Get the free Deferred Compensation - Office of the State Treasurer

Get, Create, Make and Sign deferred compensation - office

Editing deferred compensation - office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deferred compensation - office

How to fill out deferred compensation - office

Who needs deferred compensation - office?

Deferred Compensation - Office Form: A Comprehensive Guide

Understanding deferred compensation

Deferred compensation refers to an arrangement in which a portion of an employee's earnings is paid out at a later date, usually to provide tax advantages or retirement savings. It allows employees to allocate a portion of their income to be received in the future, often after retirement or when certain conditions are met. This arrangement is particularly beneficial in higher tax brackets, as it can reduce the current taxable income.

There are two prominent types of deferred compensation plans: qualified and nonqualified plans. Qualified plans, such as 401(k) plans, are subject to strict governmental regulations, offering considerable benefits, including tax deferral on contributions and earnings until withdrawal. Nonqualified plans provide more flexibility in terms of contribution limits and eligibility, allowing companies to tailor them according to specific employee needs.

Participating in deferred compensation plans can provide several benefits. These include allowing employees to save for retirement more effectively, reducing taxable income in the current year, and potentially increasing the total amount saved for retirement due to the compounding interest effect. Moreover, deferred compensation can enhance employee retention by tying benefits to future employment with the company.

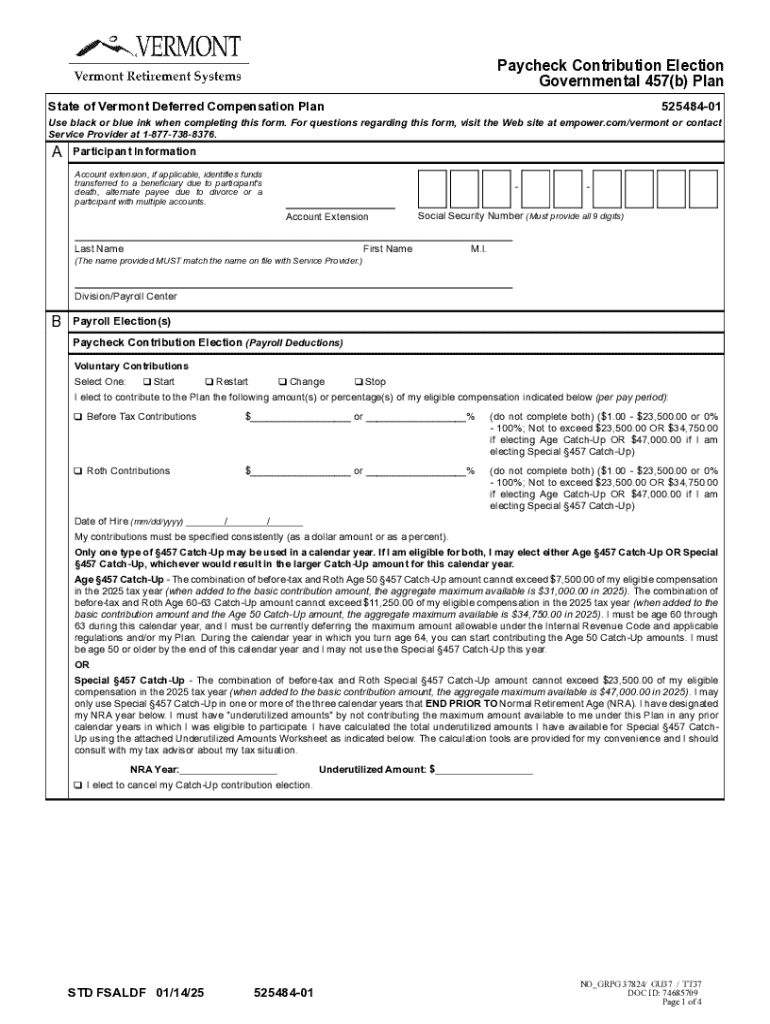

The role of the office form in deferred compensation

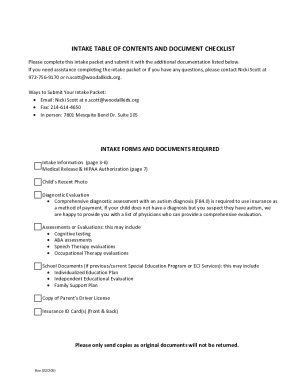

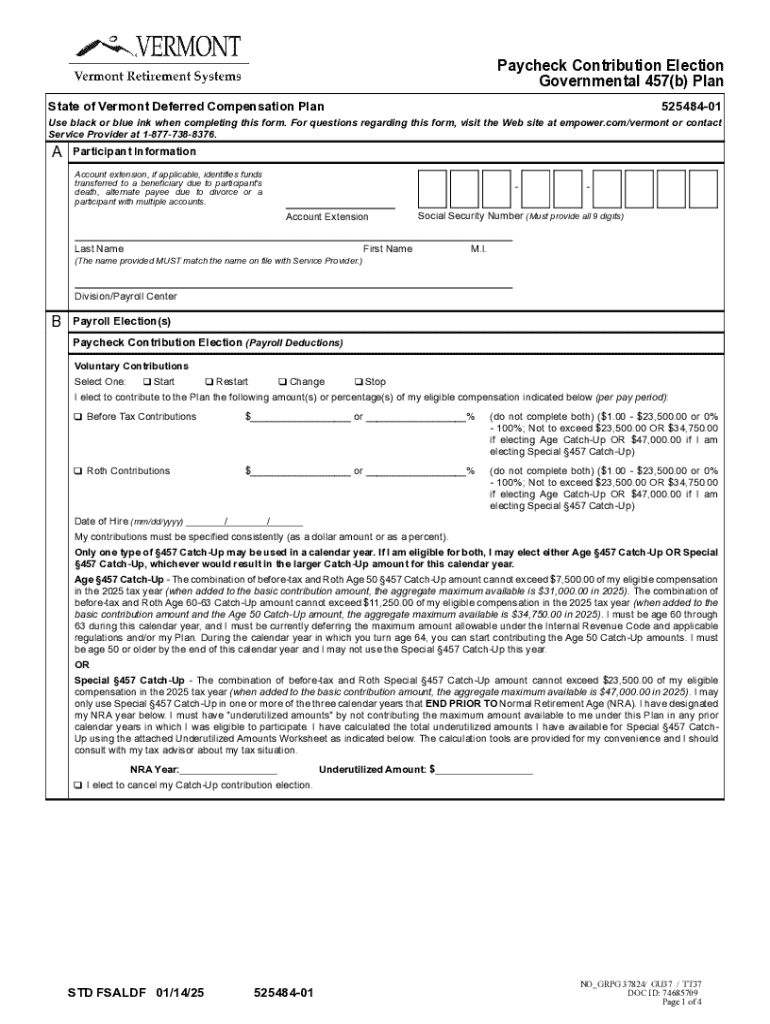

