Get the free ACA Reporting: New Procedures to Request Social ...

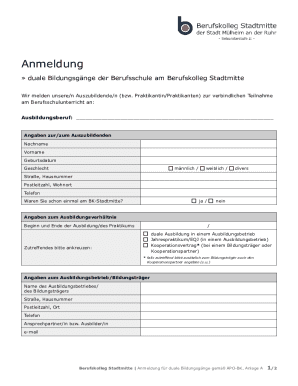

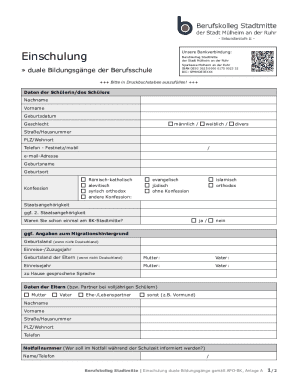

Get, Create, Make and Sign aca reporting new procedures

How to edit aca reporting new procedures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aca reporting new procedures

How to fill out aca reporting new procedures

Who needs aca reporting new procedures?

Understanding ACA Reporting New Procedures Form: A Comprehensive Guide

Understanding ACA reporting: The new landscape

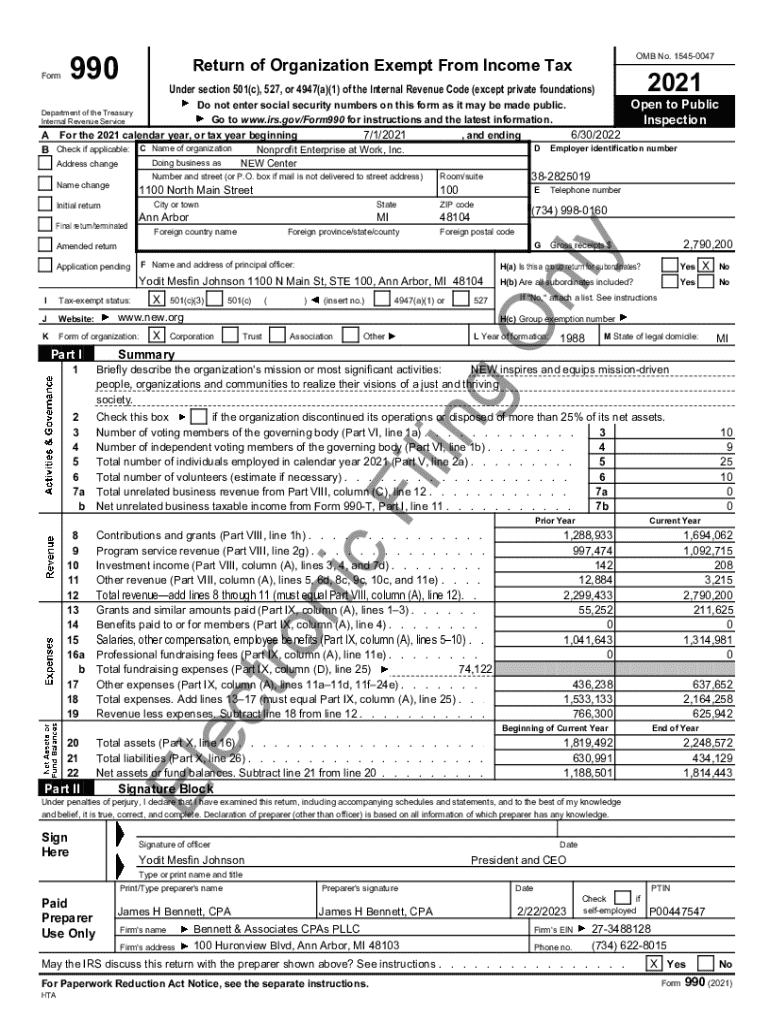

The Affordable Care Act (ACA) is a landmark piece of legislation aimed at providing affordable health insurance coverage to more Americans. As part of its mandates, specific reporting requirements have been established for employers to ensure compliance. Understanding these requirements, particularly the changes implemented for 2023, is crucial for effective health plan management and regulatory compliance.

Compliance with ACA reporting regulations not only helps in avoiding penalties but also promotes transparency regarding health coverage among employees. Given the continuously evolving nature of healthcare regulations, staying ahead of changes can significantly reduce paperwork burdens, improve employee engagement, and streamline administrative processes.

Key changes for 2023 include updated reporting procedures that impact how employers must document and submit information regarding employee health coverage. This new landscape necessitates an understanding of innovative processes, effective tools, and proactive measures to adapt to upcoming regulatory challenges.

