Get the free Form 8868: IRS Extension Guide for Exempt Organizations

Get, Create, Make and Sign form 8868 irs extension

Editing form 8868 irs extension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868 irs extension

How to fill out form 8868 irs extension

Who needs form 8868 irs extension?

Form 8868 IRS Extension Form: Your Essential Guide

Understanding Form 8868: The IRS extension form for nonprofits

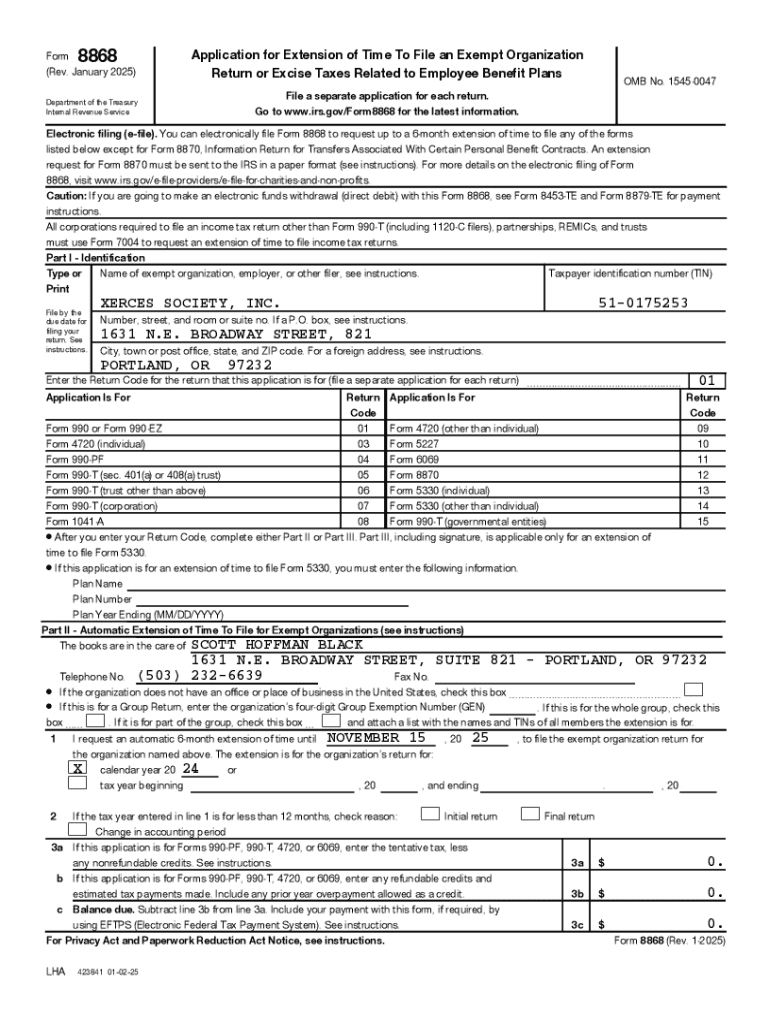

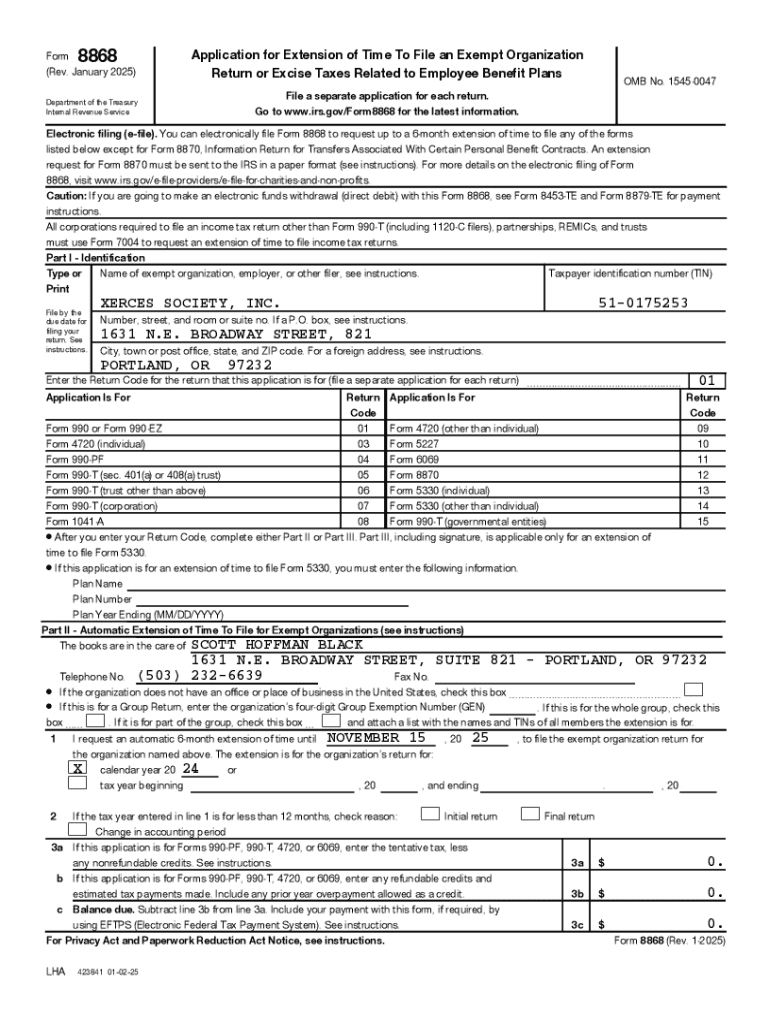

Form 8868 serves as a critical tool for nonprofit organizations seeking an extension for their annual information return. This IRS extension form allows entities exempt from income tax, like charitable organizations and certain trusts, to request additional time to file their tax returns. Understanding the purpose of Form 8868 ensures that nonprofits remain compliant and avoid penalties associated with missed deadlines.

Any exempt organization, including 501(c)(3) charities, must familiarize themselves with Form 8868. It’s essential for nonprofits that may require more time to report financial activities or both operational and compliance-related data accurately. Within the IRS framework, key deadlines help organizations ensure they do not jeopardize their tax-exempt status while adhering to federal regulations.

Types of extensions granted by Form 8868

Form 8868 primarily provides an automatic six-month extension for nonprofit organizations to file their annual information return, which is often Form 990. This extension is crucial for organizations that may find it difficult to prepare their documents in the allowed timeframe. However, it’s important to note that the extension only applies to filing, and any taxes owed must still be paid by the original deadline to avoid penalties.

