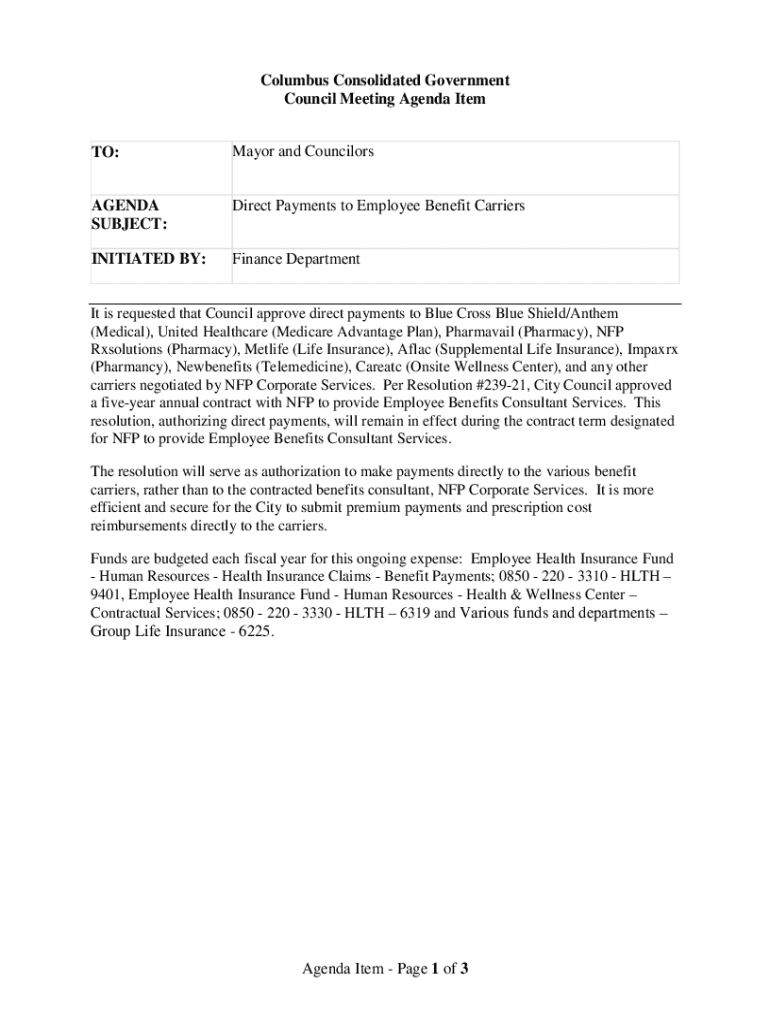

Get the free Direct Payments to Employee Benefit Carriers

Get, Create, Make and Sign direct payments to employee

How to edit direct payments to employee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct payments to employee

How to fill out direct payments to employee

Who needs direct payments to employee?

Direct Payments to Employee Form: A Comprehensive How-to Guide

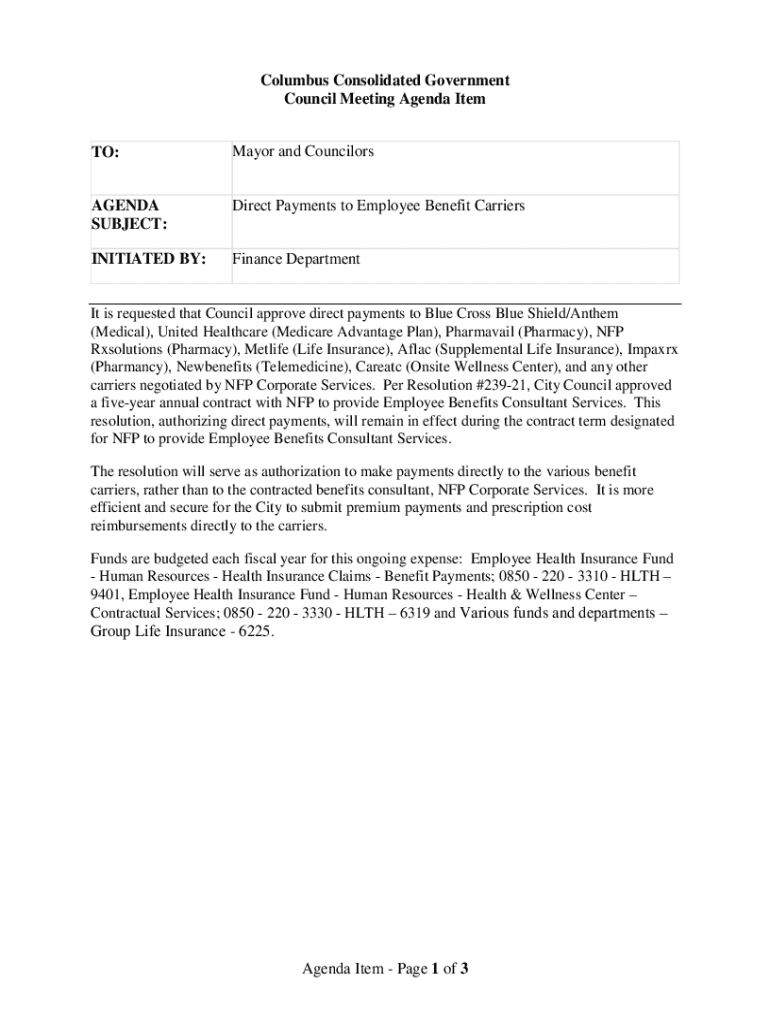

Understanding direct payments to employees

Direct payments refer to any form of financial compensation made directly to an employee, bypassing traditional payroll processes. These payments can encompass a variety of scenarios such as bonuses, reimbursements for expenses, or one-time awards for exceptional performance. Understanding the importance of direct payments in the workplace is crucial as they serve not only as motivators but also as mechanisms to ensure fair and prompt compensation for out-of-pocket expenses incurred by employees. This flexibility in payment methods allows organizations to reward employees promptly, enhancing job satisfaction and productivity.

