Get the free Tax FormsCCA - Division Of Taxation

Get, Create, Make and Sign tax formscca - division

How to edit tax formscca - division online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax formscca - division

How to fill out tax formscca - division

Who needs tax formscca - division?

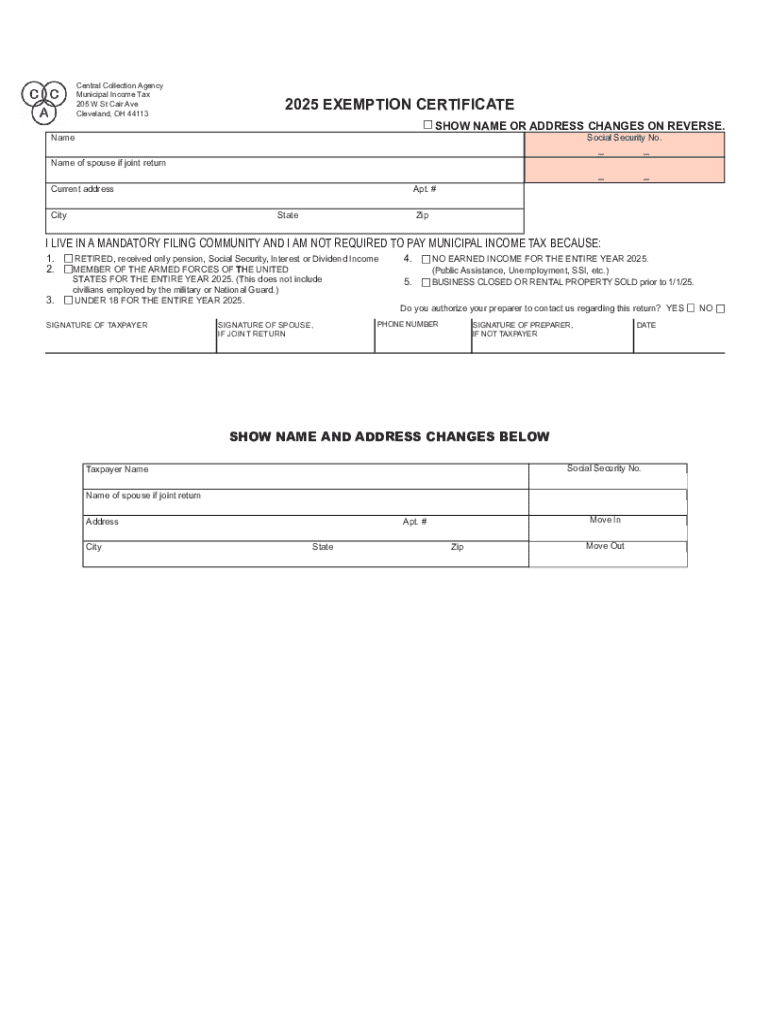

Understanding Tax Forms: CCA - Division Form

Understanding the CCA - Division Form

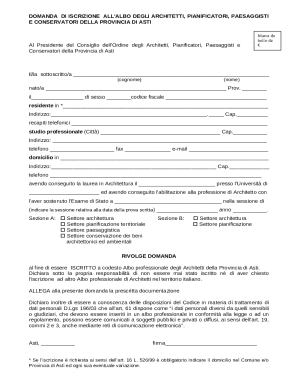

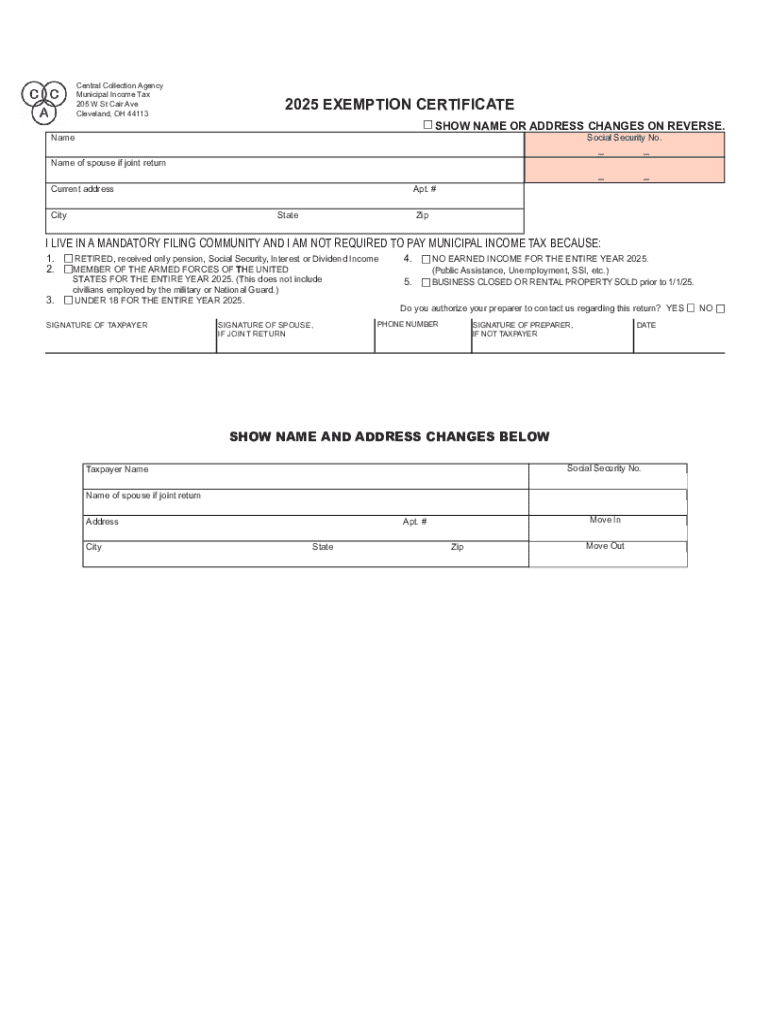

The CCA - Division Form is essential for individuals and businesses who need to report specific financial data to tax authorities. This form serves as a structured way to detail various income sources, deductions, and tax calculations that are applicable to your financial situation. Its primary purpose is to ensure compliance with tax regulations and streamline the tax preparation process for individuals and organizations.

In the context of tax compliance, the CCA - Division Form holds substantial importance. Failure to accurately complete this form can lead to complications during tax season, including audits or penalties. Understanding what the form entails and preparing the necessary information accurately can contribute significantly to a smoother filing experience.

Who needs to complete the CCA - Division Form?

This form is primarily targeted at individuals and teams who either run a business or have rental income, investments, or unique employment situations that must be reported. Freelancers, small business owners, and employees with additional income sources should prioritize completing the CCA - Division Form to accurately reflect their financial responsibilities and rights under tax law.

If you own a business or are a member of a partnership, completing this form is necessary to outline your income accurately. Additionally, for individuals earning additional income alongside a salary—from sources such as rental properties or investments—the CCA - Division Form is indispensable in clarifying income and deductions for tax calculation.

Preparing to fill out the CCA - Division Form

Before diving into filling out the CCA - Division Form, it is crucial to gather all necessary documentation. This includes income statements, deduction receipts, and any investment documentation. Compiling these documents ahead of time can simplify the completion process and reduce errors in your filing.

Organizing these files helps in ensuring that nothing is overlooked when filling out the CCA - Division Form. Additionally, familiarize yourself with common tax terminology that may appear across the document. Understanding terms like 'adjusted gross income' or 'tax liability' can make the completion of the form more intuitive.

Step-by-step guide to filling out the CCA - Division Form

Accessing the CCA - Division Form is straightforward. You can find it on the official tax authority's website or directly through pdfFiller’s platform, which offers an easily navigable interface for document management.

Filling out the form should be attempted section by section:

To avoid common mistakes during the filling process, carefully review each section before moving to the next. Utilize the features on pdfFiller, such as font adjustments and layout changes, for clarity.

Common challenges and solutions

