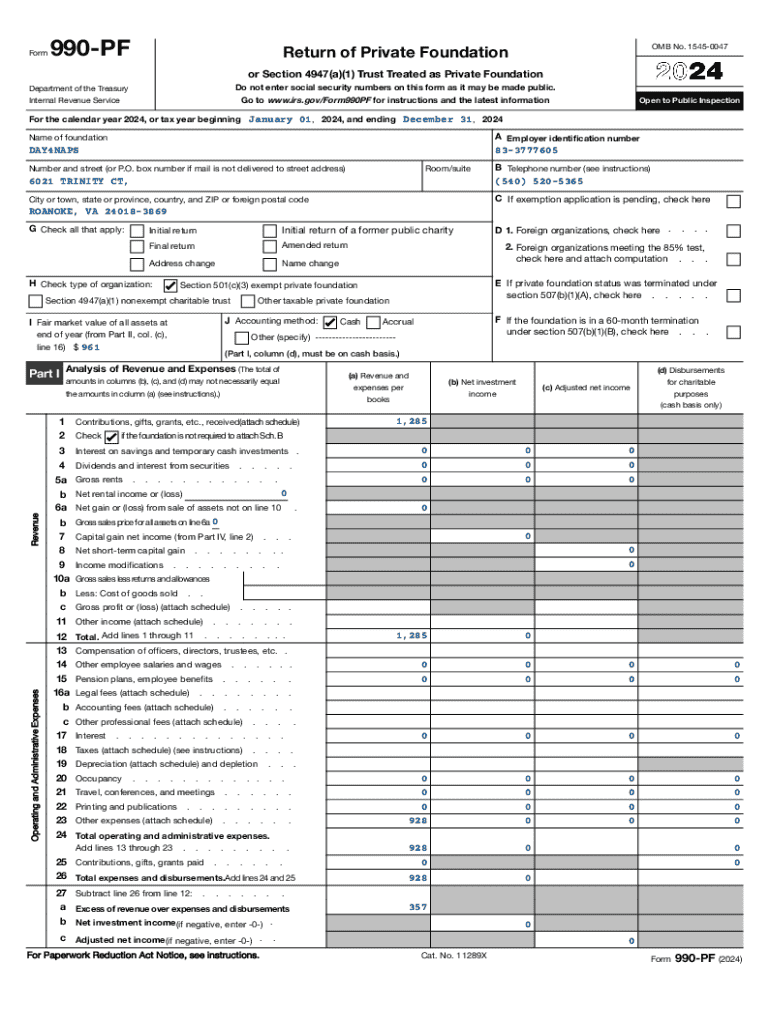

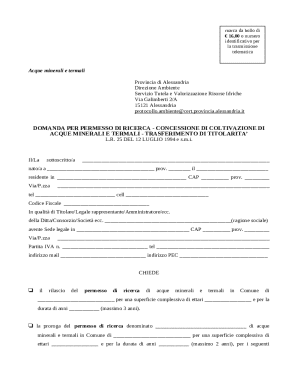

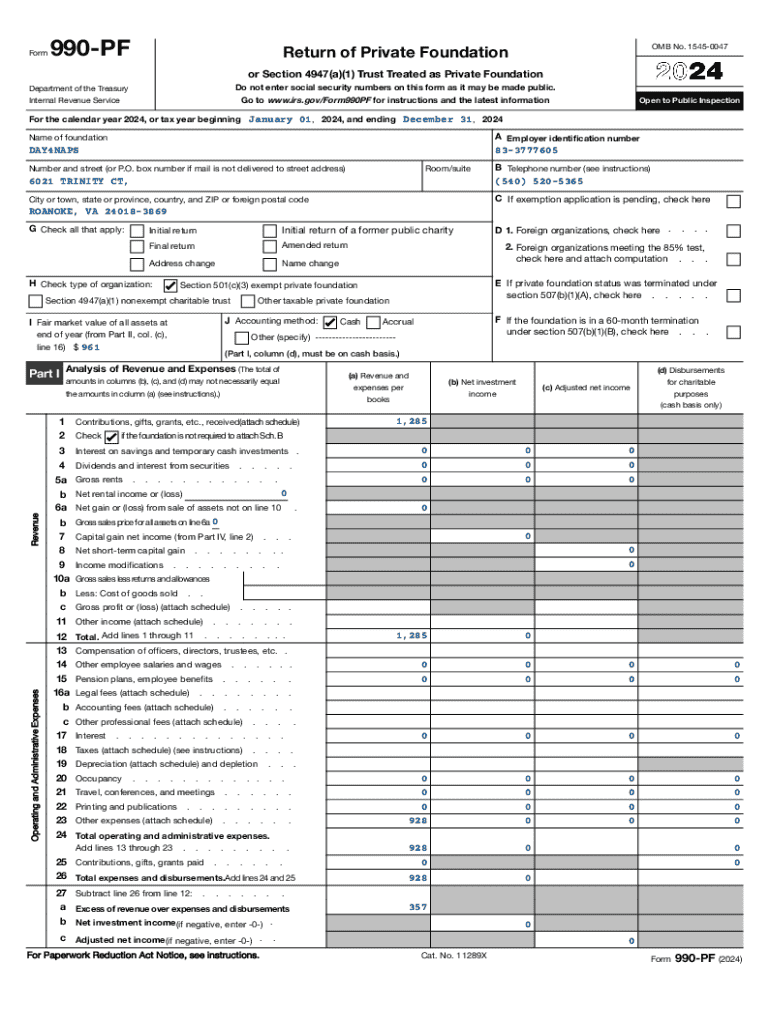

Get the free For the calendar year 2024, or tax year beginning January 01, 2024, and ending Decem...

