Get the free State of Nebraska Deferred Compensation Plan (Revised ...

Get, Create, Make and Sign state of nebraska deferred

Editing state of nebraska deferred online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of nebraska deferred

How to fill out state of nebraska deferred

Who needs state of nebraska deferred?

State of Nebraska Deferred Form: A Comprehensive How-to Guide

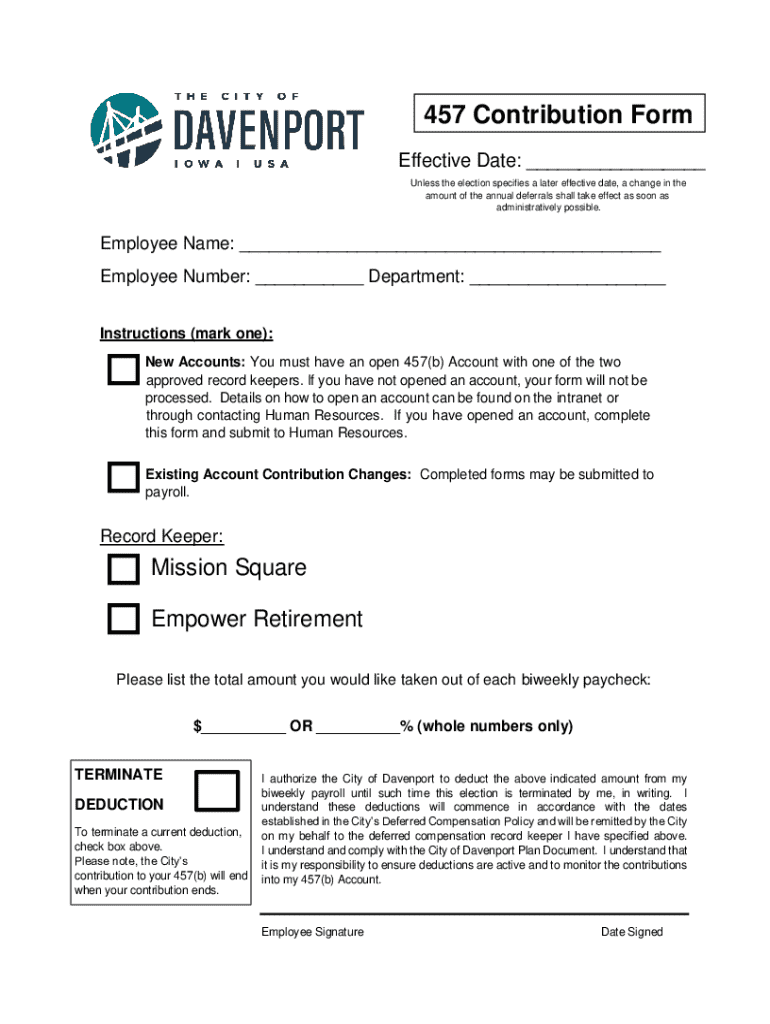

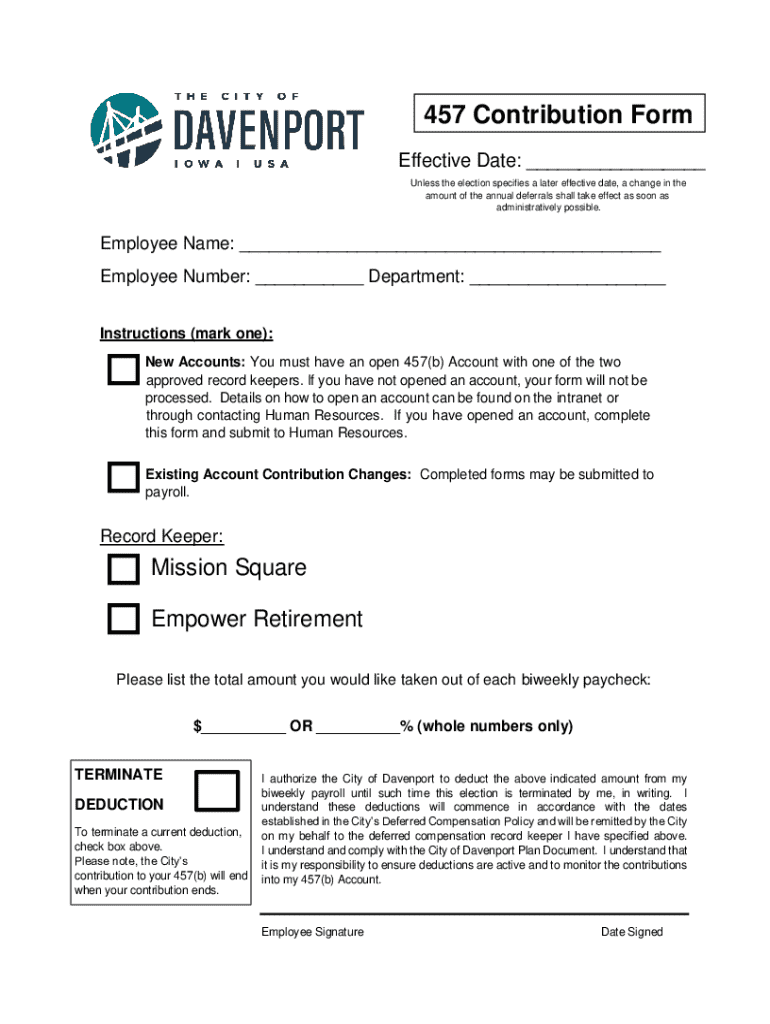

Understanding the State of Nebraska Deferred Form

The State of Nebraska deferred form is a vital document utilized in various spheres including government administration, finance, and education. This form serves to defer payments, allowing individuals or entities to postpone due dates, making it easier to manage financial obligations without immediate repercussions. By understanding the significance of the deferred form, users can navigate Nebraska's legal and financial landscape more effectively.

