Get the free Minnesota Form KS (Shareholder's Share of Income, ...

Get, Create, Make and Sign minnesota form ks shareholder039s

Editing minnesota form ks shareholder039s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota form ks shareholder039s

How to fill out minnesota form ks shareholder039s

Who needs minnesota form ks shareholder039s?

Understanding the Minnesota Form KS Shareholder's Form: A Comprehensive Guide

Understanding the Minnesota Form KS shareholder's form

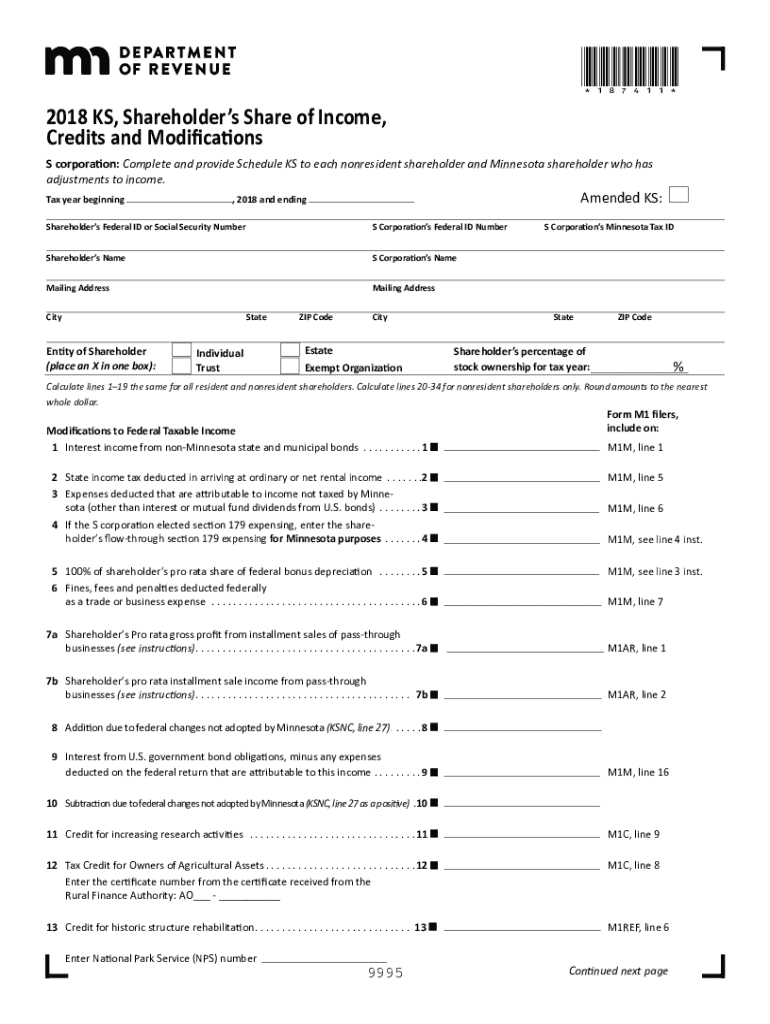

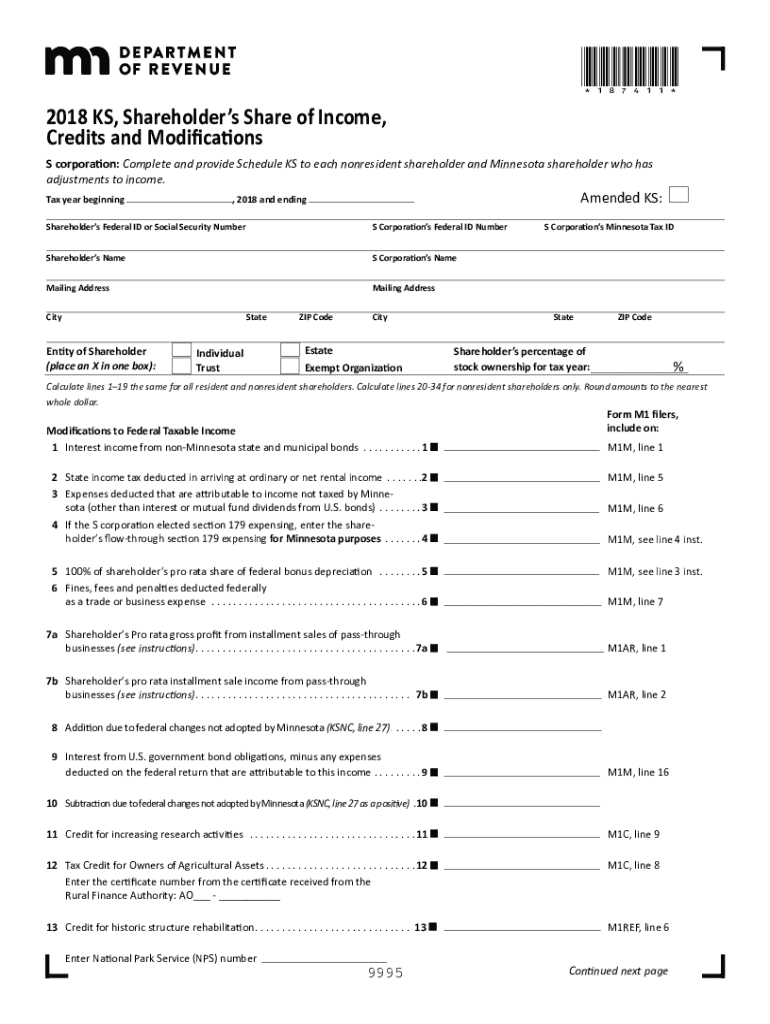

The Minnesota Form KS is a crucial document required for shareholders of S corporations in Minnesota. Its primary purpose is to report an S corporation's income, deductions, and credits, effectively allowing shareholders to determine their respective tax obligations. In this context, Form KS serves as a vehicle for both the corporation and its shareholders to comply with tax laws, ensuring that income is accurately reported and taxed at the individual shareholder level, rather than at the corporate level.

