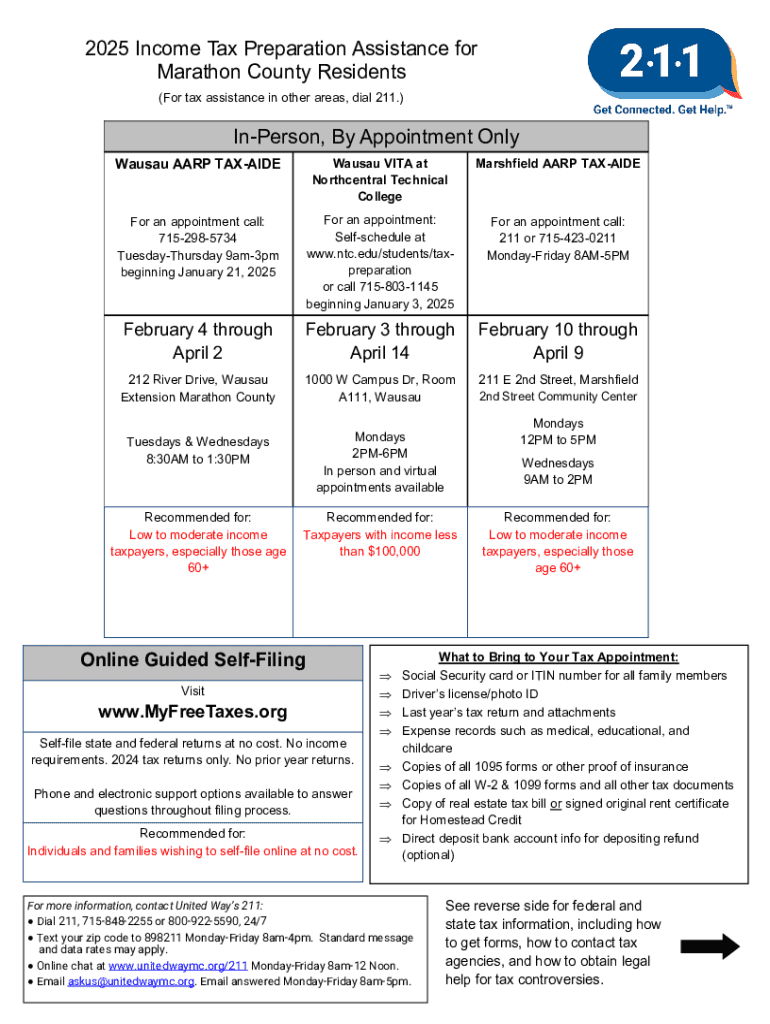

Get the FREE Tax Help is Available for Marathon County residents! ...

Get, Create, Make and Sign tax help is available

Editing tax help is available online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax help is available

How to fill out tax help is available

Who needs tax help is available?

Tax Help is Available Form: A Comprehensive How-To Guide

Understanding tax help availability

Tax help encompasses a variety of services and resources designed to support individuals and organizations in navigating the complex world of tax regulations and filings. It is crucial for ensuring compliance, maximizing deductions, and minimizing potential liabilities. For many, understanding taxes can feel overwhelming, making tax assistance invaluable.

The need for tax help is especially prominent during filing seasons, as individuals and teams scramble to meet deadlines while seeking to optimize their returns. Whether it's navigating unique tax laws or simply filling out forms correctly, access to reliable tax help can mitigate stress and enhance accuracy.

Key forms for tax help

Essential for proper tax filing, a variety of federal and state forms capture crucial financial information. Common federal forms include the IRS Form 1040 for individual income tax returns and W-2 forms provided by employers to report wages earned. These documents are vital for accurately reporting income and determining tax liability.

For residents of Arizona, state-specific forms like Form 140 are necessary for filing state taxes. Accessing these forms is easier than ever, thanks to platforms like pdfFiller, which allow you to download and fill out forms directly online.

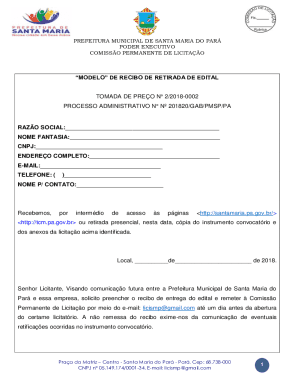

Efficiently filling out tax help forms

Filling out tax forms can be a daunting task, but a systematic approach can simplify the process. Start by gathering necessary documents such as previous returns, W-2s, and any relevant financial records. Next, utilize online platforms like pdfFiller, which offer intuitive tools for entering and managing data.

Common pitfalls to be mindful of include overlooking essential deductions and failing to double-check entered data. Always review your forms before submission to catch any errors that might affect your tax return.

Using interactive tools for tax preparation

pdfFiller offers a range of interactive tools that streamline the tax preparation process. One significant advantage of using a cloud-based solution is the ability to work collaboratively in real-time, allowing teams to fill out forms collectively, enhancing accuracy and efficiency.

Utilizing features such as e-signatures can greatly expedite the submission process. E-signing documents is legally recognized and simplifies the signing process, ensuring you can manage documentation from anywhere.

Managing and submitting your tax help forms

After filling out your tax forms, managing them effectively is the next crucial step. pdfFiller provides options to save your progress and share forms easily with tax professionals for review. This capability ensures that your documents remain accessible regardless of location.

When it comes time to submit, familiarize yourself with deadlines and acceptable submission methods. Both electronic and paper submissions have their own guidelines, so ensure you follow the correct procedure to avoid any complications.

Troubleshooting tax help related issues

While filling out tax forms is straightforward, issues can arise. Common problems include data entry errors and discrepancies with e-signatures. If you encounter an issue, check the details entered, and ensure that any required fields are accurately completed.

If mistakes persist or you're unsure about the complexities of your tax situation, seeking professional help becomes essential. Knowing when to consult a tax professional can save you from potential penalties.

Tax help for diverse audiences

Tax help is not one-size-fits-all; different demographics have varying needs. Individuals might focus on personal deductions and credits, whereas teams, especially those in small businesses, may have to handle payroll taxes and employee benefits more intricately.

Utilizing platforms like pdfFiller can ensure that both individuals and teams have the tools needed for efficient tax preparation, enabling timely submissions and collaboration.

Frequently asked questions (FAQs)

As tax season approaches, users often seek tailored advice on best practices. To maximize your experience with pdfFiller, take advantage of its comprehensive toolkit, which can streamline your tasks effectively.

Mistakes on tax forms are common, but knowing how to amend errors can prevent costly consequences. Understanding the additional features available for document security will help you safeguard sensitive information when managing tax documentation.

Testimonials and success stories

From various users sharing their experiences, the effectiveness of pdfFiller shines across different contexts. For instance, small businesses have reported significant time savings by utilizing collaborative features during tax preparation. Personal users have celebrated the ease of accessing forms and signing documents digitally.

These success stories illuminate the versatility of pdfFiller, proving it to be a reliable tool that complements a range of tax help needs.

Staying updated with tax help resources

Tax laws and forms evolve regularly, making it crucial to stay informed. Subscribing to tax help updates ensures you are aware of changes that could impact your filing. Engaging with reputable resources online will keep you empowered with the latest news.

By actively seeking information and engaging with tools like pdfFiller, users can navigate the ever-changing landscape of tax assistance with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax help is available for eSignature?

How do I fill out the tax help is available form on my smartphone?

How do I fill out tax help is available on an Android device?

What is tax help is available?

Who is required to file tax help is available?

How to fill out tax help is available?

What is the purpose of tax help is available?

What information must be reported on tax help is available?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.