In some cases, additional extensions may be necessary. Although the IRS usually does not allow more than one automatic extension, there may be circumstances that warrant further requests. Organizations can contact the IRS to discuss specific circumstances under which they could potentially secure extended filing times. Being proactive in communicating with the IRS is essential if you believe your organization’s needs may extend beyond the automatic period.

Step-by-step guide: How to complete Form 8868

Completing Form 8868 involves a systematic approach to gather the necessary details that the IRS requires. Organizations must begin by collecting their Tax ID number, which is crucial for the IRS to identify the entity when processing the extension. This number, along with accurate organization details, will facilitate a smoother filing process.

Following the data collection, the form must be completed section by section. Part I of Form 8868 requests general information about the organization, such as the name, address, and the applicable tax year. Part II delves into specifics regarding the requested extension, where organizations confirm the purpose and verify the extension request next to their annual information return.

Common mistakes include errors in the Tax ID or incompatible details with previous filings. To mitigate these issues, consider reviewing the completed form multiple times and, if possible, consult with a tax professional. Correctly filing Form 8868 is crucial for maintaining your exempt organization status.

E-filing vs. paper filing: Choosing the right method

E-filing Form 8868 presents nonprofits with a myriad of benefits over traditional paper filing methods. Speed and convenience are the most significant advantages; organizations can submit their requests rapidly through an online interface. Moreover, e-filing provides immediate confirmation of receipt, which can alleviate the anxiety associated with timing and submission.

