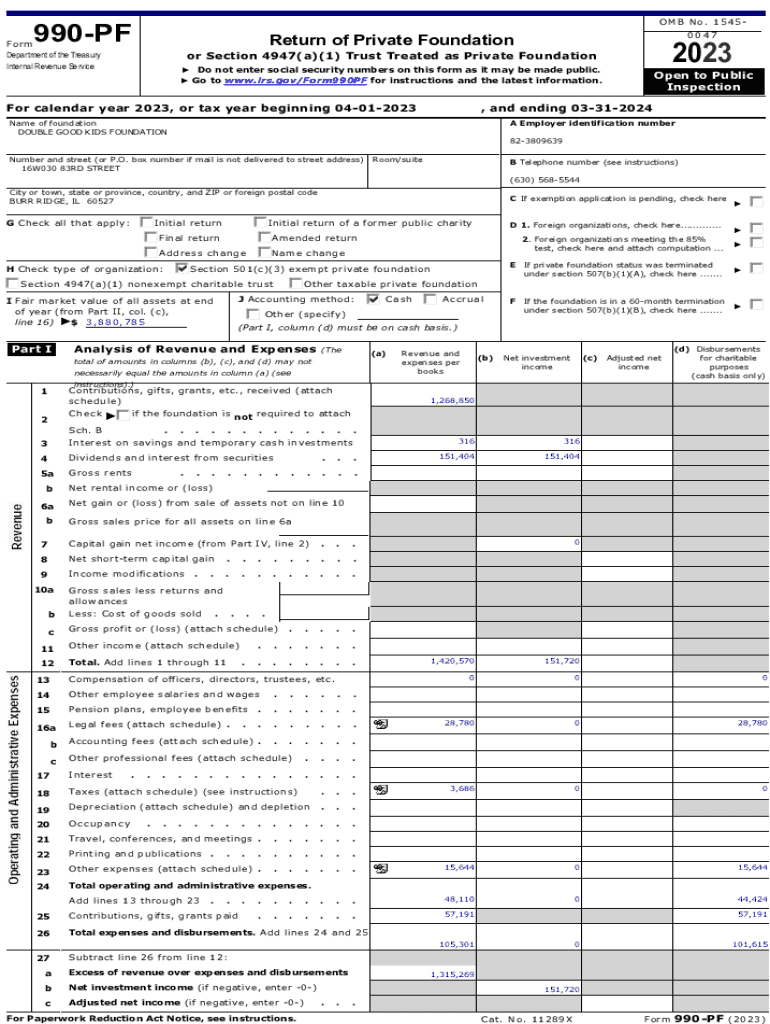

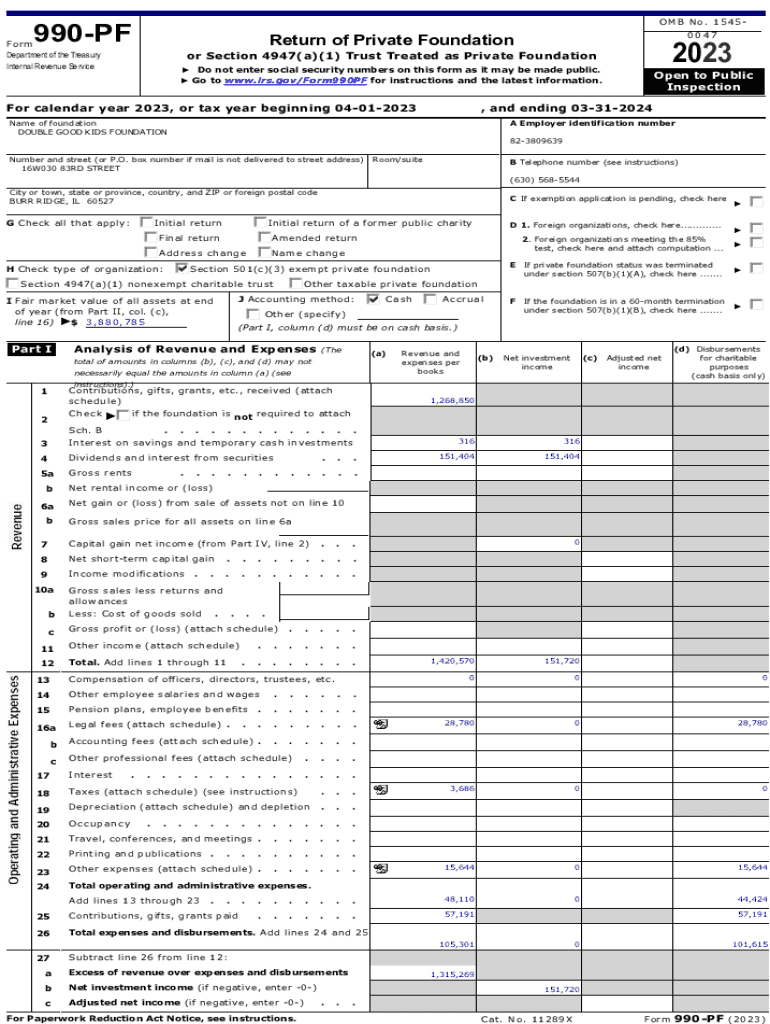

Get the free For calendar year 2023, or tax year beginning 04012023

Get, Create, Make and Sign for calendar year 2023

How to edit for calendar year 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for calendar year 2023

How to fill out for calendar year 2023

Who needs for calendar year 2023?

Comprehensive Guide to the Calendar Year 2023 Form

Overview of the 2023 form landscape

The calendar year 2023 brings new regulations and deadlines for various forms that individuals and organizations must navigate. Annual forms are essential for effective planning, compliance with tax obligations, and accurate reporting of income. Understanding the landscape is critical, as the specifics for each type of form can vary widely and impact financial decision-making.

As we move through the year, key deadlines are established for various submissions. For instance, April 15 remains the primary tax filing deadline for most individuals, while corporations and other entities have their own targeted dates. Timeliness in submitting these forms ensures avoidance of penalties and enhances financial clarity.

Major types of forms for 2023

Navigating the many forms necessary for the calendar year 2023 can be daunting. Different types of forms serve distinct purposes, primarily depending on whether you are filing as an individual or corporation.

Step-by-step guide to filling out 2023 forms

Successfully filling out forms for calendar year 2023 is a process that can be streamlined with proper preparation. Here’s a step-by-step guide to ensure you are well-prepared.

Tools and features of pdfFiller for 2023 forms

When tackling the complexities of forms for the calendar year 2023, leveraging the tools offered by pdfFiller significantly enhances the experience. There are various features designed to streamline your document management.

