee rights and benefits. It is essential for organizations operating in multiple states to familiarize themselves with the forms relevant to each location.

Understanding the requirements

Each mandated form shares common requirements that must be addressed for effective completion. This typically includes personal information, financial data, and employment details. For instance, forms submitted to the IRS often ask for your Social Security number, income details, and a summary of tax credits if applicable. Forms vary in complexity, but recognizing the key elements is crucial.

Additionally, each form comes with specific deadlines that must be adhered to. Late submissions can trigger fines, increase audit risks, and complicate tax situations. Keeping track of these deadlines, alongside ensuring that each form contains an appropriate signature, is key to maintaining compliance and avoiding penalties. Non-compliance can lead to various legal actions, including potential audits, increased taxes owed, and, in severe cases, criminal charges.

Step-by-step guide to completing federal and state forms

Completing federal and state mandated forms need not be daunting. The process can be broken down into manageable steps:

Tools for managing federal and state forms

pdfFiller offers robust cloud-based solutions, simplifying how users manage federal and state mandated forms. Its interactive platform empowers users to edit PDFs, sign documents electronically, collaborate with others, and store documents securely from virtually anywhere.

Features such as templates for frequently used forms enhance user experience, allowing for faster completions and submissions. Users can easily personalize templates, feature digital signatures, and access their forms with a simple click, streamlining the form completion process significantly.

Tips for staying compliant and updated

Navigating the complex landscape of federal and state mandated forms requires diligence and awareness of changes in regulations. Regularly checking official government websites for updates can help users stay informed of any new requirements or forms. Utilizing calendaring tools and reminders aids in keeping up with submission deadlines and necessary updates.

Additionally, seeking professional advice when uncertain about specific requirements or changes can prevent errors and ensure compliance. Many federal and state agencies provide resources and customer support, while legal advisors can offer tailored guidance when navigating more complex situations.

Common questions and troubleshooting

Many users struggle with various aspects of federal and state mandated forms, leading to common questions. Frequently asked questions can cover topics such as the timeframes for processing forms, how to correct errors after submission, and the appropriate channels for inquiries.

Common dilemmas include failed submissions due to incomplete information or incorrect formatting. Solutions often involve careful re-examination of submitted documents and utilizing pdfFiller’s editing tools to ensure every aspect aligns with requirements prior to resubmission.

Special considerations for specific audiences

Understanding federal and state mandated forms is particularly nuanced for certain groups. Small business owners must navigate employee verification forms, tax requirements, and regulatory compliance across various jurisdictions, making it imperative they stay informed about local laws.

Nonprofits have distinct compliance needs connected to fund allocation and financial transparency, while independent contractors may face unique issues concerning tax filings and service contracts. Furthermore, remote workers and digital nomads must be aware of differing regulations governing taxation in multiple jurisdictions, emphasizing the necessity to remain vigilant regarding ever-evolving rules.

Interactive tools and resources

pdfFiller provides a suite of interactive tools designed to simplify the creation and management of federal and state mandated forms. The platform includes various templates for users to tailor to their specific needs, ensuring that they can complete their forms accurately and efficiently.

Additionally, users can access tutorials that guide them through the process of filling out different forms, allowing for an intuitive understanding of their requirements. Customer support is also readily available, ensuring users can get immediate assistance if they run into challenges during form completion or submission.

Real-life examples and case studies

Explore how organizations and individuals have successfully navigated the complexities of federal and state mandated forms. Successful case studies often highlight proactive approaches to compliance, including utilizing services like pdfFiller to avoid errors and streamline the submission process.

Testimonials from users reveal how pdfFiller’s features facilitated smoother operations in managing documents, addressing common struggles with form completion. The real-life impact of understanding and effectively utilizing these forms showcases the significant advantages of being compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find federal and state mandated?

How can I edit federal and state mandated on a smartphone?

How can I fill out federal and state mandated on an iOS device?

What is federal and state mandated?

Who is required to file federal and state mandated?

How to fill out federal and state mandated?

What is the purpose of federal and state mandated?

What information must be reported on federal and state mandated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.