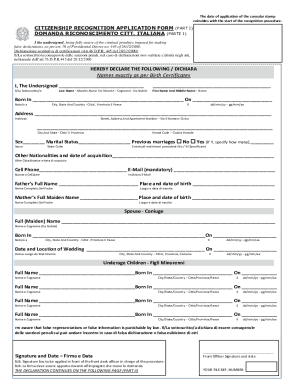

Get the free A Year of Loss... A Time For Opportunities ...

Get, Create, Make and Sign a year of loss

Editing a year of loss online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a year of loss

How to fill out a year of loss

Who needs a year of loss?

A comprehensive guide to the year of loss form

Understanding the year of loss form

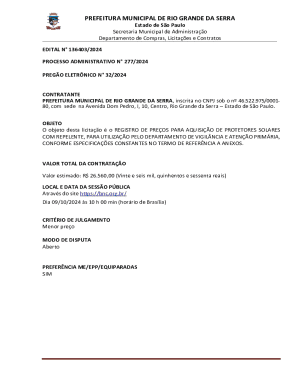

The year of loss form is a critical document for individuals or businesses that have experienced a significant setback. It serves as a formal declaration of loss, allowing you to report your financial downturn to relevant authorities or institutions. Completing this form accurately ensures that you have the necessary documentation for tax deductions, insurance claims, or financial aid applications.

This form is crucial not only for personal records but also for any negotiations with creditors or financial institutions. The timely submission of a year of loss form can sometimes determine whether you qualify for relief programs or have access to recovery resources.

Overview of the year of loss process

Filing a year of loss form involves several key steps. Initially, you need to understand the criteria for claiming losses. Your eligibility can depend on various factors, including the nature of your loss and the timeframe during which it occurred.

Once you determine you need to file, organizing your documentation is vital. Prepare your financial records, statements, and any other documentation that reflects the extent of your loss. After completing the form, be mindful of submission timelines, as late submissions can result in denied claims.

Detailed breakdown of the year of loss form

The year of loss form is composed of several components that require accurate and detailed information. Properly completing each section is critical to ensure that your claim is processed effectively.

The first section gathers your personal information, including name, address, and contact details. In the second section, you need to detail the nature of your loss, specifying whether it is financial, property-related, or another type of loss, alongside the date and context surrounding the incident.

Step-by-step instructions for filling out the year of loss form

Filling out the year of loss form requires attention to detail and accuracy. Start by gathering all necessary documents and information regarding your loss. This includes financial statements, police reports (if applicable), and any relevant correspondence with financial institutions.

Next, proceed with filling out the personal information section. Ensure that all entries are spelled correctly and reflect your current information. Common mistakes include typographical errors and outdated contact information, which can lead to processing delays.

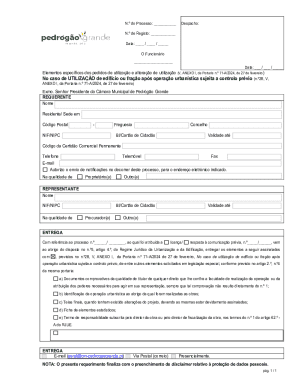

Editing and signing the form in pdfFiller

Using pdfFiller for your year of loss form offers several advantages. This platform allows you to edit the form seamlessly, providing features such as adding annotations, comments, and using predefined templates for convenience. These tools make it easy to customize your form according to your individual needs.

Once your form is prepared, the next step involves signing it. Electronic signatures through pdfFiller provide a secure and efficient way to finalize your documentation. The process is designed to be user-friendly, ensuring that you can complete your submission from anywhere, at any time.

Managing your year of loss submission

After submitting the year of loss form, managing the status of your submission is essential. Most authorities provide means to track your submission online, allowing you to stay informed about its progress. This will help you anticipate potential issues or additional requirements that might arise.

In case you need to resubmit your form due to an error or missing information, being proactive in addressing the issue can save you valuable time. Remember to keep copies of all submitted documents and correspondence to ensure your personal information remains secure throughout the process.

FAQs about the year of loss form

Individuals often have questions regarding the year of loss form. For instance, if a mistake is made on your form, rectifying it quickly is critical, as this can affect processing. Contacting the relevant authority can provide guidance on how to amend errors.

In cases where deadlines have been missed, there may still be options, including filing for an extension. Understanding what happens after submission can also help ease anxiety. These steps are designed to support individuals in navigating the complexities associated with loss declarations.

Resources and tools for document management

Using pdfFiller's cloud-based features can streamline document management, especially for those dealing with multiple submissions or teams. With collaborative tools, teams can work together on document creation, making the process more efficient for filling out the year of loss form.

In addition, pdfFiller offers a variety of templates that can be beneficial for those who may face similar filing requirements in the future. This enhances preparedness, ensuring individuals and teams can manage documentation effectively with tools at their disposal.

Staying up-to-date on year of loss regulations

The regulations surrounding the year of loss form and related policies can evolve. Staying informed about these changes is vital for effective filing. Subscribe to newsletters, follow relevant authority updates, or join online forums that discuss the latest developments.

Moreover, understanding how these changes might impact future filing requirements can provide a strategic advantage. Awareness of potential modifications ensures that you are prepared to adapt your documentation and filing processes accordingly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit a year of loss in Chrome?

How do I edit a year of loss straight from my smartphone?

How do I complete a year of loss on an iOS device?

What is a year of loss?

Who is required to file a year of loss?

How to fill out a year of loss?

What is the purpose of a year of loss?

What information must be reported on a year of loss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.