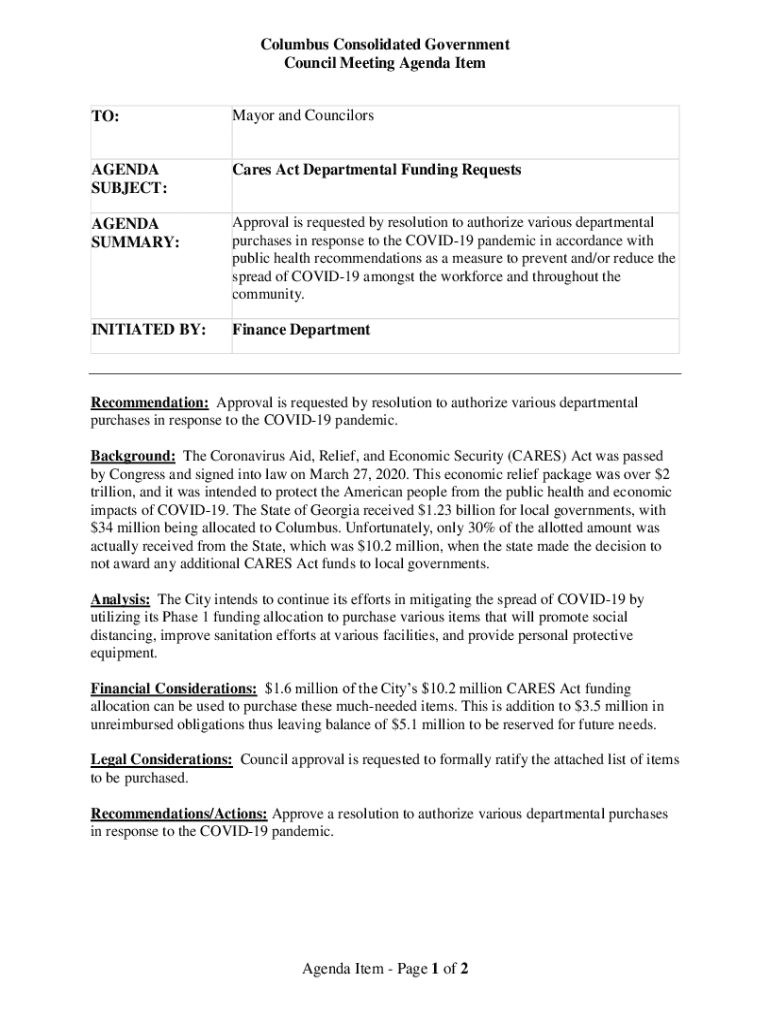

Get the free Public Money Demands Public Answers. Time ...

Get, Create, Make and Sign public money demands public

Editing public money demands public online

Uncompromising security for your PDF editing and eSignature needs

How to fill out public money demands public

How to fill out public money demands public

Who needs public money demands public?