The Deferred Compensation Office Form plays a crucial role in the setup and management of deferred compensation plans. This form captures essential information regarding the employee's participation in the plan and specifies the terms associated with their deferred compensation agreement. Having a correctly filled out form is vital for ensuring compliance and for achieving the desired tax advantages.

Key features of the form include sections that capture the employee's personal information, plan selection, contribution amounts, and investment choices. Common terms often seen in the form are 'deferral percentage', ‘vested interest’, and ‘distribution options’. These terms help guide the employee through the necessary choices they'll need to make for optimal participation in their plan.

Both employees and employers need to complete the office form. Employees provide essential personal details and choices regarding their deferral options, while employers must ensure that the form complies with relevant regulations and accurately reflects their policies.

Step-by-step guide to completing the deferred compensation office form

Before filling out the Deferred Compensation Office Form, it’s important to prepare by gathering all required information and documentation. This includes your personal details such as your name, address, and employee identification number, as well as financial details related to your expected contribution amounts. Having these documents ready helps streamline the process.

In the Personal Information Section, complete fields detailing your full name, address, work telephone number, and employee identification number. Ensure that all documents are correctly synchronized, and there are no discrepancies in what has been declared. For the Plan Selection Section, indicate which type of deferred compensation plan you wish to enroll in, such as a 401(k) or a nonqualified plan.