For shareholders in Minnesota, the importance of the Form KS cannot be understated. It allows shareholders to share relevant financial data with the state revenue department, facilitating a clear understanding of each individual’s financial participation in the corporation. This clarity not only aids in tax calculations but also plays a significant role in maintaining compliance with Minnesota tax regulations.

When is the Minnesota Form KS required?

The Minnesota Form KS is mandatory for every S corporation operating within the state that has shareholders. Specifically, it must be filed under the following conditions:

The deadline for submitting the Form KS typically aligns with the corporation's tax return deadline, which is usually the 15th day of the fourth month following the end of the tax year. For many corporations, this means that the form must be filed by April 15th.

Detailed breakdown of the Minnesota Form KS

A thorough understanding of the Minnesota Form KS requires familiarity with its key sections. The form is structured to capture vital information that is significant for both the corporation and its shareholders. An overview of the main components includes:

Each section serves a distinct purpose. For example, identifying the corporation ensures accurate association of the corporation with its reporting obligations. Shareholder information highlights who is entitled to distributions and affects individual tax liabilities, while financial details are essential for tax calculations based on share ownership.

Common terms and language used in the form

Understanding legal jargon can often be daunting. To aid in completing the form accurately, a glossary of essential terms includes:

Step-by-step guide to completing the Minnesota Form KS

Completing the Minnesota Form KS requires careful attention to details and organization. Begin by gathering all necessary information to streamline the process. Here’s a checklist of documents required:

With the necessary documents on hand, follow these steps to complete the form:

Some common mistakes to avoid include neglecting signatures, making incorrect calculations, and missing submission deadlines. Each of these errors can create significant issues with tax liability and compliance.

Editing and managing your Minnesota Form KS

Once you have filled out the Minnesota Form KS, consider using pdfFiller for effortless editing and management. pdfFiller provides an intuitive platform that allows users to upload and modify the form with ease.

Furthermore, once your document is completed, you can save and export it in various file formats. This flexibility allows for safe storage and easy sharing of your Minnesota Form KS, whether for personal records or for submission.

Filing the Minnesota Form KS

Filing the completed Minnesota Form KS is a vital step in ensuring compliance with Minnesota tax laws. There are two primary methods for submitting your form: by mail or electronically. For mailing, address the document to the Minnesota Department of Revenue, ensuring that it is sent well ahead of the deadline to avoid delays.

After you submit your Minnesota Form KS, you can expect to receive an acknowledgment of receipt. This confirmation is essential for your records and informs you that your filing has been accepted. Post-submission, ensure you keep a follow-up on any communications from the state regarding your filing.

Frequently asked questions about the Minnesota Form KS

Many individuals have concerns about mistakes and electronic filing when it comes to the Minnesota Form KS. If you make a mistake on the form, you can follow certain correction procedures. This typically involves filing an amended Form KS to rectify any errors, ensuring that the changes are clearly noted.

Regarding electronic filing, while several measures are being taken to streamline the process, you’ll need to confirm whether or not electronic submissions are accepted for the current filing year through the Minnesota Department of Revenue’s website.

Moreover, it’s important to understand that there can be penalties for late submissions. Failing to file on time may result in fines or additional interest on any taxes owed, creating unnecessary financial burdens on shareholders. Compliance ensures clearer financial practices and avoids unwanted penalties.

Related forms and documents

In addition to the Minnesota Form KS, shareholders may need to be aware of other relevant tax forms. Key related documents include:

These documents often work in conjunction with the Minnesota Form KS, aligning overall tax reporting and ensuring shareholders remain compliant with state regulations.

Resources for shareholders

For further assistance, shareholders can find valuable resources through the Minnesota Department of Revenue’s website. This includes additional information, FAQs, and even contact details for direct inquiries, helping shareholders navigate their responsibilities effectively.

Tools and resources for effective document management

pdfFiller stands out as a powerful solution for document creation and management, offering a multitude of features designed to simplify the process of managing forms such as the Minnesota Form KS. Users have the capability to easily create, edit, and sign documents all from one cloud-based platform.

Additionally, pdfFiller provides access to expert support and guidance, ensuring that users can maximize their experience with the platform. Comprehensive tutorials available on the site further enhance user competency in managing their Minnesota Form KS and other documents effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my minnesota form ks shareholder039s in Gmail?

How can I send minnesota form ks shareholder039s for eSignature?

How do I fill out minnesota form ks shareholder039s using my mobile device?

What is Minnesota Form KS Shareholder's?

Who is required to file Minnesota Form KS Shareholder's?

How to fill out Minnesota Form KS Shareholder's?

What is the purpose of Minnesota Form KS Shareholder's?

What information must be reported on Minnesota Form KS Shareholder's?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.