Public Money Demands Public Form: A Comprehensive Guide

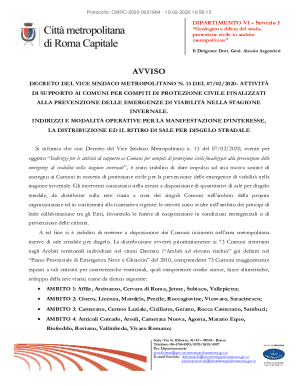

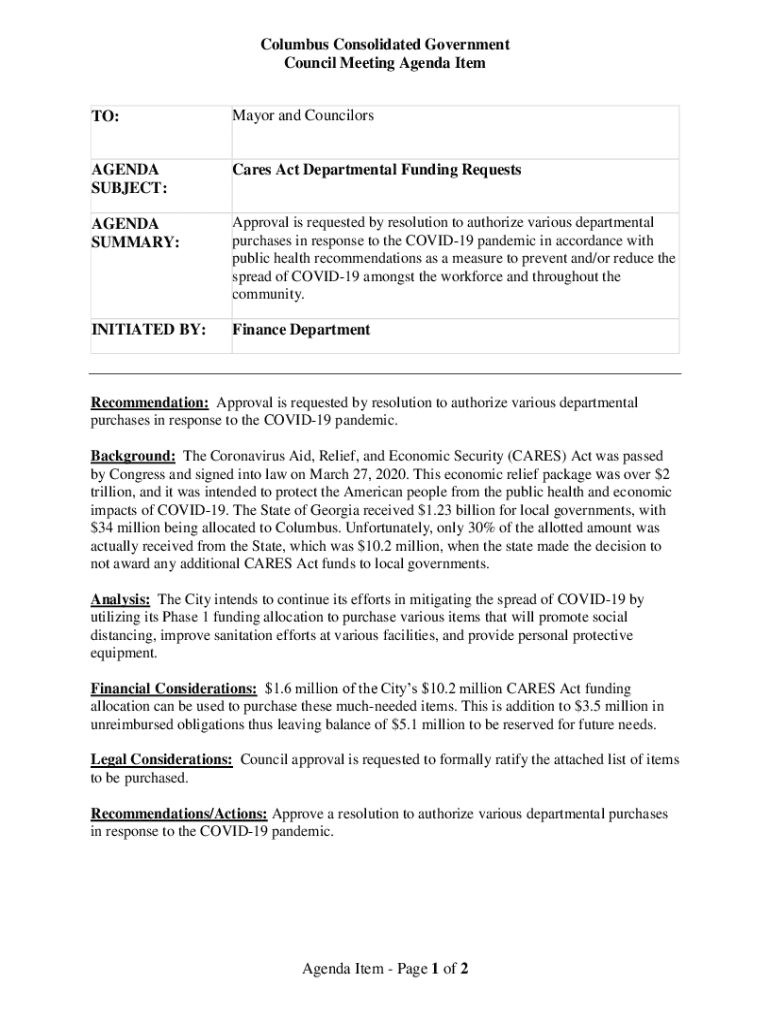

Understanding public money and its accountability

Public money refers to funds that are collected and managed by government entities, financed by taxpayer contributions. These funds are utilized to provide essential services, build infrastructure, and support community programs. The management and allocation of public money are crucial as they directly impact the lives of citizens, making accountability a top priority. Transparent handling of these funds ensures that they are used effectively, promoting public trust in governmental actions.

Public accountability, on the other hand, involves ensuring that government officials and institutions are answerable to the public for their use of public money. The relationship between public money and public forms lies within the structures established for documenting, reporting, and providing transparency regarding financial transactions and expenditure, ultimately holding those in charge accountable.

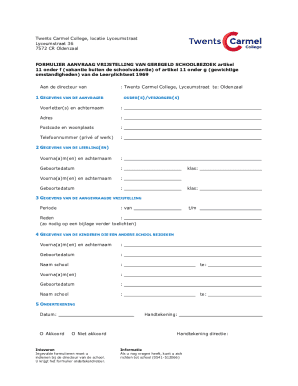

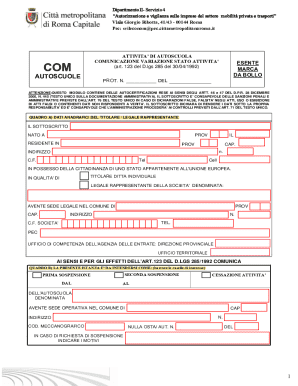

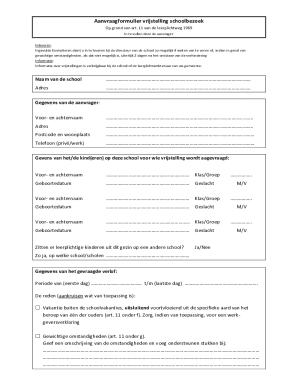

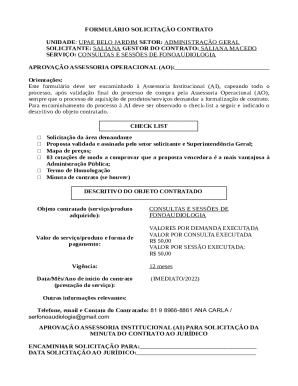

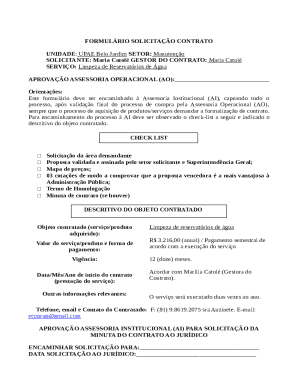

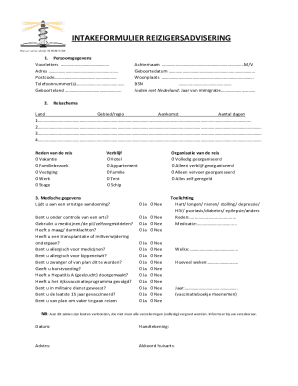

Types of public forms relevant to public money

Public forms play a significant role in tracking the flow and usage of public money. Various forms are designated for specific transparency and accountability purposes. Key types of public forms include FPPC forms, employee disclosure forms, campaign finance forms, and lobbying disclosures. Each of these forms serves a unique purpose in documenting financial data and ensuring compliance with laws governing public expenditures.