Additional support and resources

Understanding the nuances of the 2023 forms can be complicated. Thankfully, several support resources are available to guide you through the process.

Staying compliant with 2023 tax regulations

Compliance with evolving tax regulations is crucial for individuals and businesses alike. This year brings several key changes that may affect the forms you file.

Keeping updated on changes in tax laws related to your specific form types is imperative for maintaining compliance. Regularly check official resources and follow updates to ensure all submitted documentation meets current legal requirements.

Language assistance and accessibility

For those who may need language assistance or accessibility features, pdfFiller offers a variety of resources. Ensuring that all users have equitable access to forms is a priority.

Utilizing pdfFiller's accessible tools can provide support for non-English speakers and those with disabilities, ensuring everyone can complete the required forms successfully.

Connect with pdfFiller

Engaging with the pdfFiller community can enhance your understanding of form management. Social media platforms, blogs, and newsletters keep you updated on the latest features and user tips.

Following pdfFiller across various channels can provide you with a steady stream of information and best practices to optimize your document workflow for the calendar year 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send for calendar year 2023 to be eSigned by others?

How can I fill out for calendar year 2023 on an iOS device?

How do I fill out for calendar year 2023 on an Android device?

What is for calendar year 2023?

Who is required to file for calendar year 2023?

How to fill out for calendar year 2023?

What is the purpose of for calendar year 2023?

What information must be reported on for calendar year 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.