While filling out the CCA - Division Form can initially seem daunting, addressing frequent concerns proactively can significantly enhance your experience. Common errors include incorrect social security numbers, misreported income, and missing signatures—all of which can delay processing.

If you encounter a notice or inquiry regarding your form submission, promptly address it. You can contact the pdfFiller support team for troubleshooting various submission issues, or utilize their live assistance feature to get quick resolutions.

Specialized circumstances

The process of filing the CCA - Division Form varies based on the type of entity. For instance, an LLC will report income differently compared to a traditional corporation. Each structure has its own nuances in tax obligations and required disclosures, making knowledge of these differences crucial.

Each state may have its specific requirements for the CCA - Division Form. Variations in deadlines and additional forms might exist based on local regulations. For residents of Ohio, such as those in suburbs around Cleveland, it’s beneficial to check resources available at local government offices to ensure full compliance with state regulations.

After submission: What’s next?

Once you submit the CCA - Division Form, tracking its status is essential. Many jurisdictions provide online tools to check the processing status of your submissions. Ensure that you keep records of any confirmation numbers or other identifiers provided.

If your form is rejected, be prepared to correct any highlighted errors and resubmit the form. Using pdfFiller allows for easy edits, creating an uncomplicated process for re-submission. Take note of the feedback provided to mitigate future errors.

Interactive tools and resources on pdfFiller

pdfFiller is equipped with interactive tools that help streamline the tax preparation process. One valuable resource is the tax calculator, which can help estimate your tax liability based on the information provided in the CCA - Division Form.

Utilizing these resources can significantly ease the preparation and filing process by empowering users to have a comprehensive overview of their tax situation.

Navigating the tax landscape

Staying informed about changes in tax laws can prove invaluable at tax time. Engaging with online platforms that specialize in tax-related content can provide crucial insights. pdfFiller not only simplifies document management but also offers resources curated for users to stay knowledgeable about legislative updates.

In conclusion, using tools like pdfFiller allows for a seamless experience in managing tax forms and documents, placing valuable resources at your fingertips. Whether you are an individual or part of a team, understanding the intricacies of the CCA - Division Form will enhance your competence in navigating financial obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax formscca - division for eSignature?

Can I sign the tax formscca - division electronically in Chrome?

Can I edit tax formscca - division on an iOS device?

What is tax formscca - division?

Who is required to file tax formscca - division?

How to fill out tax formscca - division?

What is the purpose of tax formscca - division?

What information must be reported on tax formscca - division?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.