Utilizing these forms not only facilitates compliance with regulations but also enhances the transparency of governmental financial practices, allowing citizens to hold officials accountable for their decisions.

The necessity of transparency in public funds

Legal foundations for transparency in public funds are well-established, with regulations set by the Government Accountability Office (GAO) and various state-specific laws. These regulations require that public funds be subjected to stringent scrutiny and that their usage be documented transparently. Such legal frameworks ensure that public entities are held accountable for how taxpayer money is spent and that citizens have access to critical financial information.

The benefits of transparency extend well beyond legal compliance. When citizens are informed about how public funds are allocated and spent, it builds trust in their government. An informed citizenry is empowered to engage in meaningful dialogue, advocate for necessary changes, and foster a culture of accountability. As a result, public funds are utilized more responsibly, leading to improved services and community betterment.

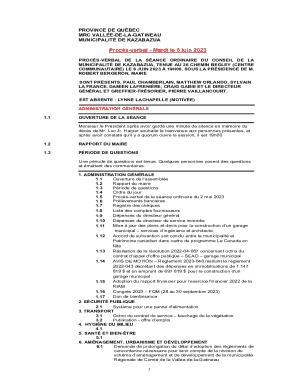

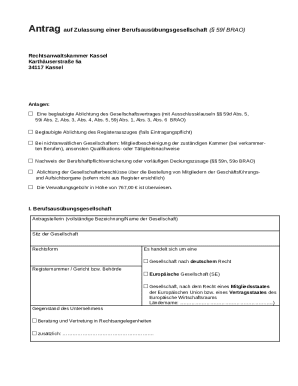

Navigating the public forms landscape

Finding and accessing public forms is simpler than it seems. Most government agencies maintain online portals that house these forms, making them accessible to the public. Citizens can easily find forms related to public money, whether for lobbying or campaign finance, through official websites. Additionally, tools like pdfFiller expedite the process, allowing users to fill and edit PDFs before submission.

To ensure you are using the most current versions of forms, regularly check the relevant government agencies' portals for updates. This step not only guarantees compliance but also helps in avoiding common mistakes associated with outdated forms.

Filling out public forms effortlessly

Correctly completing public forms is pivotal in avoiding delays and ensuring that necessary documentation is processed without issues. Key elements of properly completed forms include specified required information, such as names, addresses, and financial details. Additionally, being aware of common mistakes, such as misspellings or incomplete data, is essential.

Utilizing pdfFiller greatly enhances the experience of filling out forms. The platform provides editing capabilities that allow for easy corrections, along with eSign options for certification. If you're working within a team, pdfFiller also supports collaboration so that documents can be shared and modified in real time.

Managing and submitting public forms

Effective document management is crucial to ensure all public forms are submitted correctly and on time. This includes establishing a system for tracking deadlines and compliance requirements. Whether you’re managing a single form or multiple submissions, keeping organized files helps streamline the submission process.

When it comes to submitting public forms, adhering to specific guidelines is essential. Many forms can now be submitted online, while others may require in-person delivery. With pdfFiller, submission can often be as simple as a few clicks, as it allows users to directly submit forms from the platform, streamlining the process efficiently.

Addressing common issues in public form handling

Public forms can sometimes be rejected due to various reasons. It is important to know what steps to take if this occurs. Should a form be rejected, the first step is to review the feedback provided to understand the specific issue. Following that, you may need to update your submitted information or clarify any discrepancies.

Technical issues with online forms are not uncommon. Always ensure you are using a compatible browser and that your internet connection is stable. If you encounter persistent problems, contacting support for assistance can often resolve these issues quickly.

The future of public forms and digital solutions

The trends in public document management indicate a growing reliance on digital solutions that enhance public accountability. As technology evolves, we can expect improved tools that facilitate easier access to forms and greater transparency in financial transactions. Innovations in digital signature capabilities and automated tracking may soon become standard, simplifying the way public forms are managed and submitted.

Furthermore, public policy may evolve alongside these technological advancements, with legislation adapting to ensure that new digital frameworks maintain high standards of accountability. As citizens, being proactive in understanding these developments allows us to remain engaged and advocate for transparency in how public funds, ultimately reinforcing the principle that public money demands public form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit public money demands public from Google Drive?

How can I send public money demands public to be eSigned by others?

Where do I find public money demands public?

What is public money demands public?

Who is required to file public money demands public?

How to fill out public money demands public?

What is the purpose of public money demands public?

What information must be reported on public money demands public?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.