Next, fill out the Contribution Amounts and Investment Choices section. You'll need to specify how much of your salary you wish to defer and any specific investments you choose for those funds. Lastly, make sure to sign and date the form before submitting it. Remember to review all sections carefully to reduce errors before finalizing your submission.

To avoid common mistakes, double-check each section to ensure that all selected options align with your financial goals. Discrepancies could lead to delays or complications in your deferred compensation plan.

Editing and managing your deferred compensation office form

Once you have completed the Deferred Compensation Office Form, you may need to edit or customize it for future adjustments. Using a tool like pdfFiller simplifies this process significantly. Start by uploading the form to pdfFiller. This platform allows you not only to modify text and fields but also to add signatures, making necessary adjustments a breeze.

When using pdfFiller, the editing interface is user-friendly, allowing you to change any section efficiently. Save your changes regularly, as pdfFiller has an auto-saving feature and a version control system that allows you to revert to previous states if needed. Additionally, if you work within a team or organization, consider sharing options that enable you to collaborate with others on the form.

eSigning the office form

The importance of electronic signatures cannot be overstated, especially when dealing with documents like the Deferred Compensation Office Form. eSigning saves time and enables a smoother process for both employees and employers. When utilizing pdfFiller, adding your signature becomes a straightforward task.

To eSign in pdfFiller, begin by accessing the section intended for signatures. Here, you can either draw your signature, upload a scanned image of your written signature, or use a pre-stored signature. You also have the option to designate other signers, which is particularly helpful in team environments. Security measures are in place as well, ensuring that signatures are verified and protected.

Troubleshooting common issues

Completing the Deferred Compensation Office Form might present some challenges, including error messages that could disrupt the workflow. To troubleshoot such issues, pay particular attention to the fields indicated by error notifications; they will usually indicate what needs correction. Additionally, familiarize yourself with the FAQs regarding form completion, as many answers to common queries are readily available.

If you encounter problems specifically related to eSigning—the signature failing to apply or not being recognized—double-check the signature format and apply any required adjustments. Remember, you can return to the signature section anytime within pdfFiller, making it convenient to resolve these issues.

Storing and accessing your deferred compensation office form

Once your Deferred Compensation Office Form is completed and signed, managing these critical documents is essential. Using pdfFiller allows for easy organization of documents. Create folders according to different categories, such as 'Deferred Compensation' or 'Finance', to ensure that all paperwork is systematically organized and easily accessible.

With pdfFiller, you can access your forms anytime, anywhere. The platform offers mobile app capabilities that allow you to manage your documents on-the-go. Furthermore, the cloud storage solutions ensure that your files are securely backed up, preventing loss and making retrieval efficient whenever needed.

Further engagement and resources

Beyond simply filling out and managing the Deferred Compensation Office Form, pdfFiller offers additional tools that enhance document management. Document sharing and collaboration features allow users to work together, ensuring that teams can seamlessly engage on financial planning and compliance matters.

For those wishing to delve deeper into the topic of deferred compensation plans, pdfFiller provides links to relevant articles and guides that equip users with essential knowledge. Whether accessing FAQs or exploring detailed insights into retirement planning, resources are abundant to aid decision-making.

Real-world examples and case studies

Looking at successful deferred compensation plans, many professionals have leveraged these arrangements to secure their financial futures. For instance, a mid-level executive utilizing a 401(k) plan strategically deferred a significant portion of their income, leading to substantial retirement savings that reflected both the power of compounding and effective tax management.

User testimonials highlight positive experiences with pdfFiller for document management, illustrating how participants appreciate the ease of editing, signing, and collaborating on forms. Stories of efficient form completion and organized paperwork resonate strongly, showcasing how(pdfFiller) has transformed administrative tasks into a streamlined effort.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the deferred compensation - office in Chrome?

Can I create an eSignature for the deferred compensation - office in Gmail?

How can I fill out deferred compensation - office on an iOS device?

What is deferred compensation - office?

Who is required to file deferred compensation - office?

How to fill out deferred compensation - office?

What is the purpose of deferred compensation - office?

What information must be reported on deferred compensation - office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.