The new procedures: What you need to know

The introduction of new procedures for ACA reporting requires employers to familiarize themselves with essential updates. One significant component of these changes is revised deadlines aimed at improving the efficiency of the reporting process. Employers are now expected to adhere to stricter compliance timelines, which can vary based on organizational size and coverage options.

Modification in reporting frequency represents another substantial shift in ACA protocol. Rather than submitting reports annually, certain employers may now be obligated to report more frequently depending on their size and the nature of the coverage provided. This change is likely aimed at ensuring that accurate information is readily available for audits and checks.

Additionally, new forms have been introduced that may require more detailed documentation compared to previous years. Employers will need to gather specific information related to employee coverage, which can impose additional administrative burdens. Understanding these implications is essential for both employers and employees to navigate the regulatory obligations effectively.

Step-by-step guide: Filling out the ACA reporting form

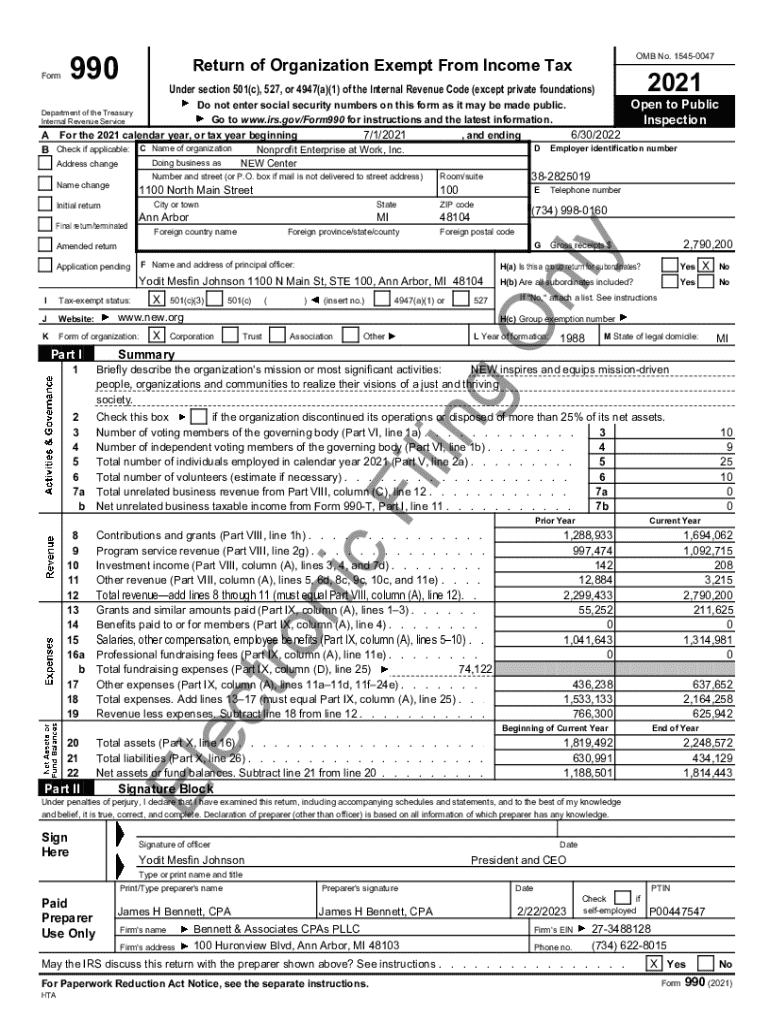

Completing the ACA reporting form can seem daunting, but by breaking it down into manageable sections, you can streamline the process significantly. The preparation phase is essential. Start by gathering all necessary information, including complete legal names, Social Security numbers (SSNs), and coverage details for each employee. Additionally, compile employer information, such as the Employer Identification Number (EIN), contact details, and comprehensive plan information.

Once you have collected the necessary data, proceed to fill out the form. Begin with Part I, where you will enter the employer information. In Part II, include detailed employee information and ensure accuracy to avoid any potential rejections or complications.

Be vigilant about common pitfalls when filling out the ACA reporting form. Incorrect data entries, missing employee information, or incomplete coverage details can lead to significant errors. Take your time, verify all information, and consider implementing a review process before submission.

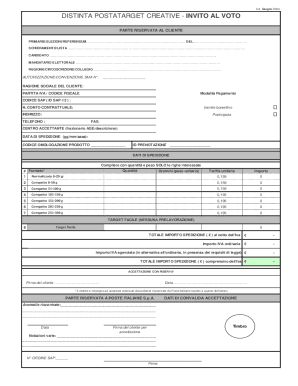

Editing and customizing your ACA reporting form

The process for completing ACA reporting forms can be further simplified using tools like pdfFiller. With pdfFiller, you can easily edit and customize your forms, ensuring that they meet updated requirements and reflect accurate information. The first step involves uploading your form directly into the platform, where you can start modifying entries as needed.

