Get the free MO-PTE Pass-Through Entity Income Tax Return - dor mo

Get, Create, Make and Sign mo-pte pass-through entity income

How to edit mo-pte pass-through entity income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-pte pass-through entity income

How to fill out mo-pte pass-through entity income

Who needs mo-pte pass-through entity income?

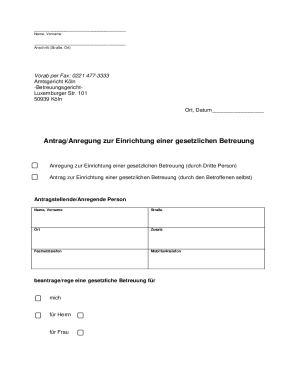

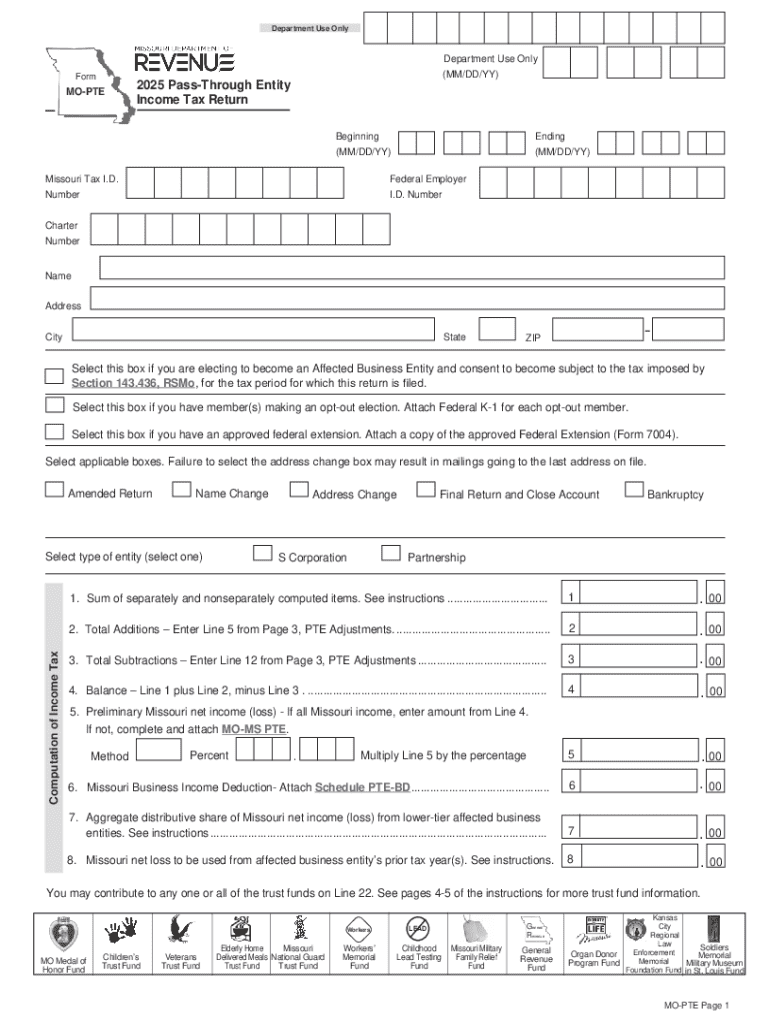

MO-PTE Pass-Through Entity Income Form: A Comprehensive How-to Guide

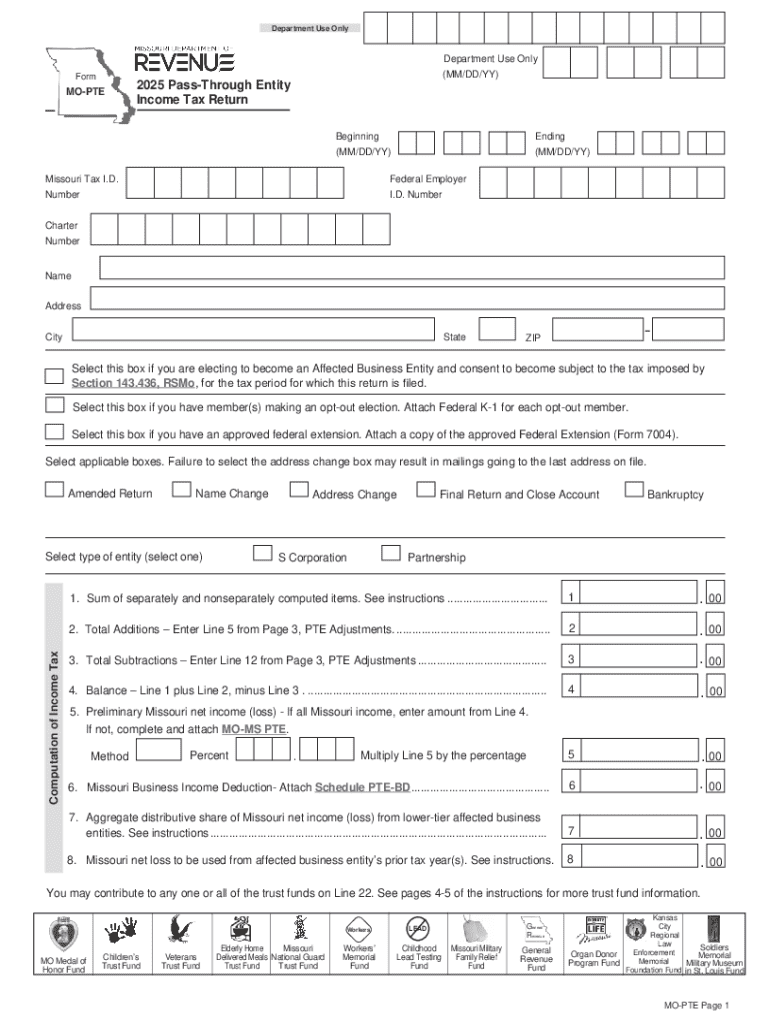

Overview of the MO-PTE pass-through entity income form

The MO-PTE Pass-Through Entity Income Form is essential for reporting income generated by pass-through entities in Missouri. This form serves as an informative conduit for partnerships, limited liability companies (LLCs), and S corporations to report their income and distribute tax obligations to their owners or investors. The significance of timely completion and submission of this form cannot be overstated as it ensures compliance with Missouri state tax requirements and helps avoid potential penalties.

Filing the MO-PTE form has specific yearly deadlines, which typically align with the tax filing season. It's crucial for business owners to keep track of these deadlines to ensure their submissions are processed without delay.

Understanding pass-through entities

Pass-through entities include partnerships, LLCs, and S corporations that allow income to 'pass through' the business directly to the owners’ personal tax returns. Unlike traditional corporations, these entities do not pay corporate income tax; instead, tax liabilities are passed to the individuals, who report their share of the income or loss on their personal returns.

There are significant advantages to choosing a pass-through tax structure, including the avoidance of double taxation—once at the corporate level and again at the individual level. Furthermore, owners can benefit from various deductions that conventional corporations might not have access to, allowing for optimized tax savings.

Detailed breakdown of the MO-PTE form sections

The MO-PTE form comprises several critical sections that need to be carefully completed to ensure accurate reporting. Understanding these sections creates a smoother filing process.

Basic information

The first section of the MO-PTE form requires essential identifying details about the entity, including the business name, tax identification number, and address. This information verifies the entity's identity to the state, making it a crucial step in the reporting process.

Income reporting

Following basic information, the income reporting section is where entities disclose their revenue. This includes various income sources such as operational income, interest, and dividends. Completing this section accurately is vital, as it affects the pass-through taxation calculations.

Deductions and credits

Deductions can significantly affect the taxable income. The MO-PTE form allows entities to input allowable expenses such as operating costs and certain tax credits. Accurately claiming these deductions and credits is key to reducing taxable income and optimizing tax liabilities.