To e-file Form 8868, nonprofits should begin by accessing an authorized e-file provider. The process typically involves creating an account, filling out the form online, and submitting electronically. Popular platforms, like pdfFiller, offer user-friendly interfaces that guide organizations through the e-filing process, ensuring compliance with IRS regulations.

Additional features and tools for managing Form 8868

Utilizing platforms like pdfFiller offers nonprofits additional features that enhance the filing experience. Interactive tools, including editing capabilities and templates for Form 8868, streamline the process considerably. Additionally, eSignature integration facilitates faster approvals and confirmations from required stakeholders within the organization.

Collaboration is an integral part of managing nonprofit documentation. pdfFiller enables users to share documents with team members, allowing for real-time editing and comments on Form 8868. This ensures that all involved parties can contribute to the filing process and maintain transparency regarding essential filing details and requirements.

Understanding IRS compliance and implications of filing Form 8868

Failure to file Form 8868 on time can have significant repercussions for nonprofit organizations. If the deadline is missed, penalties may arise, including the loss of tax-exempt status. Noncompliance ultimately jeopardizes the organization's ability to serve its mission effectively, as financial penalties can hinder funding and operational capabilities.

Timeliness is paramount in protecting your nonprofit status. Ensuring compliance with the IRS through prompt filing of Form 8868 safeguards against scrutiny and ensures the organization can focus on its primary mission rather than facing avoidable penalties or legal challenges.

Answering your questions: Frequently asked questions about Form 8868

Organizations may still have uncertainties about their filing of Form 8868. For instance, if an extension is denied, nonprofits can inquire with the IRS for clarification and guidance on corrective actions. Similarly, organizations should recognize that filing an extension does not alter the adherence to other nonprofit state filing requirements, making a detailed review of all obligations crucial.

Importantly, nonprofits can e-file Form 8868 from anywhere as long as they have internet access. This flexibility is particularly advantageous for organizations with remote teams or those operating in different locations. With pdfFiller, additional remote-support tools ensure proper guidance throughout the filing experience.

Free resources and tools to simplify your filing experience

pdfFiller offers extensive resources to assist nonprofits with their Form 8868 needs. From comprehensive guides that walk through the filing process to detailed FAQs addressing common concerns, the platform provides a wealth of knowledge. Users can access these tools directly through the website, ensuring they have everything needed to facilitate a smooth filing experience.

Additionally, the platform features live support for real-time assistance during the filing process. Nonprofits may also explore recommended third-party tax preparation services that specialize in nonprofit tax filings, ensuring that experts are on hand to provide guidance where needed.

Recent changes and updates to Form 8868 for 2025 tax year

As tax regulations continue to evolve, staying informed about changes to Form 8868 is crucial for nonprofit organizations. For the 2025 tax year, new requirements and regulatory shifts may require organizations to adapt their filing strategies. It is vital to monitor IRS announcements and industry responses to such changes, ensuring compliance and efficiency.

Organizations should consider connecting with tax professionals to navigate these new regulations effectively. Keeping abreast of updates will help nonprofits uphold their tax-exempt status and focus on their missions without interruption.

Testimonials and success stories: E-file Form 8868 with confidence

Hearing from organizations that have successfully navigated the Form 8868 filing process can provide valuable insights. Nonprofits using pdfFiller's solutions have reported significant time savings and reduced stress when managing their documentation and extensions. By sharing experiences, these organizations emphasize the importance of harnessing digital tools for efficient compliance.

Case studies reveal how various successful nonprofits maximized their operational potential while managing form submissions effectively. Their journeys demonstrate the benefits of leveraging digital platforms and maintaining a streamlined filing process, coming together to illustrate that filing Form 8868 need not be a daunting task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8868 irs extension online?

How do I edit form 8868 irs extension straight from my smartphone?

How do I fill out the form 8868 irs extension form on my smartphone?

What is form 8868 irs extension?

Who is required to file form 8868 irs extension?

How to fill out form 8868 irs extension?

What is the purpose of form 8868 irs extension?

What information must be reported on form 8868 irs extension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.