Get, Create, Make and Sign for form calendar year

How to edit for form calendar year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for form calendar year

How to fill out for form calendar year

Who needs for form calendar year?

Form Calendar Year Form: Your Comprehensive How-to Guide

Understanding the calendar year form

A calendar year form refers to the tax documents submitted based on a yearly cycle that runs from January 1 to December 31. This system is widely used by individuals and organizations to report their annual income, deductions, and other tax-related information to the Internal Revenue Service (IRS). Understanding how these forms work is critical for accurate tax compliance and optimal financial planning.

Using the correct tax year is vital, as errors can lead to complications such as fines or audits. Calendar year forms differ from fiscal year forms, which can span any 12-month period, depending on a business's chosen cycle. Knowing these distinctions will help you select the appropriate form for your needs.

Eligibility and use cases

Not everyone is required to use a calendar year form. Typically, individuals, small businesses, and non-profits are the primary users. For many, filing annually helps keep personal and organizational finances on track. A calendar year form is particularly beneficial for individuals who prefer to align their tax filing with their personal financial year.

In many scenarios — such as employment without business ownership or investment in trusts — the calendar year form becomes essential. Below are some typical cases:

Steps to complete the calendar year form

Completing a calendar year form can seem daunting, but by breaking it down into manageable steps, you can ensure accuracy and compliance. Here’s how:

Step 1: Gather required information

Start by assembling all necessary documents, which typically include your personal identification information, such as your Social Security number and employer identification number (EIN), alongside your financial statements for the year. Ensure you compile income statements, receipts for deductions, and any other crucial documentation.

Step 2: Accessing the form

Access your calendar year form through pdfFiller. The platform offers a convenient way to locate and fill out the appropriate forms digitally. Their user-friendly process ensures you can find the right forms in minutes.

Step 3: Filling out the form

When filling out the form, pay attention to detail. Each section typically includes:

Tips for accurate completion include double-checking your entries and keeping abreast of any changes in tax regulations that may affect your deductions.

Step 4: Reviewing and editing the form

After completion, utilize pdfFiller's tools for reviewing and correcting any errors. Common mistakes include incorrect Social Security numbers, math errors, or missing information. Take time to cross-verify all entries to avoid issues later.

Step 5: eSigning and submitting the form

Once reviewed, use pdfFiller's eSignature feature to sign the form electronically. This feature simplifies the signing process, allowing you to submit securely and efficiently. Be mindful of submission methods and deadlines to ensure your form is filed on time.

Tax return deadlines and key dates

Timeliness is key when it comes to tax forms. Calendar year forms typically have standardized deadlines for submission. For individuals, the federal tax return due date is usually April 15 of the following year, unless it falls on a weekend or holiday. Businesses typically follow similar deadlines but may have different requirements.

Be sure to note these important dates throughout the calendar year:

Advantages and disadvantages of using a calendar year form

Filing using a calendar year form offers several advantages. For one, it aligns with the typical personal financial year, making it easier for individuals to manage their finances within a familiar time frame. This form is also straightforward for small business owners to track income and expenses over a defined yearly period.

However, some disadvantages exist. Businesses that operate on seasonal income may find that a calendar year does not capture their financial performance accurately, which can lead to misrepresentation and tax implications. Also, filing on a calendar year can limit the flexibility that a fiscal year might provide in financial planning.

Advanced tips for efficient management

Maximize your efficiency when managing your calendar year form using pdfFiller. The platform provides features that facilitate document management, allowing you to keep track of revisions and collaborate with team members seamlessly. This promotes transparency and reduces errors.

Utilize pdfFiller’s cloud-based storage to keep your documents organized and accessible from anywhere. This provides confidence in document security while also streamlining the submission and payment processes.

Common misconceptions explained

Many individuals are misled by myths surrounding calendar year forms. One common misconception is that they can only be utilized by individuals and not businesses. However, small businesses and non-profits can and do use calendar year forms for their tax submissions. It’s essential to clarify these filing rules to avoid unintentional errors.

There are also assumptions about flexibility; companies can change their accounting periods but must follow specific guidelines. Understanding these regulations will ensure that you can adequately manage your tax planning and compliance effectively.

Frequently asked questions (faq)

Questions often arise surrounding the calendar year form, so here are the answers to some of the most common inquiries:

You may also like…

Discover other resources related to tax filing on pdfFiller. You might find it helpful to explore various forms and templates catered to diverse financial scenarios, empowering you further in your tax preparation.

Stay updated with our newsletter

Subscribing to our newsletter offers numerous benefits. By staying informed, you’ll receive updates on significant tax changes, essential filing tips, and insights into document management. This keeps you well-equipped to handle all your tax-related responsibilities efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify for form calendar year without leaving Google Drive?

How do I make changes in for form calendar year?

How do I edit for form calendar year straight from my smartphone?

What is for form calendar year?

Who is required to file for form calendar year?

How to fill out for form calendar year?

What is the purpose of for form calendar year?

What information must be reported on for form calendar year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.