Primarily, individuals or businesses facing temporary financial hardships utilize the deferred form to request changes to payment schedules. This form is particularly relevant for loans, tuition payments, or government fees, empowering users to maintain compliance without undue stress.

Overview of the deferred form in different contexts

The deferred form finds its application in several contexts across Nebraska’s infrastructure. In government administration, it helps manage public funds efficiently, ensuring that individuals can meet their obligations while also considering state budgeting limitations.

In financial transactions, the deferred form becomes essential when requesting a loan deferment or restructuring debt repayments. This feature allows borrowers to manage their finances effectively, especially during downturns or unforeseen expenses. Educational institutions also utilize this form for tuition deferment, enabling students to focus on their studies without being overwhelmed by immediate financial demands.

Preparing to complete the Nebraska deferred form

Before filling out the Nebraska deferred form, it's crucial to gather all the necessary information and documentation. This includes personal details such as your name, address, and contact information. Financial records, including bank statements, income proof, or loan documents, are typically required to justify your request for deferral.

Additionally, legal identifications such as a driver's license or social security number may be necessary to verify identity. Common mistakes to avoid include not having the correct financial records that align with your request, leaving sections blank, or submitting the form without proper signatures.

Step-by-step guide to completing the Nebraska deferred form

Accessing the deferred form starts with visiting the official Nebraska state website or using pdfFiller to find and download the most recent version. Here, users can easily obtain the PDF version of the deferred form, ensuring they have the latest updates.

Filling out the form involves entering your personal details accurately, providing all requested information. Each section, from personal identification to financial data, should be completed thoughtfully. For example, include specific reasons for deferral, alongside any relevant dates.

Double-checking the form is vital to ensure that all entries are correct and truthful; this reduces the likelihood of delays or denial of requests. Tools available on pdfFiller can assist in editing and proofreading for those less confident in their paperwork.

Editing the Nebraska deferred form with pdfFiller

pdfFiller provides excellent features for document editing, making it simple to rearrange, add, or remove information in your Nebraska deferred form. Users can easily correct errors or update details without the need for printing and starting over. The intuitive interface of pdfFiller allows for seamless revisions and ensures compliance with all necessary state requirements.

Ensuring that all aspects of the form are correctly filled is imperative for avoiding unnecessary hassle. pdfFiller’s user-friendly platform allows for real-time updates, ensuring that users can submit their forms without worrying about non-compliance or incomplete entries.

eSigning the deferred form

Nebraska recognizes electronic signatures as legally valid, making the eSigning process for the deferred form straightforward and efficient. Using pdfFiller, you can digitally sign your document, ensuring a secure and streamlined submission process.

The step-by-step eSigning process includes uploading the completed form to pdfFiller, selecting the signature option, and positioning your digital signature where required. Opting for an eSignature not only expedites the process but also provides a few additional conveniences, like easy re-signing if necessary.

Managing your documents in pdfFiller

Keeping your documents organized is paramount, especially when handling multiple forms such as the Nebraska deferred form. pdfFiller allows users to categorize and store their completed forms and templates securely, making it easy to locate important documents when needed.

Sharing your completed deferred form with relevant parties can be executed simply through pdfFiller, enhancing collaboration and ensuring prompt responses. The platform prioritizes users' security and privacy, incorporating robust features that protect sensitive document information from unauthorized access.

Frequently asked questions about the Nebraska deferred form

Users often encounter several common queries regarding the Nebraska deferred form. One frequently asked question relates to how long the deferral period lasts once approved. Typically, the deferral duration aligns with the payment schedule of the obligation in question, but specific terms can vary.

Another pertinent query involves the consequences of submitting an incomplete form. Commonly, incomplete submissions lead to processing delays or outright rejection. Therefore, ensuring all necessary information is included will facilitate a smooth process.

Exploring additional resources related to the Nebraska deferred form

For those looking to further their understanding or find specific contacts regarding the Nebraska deferred form, various resources are available. Links to additional forms and templates can be accessed directly from the Nebraska state government website or through community support forums.

Department contact information related to the specific use of the deferred form can often be found within the form’s guidelines, providing users with direct routes to assistance. Engaging with community forums also offers users the chance to exchange experiences and solutions related to deferred forms, fostering a supportive environment.

Enhancing your document experience with pdfFiller

Utilizing a cloud-based document management system like pdfFiller offers myriad benefits for users dealing with forms such as the Nebraska deferred form. This platform not only provides editing and signing functionalities but also simplifies the organizer-feature, ensuring users can manage their documents effectively.

Comparative advantages over traditional PDF editors include higher accessibility, real-time collaboration features, and integrated security measures that safeguard personal data. Testimonials from users highlight success stories in using pdfFiller to navigate complex paperwork with ease and efficiency, emphasizing the platform's ability to streamline processes for both individuals and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send state of nebraska deferred to be eSigned by others?

How do I edit state of nebraska deferred online?

Can I edit state of nebraska deferred on an iOS device?

What is state of Nebraska deferred?

Who is required to file state of Nebraska deferred?

How to fill out state of Nebraska deferred?

What is the purpose of state of Nebraska deferred?

What information must be reported on state of Nebraska deferred?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.