Tax calculation

Once income and deductions are reported, the next step is calculating the pass-through entity tax. This calculation involves applying the relevant Missouri tax rate to the reported income after deductions. It is essential to adhere to the specific tax computation rules outlined by Missouri state law to ensure compliance.

Step-by-step instructions to fill out the MO-PTE form

Gathering necessary documentation

Before starting to fill out the MO-PTE form, gather all relevant documentation. Essential documents include previous tax returns, income statements, records of other forms of income, and any details related to deductions and credits. Having this information ready will streamline the process.

Completing the online form

Utilizing platforms such as pdfFiller greatly simplifies the completion of the MO-PTE form. The user-friendly interface allows for easy entry of information, and the interactive tools help validate the data as it is entered to minimize errors. The platform's PDF editing features ensure that your filings are accurately filled out before submission.

Using eSignature and collaboration features

pdfFiller also facilitates the electronic signing of the MO-PTE form, making the submission process faster and more efficient. Moreover, its collaboration features enable team members to work together on filling out the form, ensuring accuracy and compliance from all contributors.

Troubleshooting common issues

When filling out the MO-PTE form, several common mistakes can arise. These include misreporting income, failing to include required deductions, or incorrectly calculating tax liabilities. However, identifying these discrepancies early on can save time and reduce stress.

Utilizing pdfFiller’s support resources can help users troubleshoot these issues. Whether through their knowledge base or customer service, assistance is available to guide users in resolving problems associated with form inaccuracies or technical issues related to form submission.

Tips for a smooth filing experience

To ensure a smooth filing experience, maintain organized financial records throughout the year. Consider using accounting software to automatically track income and expenses. Furthermore, keep an eye on upcoming deadlines, and aim to submit your forms well ahead of these dates to avoid late penalties.

Remaining proactive about compliance can help minimize audits. Regularly review changes in tax laws that may affect your pass-through entity. By staying informed, you can enhance your filing experience and maintain robust financial health.

Understanding follow-up and payment procedures

After submitting the MO-PTE form, anticipate an acknowledgment from the state of Missouri. It’s important to keep good records of your submission for future reference. Additionally, if tax payment is owed, guidance on payment options will be provided, including online payment initiatives that streamline this process.

To manage payment effectively, remain aware of any payment deadlines beyond the form submission. Timing is crucial for avoiding interest and penalties on late payments. Document management for future reference plays a key role in organizational success, so ensure each document is stored correctly.

Leveraging pdfFiller for document management efficiency

pdfFiller offers numerous features that streamline document management and create significant efficiencies in filing the MO-PTE form. Its cloud-based platform allows users to access their documents conveniently from any location, making it easier to manage and store tax-related documents securely.

Additionally, the platform supports a wide array of tax-related forms beyond MO-PTE, ensuring that your compliance obligations are met across different regulatory requirements and supporting seamless transitions as tax laws and forms evolve.

FAQ section

As you navigate the MO-PTE form, several frequently asked questions commonly arise. Answers to topics such as multi-state filing and specific scenarios regarding income types can be pivotal in preventing compliance issues.

Understanding how to accurately report ownership percentages and income distributions is also essential for a successful filing. Addressing these concerns proactively reduces stress and assures peace of mind as you fulfill your tax obligations.

Accessing state resources and further guidance

For additional assistance with the MO-PTE Pass-Through Entity Income Form, create easy access to relevant Missouri state tax resources. Official guidelines, supplementary forms, and practical manuals are available to help clarify requirements.

If further clarification is needed, state tax assistance services can provide additional insights or support, ensuring that users have all the tools necessary for compliant, efficient filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mo-pte pass-through entity income for eSignature?

How do I make edits in mo-pte pass-through entity income without leaving Chrome?

Can I edit mo-pte pass-through entity income on an Android device?

What is mo-pte pass-through entity income?

Who is required to file mo-pte pass-through entity income?

How to fill out mo-pte pass-through entity income?

What is the purpose of mo-pte pass-through entity income?

What information must be reported on mo-pte pass-through entity income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.