Utilizing templates can significantly reduce the time spent on form creation. pdfFiller offers various ACA reporting templates designed to accommodate the new procedures and requirements. These templates not only streamline the process but also ensure compliance with current regulations, helping reduce the administrative burdens on health plan sponsors.

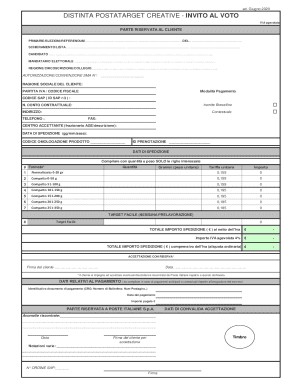

E-signing and collaborating on your ACA forms

E-signatures have become a pivotal element in ACA reporting, enhancing the efficiency and speed of document processes. The ability to electronically sign forms not only streamlines the submission process but also provides a secure method for validating that documents are official and approved. This modern approach can significantly reduce delays associated with traditional paper-based methods.

Moreover, collaboration is simplified when using platforms like pdfFiller. You can easily share forms with team members for review and feedback, making it easy to ensure accuracy before final submissions. The secure storage of these documents adds another layer of confidence, protecting sensitive information while maintaining accessibility for authorized users.

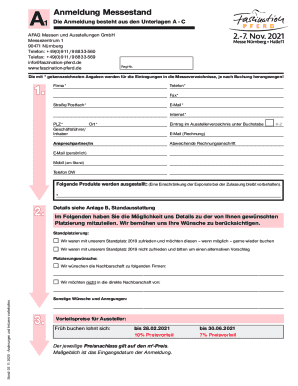

Managing your ACA reporting documents

Effective management of ACA reporting documents is essential not only for compliance but also for organizational efficiency. Implementing a structured folder system within pdfFiller allows you to categorize and tag documents, making it easy to retrieve information quickly when needed. This organizational approach helps ensure that your team is always prepared for audits or inquiries regarding reporting requirements.

Adopting best practices for document management is critical. Version control helps in tracking changes made to forms over time, ensuring that the most accurate and current version is always used. Regular backing up of data in secure cloud storage also mitigates the risk of loss, ensuring compliance in line with the needs dictated by the Paperwork Burden Reduction Act and related legislation.

Preparing for future changes in ACA regulations

Staying informed about legislative developments related to ACA reporting is crucial for employers looking to maintain compliance. Regularly monitoring updates can equip organizations to adapt their policies and procedures proactively. Being reactive is often not enough; preparation is key to ensuring your reporting is always aligned with current regulations.

Establishing a continuous learning environment within your team can further enhance your capability to adapt to changes. Resources such as webinars, newsletters, and compliance workshops are invaluable for keeping everyone updated. Integrating this knowledge into your reporting practices ensures that you are not only meeting existing obligations but are also prepared for any upcoming adjustments in the reporting act.

Benefits of streamlined ACA reporting with pdfFiller

pdfFiller serves as an excellent solution for managing ACA reporting, combining a user-friendly interface with powerful document management tools. By choosing pdfFiller, users can benefit from a streamlined workflow that automates repetitive tasks while ensuring accuracy in reporting processes, thus reducing administrative burdens on health plan sponsors significantly.

User testimonials affirm the platform’s efficacy, with many teams noting improved productivity and reduced errors in reporting. Interactive tools, templates, and collaborative features offered by pdfFiller facilitate a more seamless process, allowing users to focus on strategic compliance rather than tedious paperwork. Empowering your team to embrace these tools can lead to greater efficiency and enhanced reporting outcomes.

Contacting pdfFiller for personalized support and solutions

For organizations seeking tailored support regarding ACA reporting, pdfFiller’s support team stands ready to assist. Whether you have questions about specific procedures or need advice on compliance strategies, their experts can provide personalized solutions to cater to your needs. Engaging with pdfFiller’s team can also yield best practices that further enhance your reporting efforts.

Moreover, building a collaborative relationship with pdfFiller can open doors to additional resources that make navigating the intricacies of ACA reporting more manageable. Explore options available under their tailored services designed specifically for businesses looking to comply with the ACA reporting and reduction act while minimizing potential burdens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit aca reporting new procedures in Chrome?

How do I fill out the aca reporting new procedures form on my smartphone?

How do I fill out aca reporting new procedures on an Android device?

What is ACA reporting new procedures?

Who is required to file ACA reporting new procedures?

How to fill out ACA reporting new procedures?

What is the purpose of ACA reporting new procedures?

What information must be reported on ACA reporting new procedures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.