Overview of the employee payment form

The direct payments to employee form is a standardized document that outlines the specifics of a payment transaction between an employer and an employee. Its primary purpose is to provide a clear and concise record of payments made, ensuring both parties are in agreement about the amounts, purposes, and timing of these transactions. Common scenarios for using this form include processing bonuses, reimbursements for travel expenses, or compensations for supplies purchased by an employee on behalf of the company. By employing a standardized form, organizations can significantly reduce errors in payment processing, save time, and maintain clear records for accounting and auditing purposes.

Features of pdfFiller for creating and managing forms

pdfFiller stands out as a comprehensive solution for document creation and management, particularly when it comes to the direct payments to employee form. One of its key features is the cloud-based document creation and management system, allowing users to access forms from any device, anywhere, without being tethered to an office. The platform also includes interactive tools that make it easy to edit and customize forms. Users can quickly make changes to the direct payments form according to their specific needs, ensuring clarity and compliance with internal company policies. Furthermore, pdfFiller’s eSigning capabilities facilitate quick approval workflows, which means payments can be processed without unnecessary delays.

In addition, collaboration features allow multiple team members to input feedback or suggestions on the document in real-time. The ability to work collaboratively ensures that all perspectives are considered, which can enhance the quality of the final document. This level of versatility and user engagement makes pdfFiller an indispensable tool for teams and individuals alike, enabling seamless management of the direct payments to employee form from start to finish.

Step-by-step guide to filling out the direct payments to employee form

Completing the direct payments to employee form correctly is crucial for maintaining accurate financial records. Here is a detailed, step-by-step guide to assist you.

Common mistakes to avoid when completing the form

When filling out the direct payments to employee form, it's easy to overlook details that can lead to inaccuracies in financial records. To avoid these pitfalls, be mindful of the following common mistakes:

Managing completed forms on pdfFiller

Once the direct payments to employee form is completed and processed, effective management of these forms becomes essential. pdfFiller provides features that allow users to organize completed forms for easy retrieval. This ensures that all forms are readily available for future reference or auditing purposes. Additionally, keeping track of payment history becomes easier as all transactions are logged within pdfFiller, allowing for quick queries from employees regarding their payment status.

Organizations can also integrate pdfFiller with their existing HR tools and software, streamlining processes beyond just payment forms. This integration leads to a more organized workflow and reduces the risk of errors arising from manual data entry, making the overall payment process more efficient and user-friendly.

Ensuring compliance with payment regulations

Compliance with legal requirements for employee payments is crucial for any organization. Various laws govern payment practices, including labor laws, tax regulations, and organizational policies. It’s advisable to stay updated on the specific requirements that apply to your jurisdiction to avoid legal repercussions. pdfFiller assists in maintaining compliance by providing templates that adhere to industry standards.

Moreover, by utilizing pdfFiller’s tools, organizations can ensure that all forms are filled out correctly prior to submission, reducing the likelihood of non-compliance. With the integrated document management system, maintaining records necessary for audits or inquiries is made straightforward. Organizations can rest easier knowing that they are taking the right steps towards legal adherence with every payment made.

Frequently asked questions (FAQs)

As users navigate the direct payments to employee form, several questions commonly arise regarding the functionality and security of pdfFiller. Here are answers to some frequently asked questions that can enhance user experience.

Tips for teams: streamlining your payment processes

Efficient payment processing can significantly enhance overall team productivity. Begin by establishing a clear workflow for payment approvals. A defined process reduces confusion and ensures that everyone knows their role in the payment cycle. Best practices for team collaboration on forms should also be embraced, such as regular communication and updates regarding changes in payment policies.

Utilizing templates for consistent documentation not only helps maintain a standard format but also saves time for team members. This consistency in documentation fosters clarity and reduces errors in the direct payments to employee form, ultimately leading to smoother payment operations.

Advancing your document management skills with pdfFiller

To make the most of the pdfFiller platform, users can explore additional features geared toward document automation and integration. The platform enables seamless data entry and can connect with other applications you may already be using, fostering a holistic approach to document management.

Furthermore, resources for further learning and support are readily available within the pdfFiller community and knowledge base, empowering users to enhance their skills and optimize their document handling processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit direct payments to employee from Google Drive?

How do I complete direct payments to employee online?

How do I fill out direct payments to employee on an Android device?

What is direct payments to employee?

Who is required to file direct payments to employee?

How to fill out direct payments to employee?

What is the purpose of direct payments to employee?

What information must be reported on direct payments to employee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.